Current Report Filing (8-k)

September 20 2019 - 7:46AM

Edgar (US Regulatory)

UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): September 16, 2019

REDHAWK

HOLDINGS CORP.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

000-54323

|

|

20-3866475

|

|

(State

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S.

Employer

Identification

No.)

|

120

Rue Beauregard, Suite 206, Louisiana 70508

|

(Address

of principal executive offices) (Zip Code)

|

(337)269-5933

(Company's

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

☐

Written communications pursuant to Rule 425

under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12

under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant

to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities

registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

|

Title

of each class

|

Trading

Symbol(s)

|

Name

of each exchange on which registered

|

|

None

|

N/A

|

N/A

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.03. – Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

The

disclosures in the first two paragraphs of Item 7.01 of this Report are also responsive to this Item 2.03 and are hereby incorporated

by reference into this Item 2.03.

Item 7.01

– Regulation FD Disclosure.

On

September 16, 2019, RedHawk Holdings Corp. (the “Company”) issued a press release announcing the sale of $500,000

in aggregate principal amount of new convertible notes (the “Notes”) in a private offering that is exempt from registration

under the Securities Act of 1933, as amended (the “Securities Act”). The Company intends to use the net proceeds

of the offering of the Notes, after payment of related fees and expenses, to retire existing debt and to provide working capital.

The

Notes mature on the fifth anniversary of the date of issuance and are convertible into shares of the Company’s common stock,

par value $0.001 per share, at a price of $0.015 per share. Interest accrues at a rate of 7% per annum and is payable semi-annually.

The Convertible Notes are secured by certain real property assets of the Company.

At

closing, the Company issued to the Note purchasers a number of warrants exercisable ten years from the date of issuance for the

purchase of an aggregate of 12,500,000 shares of the Company’s common stock (the “Warrant Shares”) at

an exercise price of $0.01 per Warrant Share.

A

copy of this press release is furnished with this report as Exhibit 99.1 and is incorporated herein by reference.

Certain

Information

The

information furnished pursuant to Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, is furnished and shall

not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be incorporated

by reference into any registration statement or other document filed under the Securities Act or the Exchange Act, except as shall

be expressly set forth by specific reference in such filing.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits

99.1 Press Release issued September 16, 2019

Cautionary

Statement Regarding Forward-Looking Statements

This

Current Report on Form 8-K contains forward-looking statements. Forward-looking statements are all statements other than statements

of historical fact. Statements contained in this Current Report on Form 8-K that are not historical facts may be deemed to be

forward-looking statements. The words “anticipate,” “may,” “can,” “plans,” “believes,”

“estimates,” “expects,” “projects,” “targets,” “intends,” “likely,”

“will,” “should,” “to be,” “potential” and any similar expressions are intended

to identify those assertions as forward-looking statements.

Investors

are cautioned that forward-looking statements are inherently uncertain. Actual performance and results may differ materially from

that projected or suggested herein due to certain risks and uncertainties. In evaluating forward-looking statements, you should

consider the various factors which may cause actual results to differ materially from any forward-looking statements including

those listed in the “Risk Factors” section of our latest Annual Report on Form 10-K. Further, the Company may make

changes to its business plans that could or will affect its results. Investors are cautioned that the Company will undertake no

obligation to update any forward-looking statements.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

Date:

September 20, 2019

|

RedHawk

Holdings Corp.

|

|

|

By:

|

/s/ G.

Darcy Klug

|

|

|

Name:

|

G. Darcy Klug

|

|

|

Title:

|

Interim Chief Executive

Officer and Chief Financial Officer

|

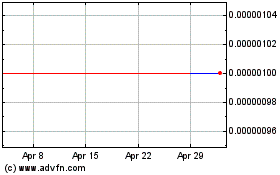

RedHawk (CE) (USOTC:SNDD)

Historical Stock Chart

From Mar 2024 to Apr 2024

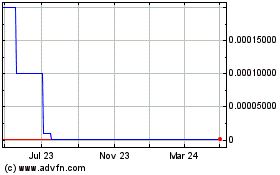

RedHawk (CE) (USOTC:SNDD)

Historical Stock Chart

From Apr 2023 to Apr 2024