New phones have more cameras, lower prices; competitors slice

into market share

By Tripp Mickle in San Francisco and Yoko Kubota in Beijing

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (September 21, 2019).

Apple Inc.'s store in Beijing's trendy Sanlitun neighborhood was

crowded Friday with shoppers checking out the latest iPhones -- but

the real test for the iPhone 11, analysts say, will be whether it

can sustain interest in the months ahead as trade tensions simmer

and competitors release 5G handsets.

Apple stores world-wide began selling the new iPhones Friday.

The base iPhone 11 model features a second-rear camera and a $699

price tag, $50 less than its predecessor's. The iPhone 11 Pro

models feature the same starting price as their predecessors, $999,

but offer a third rear camera and ultrawide photos.

The tech giant has been under fire in China, where phones with

similar features and lower prices from Huawei Technologies Co. and

others have sliced into its market share.

Sales in Greater China, including Hong Kong and Taiwan, plunged

20% to $32.54 billion for the three quarters ended in June, the

company reported in July. While that figure includes the iPhone as

well as other Apple devices, executives have noted weakness in the

performance of the company's smartphones in its second-largest

sales market.

In a bid to end those declines, Apple introduced new iPhones

this month that address camera and price, previous models'

weaknesses in the eyes of consumers.

Camera technology has become an important differentiator in

China, where Huawei has walloped Apple and others, amassing a 38%

smartphone market share in the June quarter, according to research

firm Canalys, after introducing a triple-rear camera model last

year. Meanwhile Apple had a 6% share of the market, ranking fifth

among companies, and that percentage was down from the prior

year.

Apple's best standing in China was in 2015 when it was the

third-largest smartphone seller with a nearly 13% market share,

according to Canalys data.

The iPhone Pro's triple-rear camera may help Apple catch up to

its biggest Chinese rival and give customers a reason to pause

before considering switching to Huawei.

The new features, along with the familiarity of using the

iPhone, were enough to persuade 28-year-old Gao Zhenzhen to plan an

upgrade from her iPhone 7 at the Apple Store in Sanlitun.

"It's because I'm used to iPhones," Ms. Gao said.

Apple's high prices have contributed to its slowing China sales,

analysts say. Slashing $50 off the price of the iPhone 11 compared

with last year's XR should help broaden the appeal of the company's

lowest-priced new model. Apple also aggressively touted trade-in

offers world-wide that further discount retail prices.

The lower prices and trade-in offer helped persuade Aaron Lee,

35, to buy a new iPhone 11 for around 3,100 yuan ($440) after

trading in his XR model. "The price has reached a level where it's

convenient enough," Mr. Lee said.

Many consumers still consider Apple's phones too pricey.

Zhang Tao, a 46-year-old taxi driver in Beijing, prioritizes

affordability in choosing mobile phones. "The features of domestic

phones are getting better and better," said Mr. Zhang, who

currently uses an Oppo R15.

Apple's challenges in China are expected to intensify as local

handset makers introduce models with 5G, a new, speedier generation

of wireless technology.

Huawei introduced its Mate 30 model with 5G on Thursday and

Xiaomi Corp., Oppo and Vivo are expected to release 5G-capable

devices before year-end.

Chinese consumers have been anticipating the arrival of 5G and

consider it a core technology for a premium handset, said Mo Jia, a

Shanghai-based analyst for Canalys. "This is, of course, a

significant weak point for Apple in terms of premium smartphones,"

he said.

Apple also is battling U.S.-China trade tensions that could sour

some Chinese consumers on U.S. brands. The company has largely

stayed out of the crossfire, but its reliance on China for a fifth

of its total sales makes it vulnerable if China retaliates against

continued pressure from U.S. tariffs.

The combination of 5G and trade, as well as perceived lackluster

features on the iPhone 11, has Nomura Instinet analyst Jeff Kvaal

doubting Apple will gain market share in China over the next

year.

"This upgrade simply isn't all that dramatic," Mr. Kvaal said of

the new iPhones. "Typically, they offer refreshes with more

dramatic upgrades than adding a camera."

Dow Jones & Co., publisher of The Wall Street Journal, has a

commercial agreement to supply news through Apple services.

Write to Tripp Mickle at Tripp.Mickle@wsj.com and Yoko Kubota at

yoko.kubota@wsj.com

(END) Dow Jones Newswires

September 21, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

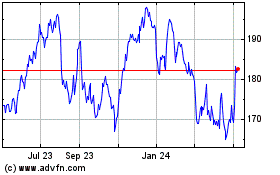

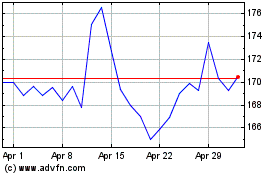

Apple (NASDAQ:AAPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Apple (NASDAQ:AAPL)

Historical Stock Chart

From Apr 2023 to Apr 2024