Current Report Filing (8-k)

September 27 2019 - 4:47PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

______________

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): September 27, 2019

|

CPI

AEROSTRUCTURES, INC.

|

|

(Exact

Name of Registrant as Specified in Charter)

|

|

New

York

|

|

001-11398

|

|

11-2520310

|

|

(State

or Other Jurisdiction

of

Incorporation)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.)

|

|

91

Heartland Boulevard, Edgewood, New York

|

|

11717

|

|

(Address

of Principal Executive Offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (631) 586-5200

|

N/A

|

|

(Former

Name or Former Address, if Changed Since Last Report)

|

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e 4(c))

|

|

Securities

registered pursuant to Section 12(b) of the Act:

|

|

Title

of each class

|

Trading

symbol(s)

|

Name

of each exchange on which registered

|

|

Common

stock, $0.001 par value per share

|

CVU

|

NYSE

American

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

As

previously disclosed, on December 20, 2018, CPI Aerostructures, Inc. (the “Company”) completed its acquisition

of Welding Metallurgy, Inc. and Compac Development Corporation pursuant to the terms of a Stock Purchase Agreement dated as

of March 21, 2018 (as amended, the “SPA”) between the Company and Air Industries Group (“Air”).

Pursuant to the SPA, as consideration for the acquisition, the Company paid to Air an aggregate of $7.9 million, of which $2

million was placed in escrow at closing to be applied against post-closing working capital adjustments and indemnification

obligations of Air. The escrowed funds are governed by the terms of the SPA and an escrow agreement entered into between the

Company and Air on December 20, 2018 (“Escrow Agreement”).

In

accordance with the terms of the SPA, the Company calculated a post-closing working capital adjustment, to which Air formally

objected. Pursuant to the terms of the SPA, the Company and Air then submitted the working capital adjustment to BDO USA, LLP

(“BDO”) for binding resolution.

On

September 3, 2019, BDO resolved the dispute in favor of the Company. In accordance with the SPA and the Escrow Agreement, following

BDO’s resolution, Air was required to join the Company in instructing the escrow agent to release the entire escrow fund

to the Company and to pay the Company an additional $2,145,870 representing the excess of the working capital adjustment amount

above the escrow amount, for a total post-closing adjustment of $4,145,870. Air has failed to do so.

On

September 27, 2019, the Company filed a notice of motion in the Supreme Court of the State of New York, County of New York, against

Air seeking, among other things, an order of specific performance requiring Air to comply with its obligations under the SPA and

Escrow Agreement and a judgment against Air in the amount of approximately $4.2 million.

The

SPA was previously filed as Exhibit 2.1 to the Company’s Current Report on Form 8-K filed with the Securities and Exchange

Commission (“SEC”) on March 22, 2018. The Order and Amendment to the Stock Purchase Agreement, dated November 9, 2018,

was included as Exhibit 10.1 to the Company’s Quarterly Report on Form 10-Q filed with the SEC on November 13, 2018. The

Second Amendment to the SPA was filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed with the SEC on

December 27, 2018. The description of the SPA contained herein does not purport to be complete, and is qualified in its entirety

by reference to the SPA, the Order and Amendment, and the Second Amendment.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

Dated:

September 27, 2019

|

CPI AEROSTRUCTURES, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Vincent Palazzolo

|

|

|

|

|

Vincent Palazzolo

Chief Financial Officer

|

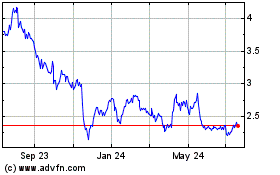

CPI Aerostructures (AMEX:CVU)

Historical Stock Chart

From Mar 2024 to Apr 2024

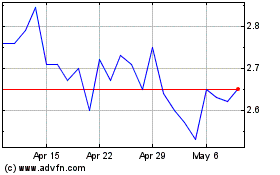

CPI Aerostructures (AMEX:CVU)

Historical Stock Chart

From Apr 2023 to Apr 2024