By Shalini Ramachandran and Drew FitzGerald

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (September 19, 2019).

AT&T Inc. is exploring parting with its DirecTV unit, people

familiar with the matter said, a sharp reversal from Chief

Executive Randall Stephenson's strategy to make the $49 billion bet

on the satellite provider a key piece of the phone giant's

future.

The telecom giant has considered various options, including a

spinoff of DirecTV into a separate public company and a combination

of DirecTV's assets with Dish Network Corp., its satellite-TV

rival, the people said.

AT&T may ultimately decide to keep DirecTV in the fold.

Despite the satellite service's struggles, as consumers drop their

TV connections, it still contributes a sizable volume of cash flow

and customer accounts to its parent.

AT&T acquired DirecTV in 2015 for $49 billion. The company's

shrinking satellite business is under a microscope after activist

investor Elliott Management Corp. disclosed a $3.2 billion stake in

AT&T last week and released a report pushing for strategic

changes. Elliott has told investors that AT&T should unload

DirecTV, The Wall Street Journal has previously reported.

There could be regulatory hurdles to any deal with Dish, which

has about 12 million subscribers. When Dish's predecessor EchoStar

Communications Corp. and DirecTV's former owner Hughes Electronics

Corp. tried to merge in 2001, regulators ultimately blocked it on

antitrust grounds, worried that many rural Americans would be left

with only a single option to get their television service. More

recently, Dish Chairman Charlie Ergen held talks to combine with

DirecTV in 2014, but lost out to AT&T.

On the idea of merging the two satellite providers, AT&T

finance chief John Stephens said, "From a regulatory perspective,

it hasn't been successful and I don't know that there is any change

in that regulatory perspective." He added, speaking last week at an

investor conference, "I understand the industrial logic, but quite

frankly it's been tried and has been rejected."

Jettisoning DirecTV would be an about-face for Mr. Stephenson,

who billed the acquisition of the company as a bold move to

diversify beyond the wireless phone business and tap into a growing

media industry. The deal made AT&T the largest distributor of

pay TV channels, ahead of Comcast Corp. DirecTV is now part of an

entertainment and consumer wireline unit that made up 27% of

AT&T's $173.3 billion 2018 revenue.

AT&T executives have argued that DirecTV's millions of

subscribers, combined with fiber-optic TV customers and cellphone

users, give the telecom giant the scale it needs to compete with

the likes of Netflix Inc. and Walt Disney Co. in entertainment and

Alphabet Inc.'s Google in advertising.

Mr. Stephenson deepened AT&T's bet on media with the

purchase last year of Time Warner Inc., after prevailing in an

antitrust battle. He refused to have AT&T divest itself of

DirecTV when the Justice Department suggested that as a condition

of approving the deal. The government lost the case.

For Mr. Stephenson, who has helmed AT&T for 12 years,

parting ways with DirecTV would be an acknowledgment that a major

cornerstone of his diversification strategy hasn't gone as planned.

It also adds pressure for AT&T to deliver on the promise of the

Time Warner deal. Mr. Stephenson has signaled he is prepared to

step down as CEO as soon as next year, the Journal reported last

week.

This month, Mr. Stephenson elevated his longtime lieutenant John

Stankey to become chief operating officer, a move that sparked

Elliott's decision to go public with its grievances about

AT&T's yearslong empire-building strategy. Mr. Stankey was put

in charge of DirecTV after AT&T acquired it and later moved to

head up WarnerMedia, the renamed Time Warner unit inside AT&T.

He is widely viewed as the heir apparent for the CEO job. But

Elliott viewed his recent promotion to COO as hasty, people

familiar with the matter have said.

AT&T had 26 million U.S. pay-TV customers after it bought

DirecTV, but subscribers have declined at a brisk pace as

cord-cutting drives them to other entertainment options. Its pay-TV

business, which includes satellite TV, fiber-optic video service

and online channels, ended the second quarter with under 23 million

customers. Mr. Stephens warned earlier this month at an investor

conference that it would lose more customers in the third

quarter.

AT&T's DirecTV disappointment follows a long line of

ill-fated deals in media and communications, dating to AOL-Time

Warner. AT&T's wireless rival, Verizon Communications Inc., has

struggled to integrate media into its DNA as well. After spending

more than $9 billion to acquire AOL and Yahoo, Verizon booked a

$4.5 billion accounting charge related to its Oath media business

last year, conceding that the company's bet on high-profile

internet properties hasn't worked out.

In its letter to AT&T's board, Elliott said AT&T's

DirecTV acquisition has come with "damaging results." The hedge

fund criticized AT&T's glitch-filled launch of the DirecTV Now

streaming service and questioned whether the numerous executive

departures at DirecTV compounded AT&T's integration challenges.

Elliott said that poor results at DirecTV "and general concern

about the company's ability to execute" were obscuring stronger

results at AT&T's core telecom businesses.

One reason AT&T may ultimately decide to keep DirecTV aboard

is AT&T's towering net debt load, which stood at more than $160

billion earlier this year. The cash generated by the pay-TV giant

has helped pay down that debt and fueled other investments in the

rest of the company.

Any spinoff of DirecTV would be unlikely until mid-2020 at the

earliest, five years after the deal closed, to make it a

tax-efficient transaction for AT&T, a person familiar with the

matter said.

Dish, which is also struggling in the pay-TV business, would be

a logical partner for DirecTV. People close to Dish said there are

obvious synergies that would come from combining both the national

satellite-TV operators, including stronger leverage in programming

negotiations, a single control center and shared customer-support

operations. Dish also sees value in the cash that the satellite-TV

business generates, which could help fund its diversification into

wireless, the people said.

Speaking Tuesday at an investor conference in New York, Mr.

Ergen said the question remains whether such a union would pass

regulatory muster. "We look at everything," he said.

It is "a unique time in Washington D.C.," said AT&T's Mr.

Stephens, the CFO. Federal agencies earlier this year said they

will approve the merger of T-Mobile US Inc. and Sprint Corp., the

third- and fourth-largest wireless carriers, but the deal is now

being challenged by a coalition of state attorneys general. That

merger also involves Dish, which stands to gain divested cellular

assets if the T-Mobile-Sprint union survives the state

challenge.

DirecTV's domestic and international operations operate as

separate units. Last year, AT&T explored taking DirecTV's Latin

American unit public but shelved the initial public offering amid

tepid interest from investors.

Write to Shalini Ramachandran at shalini.ramachandran@wsj.com

and Drew FitzGerald at andrew.fitzgerald@wsj.com

(END) Dow Jones Newswires

September 19, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

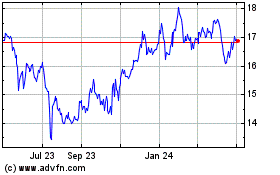

AT&T (NYSE:T)

Historical Stock Chart

From Mar 2024 to Apr 2024

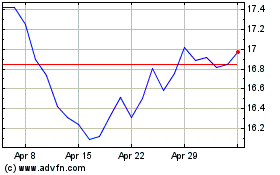

AT&T (NYSE:T)

Historical Stock Chart

From Apr 2023 to Apr 2024