Tax Issue Weighs on Costco's Profit In Latest Quarter

October 03 2019 - 5:11PM

Dow Jones News

By Micah Maidenberg

Revenue increased 7% at Costco Wholesale Corp. in the company's

latest quarter, but a tax issue hurt the company's profit.

Costco said it generated about $47.5 billion in net sales and

membership fees in its fiscal fourth quarter, up from $44.41

billion the year earlier. Analysts polled by FactSet expected

$47.44 billion in revenue for the latest period.

Profit rose to almost $1.10 billion, or $2.47 a share, from

$1.04 billion, or $2.36 a share, the year earlier. Analysts

expected $2.54 a share in adjusted profit.

The company recorded what it called a $123 million pretax

reserve related to a product-tax assessment in the quarter,

lowering earnings.

Along with rival Walmart Inc., Costco has shown it can draw in

customers and notch higher sales in a shifting retail market.

Investors have responded by bidding up shares in the Issaquah,

Wash.-based company 42% so far this year.

The company has been helped along by consumer spending, which

has been a strength for the U.S. economy for much of the year amid

worries about slowing global growth and uncertainty related to

tariffs. However, household spending rose just 0.1% in August from

July on a seasonally adjusted basis, slower than the first seven

months of the year.

Comparable sales, or those from Costco warehouses open for more

than a year as well as online sales, increased 5% for the company's

quarter that ended Sept. 1. Comparable sales in the U.S. were up

about 6%.

Shares of Costco fell 1.6% in postmarket trading.

Write to Micah Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

October 03, 2019 16:56 ET (20:56 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

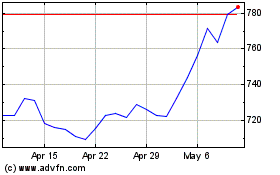

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Mar 2024 to Apr 2024

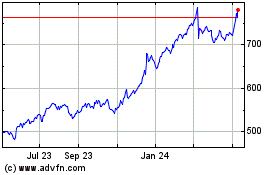

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Apr 2023 to Apr 2024