Prologis Beats Forecasts For Key Profit Metric

October 15 2019 - 8:44AM

Dow Jones News

By Micah Maidenberg

Prologis Inc. (PLD) said occupancies slipped in its warehouses

during the third quarter but the company still exceeded Wall Street

forecasts for a key profit metric.

San Francisco-based Prologis said Tuesday that core funds from

operations--an adjusted profit metric investors follow that

excludes depreciation and certain other costs--rose to 97 cents a

share for the quarter.

That beat expectations from analysts polled by FactSet by three

cents.

The company reported earnings of $450.6 million, or 71 cents a

share, on a GAAP basis, compared with $346.3 million, or 60 cents a

share, the year earlier.

Rental revenue rose 17% compared with last year, to $711

million.

The company reported its warehouses were 96.5% occupied at the

end of the quarter, down one percentage point from last year. The

drop is due to its decision to prioritize rents over boosting

occupancies, Prologis said.

In July, Prologis agreed to purchase warehouse owner Industrial

Property Trust in a deal valued at $3.99 billion including

debt.

Write to Micah Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

October 15, 2019 08:29 ET (12:29 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

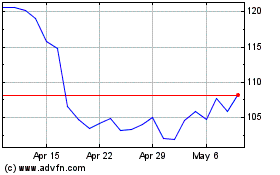

Prologis (NYSE:PLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

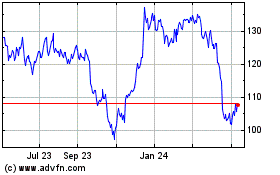

Prologis (NYSE:PLD)

Historical Stock Chart

From Apr 2023 to Apr 2024