Cat-Litter Rivals Pounce on New Shipping Strategies -- 2nd Update

October 13 2019 - 4:39PM

Dow Jones News

By Sharon Terlep

Cat-litter companies worked to make their products fresher, less

dusty and easier to clean. Now they are chasing a new goal: moving

those products more cheaply.

Clorox Co., the No. 2 U.S. litter maker, with brands including

Fresh Step and Scoop Away, plans to build an East Coast factory to

cut costs of transporting litter as the company struggles to

compete with faster-growing rivals. Meanwhile, Nestlé SA -- maker

of Tidy Cats, the top-selling U.S. brand -- is spending millions to

upgrade a Missouri factory with technology that will lower

transportation and inventory-management costs.

The more than $2 billion market for litter is a lucrative piece

of the fast-growing pet industry because it is essential to owning

an indoor cat, and owners are willing to pay more for advances that

cut down on the smell and hassle involved in keeping

feline-friendly homes clean. Leading brands promise to contain the

smell of multiple cats, slide easily from the box during cleaning,

and prevent litter from being tracked through the home, among other

claims.

"[Litter sales] tend to grow over time through innovation," said

Church & Dwight Co. finance chief Rick Dierker. "People will

pay a premium."

But the high cost of producing, shipping and delivering the

heavy product has vexed both manufacturers and retailers,

particularly as consumers increasingly prefer online shopping and

home delivery.

Cat litter is usually made from either clay or

moisture-absorbing silica crystals, similar to those found in

pouches to preserve food and medications. A typical box or bag of

litter weighs 30 to 40 pounds, though crystal-based litter can be

lighter and several brands have lightweight options. Clorox's

"Fresh Step Lightweight Simply Unscented" is about 30% lighter than

its normal-weight counterpart, while Nestlé's "Tidy Cats

LightWeight" weighs half as much, according to the companies.

Amazon.com Inc. has an advantage selling litter online over

retailers such as PetSmart Inc. and Chewy Inc. because it can

bundle a range of products in the same shipment to offset the high

cost of delivering heavy bags of dog food or cat litter. Amazon has

since discontinued its in-house AmazonBasics litter offering.

Amazon didn't respond to a request for comment.

Nestlé has four cat-litter factories, including one in

Springfield, Mo., that makes litter from recycled material. The

company is spending $115 million to expand another Missouri plant

to meet growing demand and an additional $55 million on an

automated, digitally controlled system of moving pallets in, out

and around the warehouse, which it says will cut handling and

transportation costs.

Sales of cat litter, a $2.6 billion industry in the U.S., rose

4% in 2018 from a year earlier, according to Euromonitor. Clorox

has trailed the broader market. Its litter sales increased 3% in

the period, while sales of Church & Dwight's Arm & Hammer

and Feline Pine brands rose 8%.

Americans own fewer cats but are spending more money overall on

their pets. Roughly 25% of households included a cat in 2018, down

from 30% in 2012, according to the American Veterinary Medical

Association. Households had 1.8 cats on average in 2018, compared

with 2.1 in 2012. Owners of all pets spent $16 billion on supplies

in 2018, up 6% from a year earlier, the American Pet Products

Association says.

In a recent presentation to investors, Clorox product-supply

chief Andrew Mowery highlighted the company's "litter network," in

which litter is shipped nationwide from a single factory in Spring

Hill, Kan. The company plans to invest in the litter business, he

said, and to do so without a new factory "would ignore the

opportunity to eliminate transportation miles."

Mr. Mowery said Clorox expects its new litter factory to be

complete in two years. He said Clorox would cut 7 million miles a

year off the distance driven to deliver litter, saving 1 million

gallons of diesel fuel. He didn't specify the expected cost of the

factory, how many people it would employ or where it would be

located on the East Coast.

The Oakland, Calif.-based company behind Glad trash bags,

Kingsford charcoal and Clorox cleaning products is the only major

litter producer with a single U.S. plant. Like Nestlé, Church &

Dwight also has multiple litter factories, which are costly to

build because of the machinery and equipment required to make

litter, analysts say.

A Clorox spokeswoman said the new plant will accommodate growth

and new litter varieties.

The litter discussion was part of presentations by Clorox

executives to Wall Street analysts in which the company laid out a

plan to cut costs and jump-start growth. Clorox's growth has lagged

behind rivals' in recent quarters and raised questions on Wall

Street over whether the company needs to consider a bigger strategy

shift. Clorox shares are up 5.7% in the past year.

Write to Sharon Terlep at sharon.terlep@wsj.com

(END) Dow Jones Newswires

October 13, 2019 16:24 ET (20:24 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

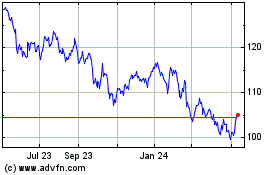

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Apr 2023 to Apr 2024