Tractor maker aims to sell farmers expensive upgrades, as demand

for machinery slows

By Bob Tita

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (September 23, 2019).

Deere & Co.'s incoming chief executive will take charge as

the struggling tractor maker switches course from its sluggish

global expansion to a narrower focus on its home U.S. market.

With demand for farm machinery receding world-wide, dealers for

the Moline, Ill., manufacturer and industry analysts say they

expect John May to focus on cutting costs and adding new technology

and data services to its equipment that will justify higher prices

in the U.S.

Those new technologies, such as a sprayer that can differentiate

between weeds and crops when applying herbicide, aim to make seed

and fertilizer applications more efficient, increase crop yields

and alert farmers when equipment shows signs of breaking down.

"It's putting money in farmers' pockets," said Scott Kraft, a

manager at Gooseneck Implement Co., a Deere dealer in North

Dakota.

But it is a difficult time to count on U.S. farmers paying more

for tractors and harvesting combines that can cost more than

$300,000. Years of high production, falling prices for commodities

and a trade war with China that has slashed U.S. exports of crops

and livestock have squeezed farmers' incomes for the past five

years. Farm bankruptcies are on the rise.

"Everybody can't afford new equipment all the time," said Lyn

Perkins, a manager and crop-data specialist at Blanchard Equipment,

a Deere dealer in Georgia.

The focus on new technology aimed at U.S. farmers is a pivot

from current CEO Sam Allen's emphasis on selling more of Deere's

green and yellow equipment in developing markets overseas.

After he took the helm a decade ago, Mr. Allen said more

productive farms would be required to provide crops and livestock

to feed a growing middle class around the world. After the 2008

recession, Deere opened or expanded factories in Brazil, Russia,

China, India and elsewhere in pursuit of $50 billion in annual

sales by 2018.

Executives have talked less about the company's global ambitions

in recent years as slowing demand for equipment at home and

decelerating economic expansion in developing countries made the

$50 billion goal unattainable. The U.S. and Canada accounted for

57% of Deere's $33.3 billion in equipment sales last year, which

also included the company's construction and forestry machinery

lines.

Deere said in August that Mr. May, 50 years old, will become CEO

in November, while Mr. Allen will remain chairman of the company's

board.

The company has seen strong sales growth in South America and

Western Europe, where farmers use the same large equipment as

farmers in North America. In Brazil, which has been a growth market

for U.S. farm-equipment manufacturers in the past decade, Deere

gained market share in tractors at the expense of market leader

AGCO Corp.

But sales expansion has been tougher in other developing

markets. The consolidation of small farms into larger ones that

require bigger equipment has been slower than Deere and its rivals

expected, industry analysts said. Farmers had less access to

financing than anticipated. Deere's sales in Asia, Africa and the

Middle East grew last year for the second time since 2012,

according to Melius Research.

Other U.S. manufacturers, including construction-equipment maker

Caterpillar Inc. and industrial conglomerate 3M Co. that made big

bets on developing markets have also had disappointing results.

Deere's sales of farm equipment over the past three quarters are

up 2% from the year-ago period because of price increases. But

profit from those sales fell 12%, partly due to higher material

costs and rising factory expenses. Deere's gross profit margin on

equipment has been flat for most of the past decade even though

overall equipment sales have increased about 61% during that time.

Margins in manufacturing typically expand with higher production

volumes.

Deere has said it would decide this fall whether to close some

of its world-wide network of around 50 factories. The company last

month aimed to raise its operating margin to 15% by 2022 from about

10% currently.

Some U.S. farmers using technology to guide their planting

decisions say rising prices for new equipment have been offset by

savings on seed and fertilizer.

Christian Yunker, who raises dairy cattle and grows corn,

soybeans, wheat, vegetables and sod on about 7,800 acres near Elba,

N.Y., said the $200,000 he has spent on precision agriculture

equipment from Deere and other manufacturers have helped him

improve his yields.

His planters now apply more seeds on acres with a record of

higher output, and cut back on seeds on acres that have been less

fertile. He said that technology upgrade, which cost him about

$70,000 for two planters, has lowered his seed expenses by as much

as $15 an acre.

Mr. Yunker has cut his spending on equipment purchases by about

20% this year but continues to invest in technology for his

planters.

"There's advancements all the time to continue to invest in," he

said.

Write to Bob Tita at robert.tita@wsj.com

(END) Dow Jones Newswires

September 23, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

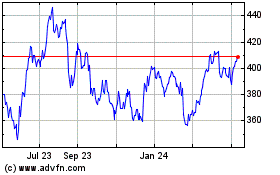

Deere (NYSE:DE)

Historical Stock Chart

From Mar 2024 to Apr 2024

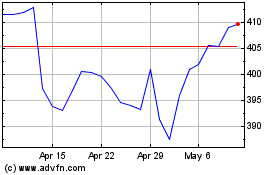

Deere (NYSE:DE)

Historical Stock Chart

From Apr 2023 to Apr 2024