CFTC: Commissioners Shouldn't Be Forced to Testify

October 03 2019 - 8:17PM

Dow Jones News

By Dylan Tokar

The Commodity Futures Trading Commission has asked an appeals

court to block an order requiring three of its commissioners to

testify over statements the agency published following a

market-manipulation settlement.

The derivatives regulator argued in a motion unsealed Wednesday

that U.S. District Judge John Robert Blakey had overstepped

judicial bounds by ordering the CFTC's presidentially appointed

commissioners to show up in court for a hearing that the judge said

could result in a referral for criminal contempt.

The appeal is the latest in a series of attempts by the agency

to prevent its new chairman, Heath Tarbert, and two Democratic

commissioners from becoming entangled in a legal battle related to

a CFTC settlement. The regulator had sued Kraft Heinz Co. and

Mondelez International Inc. over alleged manipulation of the

wheat-futures market.

To settle the CFTC's allegations, Kraft and Mondelez -- which

were one corporate entity when the agency announced its civil

charges in 2015 -- had agreed to pay $16 million.

In a move the CFTC called unprecedented, Judge Blakey in August

ordered the three commissioners and a group of CFTC lawyers to

appear at a hearing on whether the agency had violated an unusual

provision prohibiting parties to the settlement from making certain

public comments about the deal.

Despite the prohibition, the CFTC published a press release and

two statements a day after the settlement was completed, causing

Kraft and Mondelez to ask Judge Blakey to hold the agency in

contempt.

Following the order, the CFTC filed a series of emergency

requests, which were kept under seal, asking Judge Blakey's court

as well as the appeals court to delay or cancel the hearing. The

regulator argued there are legal issues around forcing its

commissioners -- high-ranking executive branch officials -- to

testify.

The motions were unsealed by the U.S. Court of Appeals for the

Seventh Circuit on Wednesday. The CFTC argued Judge Blakey was

acting as an "inquisitor" by attempting to personally investigate

Kraft and Mondelez's claims, adding the judge should be

disqualified from conducting a contempt hearing because he had

participated in the settlement negotiations.

A lawyer for Kraft and Mondelez didn't return a request for

comment.

The appeals court last week agreed to hear the CFTC's request

and ordered Judge Blakey to halt proceedings until it reached a

decision.

Judge Blakey's order would cause serious disruptions and divert

public resources away from its heavy enforcement workload, the CFTC

said in one of the unsealed motions.

Extensive coverage of the settlement would have occurred

regardless of the CFTC's press release and statements, the agency's

lawyers also argued.

"[Media] coverage of the settlement...was inevitably going to be

terrible for Kraft," they said.

One focus of the legal battle is whether the gag provision in

the settlement with Mondelez and Kraft applies to the CFTC's

commissioners.

The CFTC has argued that it is required to publish additional

statements made by a commissioner about an enforcement decision,

beyond the commission's official statement.

Along with the initial press release about the settlement, the

five-member commission had released a statement about the

settlement. Its two Democratic commissioners, Rostin Behnam and Dan

Berkovitz, also released a separate statement in which they touted

the settlement and noted the restriction on public statements.

Kraft and Mondelez have disputed the CFTC's characterization

that the commissioners weren't parties to the settlement, saying it

is at odds with the regulator's process for approving enforcement

actions, which require a vote by the commissioners.

Records unsealed Wednesday revealed that the unusual gag

provision was formulated during a confidential hearing in March,

when Judge Blakey had acted as a mediator in an effort to help the

CFTC and the two companies reach a settlement agreement.

After the hearing, CFTC lawyers had approached counsel for Kraft

and Mondelez on several occasions to relay a request by its

commissioners that the clause be removed. The companies refused,

according to the declaration of a lawyer for Kraft and

Mondelez.

The requests showed the commissioners knew they would be subject

to the gag provision, Kraft and Mondelez wrote in their brief.

"The CFTC's new interpretation is nothing more than an attempt

to manufacture an excuse and blur what was unambiguously clear to

all sides when the parties' agreed to the consent order and the

court entered it," they wrote.

Write to Dylan Tokar at dylan.tokar@wsj.com

(END) Dow Jones Newswires

October 03, 2019 20:02 ET (00:02 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

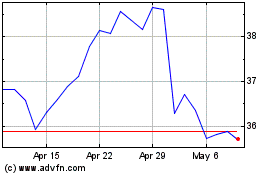

Kraft Heinz (NASDAQ:KHC)

Historical Stock Chart

From Mar 2024 to Apr 2024

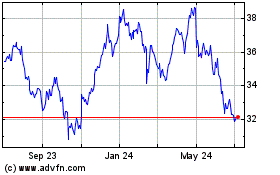

Kraft Heinz (NASDAQ:KHC)

Historical Stock Chart

From Apr 2023 to Apr 2024