UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Schedule 14F-1

INFORMATION STATEMENT

PURSUANT TO SECTION 14(f) OF THE

SECURITIES EXCHANGE ACT OF 1934

AND RULE 14f-1 THEREUNDER

RELIABILITY

INCORPORATED

(Exact name of registrant as specified in its

corporate charter)

|

Texas

|

|

000-55177

|

|

75-0868913

|

(State

or other jurisdiction of

incorporation or organization)

|

|

Commission

File No.:

|

|

(I.R.S.

Employer

Identification No.)

|

53 Forest Avenue, First Floor, Old Greenwich,

Connecticut, 06870

(Address of principal executive offices)

Tel: (203) 489-9500

(Registrant’s telephone number, including

area code)

Approximate Date of Mailing: October 11, 2019

Reliability Incorporated

53 Forest Avenue, First Floor, Old Greenwich,

Connecticut, 06870

INFORMATION STATEMENT

PURSUANT TO SECTION 14(f) OF THE

SECURITIES EXCHANGE ACT OF 1934

AND RULE 14f-1 THEREUNDER

THIS INFORMATION STATEMENT IS BEING PROVIDED SOLELY FOR INFORMATIONAL

PURPOSES AND NOT IN CONNECTION WITH ANY VOTE OF THE STOCKHOLDERS OF RELIABILITY INCORPORATED.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE NOT BEING REQUESTED

TO SEND US A PROXY.

Schedule 14F-1

INTRODUCTION

You are urged to read this Information Statement

carefully and in its entirety. However, you are not required to take any action in connection with this Information Statement.

Unless the context otherwise requires, references throughout this Information Statement to “the Company,” “we,”

“our” and “us” refer to Reliability Incorporated.

This Information Statement

is being mailed on or about October 11, 2019 to the holders of record at the close of business on September 30, 2019 (the “Record

Date”) of outstanding shares of common stock, no par value per share (the “Common Stock”), of the

Company, in accordance with the requirements of Section 14(f) of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), and Rule 14f-1 promulgated thereunder. This Information Statement relates to an anticipated change in the composition

of our Board of Directors (the “Board”) that is expected to occur in connection with a merger to be completed

by and among the Company, a wholly owned subsidiary of the Company, R-M Merger Sub, Inc., a Virginia corporation (“Merger

Sub”), The Maslow Media Group, Inc., a Virginia corporation (“Maslow”), Naveen Doki (“Mr. Doki”),

an individual, Silvija Valleru (“Mrs. Valleru”), an individual, and Jeffrey Eberwein (“Mr. Eberwein), an individual

(collectively, the “Parties”). Section 14(f) of the Exchange Act and Rule 14f-1 requires the mailing to our

stockholders of record the information set forth in this Information Statement at least 10 days prior to the date a change in a

majority of our directors occurs (otherwise than at a meeting of our stockholders). Accordingly, the change in a majority of our

directors pursuant to the transaction described below will not occur until at least 10 days following the mailing of this Information

Statement.

On September 18, 2019 (the

“Effective Date”), the Parties entered into a merger agreement (the “Merger Agreement”) pursuant

to which the Parties agreed that, subject to the terms and conditions of the Merger Agreement, Merger Sub would be merged with

and into Maslow, with Maslow surviving as a wholly owned subsidiary of the Company (collectively with the other transactions set

forth in the Merger Agreement, the “Merger”). The closing of the Merger Agreement will occur upon the satisfaction

of the terms of the Merger Agreement (the “Closing”), at which time the Parties will cause the Merger to be

consummated by filing a Statement of Merger with the Secretary of State of Virginia. At the date and time the Statement of Merger

is filed with the Secretary of State of Virginia, the Merger will be effective (the “Effective Time”).

At the Effective Time,

each share of common stock, $1.00 par value per share, of Maslow (the “Maslow Common Stock”) issued and outstanding

immediately prior to the Effective Time will be canceled and converted, collectively, into the right to receive an aggregate number

of shares of the Common Stock constituting 94% of the issued and outstanding shares of the Common Stock as of immediately following

the Closing, which is expected to be approximately 282,000,000 shares of Common Stock. The shareholders of the Company as of immediately

prior to the Closing collectively will retain a total aggregate number of shares of the Common Stock constituting 6% of the issued

and outstanding shares of the Common Stock immediately following the Closing, which is expected to be 18,000,000 shares of Common

Stock.

In addition, at the Effective

Time, any outstanding shares of Common Stock owned by the Company, Merger Sub or any other direct or indirect wholly owned subsidiary

of the Company or Merger Sub, will be cancelled and cease to exist and no cash or consideration will be delivered in exchange for

such shares; and all outstanding shares of common stock, par value $0.01 per share, of Merger Sub issued and outstanding immediately

prior to the Effective Time will be converted into and become, collectively, one share of Maslow Common Stock, and constitute the

only outstanding share of capital stock of Maslow.

The Merger Agreement also

contemplates a change in the composition of the Board at the Closing, which will be no earlier than the tenth day following the

date of this Schedule 14f-1 is filed with the Securities and Exchange Commission (the “SEC”) and mailed to our

stockholders (the “New Board Effective Date”). Pursuant to the terms of the Merger Agreement, at the Closing,

the Board, which currently consists of Hannah Bible, Shawn Miles, and Julia Dayton will elect Mr. Doki, Mrs. Valleru, Mrs. Shirisha

Janumpally (“Mrs. Janumpally”), and Mark Speack (“Mr. Speak”) to serve on the Board, and all other directors

shall resign, provided that Mr. Eberwein shall have the right to name one director to the Board, which may be Ms. Bible, in which

event she will not resign. All officers of the Company as of immediately prior to the Closing will also resign and will be replaced

by officers as selected by the newly constituted Board.

By the Effective Time,

the new management described above will be installed and the Company will be engaged in the business of Maslow, a workforce solutions

company.

The Merger Agreement contains

customary representations, warranties, and covenants of the Company and the other parties to the Merger Agreement for (and accompanying

transactions). Subject to certain limitations, the Parties agreed to indemnify each other for breaches of representations, warranties,

agreements and certain other items.

The foregoing description

of the proposed Merger Agreement does not purport to be complete and is qualified in its entirety by the terms of the actual Merger

Agreement, which is filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed on September 23, 2019.

No action is required by

our stockholders in connection with this Information Statement. However, Section 14(f) of the Exchange Act and Rule 14f-1 promulgated

thereunder require the mailing to our stockholders of record of the information set forth in this Information Statement at least

ten (10) days prior to the date a change in a majority of our directors occurs (otherwise than at a meeting of our stockholders).

Accordingly, the change in a majority of our directors will not occur until at least ten (10) days following the mailing of this

Information Statement. This Information Statement will be first mailed to the Company’s stockholders of record as of September

30, 2019 on or about October 11, 2019[1].

Please read this Information

Statement carefully. It describes the terms of the proposed Merger Agreement and contains certain biographical and other information

concerning our executive officers and directors after completion of the proposed Merger. All Company filings and exhibits thereto

are available to the public at the SEC’s website at http://www.sec.gov.

THIS INFORMATION STATEMENT IS REQUIRED BY

SECTION 14(F) OF THE EXCHANGE ACT AND RULE 14F-1 PROMULGATED THEREUNDER IN CONNECTION WITH THE APPOINTMENT OF DIRECTOR DESIGNEES

TO THE BOARD. NO ACTION IS REQUIRED BY OUR STOCKHOLDERS IN CONNECTION WITH THE RESIGNATION AND APPOINTMENT OF ANY DIRECTOR.

CHANGES TO THE BOARD OF DIRECTORS AND EXECUTIVE

OFFICERS

The Board has determined

that the consummation of the Merger will constitute a change of control of the Company, as upon the Closing of the Merger, the

majority of the members of the Board will change. In addition, more than a majority of the shares of our Common Stock outstanding

immediately following the Effective Time of Merger will be beneficially owned by Dr. Doki and Dr. Janumpally.

The following actions relating

to our Board and executive officers, all of which would be effective upon the Closing, will be taken:

|

|

·

|

our current Board will

elect Mr. Doki, Mrs. Valleru, Mrs. Janumpally, and Mr. Speck to the Board (the “New Directors”;

|

|

|

·

|

all officers and Board

members (other than as set forth immediately below) other than the New Directors will resign from the Board; and

|

|

|

·

|

Mr. Eberwein shall name

one director to the Board, which may be Ms. Bible, in which event she will not resign.

|

As a result, we expect

that our Board will be comprised solely of the New Directors and Mr. Eberwein’s designee, which we expect to be Ms. Bible,

following the Closing (the “New Board”). In addition, at the Closing, the New Board will elect new officers

of the Company. The individuals the New Board intends to elect to officer positions are reflected “Directors and Executive

Officers Following the Merger” table below.

Current Officers and Directors of the

Company

The following paragraphs

provide information as of the date of this report about each of our current directors and executive officers. There are no

family relationships between any of the directors and executive officers listed. In addition, there was no arrangement or understanding

between any executive officer and any other person pursuant to which any person was selected an executive officer.

|

Name

|

|

Age

|

|

Position

|

|

|

|

|

|

|

|

Hannah M. Bible

|

|

39

|

|

Chairman of the Board of Directors, President, Chief Executive Officer, Chief Financial Officer

|

|

Shawn Miles

|

|

26

|

|

Director

|

|

Julia Dayton

|

|

50

|

|

Director, Treasurer

|

The biographies of the above-identified individuals

are set forth below:

Hannah

M. Bible, Chairman of the Board of Directors, President, Chief Executive Officer, Chief Financial Officer, and Secretary

Hannah

M. Bible is Chief Financial Officer and in-house counsel of Lone Star Value Management, LLC (“Lone Star Value Mgmt.”).

Ms. Bible has over 15 years of combined legal and accounting experience across a variety of industries. From May 2016 through August

2017 Ms. Bible served on the board of Crossroads Systems, Inc. (NASDAQ: CRDS), a data storage company. Prior to joining Lone Star

Value Mgmt. in June 2014, Ms. Bible was the Director of Finance/CFO at Trinity Church in Greenwich, CT. From October 2011 to December

2012, Ms. Bible served as a legal advisor to RRMS Advisors, a company providing advisory and due diligence services to banking

and other institutions with high risk assets. From June 2009 to December 2013, Ms. Bible advised family fund and institutional

clients of International Consulting Group, Inc., and its affiliates within the Middle East on matters of security, corporate governance,

and U.S. legal compliance. From 2006 to 2008, Ms. Bible served within the U.N. General Assembly as a diplomatic advisor to the

Asian-African Legal Consultative Organization, a permanent observer mission to the United Nations. From 2007 until recently, Ms.

Bible taught as an Adjunct Professor at Thomas Jefferson School of Law, within the International Tax and Financial Services program.

Prior to this Ms. Bible held various accounting positions with Samaritan’s Purse, a large $300MM+ 501(c)(3) organization

dedicated to emergency relief and serving the poor worldwide. Previously, Ms. Bible served as a director of AMRH Holdings, Inc.

(formerly Spatializer Audio Laboratories). Ms. Bible earned an LLM in Tax from New York University School of Law, a JD with

honors from St. Thomas University School of Law, and a BBA in Accounting from Middle Tennessee State University.

Shawn

Miles, Director

Shawn Miles,

a director of the Company since May 2018, has served as an analyst at Hudson Global, Inc., a global recruitment company, since

April 2018. Prior to joining Hudson, Mr. Miles served as a research analyst at Lone Star Value Mgmt. Mr. Miles earned master’s

and bachelor’s degrees in Applied Economics from Cornell University’s Dyson School of Applied Economics & Management.

Julia

Dayton, Director

Julia

M. Dayton, a director of the Company since May 2018, is a Consultant in the Health, Nutrition and Population Global Practice at

the World Bank, Washington, D.C., working to analyze the cost-effectiveness and optimal allocation of nutrition interventions at

the country and global level. Past research topics include the inter-generation impact of HIV/AIDS, health program evaluation and

cost-effectiveness analysis. She also served as a research associate at the Population Council and was a post-doctoral fellow

at Yale University’s Center for Interdisciplinary Research on AIDS. She holds a PhD in Health Economics from Yale University,

MPA from the Middlebury Institute of International Studies and a BA from Emory University. She lives in Old Greenwich, CT, with

her husband Jeffrey Eberwein, a significant shareholder of the Company and five children.

Directors and Executive Officers Following

the Merger

The following paragraphs provide information

about each of our directors and executive officers following the consummation of the Merger. Mr. Doki and Mrs. Janumpally are married.

There are no other family relationships between any of the officers or directors listed below.

|

Name

|

|

Age

|

|

Position

|

|

Mark Speck

|

|

59

|

|

Chief Financial Officer, Director

|

|

Nick Tsahalis

|

|

42

|

|

President, Acting CEO

|

|

Naveen Doki

|

|

44

|

|

Director

|

|

Silvija Valleru

|

|

48

|

|

Director

|

|

Shirisha Janumpally

|

|

43

|

|

Director

|

|

Hannah Bible*

|

|

39

|

|

Director

|

* Background information on this

Ms. Bible is included in the “Current Officers and Directors of the Company" section above, and assumes that she will

be Mr. Eberwein’s designee to the Board.

Mark Speck, Chief Financial Officer,

Director

Mr. Speck is an executive

who leverages technology, business intelligence, innovation, enterprise-wide synergies, M&A opportunities, team development,

and smart risk to capture opportunities for aggressive growth.

Mr. Speck has 25+ years

of business experience and has held executive and senior leadership roles in the areas of finance, audit, business development,

operations, and compliance across a range of technology, software, legal and professional service, staffing, telecommunications,

consulting, non-profit, and government contracting industries for a variety of public, private, and private equity held firms.

Mr. Speck has served as

the Chief Financial Officer for Maslow since April 2019. Prior to this, Mr. Speck was the COO and CFO of a Specktrum, Inc. a finance,

accounting and compliance services firm he founded, titled In that capacity he raised capital, led sales, marketing, operations,

and finance. He served in this capacity from August 2017 to March 31, 2019 prior to joining Maslow.

Previously, Mr. Speck was

CFO of CPA Global North America, an intellectual property lifecycle management firm with US headquarters in Alexandria, Virginia,

from February 2010 to June 2011, and Chief Compliance Officer and Head of Internal Audit of CPA Global corporate based out of St.

Hellier, Jersey, Channel Islands from June 2011 to August 2017. As CFO he presided over financial management of 50% of the firm’s

$3.1B customer portfolio facilitating double digit growth by establishing fiscal discipline in terms of internal controls and policies,

installing improved cash conversion facilities, implementing KPI’s for 5 separate lines of business, including its sales

pipeline, and upgrading the region’s financial reporting requirements which were later employed as group global reporting

standards. Mr. Speck also introduced a revenue enhancement program that generated a multi-million annuitized impact.

In 2011, Mr. Speck was asked to set

up and lead CPA Global’s a regulatory compliance programme, which was required to complete a capital event, so he was named

the firm’s global Chief Compliance Officer and Head of Internal Audit, a post he presided over for 6 years. In this capacity

he was responsible for global compliance covering regulations in 14 countries on 5 continents. As head of internal audit his team

added value by driving organizational and operating optimization and detecting revenue and cost savings opportunities that often

had a financial impact which often exceeded his organizational budget. He also led the formal creation of both a data protection

and anti-bribery and corruption programs.

Nick Tsahalis, President

Nick Tsahalis currently

serves as the Chief Executive Officer of Maslow, and has served in such capacity since July 2017. Mr. Tsahalis joined Maslow in

2015 as its Chief Financial Officer. Prior to joining Maslow, he previously served as Chief Financial Officer of Recycled Green

Industries, a company that processed food scraps into composted materials with commercial applications from June 2011 to July 2015.

Prior to that, he served as Chief Financial Officer of Atlantic Video Productions & Internet Services, Inc., which provided

production and internet services. In each position as CFO, he was responsible for managing the company's finances, including financial

planning, management of financial risks, record-keeping, and financial reporting. He received his degree in Accounting from the

University of Maryland, Robert H. Smith School of Business.

Naveen Doki, Director

Naveen Doki is a clinically trained Hematologist

and Oncologist. He obtained his MD from India and trained in Internal Medicine at UC Irvine and completed his fellowship in Hematology

and Oncology at University of Sothern California. Shortly after completing his fellowship, Dr. Doki started his own practice in

Fairfax, VA after a 3 month stint at a local practice in Frederick, MD.

Mr. Doki is an entrepreneur who has invested

in real-estate, information technology, infrastructure and urgent care practices. He previously owned an urgent care facility,

CareMed, LLC in Virginia which he divested in early 2019. In May of 2012, he acquired an existing practice called Hematology Oncology

Care of Northern Virginia. in Fairfax, Virginia, where he practices as a Hematologist-Oncologist. Since Sep, 2019, he has held

a majority ownership interest in a technology services company, Futuris Technology Services, Inc. located in Virginia.

He has active medical licenses in Virginia,

California and Maryland. He is board certified by ABIM in Medical Oncology. Prior to relocating to the United States, he worked

for Kingston Public Hospital in Jamaica.

He is the husband of Dr. Shirisha Janumpally, who is also to become

a director of the Company.

Dr. Silvija Valleru, Director

Silvija Valleru has been practicing dentistry

for over 20 years. She earned her Doctor of Dental Surgery (DDS) in 1998 from the University of the Pacific. From 1999-Present

Dr. Valleru has been a resident dentist at the Dental Care Alliance in Woodbridge, VA. She previously practiced dentistry and co-managed

her dental practice in Loudoun County, VA between 2009 and 2013. She owned her own facility with her partner in Loudoun County

and divested it out in early 2016.

Dr. Valleru has made several private investments

in real-estate and information technology. She made investments in Maslow Media Group, Futuris Technology Services, Inc and an

office building in Rockville, MD.

Dr. Shirisha Janumpally, Director

Shirisha Janumpally, MD is a board-certified

neurologist and sleep specialist that has been practicing for 18 years. She is also a member of the American Academy of Sleep Medicine,

American Academy of Neurology and American Medical Association. She has worked in both academic and community settings as a neurologist

and sleep medicine specialist.

Ms. Janumpally completed her internship at Loma

Linda University Medical center in Internal medicine.

Subsequently, she completed her neurology residency and sleep medicine

training at University of California-Irvine (UCI) Medical Center. During her residency her research focus was on the role of dopamine

agonists (which are used to treat restless leg syndrome) in causing impulse control behavior disorders. Following her training

she worked as a sleep medicine attending physician as well as an Assistant Professor of Neurology at UCI Medical Center. Her clinical

interests include sleep related breathing disorders, parasomnias, and circadian rhythm disorders.

From 2014 to present, Ms. Janumpally has been

an active practicing neurologist within SJanumpally, Inc.

She is an active investor in various businesses and currently has

holdings in real-estate and information technology within IQS, Corp in Minneapolis, MN and Senryo, Inc. in Chicago, Illinois.

She is the wife of Mr.

Doki, who is also a potential director of the Company.

No action is required by

our stockholders in connection with this Information Statement. However, Section 14(f) of the Exchange Act and Rule 14f-1 promulgated

thereunder require the mailing to our stockholders of the information set forth in this Information Statement at least ten (10)

days prior to the date a change in a majority of our directors occurs (otherwise than at a meeting of our stockholders).

Unless otherwise indicated,

the address for each executive officer and director listed is: c/o Reliability Incorporated 53 Forest Avenue, First Floor, Old

Greenwich, Connecticut 06870.

Related Parties

Mr. Doki and Mrs. Janumpally

are married; and Mr. Eberwein and Mrs. Dayton are married. Mr. Miles is an employee of Hudson Global wherein Mr. Eberwein is CEO,

and a previous employee of Lone Star Value Management. Ms. Bible is an employee of Lone Star Value Management. Mr. Eberwein is

the sole manager of Lone Star Value Management, and Lone Star Value Management is the investment manager for Lone Star Value Investors

and Lone Star Value Co-Invest I. There are no other family relationships between any director, executive officer, or person nominated

or chosen by the Company to become a director or executive officer.

VOTING SECURITIES

Our authorized capital

stock consists of 300,000,000 shares of Common Stock, of which approximately 16,916,693 shares were outstanding as of the Record

Date, and 1,000,000 shares of preferred stock, no par value per share (the “Preferred Stock”), of which no shares

were issued and outstanding on the Record Date. Each share of Common Stock and each share of Preferred Stock entitles the holder

thereof to one vote on each matter which may come before a meeting of the stockholders The holders of the Common Stock and the

Preferred Stock generally vote as a single class on all matters.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

The following tables set

forth information on the beneficial ownership of our voting securities as of immediately prior to the Closing of the Merger Agreement

by the individuals who are our executive officers, directors and/or greater than 5% stockholders. Beneficial ownership is determined

in accordance with the rules of the SEC. To our knowledge, each of the holders of stock listed below will have sole voting and

investment power as to the stock owned unless otherwise noted.

Beneficial Ownership Immediately Prior to

the Closing of the Merger Agreement[2]:

|

Name and Address

|

|

Amount and nature of beneficial ownership (Common Stock)

|

|

|

Percentage of Class (Common Stock)

|

|

|

|

|

|

|

|

|

|

|

|

Officers and Directors

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hannah M. Bible, 53 Forest Avenue, First Floor, Old Greenwich, CT 06870

|

|

|

0

|

|

|

|

0

|

|

|

%

|

|

|

|

|

|

Shawn Miles, 53 Forest Avenue, First Floor, Old Greenwich, CT 06870

|

|

|

0

|

|

|

|

0

|

|

|

%

|

|

|

|

|

|

Julia Dayton, 53 Forest Avenue, First Floor, Old Greenwich, CT 06870

|

|

|

6,786,588 (1)

|

|

|

|

40.12

|

|

|

%

|

|

|

|

|

|

5% Shareholders

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jeffrey E. Eberwein, 53 Forest Avenue, First Floor, Old Greenwich, CT 06870

|

|

|

10,187,948 (2)

|

|

|

|

60.23

|

|

|

%

|

|

|

|

|

|

Lone Star Value Co-Invest I, LP, 53 Forest Avenue, First Floor, Old Greenwich, CT 06870 (1)

|

|

|

6,786,588

|

|

|

|

40.12

|

|

|

%

|

|

|

|

|

|

Lone Star Value Investors, LP, 53 Forest Avenue, First Floor, Old Greenwich, CT 06870

|

|

|

3,401,360

|

|

|

|

20.11

|

|

|

%

|

|

|

|

|

|

All directors and officers as a group (3)

|

|

|

6,786,588

|

|

|

|

40.12

|

|

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

Represents shares Mrs. Dayton may be deemed

to indirectly beneficially own as Mr. Eberwein’s wife. Mr. Eberwein is the 100% owner of Lone Star Value Co-Invest I, LP

(“Lone Star Value Co-Invest I”), and has voting and dispositive control over the shares held by Lone Star Value Co-Invest

I. As such, Mr. Eberwein may be considered the beneficial owner of such shares. Mrs. Dayton disclaims beneficial ownership of such

shares except to the extent of her pecuniary interest therein.

|

|

|

(2)

|

Represents (i) 3,401,360 shares owned by Lone Star Value Investors,

LP (“Lone Star Value Investors”) and (ii) 6,786,588 shares owned by Lone Star Value Co-Invest I, for which Mr. Eberwein

may be deemed the beneficial owner. Mr. Eberwein is the manager of Lone Star Value Management, LLC, the investment manager of Lone

Star Value Investors and Lone Star Value-Co-Invest I. Mr. Eberwein is the sole investor of Lone Star Value Co-Invest I, and contributed

the shares to Lone Star Value Co-Invest I. Mr. Eberwein disclaims beneficial ownership of such shares except to the extent of his

pecuniary interest therein.

|

The following table sets

forth information regarding the beneficial ownership of our Common Stock after the Effective Time of the Merger for (i) each of

the persons expected to serve as executive officers and directors of the Company after the Merger and (ii) other persons known

or anticipated by us to hold more than 5% of our outstanding shares of Common Stock after giving effect to the Merger.

Beneficial ownership is

determined in accordance with the rules of the SEC. To our knowledge, each of the holders of stock listed below will have sole

voting and investment power as to the stock owned unless otherwise noted.[3]

Beneficial Ownership After the Effective

Time of the Merger[4]:

|

Name and Address

|

|

Amount and nature of beneficial ownership (Common Stock)

|

|

|

Percentage of Class

(Common Stock)

|

|

|

|

|

|

|

|

|

|

|

Officers and Directors

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mark Speck, 22 Baltimore Rd., Rockville, MD 20850

|

|

|

3,288,233

|

(1)

|

|

|

1.1

|

|

|

%

|

|

|

|

|

Nick Tsahalis, 22 Baltimore Rd., Rockville, MD 20850

|

|

|

3,288,233

|

|

|

|

1.1

|

|

|

%

|

|

|

|

|

Naveen Doki, 3022 Williams Dr, Suite 100, Fairfax, VA 22031

|

|

|

207,384,793

|

(2)

|

|

|

69.13

|

|

|

%

|

|

|

|

|

Silvija Valleru, 14520 Smoketown Rd., Woodbridge, VA 22192

|

|

|

51,844,970

|

(3)

|

|

|

17.3

|

|

|

%

|

|

|

|

|

Shirisha Janumpally, 3022 Williams Dr., Suite 100, Fairfax, VA 22031

|

|

|

207,384,793

|

(4)

|

|

|

69.13

|

|

|

%

|

|

|

|

|

Hannah Bible, 53 Forest Avenue, First Floor, Old Greenwich, CT 06870

|

|

|

0

|

|

|

|

0.0

|

|

|

%

|

|

|

|

|

5% Holders

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kalyan Pathuri, 6206 Colchester Rd, Fairfax, Virginia, 22030

|

|

|

51,844,970

|

(5)

|

|

|

17.3

|

|

|

%

|

|

|

|

|

All directors and officers as a group (6)

|

|

|

265,806,229

|

|

|

|

88.6

|

|

|

%

|

|

|

|

|

|

(1)

|

Represents (i) 3,026,092 shares held by Mr. Speck; (ii) 262,141 shares

held by Hawkeye Enterprises Inc, a company owned and controlled by Mr. Speck.

|

|

|

(2)

|

Represents (i) 10,369,322 shares held by Mr. Doki; (ii) 20,738,643 shares held by Federal Systems,

a company owned and controlled by Mrs. Janumpally, which Mr. Doki may be deemed to indirectly beneficially own as the husband of

Mrs. Janumpally;(iii) 165,907,507 shares held by Judos Trust, a trust in which Mrs. Janumpally is the sole trustee and beneficiary,

and of which Mr. Doki may be deemed to indirectly beneficially own as the husband of Mrs. Janumpally; and (iv) 10,369,322 shares

held directly by Mrs. Janumpally which Dr. Doki may be deemed to indirectly beneficially own as the husband of Mrs. Janumpally.

|

|

|

(3)

|

Represents (i) 5,183,842 shares held by Mrs. Valleru; and (ii) 41,477,286 shares held by Igly

Trust of which Mrs. Valleru may be deemed to indirectly beneficially own as the wife of Kalyan Pathuri, who is the sole trustee

and beneficiary of the Igly Trust; and (iii) 5,183,842 shares held by Mr. Pathuri, which Mrs. Valleru may be deemed to indirectly

beneficially own as the wife of Mr. Pathuri.

|

|

|

(4)

|

Represents (i) 10,369,322 shares that Mrs. Janumpally may be deemed to indirectly beneficially

own as the wife of Mr. Doki; (ii) 20,738,643 shares held by Federal Systems, a company owned and controlled by Mrs. Janumpally;

(iii) 165,907,507 shares held by Judos Trust, a trust in which Mrs. Janumpally is the sole trustee and beneficiary, and (iv) and

10,369,322 shares Mrs. Janumpally owns directly.

|

|

|

(5)

|

Represents (i) 5,183,842 shares held by Mr. Pathuri; (ii) 41,477,286 shares held by Igly Trust

of which Mr. Pathuri is the sole trustee and beneficiary; and (iii) 5,183,842 shares held by Mrs. Valleru of which Mr. Pathuri

may be deemed to indirectly beneficially own as the husband of Mrs. Valleru.

|

[1] Assumes

300,000,000 RLBY Common Stock outstanding as of the Closing of the Merger.

CORPORATE GOVERNANCE

Committees of the Board of Directors

We are currently

quoted on the OTC Marketplace (the “OTC”) under the symbol “RLBY”. The OTC does not have any requirements

for establishing any committees. For this reason, we have not established any committees. All functions of an audit committee,

nominating committee and compensation committee are and have been performed by our Board.

Our Board believes

that, considering our size, decisions relating to director nominations can be made on a case-by-case basis by all members of the

Board without the formality of a nominating committee or a nominating committee charter. To date, we have not engaged third parties

to identify or evaluate or assist in identifying potential nominees, although we reserve the right to do so in the future.

Code of Ethics

At present we have not adopted a Code of Ethics applicable to our

directors, officers and employees.

Director Independence

Under NASDAQ Marketplace

Rule 4200(a)(15), a director is not considered independent if he or she has also been an executive officer or employee of the corporation

during the current year or any of the past three years. As such, only Mr. Miles can be classified as independent under this definition.

The OTC does not maintain

any standards regarding the “independence” of the directors for our Board, and we are not otherwise subject to the

requirements of any national securities exchange or an inter-dealer quotation system with respect to the need to have a majority

of our directors be independent.

Director Nominations

Our Board believes that,

considering our size, decisions relating to director nominations can be made on a case-by-case basis by all members of the Board

without the formality of a nominating committee or a nominating committee charter. To date, we have not engaged third parties to

identify or evaluate or assist in identifying potential nominees, although we reserve the right to do so in the future.

The Board does not have

an express policy with regard to the consideration of any director candidates recommended by shareholders since the Board believes

that it can adequately evaluate any such nominees on a case-by-case basis; however, the Board will evaluate shareholder-recommended

candidates under the same criteria as internally generated candidates. Although the Board does not currently have any formal minimum

criteria for nominees, substantial relevant business and industry experience would generally be considered important, as would

the ability to attend and prepare for board, committee and shareholder meetings. Any candidate must state in advance his or her

willingness and interest in serving on the Board.

Board Oversight

Our management is responsible

for managing risk and bringing the most material risks facing the Company to the Board’s attention. Because we do not yet

have separately designated committees, the entire Board has oversight responsibility for the processes established to report and

monitor material risks applicable to the Company relating to (1) the integrity of the Company’s financial statements and

the review and approval of the performance of the Company’s internal audit function and independent accountants, (2) succession

planning and risks related to the attraction and retention of talent and to the design of compensation programs and arrangements,

and (3) monitoring the design and administration of the Company’s compensation programs to ensure that they incentivize strong

individual and group performance and include appropriate safeguards to avoid unintended or excessive risk taking by Company employees.

Board Diversity

While we do not

have a formal policy on diversity, our Board considers diversity to include the skill set, background, reputation, type and length

of business experience of our Board members, as well as a particular nominee’s contributions to that mix.

SECTION 16(a)

BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of

the Securities Exchange Act of 1934, as amended, requires our officers and directors, and persons who own more than 10 percent

of a registered class of our equity securities, to file reports of ownership and changes in ownership of such securities with the

SEC. Officers, directors and greater than ten percent stockholders are required by SEC regulations to furnish us with copies of

all Section 16(a) forms they file. Based solely on review of the copies of Forms 3 and 4 and amendments thereto furnished to us

during the fiscal year December 31, 2018 and Forms 5 and amendments thereto furnished to us with respect to such fiscal year, or

written representations that no Forms 5 were required, we believe all required forms have been filed by our officers, directors

and greater than ten percent beneficial owners.

COMPENSATION OF

DIRECTORS AND EXECUTIVE OFFICERS

The Company did not pay any salary to its officers or directors in 2017 or 2018. The Company has no employees, and no employment

agreements with any of its current officers or directors.

Compensation Agreements

We have no compensation

arrangements (such as fees for retainer, committee service, service as chairman of the Board or a committee, and meeting attendance)

with directors for their services as directors.

Director Compensation

None

of the Company’s directors received any cash compensation, stock option awards or other arrangements for services provided

in their capacity as directors during the fiscal year ended December 31, 2018. However, Ms. Bible is an employee of Lone Star Value

Management, the investment manager of Lone Star Value Investors, LP and Lone Star Value Co-Invest I, LP; Mr. Miles is a former

employee of Lone Star Value Management, who still provides services on a consultant basis.

Stock Option Plan

The Company has no outstanding

stock options. Under the Company’s Amended and Restated 1997 Stock Option Plan (“Option

Plan”), which expired in 2006, stock option grants were available for officers, directors, and key employees. The objective

of the Option Plan was to promote the interest of the Company by providing an ownership incentive to officers, directors, and key

employees, to reward outstanding performance, and to encourage continued employment. The Board, which acted as the Plan Administrator,

determined to whom options were granted, the type of options, the number of shares covered by such options and the option vesting

schedule. All options were issued at market value on the date of the grant and generally had a ten-year contractual term with graded

vesting.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Mr. Eberwein, Mr. Doki,

and Mr. Valleru are each parties to the Merger Agreement in their individual capacities. Mr. Eberwein is beneficial owner of more

than 10% of the outstanding shares of the Common Stock as of the date of this report. Additionally, pursuant to the Merger Agreement,

Mr. Doki and Mr. Valleru are to be appointed to the Board as directors upon the Closing of the Merger Agreement. As such, they

are currently considered proposed directors of the Company. Therefore, the Merger Agreement is considered a transaction with related

parties of the Company.

Mr. Doki and Mrs. Janumpally

are married. There are no other family relationships between any director, executive officer, or person nominated or chosen by

the registrant to become a future director or executive officer.

On

June 6, 2014, Lone Star Value Investors, LP issued a promissory note to the Company

in the principal amount of $50,000 (“2014 Note”) and on August 2, 2016, Lone Star Value Co-Invest I issued a promissory

note a in the amount of $40,000 (“2016 Note”). On August 10, 2018, the Company issued a promissory note

to a shareholder in the amount of $15,000 (“2018 Note”). Lone Star Value Investors and Lone Star Value Co-Invest

I are significant shareholders of the Common Stock. Under the terms of the 2014 Note, 2016 Note, and 2018 Note interest on the

outstanding principal amount accrues at a rate of 10% per annum, and all amounts outstanding under the notes are due and payable

on or before June 30, 2019 in respect of the 2014 Note, and August 31, 2021 in respect to the 2016 Note and 2018 Note. All payments

of the 2016 Note and 2018 Note are subordinate to the payment of all outstanding amounts due under the 2014 Note. The Company intends

to use the proceeds for operating expenses.

Other than in the aforementioned

transactions and in any reports filed by us with the SEC, there have been no related party transactions in which the amount involved

exceeds the lesser of $120,000 or one percent of the average of our total assets (including with current or proposed directors,

officers and beneficial owners of more than 10% of the Company’s outstanding shares), or any other transactions or relationships

required to be disclosed pursuant to Item 404 Regulation S-K. The Company is currently not a subsidiary of any company.

LEGAL PROCEEDINGS

To the Company’s

best knowledge, there are no pending legal proceedings to which the Company is a party or of which any of its property is the subject.

WHERE YOU CAN FIND MORE INFORMATION

The Company is subject

to the information and reporting requirements of the Exchange Act, and in accordance with the Exchange Act, the Company files reports,

documents and other information with the SEC. These reports and other information filed with the SEC by the Company may be inspected

and are available for copying at the public reference facilities maintained by the SEC at 100 F Street, N.E. Washington, D.C. 20549.

Copies may be obtained at prescribed rates from the Public Reference Section of the SEC at its principal office in Washington,

D.C. The SEC also maintains an internet website that contains periodic and other reports, proxy and information statements and

other information regarding registrants, including the Company, that file electronically with the SEC. The address of the SEC’s

website is http://www.sec.gov.

The Company’s Annual

Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K can be accessed through the SEC website.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Company has duly caused this information statement on Schedule 14f-1 to be signed on

its behalf by the undersigned hereunto duly authorized.

|

|

Reliability Incorporated

|

|

|

|

|

|

|

By:

|

/s/ Hannah M. Bible

|

|

|

|

Name: Hannah M. Bible.

|

|

|

|

Title: Chief Executive Officer

|

|

|

|

|

|

Dated: October 11, 2019

|

|

|

|

|

|

|

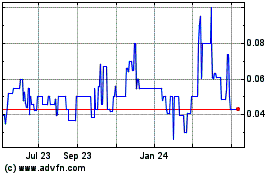

Reliability (PK) (USOTC:RLBY)

Historical Stock Chart

From Mar 2024 to Apr 2024

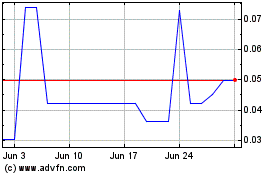

Reliability (PK) (USOTC:RLBY)

Historical Stock Chart

From Apr 2023 to Apr 2024