Unilever Cuts Prices as Shampoo Rivalry Grows -- Update

October 17 2019 - 5:17AM

Dow Jones News

By Saabira Chaudhuri

LONDON -- Unilever PLC said it was forced to lower prices in the

U.S. to compete in the shampoo market with its rival Procter &

Gamble Co., as the owner of Dove and TRESemmé reported slower

third-quarter revenue growth compared with a year earlier.

"There's been a very vibrant and competitive battle in hair care

in North America," said chief financial officer Graeme

Pitkethly.

Unilever reported sales of EUR13.25 billion ($14.64 billion) for

the quarter, up from EUR12.53 billion a year earlier. Underlying

sales growth -- a closely watched figure that strips out currency

movements and deals -- was 2.9%. That is a deterioration from a

year ago when Unilever reported growth of 3.8%, and slightly below

analyst estimates for growth of 3%.

Mr. Pitkethly said Unilever is still on track to hit annual

growth targets and results were held back by a tough comparison

with a year ago, which included an exceptionally hot summer in

Europe that had boosted sales of its ice cream products.

Overall, results were driven by both volume and price, with

emerging markets growth driving sales.

In North America, however, Unilever raised prices by just 0.6%

compared with a 1.5% increase a year earlier. Mr. Pitkethly blamed

the rivalry with P&G for capping price growth, saying the U.S.

company was "very focused on the fundamentals" in hair care after

"a very lackluster period."

P&G said its hair brands have been expanding globally and

the company is focused on improving products, packaging,

communication and distribution.

Hair care has been a key battleground for consumer-goods

companies in developed markets like the U.S. and Western Europe for

years, and recently in China as well. Shampoo provides big profit

margins and the potential for innovation through adding minor

ingredients like vanilla extract or keratin proteins.

For Unilever, success in shampoo against its rival is

particularly important. Over the past decade, it has shifted its

focus toward personal-care products. Its new chief executive Alan

Jope was previously head of its personal-care arm.

Unilever bought Alberto Culver Co., maker of Alberto VO5 and

TRESemmé hair-care products, for $3.7 billion in 2011 and the TIGI

professional hair-care business for EUR411.5 million in 2009. Since

then, armed with this new range of shampoos, Unilever has gone on

the attack in the U.S. Its North American hair-care business now

comprises about 3% of global sales.

The company has doubled down on digital marketing over the past

few years, with a YouTube channel that offers styling tutorials. It

has also used social media channels to gather consumer insights

that can be translated into new products and launched bar shampoos

under its Love, Beauty and Planet brand, eliminating plastic

packaging.

P&G has been rolling out its Herbal Essences and Aussie hair

brands globally and the company has said it is focused on improving

products, packaging, communication and distribution. It has

launched a new rose water sulfate-free shampoo under its Pantene

brand and tweaked the formula and packaging for Head &

Shoulders.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

October 17, 2019 05:02 ET (09:02 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

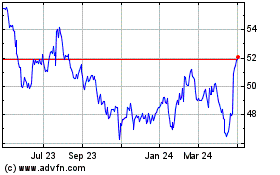

Unilever (NYSE:UL)

Historical Stock Chart

From Mar 2024 to Apr 2024

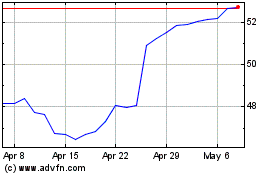

Unilever (NYSE:UL)

Historical Stock Chart

From Apr 2023 to Apr 2024