EUROPE MARKETS: European Stocks Surge To Best Level In 16 Months On Brexit Optimism, U.S. Earnings

October 15 2019 - 12:23PM

Dow Jones News

By Steve Goldstein, MarketWatch

European stocks on Tuesday rallied on optimism over the

possibility of a deal for an agreed Brexit pact as well as

better-than-forecast U.S. earnings.

After losing 0.49% on Monday, the Stoxx Europe 600 ended 1.1%

higher to 394.02, its best level since May 22, 2018. Banks and

insurers led the advance.

The German DAX increased 1.1% to 12629.79, the French CAC 40

added 1% to 5702.05 while the U.K. FTSE 100 fell a fraction,

closing at 7211.64.

U.K. banks switched directions for a third straight session,

this time rising, as they trade on the relative prospects of an

agreed deal for Britain to exit the European Union. Lloyds Banking

Group (LLOY.LN) and the Royal Bank of Scotland (RBS.LN) rose as

Michel Barnier, the top EU negotiator, said a deal was possible

this week, and Bloomberg News reported negotiators were closing in

on a draft deal. The pound surged to nearly $1.28.

The FTSE 100 however was weighed down by struggles from

multinationals such as GlaxoSmithKline (GSK.LN) and Unilever

(ULVR.LN) , which are hurt by a rising pound.

A number of U.S. companies reported better-than-forecast

earnings, including JPMorgan Chase and Johnson & Johnson,

sending the Dow industrials higher.

The worst Stoxx 600 component was Wirecard (WDI.XE) , which lost

16% as the Financial Times reported that internal documents

appeared to show the company was trying to inflate profit and

revenue at an Irish and Dubai subsidiary.

Wirecard said it "categorically rejected" the allegations, which

it called "a compilation of a number of false and misleading

allegations."

(END) Dow Jones Newswires

October 15, 2019 12:08 ET (16:08 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

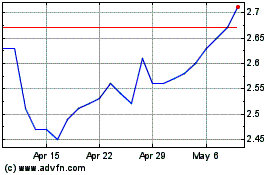

Lloyds Banking (NYSE:LYG)

Historical Stock Chart

From Mar 2024 to Apr 2024

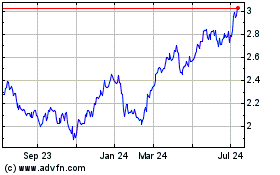

Lloyds Banking (NYSE:LYG)

Historical Stock Chart

From Apr 2023 to Apr 2024