Schlumberger 3Q Revenue Likely to Be Around Last Year's -- Earnings Preview

October 17 2019 - 3:55PM

Dow Jones News

By Dave Sebastian

Schlumberger Ltd. (SLB) is scheduled to report results for its

fiscal third quarter premarket on Friday. Here is what you need to

know:

EARNINGS FORECAST: Analysts on average expect profit of 40 cents

a share, according to FactSet. Analysts expect Schlumberger to

report adjusted earnings of 41 cents a share. The company will hold

its investor call at 8:30 a.m. ET.

REVENUE FORECAST: Analysts expect sales of $8.5 billion, which

is about flat compared with the same period last year, according to

FactSet.

WHAT TO WATCH:

NEW CEO: The oilfield-service company named Olivier Le Peuch its

new chief executive in July. Mr. Le Peuch has said shale companies

are increasingly focused on avoiding parent-child well problems,

which is when wells are drilled too closely, and one siphons

production off the other. This is leading to increased demand for

Schlumberger's products that help mitigate the issue, seen as a

primary reason shale wells aren't producing as much as forecast.

Cowen analysts said in a note Monday that they are looking for more

specificity beyond a "foreseeable future" and a double-digit free

cash flow margin, both of which are part of the Mr. Le Peuch's

strategy.

NORTH AMERICA BUSINESS: Schlumberger's North American business

has been hurt in recent quarters by a cutback in spending by U.S.

shale drillers. The company has estimated that U.S. producers have

cut spending in 2019 by about 10%, but that has been offset by

efficiency gains enabling drillers to get more oil with less

spending. It has also said it expects international exploration and

production investment to grow 7% to 8% in 2019.

Write to Dave Sebastian at dave.sebastian@wsj.com

(END) Dow Jones Newswires

October 17, 2019 15:40 ET (19:40 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

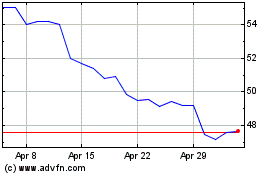

Schlumberger (NYSE:SLB)

Historical Stock Chart

From Mar 2024 to Apr 2024

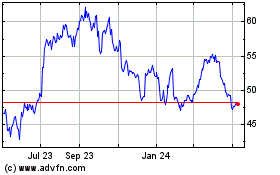

Schlumberger (NYSE:SLB)

Historical Stock Chart

From Apr 2023 to Apr 2024