Brexit Hopes Carry Pound and Banking Stocks Higher

October 15 2019 - 1:33PM

Dow Jones News

By Anna Isaac and Cailtin Ostroff

The British pound and stocks of banks and home builders rallied

Tuesday on speculation that the U.K. and European Union may be

close to finishing a draft divorce agreement.

The currency climbed 1% against the U.S. dollar, reaching its

highest level in about four months and putting it on course to wipe

out losses from earlier this year. Shares in the region's banks --

led by Ireland's AIB Group PLC and the U.K.'s Lloyds Banking Group

PLC -- and in property developers such as Hammerson PLC were also

buoyed.

Negotiators from both sides are closing in on a draft Brexit

deal ahead of the midnight deadline, according to people familiar

with the talks. The market moves suggested optimism that a

breakthrough might finally be in sight, signaling an end to the

logjam in negotiations that has almost paralyzed the U.K. economy

for over three years. A deal would allow authorities and business

leaders to turn their attention to bolstering growth and

investment.

"A lot of the uncertainty that has been weighing on businesses

and consumption would be lifted," said Andrew Wishart, a U.K.

economist at research firm Capital Economics. "It could put rate

hikes back on the agenda at the Bank of England."

Any agreement would have to take into account how to handle the

border between Northern Ireland and the Republic of Ireland, an

issue that has been a major hurdle in discussions so far. U.K.

Prime Minister Boris Johnson would still need to secure approval

for a deal from lawmakers and the European Council. Most crucially,

the pact would also need support from the Democratic Unionist Party

of Northern Ireland, which has previously resisted any difference

in regulation between the region and the rest of the U.K.

"There's two phases to this: confirmation of a deal between

Brussels and London, and then getting it through parliament," said

Derek Halpenny, head of research, global markets EMEA at MUFG

Bank.

The pound hit a high of $1.28, its highest since June 12,

according to Dow Jones Market Data Group.

A confirmed deal could see sterling climb as high as $1.30 and

rise further to $1.33 if the accord got parliament's approval, Mr.

Halpenny said.

Sectors such as banks and airlines had already seen a recovery

in share prices as prospects for a deal have improved. This effect

could increase if it were confirmed, Mr. Halpenny said. "There's

more risk premium to be taken out of those sectors."

While the banking sector as a whole has long faced Brexit

pressures, Irish banks have particularly been hammered as they are

seen as vulnerable to economic implications from the U.K.'s

separation from the EU.

Shares in AIB rose 8.4% in Dublin, while Bank of Ireland Group

PLC gained 6.6%. Both stocks have taken a beating this year,

largely because of concerns surrounding Brexit and fears that a

disorderly exit by the U.K. could make the business environment

worse, hurting banking operations.

"A lot of pessimism was some time ago put into prices," said

Anastasia Turdyeva, an analyst at S&P Global Inc. She said she

expects the shares to remain volatile until there is more clarity

about Brexit.

In London, Lloyds and Royal Bank of Scotland Group PLC both rose

over 5%. Among real-estate firms, Hammerson surged 7% while Land

Securities Group PLC climbed 6%.

Write to Anna Isaac at anna.isaac@wsj.com

(END) Dow Jones Newswires

October 15, 2019 13:18 ET (17:18 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

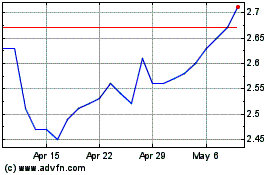

Lloyds Banking (NYSE:LYG)

Historical Stock Chart

From Mar 2024 to Apr 2024

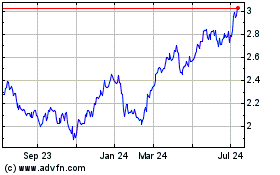

Lloyds Banking (NYSE:LYG)

Historical Stock Chart

From Apr 2023 to Apr 2024