Current Report Filing (8-k)

October 17 2019 - 12:16PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

October 17, 2019 (October 14, 2019)

Bat Group, Inc.

(Exact name of registrant as specified in its

charter)

|

Delaware

|

|

001-36055

|

|

45-4077653

|

(State

or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS

Employer

Identification No.)

|

Room 104, No. 33 Section D,

No. 6 Middle Xierqi Road,

Haidian District, Beijing, China

(Address of Principal Executive Offices)

+86 (010) 59441080

(Issuer’s telephone number)

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation to the registrant under any of the following provisions:

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section

12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

Common

Stock, par value $0.001

|

|

GLG

|

|

Nasdaq

Capital Market

|

Item 1.01. Entry into a Material Definitive Agreement.

Share Purchase Agreement

On October 14, 2019, Bat Group, Inc. (the

“Company”) entered into certain share purchase agreements (the “SPA”) with Zhuji Xingmai

Network Technology Co., Ltd., (the “Seller”), a limited liability company organized under the laws of People’s

Republic of China (“PRC”), and Hangzhou Yihe Network Technology Co., Ltd. (the “Target”),

a limited liability company organized under the laws of PRC. The Seller is the record holder and beneficial owner of all issued

and outstanding capital stock of the Target. Pursuant to the SPA the Company agreed to transfer to the Seller an

aggregate of 1,253,814 shares (the “Company’s Shares”) of its common stock, par value $0.001 per share

(“Common Stock”), and the Seller agreed to transfer to the Company such number of shares which represents 20%

of the capital stock of the Target (the “Target’s Shares”, and the transaction contemplated therein,

the “Acquisition”)

The parties to the SPA have each made customary

representations, warranties and covenants, including, among other things, (a) the Seller and the Target are duly organized, validly

existing and in good standing under the laws of PRC; (b) all parties are authorized to execute the SPA, (d) the absence of any

undisclosed material adverse effects, and (e) the absence of legal proceedings that affect the completion of the transaction contemplated

by the SPA.

The closing of the Acquisition is subject

to various conditions to closing, including, among other things, (a) Nasdaq’s approval of the listing of the Company’s

Shares; (b) accuracy of the parties’ representations and warranties at the time of closing.

We cannot assure you that any of the approvals

of governmental authorities or other third parties described above will be obtained, and, if obtained, we cannot assure you as

to the date of such approvals. We are not aware of, and the Sellers

and the Target have not identified to us, any material governmental authority or third party approvals or actions that are required

for completion of the Acquisition, except for the approval of NASDAQ for listing of additional shares. It is presently contemplated

that if any such additional approvals or actions are required, those approvals or actions will be sought, but there can be no

assurance that any additional approvals or actions will be obtained.

The SPA is filed as Exhibit 10.1 to this Current

Report on Form 8-K and such document is incorporated herein by reference. The foregoing is only a brief description of the material

terms of the SPA, and does not purport to be a complete description of the rights and obligations of the parties thereunder and

is qualified in its entirety by reference to such exhibits.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

BAT

GROUP, INC.

|

|

|

|

|

|

Date:

October 17, 2019

|

By:

|

/s/

Jiaxi Gao

|

|

|

Name:

|

Jiaxi

Gao

|

|

|

Title:

|

Chief

Executive Officer

|

2

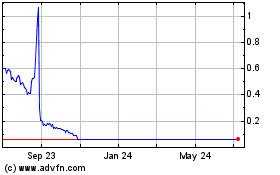

TD (NASDAQ:GLG)

Historical Stock Chart

From Mar 2024 to Apr 2024

TD (NASDAQ:GLG)

Historical Stock Chart

From Apr 2023 to Apr 2024