Japanese Makers Stumble in the U.S. -- WSJ

October 02 2019 - 3:02AM

Dow Jones News

By Patrick Thomas

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (October 2, 2019).

Major Japanese auto makers reported a drop in U.S. vehicle sales

for September as the American car market's historic run tapers

off.

Toyota Motor Corp., Nissan Motor Co. and Honda Motor Co. all

posted double-digit-percentage sales declines from a year

earlier.

Two fewer selling days and an early Labor Day holiday were

expected to slow down auto sales, but the decline was greater than

industry analysts had expected.

Toyota said Tuesday that it sold 169,656 vehicles in its latest

month, a decrease of nearly 17% on a volume basis and a decline of

9% on a daily selling rate, compared with the same period a year

earlier. Analysts at Edmunds had expected the company to sell

180,595 vehicles for the month.

Honda reported its U.S. sales fell 14% to 113,925 vehicles,

below the roughly 120,000 that analysts were expecting. Nissan

reported its U.S. sales fell about 18%, slightly better than the

20% drop that was expected. Nissan's falling sales come as it

searches for a new chief executive who the company hopes will bring

a fresh outlook to the troubled car maker.

U.S. vehicle sales this year are projected to be around 17.1

million, according to Edmunds, slightly lower than the past few

years. Rising car prices and higher interest rates dulled demand in

the first six months of 2019.

Detroit auto makers General Motors Co. and Ford Motor Co., as

well as Fiat Chrysler Automobiles NV, recently ended their

long-term practice of reporting monthly U.S. sales numbers,

although most major car companies still disclose the results each

month. The companies now report their U.S. sales quarterly.

Car prices have been growing rapidly as new technological and

safety features, such as larger and more sophisticated multimedia

displays, have made basic cars more expensive. U.S. consumers have

also veered toward pricier rides such as sport-utility vehicles, as

demand for minivans fades.

While sales struggled in September, Edmunds analyst Jeremy

Acevedo said he is optimistic sales will rebound in October and the

rest of 2019. "September was a down month that was expected to be

down," he said.

Write to Patrick Thomas at Patrick.Thomas@wsj.com

(END) Dow Jones Newswires

October 02, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

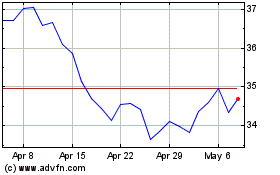

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

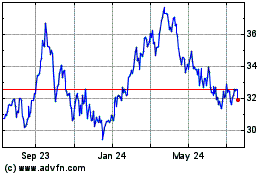

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Apr 2023 to Apr 2024