Progyny Inc. Sets IPO at 10 Million Shares; Sees Pricing at $14-$16 Each

October 15 2019 - 11:37AM

Dow Jones News

By Colin Kellaher

Progyny Inc., a benefits-management company backed by

private-equity firm TPG Inc., on Tuesday said it expects to sell

6.7 million shares at $14 to $16 apiece in its initial public

offering.

At the $15 midpoint of that range, the New York company focused

on fertility and family-building benefits said it expects net

proceeds of about $91 million.

Certain shareholders, including Germany's Merck KGaA (MRK.XE),

are selling another 3.3 million shares in the IPO, for a total

offering of 10 million shares, Progyny said.

Progyny will have about 82.2 million shares outstanding after

the IPO, according to a filing with the Securities and Exchange

Commission, for a market capitalization of roughly $1.23 billion at

the $15-a-share midpoint.

TPG, which isn't selling any shares, will own about 25% of

Progyny after the offering.

Write to Colin Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

October 15, 2019 11:22 ET (15:22 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

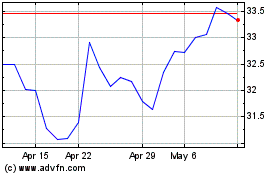

Merck KGaA (PK) (USOTC:MKKGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

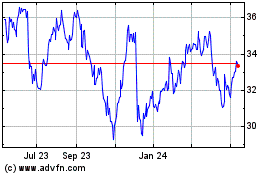

Merck KGaA (PK) (USOTC:MKKGY)

Historical Stock Chart

From Apr 2023 to Apr 2024