First Citizens Bank, Community Financial Holding Co. Inc. Announce Merger Agreement

September 24 2019 - 5:00PM

First-Citizens Bank & Trust Company (known as First Citizens

Bank) and Community Financial Holding Company, Inc. (Community

Financial) announced today the signing of a definitive merger

agreement.

The agreement provides for the acquisition of Duluth, Ga.-based

Community Financial by Raleigh N.C.-headquartered First Citizens

Bank. Community Financial offers deposit and loan services through

its subsidiary Gwinnett Community Bank, which operates three branch

locations in Duluth, Suwanee and Buford, Ga.

The agreement has been unanimously approved by the boards of

directors of both companies. The transaction is anticipated to

close in the first quarter of 2020, subject to the receipt of

regulatory approvals, the approval of Community Financial

shareholders and the satisfaction of other customary closing

conditions. Under the terms of the agreement, total cash

consideration of $2.325 million will be paid to the shareholders of

Community Financial.

Gwinnett Community customers should bank as they normally do at

their existing branches, which will become part of First Citizens

Bank upon the completion of the merger. With more than 550

locations in 19 states, First Citizens operates 27 locations in

Georgia, including two branches in Gwinnett County.

Frank B. Holding Jr., chairman and chief executive officer of

First Citizens, said: “We’re glad to announce this merger with a

company whose values and commitment to customers are a very good

fit with ours. For more than 22 years, we’ve been helping Georgia

families and businesses with their finances, and we’re excited

about delivering our Forever First brand of banking to our new

clients as we further solidify our presence in the state.”

Leonard D. Davenport, CFA, chief executive officer of Community

Financial, said: “Both banks share a strong commitment to provide

exceptional service to the people of these communities. First

Citizens is a strong, well-managed institution, and our customers

will benefit from its stability, long-term perspective and

comprehensive product offerings.”

As of June 30, 2019, Community Financial reported $223 million

in consolidated assets, $206 million in deposits and $146 million

in gross loans.

Sandler O’Neill + Partners LP, acted as financial advisor and

rendered a fairness opinion to the board of directors of Community

Financial in connection with this transaction. Ward and Smith,

P.A., represented First Citizens Bank in the transaction;

James-Bates-Bannan-Groover LLP, represented Community

Financial.

Additional Information

In connection with the proposed merger, Community Financial will

prepare and send a proxy statement to each of its shareholders.

SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT REGARDING THE

MERGER WHEN IT BECOMES AVAILABLE, AS WELL AS ANY AMENDMENTS OR

SUPPLEMENTS TO THAT DOCUMENT, BECAUSE IT WILL CONTAIN IMPORTANT

INFORMATION.

About First Citizens Bank

Founded in 1898 and headquartered in Raleigh, N.C., First

Citizens Bank serves customers at more than 550 branches in 19

states. First Citizens Bank is a wholly owned subsidiary of First

Citizens BancShares, Inc. (Nasdaq: FCNCA), which has more than $37

billion in assets. For more information, call toll free 1.888.FC

DIRECT (1.888.323.4732) or visit firstcitizens.com. First Citizens

Bank. Forever First®.

About Community Financial Holding Company, Inc. and

Gwinnett Community Bank

Gwinnett Community Bank, founded in 1999 and headquartered in

Duluth, Ga., is a subsidiary of Community Financial. Gwinnett

Community Bank serves customers through banking centers located in

Duluth, Suwanee and Buford, Ga. For more information on Gwinnett

Community Bank, visit www.gwinnettcommunitybank.com.

Disclosures About Forward Looking

Statements

This Press Release may contain forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, including Section 21E of the Securities Exchange Act of 1934

and Section 27A of the Securities Act of 1933. For the purposes of

these discussions, any statements that are not statements of

historical fact may be deemed to be forward looking statements.

Such statements are often characterized by the use of qualifying

words such as “expects,” “anticipates,” “believes,” “estimates,”

“plans,” “projects,” or other statements concerning opinions or

judgments of Community Financial and First Citizens Bank and their

managements about future events. Such statements involve known and

unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those described

in the statements. Forward-looking statements in this Press Release

include statements regarding Community Financial’s and First

Citizens Bank’s expectations regarding the benefits of the merger,

and when the merger will be completed. The accuracy of such

forward-looking statements could be affected by factors beyond

Community Financial’s and First Citizens Bank’s control, including,

but not limited to, delays in the receipt of regulatory and

shareholder approvals that must be received before the merger may

be completed, delays in the satisfaction or waiver of other

conditions to the consummation of the merger, and difficulties

experienced in the integration of the businesses of Community

Financial and First Citizens Bank. Additional factors that could

cause actual results to differ materially from those anticipated by

forward-looking statements will be discussed in Community

Financial’s proxy statement for its special meeting of

shareholders. Community Financial and First Citizens Bank undertake

no obligation to revise or update these statements following the

date of this Press Release.

| Contacts: |

Barbara Thompson |

Leonard D. Davenport |

| |

919.716.2716 |

770.476.2775 |

| |

First Citizens Bank |

Community Finanical |

| |

|

Holding Company, Inc. |

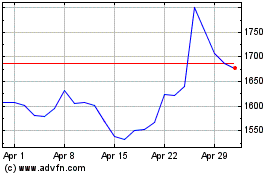

First Citizens BancShares (NASDAQ:FCNCA)

Historical Stock Chart

From Mar 2024 to Apr 2024

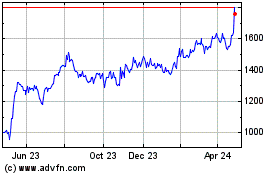

First Citizens BancShares (NASDAQ:FCNCA)

Historical Stock Chart

From Apr 2023 to Apr 2024