Facebook Scrambles to Keep Libra on Track as Partners Waver -- 2nd Update

October 01 2019 - 7:08PM

Dow Jones News

By AnnaMaria Andriotis and Peter Rudegeair

Cracks are forming in the coalition Facebook Inc. assembled to

build a global cryptocurrency-based payments network.

Visa Inc., Mastercard Inc. and other key financial partners that

signed on to help build and maintain the Libra payments network are

reconsidering their involvement following backlash from U.S. and

European government officials, according to people familiar with

the matter. Wary of attracting regulatory scrutiny, executives of

some of Libra's backers have declined Facebook's requests to

publicly support the project, the people said.

Their reluctance has Facebook scrambling to keep Libra on track.

Policy executives from Libra's more than two dozen backers -- a

group called the Libra Association -- have been summoned to a

meeting in Washington, D.C., on Thursday, according to people

familiar with the matter.

On Oct. 14, representatives from the companies are slated to

meet in Geneva to review a charter for the Libra Association and

appoint a board of directors, according to a memo reviewed by The

Wall Street Journal.

Major defections could imperil Libra, Facebook's audacious

attempt to convince consumers to swap their national currencies for

a digital coin that could be used to pay for goods and services on

the internet. Without a network of financial partners that could

help transfer currencies into Libra and global retailers to accept

it as a form of payment, Libra's reach would be limited.

When it unveiled the project in June, Facebook said Libra could

change the entire financial system, giving consumers a whole new

way to move money across borders. The project's backers saw the

effort as a long-shot way to profit on Facebook's 2.4 billion

monthly active users.

After watching popular social-media company Tencent Holdings

Ltd. come to dominate the market for Chinese digital payments with

WeChat Pay, some payments companies agreed to take part in Libra to

avoid missing out on the next big thing.

Facebook, which worked in secret for more than a year to develop

Libra, has broad ambitions for the project as part of a shift away

from its nearly complete reliance on targeted advertising.

Facebook Chief Executive Mark Zuckerberg is steering the

social-media giant to more private and encrypted communications,

and Libra could offer a means of providing financial services

through those channels.

In announcing the project in June, the company said it hoped to

provide basic financial services to people around the world who

lack bank accounts and to save some of the $25 billion "lost by

migrants every year through remittance fees."

Some analysts have been bullish that Libra could help Facebook

diversify its revenue base and potentially transform the digital

consumer economy over the long term.

Yet government officials and central bankers were quick to

criticize the project, citing concerns about how the network would

protect users' privacy and prevent criminals from using it to

launder money.

David Marcus, the Facebook executive in charge of the project,

endured two days of tongue-lashings from members of Congress over

the summer for the lack of details about how the new cryptocurrency

would work as well as the company's past missteps on data privacy.

Federal Reserve Chairman Jerome Powell told legislators he had

"serious concerns" about Libra and its timetable of launching next

year.

Privately, U.S. regulators have leaned on Libra's backers. The

Treasury Department sent letters to companies including Visa,

Mastercard, PayPal Holdings Inc. and Stripe Inc. asking for a

complete overview of their money-laundering compliance programs and

how Libra will fit into them, people familiar with the matter

said.

Libra Association members, meanwhile, have been pressing

Facebook for more information. They have asked Mr. Marcus and other

Facebook executives how illegal activities such as money laundering

and terrorist financing would be kept off Libra and haven't

received detailed answers, one of the people said.

It is unclear how many of the initial Libra Association members

ultimately will commit to the network. So far, members have signed

nonbinding letters of intent, and they haven't yet handed over the

$10 million that Facebook requested from each member to fund the

creation of the coin and build out the network, people familiar

with the matter said.

"It's important to understand the facts here and not any of us

get out ahead of ourselves," Visa Chief Executive Al Kelly said on

the company's earnings conference call in July. "No one has yet

officially joined."

Write to AnnaMaria Andriotis at annamaria.andriotis@wsj.com and

Peter Rudegeair at Peter.Rudegeair@wsj.com

(END) Dow Jones Newswires

October 01, 2019 18:53 ET (22:53 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

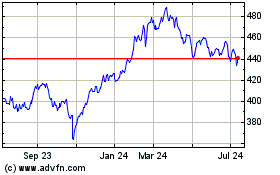

MasterCard (NYSE:MA)

Historical Stock Chart

From Mar 2024 to Apr 2024

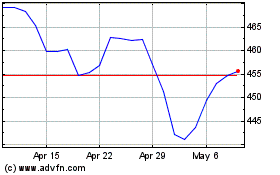

MasterCard (NYSE:MA)

Historical Stock Chart

From Apr 2023 to Apr 2024