Metro Pacific Investments Delays Hospital Unit IPO; Gets KKR, GIC Funding Instead

October 15 2019 - 12:54AM

Dow Jones News

By Saurabh Chaturvedi

Metro Pacific Investments Corp (MPI.PH) has delayed the planned

initial public offering of its hospital unit and opted instead for

a 35.3 billion-Philippine peso ($684.5 million) investment from

U.S. private-equity firm KKR & Co. (KKR) and Singapore

sovereign wealth fund GIC Pte.

Under the deal, KKR and GIC will buy 41.4 million new shares of

Metro Pacific Hospital Holdings--the operator of the largest

private hospital-and-healthcare network in the Philippines--for

PHP5.2 billion, the companies said in a statement Tuesday. KKR and

GIC will also jointly invest PHP30.1 billion in mandatory

exchangeable Metro Pacific Investments bonds that are convertible

into 239.93 million shares in the hospital unit.

The deal is expected to be completed by the end of 2019.

Some of the proceeds from the share sale will be used to fund

Metro Pacific Hospitals' potential investments in other hospitals

and new healthcare businesses, the statement said. MPIC will use

the proceeds from the bond sale to cut debt.

Bank of America Merrill Lynch and UBS AG were financial advisors

to MPIC and GIC.

Write to Saurabh Chaturvedi at saurabh.chaturvedi@wsj.com

(END) Dow Jones Newswires

October 15, 2019 00:39 ET (04:39 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

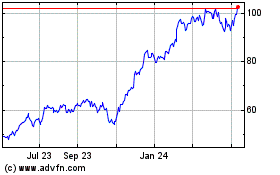

KKR (NYSE:KKR)

Historical Stock Chart

From Mar 2024 to Apr 2024

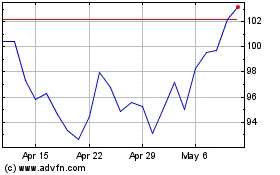

KKR (NYSE:KKR)

Historical Stock Chart

From Apr 2023 to Apr 2024