Newtek Business Services Corp. (“Newtek”) (Nasdaq: NEWT), an

internally managed business development company (“BDC”), today

announced that it has priced its tenth and largest small business

loan securitization, with the offering of $118,920,000 of

Unguaranteed SBA 7(a) Loan-Backed Notes, Series 2019-1, consisting

of $93,540,000 of Class A Notes and $25,380,000 Class B Notes

(collectively, the “Notes”), rated “A” and “BBB-”, respectively, by

S&P Global Ratings, (“S&P”). The Company anticipates

this transaction will close on October 4, 2019. The Notes had

an approximate 83% advance rate, and were priced at an average

initial yield of approximately 3.84% (Note Interest Rates will be

floating rate), which is equivalent to a spread of 183 basis points

over LIBOR, across both classes.

The Notes are collateralized by the right to

receive payments and other recoveries attributable to the

unguaranteed portions of SBA 7(a) loans made by Newtek Small

Business Finance, LLC ("NSBF") pursuant to Section 7(a) of the

Small Business Act, and overcollateralized by NSBF's participation

interest in the unguaranteed portions. Deutsche Bank

Securities Inc. acted as sole book-running manager and Capital One

Securities, Inc. acted as co-manager for the sale of the Notes.

Barry Sloane, Chairman, President and Chief Executive Officer of

Newtek Business Services Corp. said, “We are extremely pleased to

announce our 10th and largest securitization, on which we received

the best pricing of any prior NSBF securitization. We received

approximately $451 million in aggregate orders across both classes

of Notes, and we issued over $118 million in investment grade Notes

to 12 investors across both classes. We believe that these

attractive economics and demand for our securitized classes are

evidence of our continued ability to lower our cost of

capital and is indicative of the performance of our prior

secutiziations. In fact, all of our prior nine

securitizations have either maintained their ratings or been

upgraded by S&P, which we believe is a product of our

securitization transactions turbo principal payment structure and

the loan portfolios’ stable performance. Additionally, in

July 2019, Newtek closed a public offering of $55.0 million in

aggregate principal amount of 5.75% Notes Due 2024, and used a

portion of the net proceeds of that offering to redeem our 7.50%

notes due 2022. We also recently reported that we increased our

Capital One revolving credit facility from $100 million to $150

million, and last year we received a 50 basis point reduction on

this facility thereby reducing the interest expense associated with

this facility.”

Mr. Sloane continued, “We believe that the core strength of our

Company is our diverse business model, which seeks to generate

multiple streams of reoccurring revenue and earnings. The

Company is revising its 2019 SBA 7(a) loan funding guidance to $520

million. This repositioned forecast is due to changes in, among

other things, the economy, company personnel and loan

processing. We have factored these changes into our

reconfirmed business forecast. We will further discuss these

changes and the growth forecasts for our SBA 7(a) loan business and

other businesses during our third quarter 2019 earnings conference

call in early November. We believe that Newtek Conventional

Lending, LLC, our non-conforming conventional loan joint venture,

will contribute to our 2019 and 2020 earnings.”

Mr. Sloane concluded, “We are reconfirming our 2019 annual

dividend guidance of $2.151 per share, which would represent an

approximate 20% increase over our annual dividend payment of $1.80

per share in 2018, and are presently forecasting a $0.71 per share

dividend for the fourth quarter 2019. We expect to declare

the fourth quarter 2019 dividend in the coming weeks. In

addition, during our third quarter 2019 earnings conference call,

we expect to issue our annual dividend guidance for 2020, which we

believe will be consistent with past forecasts of year-over-year

dividend growth. We expect to maintain our dividend policy of

distributing an amount that approximates 90 - 100% of the Company's

annual taxable income.”

1Amount and timing of dividends, if any, remain

subject to the discretion of the Company’s Board of Directors.

About Newtek Business Services Corp.Newtek

Business Services Corp., Your Business Solutions Company®, is an

internally managed BDC, which along with its controlled portfolio

companies, provides a wide range of business and financial

solutions under the Newtek® brand to the small- and medium-sized

business (“SMB”) market. Since 1999, Newtek has provided

state-of-the-art, cost-efficient products and services and

efficient business strategies to SMB relationships across all 50

states to help them grow their sales, control their expenses and

reduce their risk.

Newtek’s and its portfolio companies’ products and services

include: Business Lending, SBA Lending Solutions, Electronic

Payment Processing, Technology Solutions (Cloud Computing,

Data Backup, Storage and Retrieval, IT Consulting), eCommerce,

Accounts Receivable Financing & Inventory Financing,

Insurance Solutions, Web Services, and Payroll and Benefits

Solutions.Newtek® and Your Business Solutions Company®, are

registered trademarks of Newtek Business Services Corp.

Note Regarding Forward Looking

StatementsThis press release contains certain

forward-looking statements. Words such as “believes,” “intends,”

“expects,” “projects,” “anticipates,” “forecasts,” “goal” and

“future” or similar expressions are intended to identify

forward-looking statements. All forward-looking statements involve

a number of risks and uncertainties that could cause actual results

to differ materially from the plans, intentions and expectations

reflected in or suggested by the forward-looking statements. Such

risks and uncertainties include, among others, intensified

competition, operating problems and their impact on revenues and

profit margins, anticipated future business strategies and

financial performance, anticipated future number of customers,

business prospects, legislative developments and similar matters.

Risk factors, cautionary statements and other conditions, which

could cause Newtek’s actual results to differ from management’s

current expectations, are contained in Newtek’s filings with the

Securities and Exchange Commission and available through

http://www.sec.gov/. Newtek cautions you that forward-looking

statements are not guarantees of future performance and that actual

results or developments may differ materially from those projected

or implied in these statements.

SOURCE: Newtek Business Services Corp.

Investor Relations & Public

RelationsContact: Jayne Cavuoto Telephone: (212) 273-8179

/ jcavuoto@newtekone.com

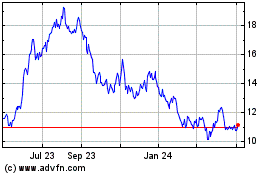

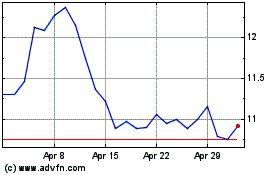

NewtekOne (NASDAQ:NEWT)

Historical Stock Chart

From Mar 2024 to Apr 2024

NewtekOne (NASDAQ:NEWT)

Historical Stock Chart

From Apr 2023 to Apr 2024