Dominion Energy to Sell 25% Stake in Cove Point to Brookfield

October 21 2019 - 8:20AM

Dow Jones News

By Colin Kellaher

Dominion Energy Inc. (D) on Monday said it agreed to sell a 25%

stake in its Cove Point liquefied natural gas facility to

Brookfield Super-Core Infrastructure Partners, an infrastructure

fund managed by Brookfield Asset Management Inc. (BAM), for cash

consideration of just over $2 billion, excluding working

capital.

Dominion said the transaction represents an implied enterprise

value of $8.22 billion for Dominion Energy Cove Point LNG LP, which

owns an LNG import, export and storage facility in Lusby, Md., that

includes a 136-mile pipeline connecting the facility with the

interstate pipeline system.

Dominion, a Richmond, Va., provider of electricity and natural

gas, said the transaction is part of its plan to establish a

permanent capital structure for Cove Point.

Dominion said it will retain full operational control of the

facility and its services upon completion of the transaction,

expected by the end of the year.

Write to Colin Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

October 21, 2019 08:05 ET (12:05 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

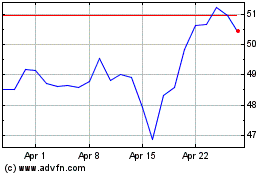

Dominion Energy (NYSE:D)

Historical Stock Chart

From Mar 2024 to Apr 2024

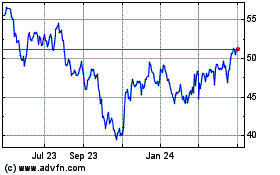

Dominion Energy (NYSE:D)

Historical Stock Chart

From Apr 2023 to Apr 2024