Lowe's Goes DIY on Software Development

September 25 2019 - 7:18PM

Dow Jones News

By Agam Shah

Lowe's Cos. is taking more of a do-it-yourself approach to

software development, retooling its e-commerce platform to boost

sales.

As part of the effort, the home-improvement retailer is

identifying key business processes that use off-the-shelf software,

such as inventory management, and coming up with a more tailored

concept for them.

The hope is to better personalize, through custom code, the

online shopping experience for a range of customers, from

professional contractors to weekend DIYers.

"To do something like this in a package software is almost

impossible, because you are dependent on a completely different

company to change their product roadmap and respond to your needs

at your speed," said Chief Information Officer Seemantini

Godbole.

The retrofit of its decade-old e-commerce platform is part of a

larger technology initiative. Lowe's last year said it would invest

$500 million annually in technology through 2021, hiring as many as

2,000 software engineers, infrastructure engineers and data

analysts to beef up its tech workforce of about 4,800. A

spokeswoman said Wednesday that "executives have shared that we

have historically underinvested in talent and technology," without

giving details.

Lowe's earlier this year bought a retail-analytics platform from

Boomerang Commerce in a move that will help automate price changes

of products across multiple sales platforms.

In August, Lowe's Chief Executive Marvin Ellison announced plans

to complete moving the Lowe's website to the cloud in the first

quarter of 2020.

"I don't think technology has had as much seat at the table as

it has now, which is really front and center," said Ms. Godbole,

who joined Lowe's from Target Corp. in November.

Lowe's expects 80% of its application portfolio to be built

internally by 2021. Applications for common tasks like payroll

processing will be purchased off the shelf.

More companies -- particularly in retail -- are hiring data

scientists, business analysts and domain experts to take advantage

of nuanced data integral to the business, said Mark Driver, a

research vice president at Gartner Inc.

"We're in an age where people have their clothes custom fit. The

same thing goes with software; it's about gaining that advantage,"

Mr. Driver said.

Much of Ms. Godbole's effort has been directed at Lowe's

e-commerce platform. Over the past nine months, the company has

deployed custom e-commerce features related to inventory, pricing

and reviews.

"If 100% of e-commerce is going to be brought in house, I would

say we are absolutely 40% of the way," Ms. Godbole said. She

expects the in-house version of key features such as online

checkout to be deployed by the middle of next year.

The company is now developing and evaluating personalization

features, where the online experience is geared around the type of

shopper. Professional customers typically know what they want, and

their product description page might include items they buy

regularly. A do-it-yourself buyer will get a different experience

with more details on features, functionality, and price comparisons

as well as videos. The company will use internally developed

machine-learning algorithms to personalize experiences, the Lowe's

spokeswoman said.

The nature of personalization for a home-improvement chain is

different than on a site like Amazon.com Inc. as there is a

connection between in-store and online shopping experiences, said

Jeriad Zoghby, global lead of digital marketplace services at

Accenture Interactive, the marketing unit of Accenture PLC.

A bathroom installation project could involve an in-store visit

plus value-added services like installation, which calls for a

different technology platform.

"My guess is that's where [Ms. Godbole is] headed, she's

realizing that they have to truly own the experience -- and to

really create a more cohesive experience, one that's fully

orchestrated," Mr. Zoghby said.

Lowe's effort to personalize online shopping comes as the

company tweaks its operations. In August, the company cut jobs as

it outsourced tasks such as assembling barbecue grills and

janitorial services.

In recent years, the retailer's sales growth has lagged behind

rival Home Depot Inc. In the latest quarter, Lowe's profit grew 10%

to $1.68 billion, helped by a 7.7% drop in expenses.

Write to Agam Shah at agam.shah@wsj.com

(END) Dow Jones Newswires

September 25, 2019 19:03 ET (23:03 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

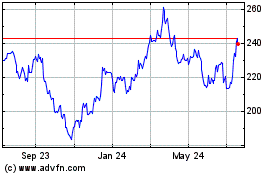

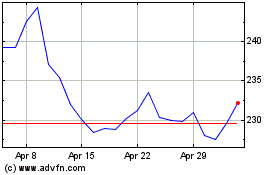

Lowes Companies (NYSE:LOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lowes Companies (NYSE:LOW)

Historical Stock Chart

From Apr 2023 to Apr 2024