Snack Brands Hurt General Mills -- WSJ

September 19 2019 - 3:02AM

Dow Jones News

By Annie Gasparro and Micah Maidenberg

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (September 19, 2019).

General Mills Inc. extended its sales slump after encountering

poor demand for brands including Yoplait yogurt and Nature Valley

granola bars.

The purveyor of classic packaged foods including Cheerios,

Hamburger Helper and Betty Crocker cake mix has struggled to revive

growth amid tougher competition from newer, trendier products and

less costly store brands.

The company said Wednesday that comparable sales fell 1% in the

latest quarter. But General Mills widened its profit margin in the

quarter in part by raising prices. Shares in the company declined

50 cents to close at $54.53.

"We got off to a slower start, but we're on the right track"

Chief Executive Jeff Harmening said in an interview.

Like other large packaged-food companies, General Mills is

facing pressure to sell foods perceived as healthier and fresher.

Retailers have also introduced more of their own store-brand

products, ramping up longtime competition.

General Mills has made some progress. U.S. cereal sales rose 1%

in the quarter, indicating improvement from the company's yearslong

efforts to revive the dying American breakfast tradition. And its

yogurt sales in the U.S. were flat, compared with double-digit

declines in the past.

"It's about making sure we give consumers what they want," Mr.

Harmening said.

Part of the company's strategy has been to diversify its

business. Last year, General Mills bought Blue Buffalo pet food for

about $8 billion, giving it a foothold in the faster-growing

pet-food category.

The company has been expanding distribution of Blue Buffalo

products, including to Walmart Inc. stores, which helped its

pet-food business log 7% sales growth to $368 million. Some

analysts say competition is pushing pricing down and pressuring

profit margins in pet food.

General Mills reported a quarterly profit of $520.6 million,

compared with $392.3 million a year earlier. After adjustments, the

company reported a profit of 79 cents a share, topping the 77 cents

a share that analysts predicted.

Write to Annie Gasparro at annie.gasparro@wsj.com and Micah

Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

September 19, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

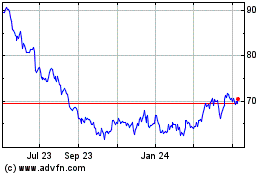

General Mills (NYSE:GIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

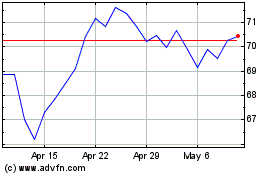

General Mills (NYSE:GIS)

Historical Stock Chart

From Apr 2023 to Apr 2024