By Nora Naughton and Mike Colias

The United Auto Workers scored major wins on wages, health care

and temporary workers in its new tentative labor pact with General

Motors Co., after calling a costly nationwide strike that has

halted work at the company's U.S. factories.

But GM will move forward with plans to close three idled U.S.

factories, including a plant in Lordstown, Ohio, that President

Trump had pressed the company to keep open. GM intends to sell the

Ohio factory to a startup electric-truck builder.

The strike will continue for now, pending a vote by a council of

UAW labor leaders gathered in Detroit. These UAW officials will

decide whether to end the strike immediately or continue it until

the proposed contract is ratified by rank-and-file members. A

decision was expected Thursday afternoon.

The strike, which is in its fifth week, is already the company's

longest nationwide walkout since 1970.

The agreement struck by union and company bargainers Wednesday

will move newer workers to the top wage in four years rather than

the eight years now, provide wage increases and lump-sum bonuses of

3% to 4% in each year of the contract and give temporary workers

full-time status after three years, according to details made

public Thursday.

The proposed contract, covering more than 46,000 UAW-represented

workers at GM, also includes a $11,000 bonus for full-time workers

if the deal is ratified, as well as a $4,500 signing bonus for

temporary workers, more than double their bonus in 2015.

The UAW succeeded in holding the line on health care, with the

3% contribution workers pay for their benefits unchanged. GM had

entered into talks looking to increase the cost-share to help

defray fast-rising medical costs that totaled roughly $900 million

last year for its union-represented workforce.

While analysts say the deal is likely to increase GM's labor

costs, the contract would also let GM trim excess factory capacity

in the U.S., long a drag on its bottom line. The company won the

formal go-ahead from the UAW to close three underused U.S.

factories that had weighed on profits.

During contract talks, UAW leaders had pressed GM to move more

factory production from Mexico to the U.S. -- even criticizing the

company publicly for not supporting American workers -- but the

agreement summary makes no such commitments.

Missing from the summary released Thursday by the UAW was a

breakdown of the money GM will invest in U.S. factories, which the

union has made sure to highlight in past contract deals.

As part of this agreement, GM has pledged roughly $7.7 billion

in new investments for its U.S. factories, creating or preserving

around 9,000 jobs, a UAW spokesman confirmed.

Kristin Dziczek, an economist and labor specialist at the Ann

Arbor, Mich.-based Center for Automotive Research, said she was

surprised the UAW didn't provide details on the new company

investment. "That has been how they convey job security to

workers," she said. "I don't know how that will go over."

The UAW didn't have an immediate comment on why those details

weren't included in the summary.

The plant closures, announced last November, drew sharp

condemnation from Mr. Trump and elected officials whose districts

were affected. GM Chief Executive Mary Barra has made several

visits to Washington, D.C., over the past year, in part to discuss

the restructuring plans with lawmakers.

Mr. Trump called Ms. Barra Wednesday to discuss the agreement

details, a GM spokesman confirmed, declining to elaborate. The

president also spoke with UAW President Gary Jones, the union

confirmed.

The factory cuts are central to a restructuring plan GM laid out

last year, aimed at boosting cash flow by $6 billion annually. A

fourth plant that GM had slated for closure will remain open,

eventually to build an electric pickup truck, people close to the

talks said.

"We see the agreement to close three out of the four plants

initially targeted as a 'win' for GM, keeping their restructuring

plan on track," said Jefferies analyst Philippe Houchois in an

investor note Thursday.

Still, any increase in labor costs for GM will likely be

replicated at Ford Motor Co. and Fiat Chrysler Automobiles NV, with

the UAW bargainers seeking to use the GM contract as a template to

reach similar agreements.

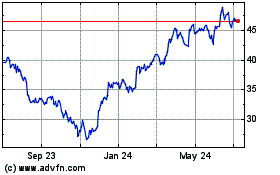

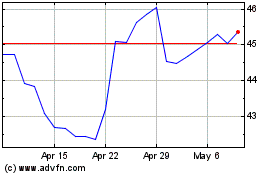

GM shares fell nearly 1% in afternoon trading Thursday. They

have fallen about 6% since the strike began.

Analysts estimate the strike has eroded GM's bottom line by $2

billion or more, and is likely to put a major dent in the company's

second-half results. GM is scheduled to report its third-quarter

results Oct. 29.

If approved by workers, the new GM-UAW labor pact will set the

framework for how these two big institutions navigate an expected

downturn in the U.S. car market and disruptive forces reshaping the

auto business, from the emergence of electric cars to self-driving

cars and ride-hailing ventures.

Still, winning their support isn't guaranteed. Ratification

could face challenges, particularly because nearly half of GM's

unionized workforce has never experienced an industry downturn and

will be less inclined to accept concessions, labor experts

said.

UAW officials entered negotiations already rattled by GM's

decision to close the plants, driven in part by the company's need

to steer capital toward bets on electric vehicles. Analysts say the

long-term shift toward battery-powered cars is a threat to

traditional factory jobs because they require fewer parts and less

manpower to assemble.

GM bargainers during negotiations assured union leaders that UAW

members would be in line for work and retraining related to new

technologies like electric and autonomous vehicles, according to

the union's summary of the contract.

A new committee of union and company officials will meet

regularly to discuss new technologies and how they might affect the

jobs of union workers, the union said.

Separate from the proposed contract, GM said Thursday it will

invest with partners in a battery-cell plant near the Lordstown

factory that would employ about 1,000 UAW-represented workers. The

sale of the factory to the electric-truck maker should create

around 400 jobs initially, the company said.

Write to Nora Naughton at nora.naughton@wsj.com and Mike Colias

at Mike.Colias@wsj.com

(END) Dow Jones Newswires

October 17, 2019 15:43 ET (19:43 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

General Motors (NYSE:GM)

Historical Stock Chart

From Mar 2024 to Apr 2024

General Motors (NYSE:GM)

Historical Stock Chart

From Apr 2023 to Apr 2024