Brookfield Embarks on High-Price Makeover of Fifth Avenue Tower

October 15 2019 - 12:35AM

Dow Jones News

By Peter Grant

Real-estate giant Brookfield Asset Management is starting a $400

million overhaul of the tower at 666 Fifth Avenue, undeterred by a

lackluster office leasing market in Midtown Manhattan and an aging

bull market in commercial property.

Toronto-based Brookfield said it would deliver 1.6 million

square feet of modern office space and expects to begin

construction in 12 to 18 months after roughly 10 business tenants

vacate the building. Brookfield officials said they expect to

complete the project in early 2023.

Brookfield purchased a 99-year lease of the property in a 2018

deal that valued it at $1.29 billion. When finished, the project

will be one of the costliest office building makeovers ever in New

York.

"The building in its current state is probably a $60- to

$70-a-square-foot building," said Ric Clark, Brookfield Property

Group chairman, referring to current rents. "After investing this

money, we expect to get substantially higher rents."

He said Brookfield is aiming for an average of more than $100 a

square foot, though the firm hasn't started marketing the property

and no leases have been signed.

The tower is one of the best-known office buildings in the city.

It was owned by a venture led by Kushner Cos., which is owned by

the family of Jared Kushner, President Trump's son-in-law and

senior adviser. The building was facing a possible default on its

mortgage coming due in 2019 when Brookfield acquired it, according

to public loan documents. The Kushners still own the land under the

building.

The lease gives Brookfield complete operational, leasing and

development control.

Brookfield plans to upgrade the 1950s-era building between 52nd

and 53rd streets, which has fallen behind more modern competitors

because of low ceilings and numerous columns. It plans to eliminate

many of those columns and offer double-high ceilings and add four

terraces on the 39-story building.

"It's kind of a dinosaur," said Mr. Clark. "You can basically

feel the wind coming through it."

The firm also plans to replace aluminum cladding on the exterior

of the building with floor-to-ceiling windows and change the

building's address from 666 Fifth to 660 Fifth. A Brookfield

spokesman said the firm is changing the name because "it will be a

completely new building with a completely new identity."

The $400 million price tag includes $300 million to overhaul the

exterior and core of the building and $100 million for tenant

interior work.

Brookfield is moving ahead with the project when the Midtown

market is showing signs of softening because of slow leasing and

increasing development. The "availability rate," which includes

vacancy and space coming on the market, increased to 11.5% in the

third quarter, its highest level since the third quarter of 2017,

according to commercial real estate services firm CBRE Group

Inc.

But the situation is slightly better for developers who are

building from the ground up or giving existing buildings makeovers.

For example, Rockefeller Group International, a subsidiary of

Mitsubishi Estate Co., had fully leased 1271 Sixth Avenue while an

overhaul of that building was in progress. SL Green Realty Corp.

has leased about 60% of One Vanderbilt, a new 1,401-foot office

tower above Grand Central Terminal that is still under

construction.

CBRE said that 42% of the blocks of office space larger than

50,000 square feet leased in the first half of 2019 were in new or

renovated buildings, up from 41% in 2018. Tenants today are more

willing to pay up for modern space than they were in the past to

attract a millennial workforce at a time of low unemployment,

analysts say.

The younger workforce "has a completely different expectation of

what a workplace should offer them," said Nicole LaRusso, CBRE's

research director for the New York region.

Write to Peter Grant at peter.grant@wsj.com

(END) Dow Jones Newswires

October 15, 2019 00:20 ET (04:20 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

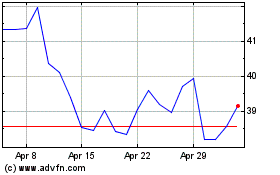

Brookfield Asset Managem... (NYSE:BAM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Brookfield Asset Managem... (NYSE:BAM)

Historical Stock Chart

From Apr 2023 to Apr 2024