Soda Comeback Lifts Sales at Coke -- WSJ

October 19 2019 - 3:02AM

Dow Jones News

By Jennifer Maloney

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (October 19, 2019).

Coca-Cola Co.'s carbonated soft drinks are making a comeback,

especially with younger drinkers.

The beverage giant over the past few years has expanded into

coffee, tea, dairy and water as consumers shifted away from sugary

sodas. But in the latest quarter, CEO James Quincey said, the

company's sales rose in large part thanks to variations on its

namesake cola -- including some that contain less sugar.

A diet version called Coke Zero Sugar has grown 14% by volume

globally so far this year, Mr. Quincey said. And unit sales of the

company's 7.5 oz "mini cans" have increased 15% this year in the

U.S. Meanwhile, the company is rolling out a coffee-flavored

variant called Coca-Cola Plus Coffee and a new energy drink called

Coca-Cola Energy, available in more than 25 countries and expected

to launch in the U.S. in January.

"It's a reflection of how we've adapted our strategy to what

needs to be done to help people moderate their sugar," Mr. Quincey

said Friday in an interview. Young adults who previously didn't

drink soda are now starting to do so, he said, because of new

offerings such as Coke Zero Sugar, which tastes more like original

Coca-Cola than Diet Coke does.

"I think what you're starting to see is, yes, some

reconsideration of the category," he said. "Has it flip-flopped

overnight? No, it hasn't, but I think you're starting to see that

if you bring relevantly marketed innovation for the right occasion

to people then they will engage."

The energy and coffee drinks are also available in sugarless

versions.

The company is reaching new demographic groups with Coke Zero

Sugar and Coca-Cola Energy, Bernstein analyst Ali Dibadj said. "The

former can bring younger drinkers into cola and the latter is to

get older drinkers into energy. We'll see if this success of

expanding the scope of consumer persists, but so far, it seems to

be working OK."

Coke cleared a legal hurdle earlier this year with Monster

Beverage Corp. to launch its new energy drink in the U.S. Monster,

which counts Coca-Cola as a distribution partner and a significant

shareholder, had sought to block the sale of Coke's energy drink,

citing a noncompete agreement.

Mr. Quincey said he hopes Coca-Cola Energy will appeal to people

who don't currently buy energy drinks: "people who perhaps didn't

come into the category because of the flavor profile that tends to

be pretty strong.... It's an easier way into the category."

After launching the drink in Europe, the company is tweaking the

recipe for the U.S. launch to make it taste more like original

Coke, he said.

In January Coke spent $5.1 billion to buy British coffee-shop

chain Costa Coffee. Sales in the U.K. have been hurt by a dip in

consumer confidence amid Brexit worries, Mr. Quincey said. Coke is

now talking to food-service customers in the U.S. about bringing

Costa's coffee machines here, he said.

Coke also is eyeing the competitive seltzer market. The

Atlanta-based company in 2017 bought a sparkling mineral water from

Mexico called Topo Chico, which has a cult following in Texas.

Rival PepsiCo Inc. then launched a flavored seltzer called Bubly

that has taken share from market leader LaCroix.

"I think we have to see what we do next," Mr. Quincey said.

Coca-Cola on Friday reported higher quarterly profit and sales,

extending a recent streak of growth after several years of sluggish

demand for sugary drinks.

Organic revenue, a measure of sales that excludes currency

swings, acquisitions and divestitures, increased 5% from the same

time a year ago. By that measure, the company now forecasts at

least 5% growth for the full year.

PepsiCo, which also has a large snacks business, reported

organic-revenue growth of 4.3% for the latest period as it ramped

up advertising for its biggest brands.

Coke reported a profit of $2.59 billion, up from $1.89 billion a

year ago. Net revenue rose about 8% to $9.5 billion.

Global unit case volume grew 2% in the quarter. In North

America, unit case volume rose 1%, driven by a 3% increase in

Coca-Cola and double-digit growth in Coke Zero Sugar.

Sales of water, enhanced water and sports drinks grew 2% in the

quarter. Tea and coffee volume grew 4%.

--Patrick Thomas contributed to this article.

Write to Jennifer Maloney at jennifer.maloney@wsj.com

(END) Dow Jones Newswires

October 19, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

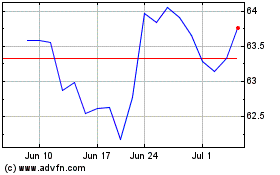

Coca Cola (NYSE:KO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Coca Cola (NYSE:KO)

Historical Stock Chart

From Apr 2023 to Apr 2024