Amended Statement of Beneficial Ownership (sc 13d/a)

September 16 2019 - 8:06AM

Edgar (US Regulatory)

|

|

UNITED STATES

|

|

|

|

SECURITIES AND EXCHANGE COMMISSION

|

|

|

|

Washington, D.C. 20549

|

|

|

|

|

|

|

|

SCHEDULE 13D

|

|

Under the Securities Exchange Act of 1934

(Amendment No. 13)

Willis Lease Finance Corporation

(Name of Issuer)

(Title of Class of Securities)

(CUSIP Number)

Charles F. Willis, IV

c/o Willis Lease Finance Corporation

4700 Lyons Technology Parkway

Coconut Creek, Florida 33073

(415) 408-4700

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

Date of Event Which Requires Filing of this Statement

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this statement, and is filing this schedule because of Rule 13d-1(e), Rule 13d-1(f) or Rule 13d-1(g), check the following box. o

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7(b) for other parties to whom copies are to be sent.

The share numbers listed for voting and dispositive power as of a particular date include the number of shares into which options were exercisable or would be exercisable within 60 days of such date.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (the “Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

September 16, 2019

|

CUSIP No. 970646 10 5

|

|

|

|

|

1

|

Names of Reporting Persons:

CFW Partners, L.P.

I.R.S. Identification Nos. of above persons (entities only).

68-0392529

|

|

|

|

|

2

|

Check the Appropriate Box if a Member of a Group

|

|

|

|

(a)

|

o

|

|

|

|

(b)

|

o

|

|

|

|

|

3

|

SEC Use Only

|

|

|

|

|

4

|

Source of Funds (See Instructions)

OO, PF

|

|

|

|

|

5

|

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) o

|

|

|

|

|

6

|

Citizenship or Place of Organization

Delaware

|

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With

|

7

|

Sole Voting Power

0

|

|

|

|

8

|

Shared Voting Power

2,134,148

|

|

|

|

9

|

Sole Dispositive Power

0

|

|

|

|

10

|

Shared Dispositive Power

2,134,148

|

|

|

|

|

11

|

Aggregate Amount Beneficially Owned

2,134,148

|

|

|

|

|

12

|

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares o

|

|

|

|

|

13

|

Percent of Class Represented by Amount in Row (11)

33.58%

|

|

|

|

|

14

|

Type of Reporting Person

PN

|

|

|

|

|

|

|

|

2

September 16, 2019

|

CUSIP No. 970646 10 5

|

|

|

|

|

1

|

Names of Reporting Persons:

Charles F. Willis, IV

I.R.S. Identification Nos. of above persons (entities only).

|

|

|

|

|

2

|

Check the Appropriate Box if a Member of a Group

|

|

|

|

(a)

|

o

|

|

|

|

(b)

|

o

|

|

|

|

|

3

|

SEC Use Only

|

|

|

|

|

4

|

Source of Funds (See Instructions)

OO, PF

|

|

|

|

|

5

|

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) o

|

|

|

|

|

6

|

Citizenship or Place of Organization

United States of America

|

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With

|

7

|

Sole Voting Power

696,381

|

|

|

|

8

|

Shared Voting Power

2,256,080

|

|

|

|

9

|

Sole Dispositive Power

445,715

|

|

|

|

10

|

Shared Dispositive Power

1,974,415

|

|

|

|

|

11

|

Aggregate Amount Beneficially Owned

2,952,461

|

|

|

|

|

12

|

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares o

|

|

|

|

|

13

|

Percent of Class Represented by Amount in Row (11)

46.45%

|

|

|

|

|

14

|

Type of Reporting Person

IN

|

|

|

|

|

|

|

|

3

September 16, 2019

|

CUSIP No. 970646 10 5

|

|

|

|

|

1

|

Names of Reporting Persons:

Austin Chandler Willis

I.R.S. Identification Nos. of above persons (entities only).

|

|

|

|

|

2

|

Check the Appropriate Box if a Member of a Group

|

|

|

|

(a)

|

o

|

|

|

|

(b)

|

o

|

|

|

|

|

3

|

SEC Use Only

|

|

|

|

|

4

|

Source of Funds (See Instructions)

OO, PF

|

|

|

|

|

5

|

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) o

|

|

|

|

|

6

|

Citizenship or Place of Organization

United States of America

|

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With

|

7

|

Sole Voting Power

1,068

|

|

|

|

8

|

Shared Voting Power

532,044

|

|

|

|

9

|

Sole Dispositive Power

1,068

|

|

|

|

10

|

Shared Dispositive Power

86,865

|

|

|

|

|

11

|

Aggregate Amount Beneficially Owned

533,112

|

|

|

|

|

12

|

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares o

|

|

|

|

|

13

|

Percent of Class Represented by Amount in Row (11)

8.39%

|

|

|

|

|

14

|

Type of Reporting Person

IN

|

|

|

|

|

|

|

|

4

The Schedule 13D filed with the Securities and Exchange Commission on December 11, 2000 (the “Initial 13D”) by CFW Partners, the Trust and Mr. Charles F. Willis, IV with respect to the Common Stock, par value $0.01 per share (the “Shares”), issued by Willis Lease Finance Corporation, a Delaware corporation (the “Issuer”), as amended on August 28, 2013, October 1, 2013, July 7, 2015, December 23, 2015, March 23, 2016, May 20, 2016, June 8, 2016, October 6, 2016, April 4, 2018, September 13, 2018, April 1, 2019 and June 27, 2019 (together with the Initial 13D, the “13D”), is hereby amended as set forth below. Capitalized terms not defined herein have the meanings ascribed to them in the 13D.

Item 4. Purpose of the Transaction

Item 4 of the 13D is hereby amended to add the following:

On September 16, 2019, Charles F. Willis, IV, on behalf of the Reporting Persons, delivered a revised non-binding indication of interest (the “Indication of Interest”) to acquire all of the outstanding Shares of the Issuer not already owned by any of the Reporting Persons in exchange for cash consideration of $58.00 per Share (the “Offer Price”), which represents a premium of 5.7% over the Issuer’s closing stock price the day before the Reporting Persons submitted their previous non-binding indication of interest and an increase of 68.95% over the Issuer’s closing stock price on September 17, 2018. The foregoing description of the Indication of Interest does not purport to be complete and is qualified in its entirety by reference to the full text of the Indication of Interest, which is filed as Exhibit 2 hereto.

While the Reporting Persons believe the Offer Price represents a fair value for the Company, the ultimate terms of a transaction, including price, will be determined through negotiations between the Reporting Persons and the Independent Committee of the Board of Directors of the Issuer, and accordingly there can be no assurance that an agreement for a transaction will be entered into or that the terms of any such transaction will not differ materially from the terms contemplated by the Indication of Interest.

Except as set forth in this Item 4, the Reporting Persons do not have any plans or proposals with respect to any of the actions specified in Item 4 of the 13D.

Item 7. Materials to be Filed as Exhibits

Item 7 is hereby amended and supplemented by adding the following exhibits as the last exhibits of Item 7 of the 13D:

|

1.

|

|

Joint Filing Agreement

|

|

2.

|

|

Indication of Interest, dated September 16, 2019.

|

5

SIGNATURES

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this Statement is true, complete, and correct.

|

|

CFW PARTNERS, L.P.

|

|

|

|

|

|

|

|

|

Date: September 16, 2019

|

By:

|

/s/ Charles F. Willis, IV

|

|

|

|

Charles F. Willis, IV,

|

|

|

|

its General Partner

|

|

|

|

|

|

Date: September 16, 2019

|

By:

|

/s/ Charles F. Willis, IV

|

|

|

|

Charles F. Willis, IV

|

|

|

|

|

|

Date: September 16, 2019

|

By:

|

/s/ Austin Chandler Willis

|

|

|

|

Austin Chandler Willis

|

6

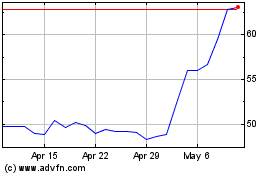

Willis Lease Finance (NASDAQ:WLFC)

Historical Stock Chart

From Mar 2024 to Apr 2024

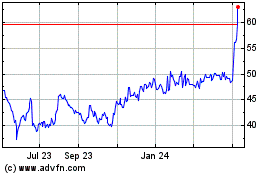

Willis Lease Finance (NASDAQ:WLFC)

Historical Stock Chart

From Apr 2023 to Apr 2024