Pilgrim’s Pride Announces Closure of Tulip Limited Acquisition

October 15 2019 - 7:00AM

Pilgrim’s Pride Corporation (Nasdaq: PPC) (“Pilgrim’s” or the

“Company”) today announced the completion of the previously

announced acquisition of Tulip Ltd from Danish Crown. Tulip Ltd

will operate as a business unit within Pilgrim’s.

The transaction was unanimously approved by the Pilgrim’s Board

of Directors and was funded with cash on hand, valuing Tulip Ltd at

£290 million (or approximately $354 million based on a

1.22 exchange rate as of August 27, 2019).

About Pilgrim’s Pride Corporation

Pilgrim’s employs approximately 51,400 people and operates

chicken processing plants and prepared-foods facilities in 14

states, Puerto Rico, Mexico, the U.K., and continental Europe. The

Company’s primary distribution is through retailers and foodservice

distributors. For more information, please visit

www.pilgrims.com.

Forward-Looking Statements

Statements contained in this press release that state the

intentions, plans, hopes, beliefs, anticipations, expectations or

predictions of the future of Pilgrim’s Pride Corporation and its

management are considered forward-looking statements. It is

important to note that actual results could differ materially from

those projected in such forward-looking statements. Factors that

could cause actual results to differ materially from those

projected in such forward-looking statements include: matters

affecting the poultry industry generally; the ability to execute

the Company’s business plan to achieve desired cost savings and

profitability; future pricing for feed ingredients and the

Company’s products; outbreaks of avian influenza or other diseases,

either in Pilgrim’s Pride’s flocks or elsewhere, affecting its

ability to conduct its operations and/or demand for its poultry

products; contamination of Pilgrim’s Pride’s products, which has

previously and can in the future lead to product liability claims

and product recalls; exposure to risks related to product

liability, product recalls, property damage and injuries to

persons, for which insurance coverage is expensive, limited and

potentially inadequate; management of cash resources; restrictions

imposed by, and as a result of, Pilgrim’s Pride’s leverage; changes

in laws or regulations affecting Pilgrim’s Pride’s operations or

the application thereof; new immigration legislation or increased

enforcement efforts in connection with existing immigration

legislation that cause the costs of doing business to increase,

cause Pilgrim’s Pride to change the way in which it does business,

or otherwise disrupt its operations; competitive factors and

pricing pressures or the loss of one or more of Pilgrim’s Pride’s

largest customers; currency exchange rate fluctuations, trade

barriers, exchange controls, expropriation and other risks

associated with foreign operations; disruptions in international

markets and distribution channel, including anti-dumping

proceedings and countervailing duty proceedings; and the impact of

uncertainties of litigation as well as other risks described under

“Risk Factors” in the Company’s Annual Report on Form 10-K and

subsequent filings with the Securities and Exchange Commission.

Pilgrim’s Pride Corporation undertakes no obligation to update or

revise publicly any forward-looking statements, whether as a result

of new information, future events or otherwise.

|

Contact: |

Dunham Winoto |

| |

Director, Investor Relations

Pilgrim's Pride Corporation |

| |

IRPPC@pilgrims.com |

| |

(970) 506-8192 |

| |

www.pilgrims.com |

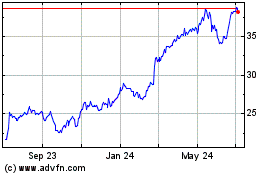

Pilgrims Pride (NASDAQ:PPC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pilgrims Pride (NASDAQ:PPC)

Historical Stock Chart

From Apr 2023 to Apr 2024