By Ryan Dezember

This article is part of the Journal's quarterly markets review,

" Investing in a Low-Yield World."

Low interest rates and lingering fears of recession have

investors socking away money in self storage.

Companies such as Public Storage and Extra Space Storage Inc.,

which operate facilities where people pay to stash their stuff, are

among a breed of property-owning entities called real-estate

investment trusts, or REITs. These companies distribute nearly all

of their profits to shareholders, which makes them appealing to

investors looking to generate income when many debt or cash

instruments pay out little.

The Federal Reserve chopped its benchmark interest rate twice in

the third quarter to cushion the U.S. economy from a global

slowdown. Meanwhile, yields on short-term debt rose above those of

longer-term issues several times during the period, an unusual

occurrence that often has presaged recessions.

Both developments bode well for real-estate stocks. "When rates

go down, REITs tend to outperform," said Raymond James analyst

Jonathan Hughes.

Different segments of REITs don't move in lockstep, of course.

For example, favorable conditions this year haven't prevented those

that own regional malls from losing 3.15% through Friday. Besides

storage facilities and shopping malls, there are REITs that

specialize in office towers, timberlands, apartment complexes, cell

towers, nursing homes and the warehouses that enable

e-commerce.

After the financial crisis, REITs emerged to manage tens of

thousands of foreclosed suburban houses that were turned into

rentals. Most REITs make money collecting rent at property they

own. A few lend against property.

They are all required to distribute at least 90% of their

taxable income to shareholders. Like utility stocks, investors tend

to treat REITs as shelter in slowdowns, when investors move money

from the highflying stocks, like technology companies, that they

ride during economic expansions. Though many investors treat them

as proxies for bonds, REITs are typically riskier than debt

securities. REITs, like the broader stock market, lost money as a

group last year.

The FTSE Nareit All Equity REITs Index, which tracks the

performance of 164 companies, is up 28.2% in 2019 through Thursday,

including dividends. That compares with a 19.9% total return for

the S&P 500 and an 8.5% return for the Bloomberg Barclays U.S.

Aggregate bond index, which tracks a mix of corporate, government

and mortgage-backed bonds.

Self storage hasn't been the hottest-performing REIT sector this

year; that would be data centers and manufactured homes, which

through Friday had returned 47.8% and 43.4% respectively, including

dividends.

But storage's total return of 25.6% has trounced the broader

market and shares of the segment's biggest players, Public Storage

and Extra Space, have proven particularly good bets on otherwise

bad days for stocks.

Extra Space and Public Storage are up 32.3% and 24.3%, this year

on a total return basis.

On days this year when the S&P 500 fell by at least 1%,

storage stocks averaged returns of 0.3%, according to an analysis

by real-estate research firm Green Street Advisors.

That doesn't sound like much, but they were one of only two

segments of REITs not to lose value on down days in the market. The

other, manufactured housing, held flat. The worst performers during

bad days were REITs that own hotels, offices and malls.

Dave Bragg, managing director at Green Street, said the results

of that analysis support a time-tested way to pick REIT stocks:

Choose those that can maintain the quality of their properties

cheaply, like owners of trailer parks and storage units, over

those, such as hotel and office buildings, that have to spend a lot

to keep their customers happy.

"A terrific real-estate investing strategy is to prioritize

low-capital-expenditure sectors," Mr. Bragg said. "It's the most

important thing and it tends to get underestimated."

That isn't to say that investing in self storage and other

cheap-to-maintain real estate is a sure thing. Self-storage stocks

have been on a decadelong bull run for which many investors have

been anticipating an end. The companies got a boost during the

foreclosure crisis, when many Americans downsized and moved in with

each other.

Some analysts have warned that the shares, particularly Public

Storage, have gotten somewhat pricey given forecasts for slower

growth.

"The risk-off trade and low interest rates are giving Public

Storage shares an additional valuation boost, which may not last,"

analysts with SunTrust Robinson Humphrey wrote in a note to clients

in September.

Public Storage, which owns about 2,500 facilities and has a

stock-market value of $43 billion, has returned 355% over the past

10 years, including dividends. Extra Space, the next-biggest

player, is up 1,439% on a total-return basis. The S&P 500

return including dividends is 245% over that span.

That performance inspired developers to build more storage

space, which has threatened to swamp the market and limit rent

growth.

Public Storage executives estimate $4 billion worth of new

facilities will come online industrywide this year, about equal to

last year's added supply and about four times the billion dollar's

worth of new space that hit the market in a typical year during the

decade leading up to 2016.

Mr. Hughes of Raymond James said that the storage space in the

development pipeline equates to about 9% of current supply. That is

way above the 1% to 2% of existing supply that is typically under

development in other commercial real estate segments.

So far, though, the big operators have weathered the flood of

competition with sophisticated advertising and pricing strategies

that adjust asking rents on an hourly basis.

"If you're looking for somewhere to put your money," Mr. Hughes

said, "storage is hard to beat."

Write to Ryan Dezember at ryan.dezember@wsj.com

(END) Dow Jones Newswires

September 30, 2019 17:13 ET (21:13 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

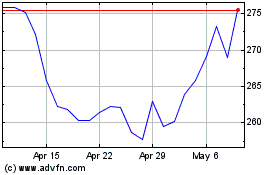

Public Storage (NYSE:PSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Public Storage (NYSE:PSA)

Historical Stock Chart

From Apr 2023 to Apr 2024