Current Report Filing (8-k)

October 01 2019 - 8:57AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): September 25, 2019

INTERNATIONAL

LAND ALLIANCE, INC.

(Exact

Name of Registrant As Specified In Its Charter)

|

Wyoming

|

|

6552

|

|

46-3752361

|

|

(State

or other jurisdiction of

incorporation or organization)

|

|

(Primary

Standard Industrial

Classification

Code Number)

|

|

IRS

I.D.

|

|

350

10th Ave., Suite 1000

San

Diego, CA

|

|

92101

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

Jason Sunstein, COO

350 10th Ave., Suite 1000

San Diego, CA 92101

(877) 661-4811

(Name, address and telephone number of agent for service)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

[ ]

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425).

[ ]

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12).

[ ]

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)).

[ ]

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)).

As

used herein, the terms, “we,” “us,” “our,” and the “Company” refers to International

Land Alliance, Inc., a Wyoming corporation and its subsidiaries, unless otherwise stated.

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

Common

Stock, par value $0.001 per share

|

|

ILAL

|

|

OTC

Markets Group

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR

§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company [X]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

FORWARD-LOOKING

STATEMENTS

THIS

FORM 8-K CONTAINS “FORWARD-LOOKING STATEMENTS.” FORWARD-LOOKING STATEMENTS ARE STATEMENTS CONCERNING PLANS, OBJECTIVES,

GOALS, STRATEGIES, EXPECTATIONS, INTENTIONS, PROJECTIONS, DEVELOPMENTS, FUTURE EVENTS, OR PERFORMANCE, UNDERLYING (EXPRESSED OR

IMPLIED) ASSUMPTIONS AND OTHER STATEMENTS THAT ARE OTHER THAN HISTORICAL FACTS. THESE FORWARD-LOOKING STATEMENTS ARE ONLY PREDICTIONS.

NO ASSURANCES CAN BE GIVEN THAT SUCH PREDICTIONS WILL PROVE CORRECT. ACTUAL EVENTS OR RESULTS MAY DIFFER MATERIALLY. FORWARD-LOOKING

STATEMENTS SHOULD BE READ IN LIGHT OF THE CAUTIONARY STATEMENTS AND RISKS THAT INCLUDE, BUT ARE NOT LIMITED TO, THE RISKS ASSOCIATED

WITH A SMALL COMPANY, OUR LIMITED FINANCIAL RESOURCES, AND THE UNCERTAINTIES OF COMPETITIVE PRESSURES WE FACE. THESE OR OTHER

RISKS COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THE FUTURE RESULTS INDICATED OR IMPLIED IN SUCH FORWARD-LOOKING STATEMENTS.

WE UNDERTAKE NO OBLIGATION TO UPDATE OR REVISE SUCH STATEMENTS.

Item

1.01 Entry into a Material Definitive Agreement.

On

September 25, 2019, International Land Alliance, Inc., a Wyoming corporation (the “Company”), entered into

a definitive Land Purchase Agreement (the “Agreement”) with Valdeland, S.A. de C.V. to acquire approximately

one acre of land with plans and permits to build 34 units at the Bajamar Ocean Front Golf Resort located in Ensenada,

Baja California. Pursuant to the terms of the Agreement, the total purchase price is $1,000,000, payable in a combination

of preferred stock ($600,000); common stock ($250,000/250,000 common shares at $1.00/share); a promissory

note ($150,000); and an initial construction budget of $150,000 payable upon closing. A recent appraisal valued the land

“as is” for $1,150,000. The closing is subject to obtaining the necessary approval by the City of Ensenada

and transfer of title, which includes the formation of a wholly-owned Mexican subsidiary. The Company anticipates that the

closing will be completed within the next 30 to 45 days with site preparation starting by October 15 and the initial

construction budget of $150,000 includes the buildout 2 model units to commence pre-sales.

The

foregoing description of the Land Purchase Agreement does not purport to be complete and is qualified in its entirety by

reference to the complete text of the document, which is filed as an exhibit to this report and is incorporated herein by reference.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities and Exchange Act of 1934, the Registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

|

|

INTERNATIONAL

LAND ALLIANCE, INC.

|

|

|

|

|

|

Date:

October 01, 2019

|

By:

|

/s/

Roberto Valdes

|

|

|

Roberto

Valdes, President, Principal Executive Officer and a Director

|

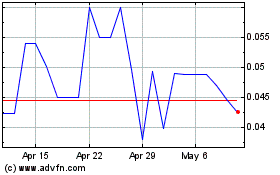

International Land Allia... (QB) (USOTC:ILAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

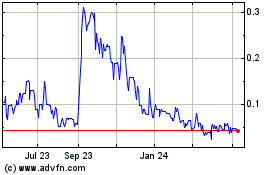

International Land Allia... (QB) (USOTC:ILAL)

Historical Stock Chart

From Apr 2023 to Apr 2024