LONDON MARKETS: 'Shock' Bank Of England Rate-cut Talk Sends British Pound Below Key Level

September 27 2019 - 5:55AM

Dow Jones News

By Steve Goldstein, MarketWatch

The British pound came under pressure after a Bank of England

official thought to be a hawk on interest rates suggested rates may

need reducing.

Michael Saunders, who in 2017 voted for rate hikes, said in a

speech that "persistently high uncertainty," even if the U.K.

reaches a deal with the European Union, will make it "probably"

appropriate to maintain an expansionary monetary policy "and

perhaps to loosen further."

"This came as a shock - Saunders is known as a hawk, but his

stance here was very dovish," said Ricardo Evangelista, senior

analyst at ActivTrades.

The pound fell under $1.23 for the first time in three weeks,

sliding to $1.2286 from $1.2323 on Thursday.

The pound's weakness by contrast spurred gains for the FTSE 100

, with the stock market index rising 0.79% to 7409.24.

Gains were led by Pearson (PSON.LN) , which despite a 3% advance

is still much lower than where it stood before warning on U.S.

higher education revenue on Thursday.

(END) Dow Jones Newswires

September 27, 2019 05:40 ET (09:40 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

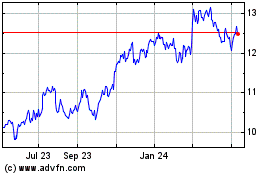

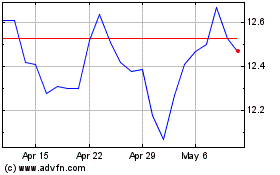

Pearson (NYSE:PSO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pearson (NYSE:PSO)

Historical Stock Chart

From Apr 2023 to Apr 2024