Coffee Holding Co., Inc. (Nasdaq: JVA) (the “Company” or “Coffee

Holding Company”) today announced its operating results for the

three months and nine months ended July 31, 2019.

Net Sales. Net sales totaled

$21,594,285 for the three months ended July 31, 2019, a decrease of

$1,845,618, or 7.8%, from $23,439,903 for the three months ended

July 31, 2018. Net sales totaled $65,944,583 for the nine months

ended July 31, 2019, a decrease of $1,772,436 from $67,717,019 for

the nine months ended July 31, 2018. The decrease in net sales

reflects the lower selling price of coffee during this period due

to the continued depressed price of the green coffee market as well

as a decrease in sales of approximately $7,400,000 to the Company’s

former largest wholesale green coffee customer.

Cost of Sales. Cost of sales

for the three months ended July 31, 2019 was $17,465,685, or 80.9%

of net sales, as compared to $19,648,710, or 83.8% of net sales,

for the three months July 31, 2018. Cost of sales for the nine

months ended July 31, 2019 was $53,705,272, or 81.4% of net sales,

as compared to $56,263,183, or 83.1% of net sales, for the nine

months July 31, 2018. The decrease in cost of sales was due to the

Company’s decreased sales offset by the increased cost of steel

cans due to the increased tariffs, inbound trucking costs and the

Company’s increased losses from its hedging of futures and option

contracts.

Gross Profit. Gross profit for

the three months ended July 31, 2019 was $4,128,600, an increase of

$337,407 from $3,791,193 for the three months ended July 31, 2018.

Gross profit for the nine months ended July 31, 2019 was

$12,239,311, an increase of $785,475 from $11,453,836 for the nine

months ended July 31, 2018. The increase in gross profits resulted

from improved margins on the Company’s wholesale and roasted

business, partially offset by higher steel and trucking costs and

losses from the Company’s hedging of futures and options contracts

for the nine months ended July 31, 2019.

Operating Expenses. Total

operating expenses increased by $348,844 to $3,871,362 for the

three months ended July 31, 2019 from $3,522,518 for the three

months ended July 31, 2018. Total operating expenses increased by

$1,967,665 to $11,384,245 for the nine months ended July 31, 2019

from $9,416,580 for the nine months ended July 31, 2018. The

primary reasons for this increase were the acquisition of Steep

& Brew and the increase in the Company’s outbound freight costs

as it increased and expanded its product distribution.

Net Income.

The Company had net income of $111,494 or $0.02 per share basic and

diluted, for the three months ended July 31, 2019 compared to net

income of $15,690, or $0.00 per share basic and diluted for the

three months ended July 31, 2018. The Company had net income of

$187,741 or $0.03 per share basic and diluted, for the nine months

ended July 31, 2019 compared to net income of $957,926, or $0.17

per share basic and diluted for the nine months ended July 31,

2018. The decrease in net income was due primarily to the reasons

described above.

“During our fiscal third quarter we were able to

maintain our sales volumes and earn a small profit despite coffee

prices trading to their lowest levels since 2005. The decrease in

sales was almost entirely the result of a decline in sales to our

former largest green coffee customer, which for the nine months

ended July 31, 2019 were down $7.4 million. However, excluding

sales to our former largest green coffee customer, sales to all of

our other customers are up $5.7 million, an increase of 8.4%.

Further, we earned $0.02 cents a share on both a basic and diluted

basis, including a onetime non-cash charge of $0.04 per share on a

basic and diluted basis relating to option grants under our option

plan. Without this non-cash charge, we would have earned $0.06

cents a share,” stated Andrew Gordon, President and CEO of Coffee

Holding Company. “We continue to operate in an extremely

challenging environment. Historically low coffee prices, steel

tariffs, as well as increased competitive pressure at the grocery

store level due to the low coffee prices, continue to erode our

earnings potential in the near term. However, I remain

positive about our company’s long term outlook as we have weathered

these industry forces before while managing to strengthen our core

business of private label and green coffee sales and expand our

distribution network for our brands. Despite these headwinds, we

have seen a dramatic increase in the sales of our Café Caribe

single serve during this period, partially offset by a modest

decline in sales of our Harmony Bay brand bag and can lines

which were acquired in February 2017 as part of our Comfort Foods

acquisition. Although I am never pleased to see declines in sales

of our brands, we recognize that the Harmony Bay brand is a very

mature brand compared to Café Caribe. Café Caribe’s importance

within our brand portfolio remains second to none. The sales of

espresso in the Latin coffee category continues to outperform the

sales of mainstream and private label coffees in supermarkets and

we are extremely pleased to be participating in that growth as

well,” stated Mr. Gordon.

“Lastly, we continue to closely monitor the

regulatory environment as it relates to CBD products being sold in

the mainstream market. We believe given our diverse portfolio of

branded coffees, we will have the opportunity to service multiple

demographics in consumer tastes and preference when the opportunity

finally presents itself,” concluded Mr. Gordon.

About Coffee Holding

Coffee Holding Co., Inc. is a leading integrated

wholesale coffee roaster and dealer in the United States and one of

the few coffee companies that offers a broad array of coffee

products across the entire spectrum of consumer tastes, preferences

and price points. Coffee Holding has been a family-operated

business for three generations and has remained profitable through

varying cycles in the coffee industry and the economy. The

Company’s private label and branded coffee products are sold

throughout the United States, Canada and abroad to supermarkets,

wholesalers, and individually owned and multi-unit retail

customers.

Any statements that are not historical facts

contained in this release are “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995, including the Company’s outlook on future margin performance.

Forward-looking statements include statements with respect to our

beliefs, plans, objectives, goals, expectations, anticipations,

assumptions, estimates, intentions, and future performance, and

involve known and unknown risks, uncertainties and other factors,

which may be beyond our control, and which may cause our actual

results, performance or achievements to be materially different

from future results, performance or achievements expressed or

implied by such forward-looking statements. All statements other

than statements of historical fact are statements that could be

forward-looking statements. We have based these forward-looking

statements upon information available to management as of the date

of this release and management’s expectations and projections about

certain future events. It is possible that the assumptions made by

management for purposes of such statements may not materialize.

Such statements may involve risks and uncertainties, including but

not limited to those relating to product demand, pricing, market

acceptance, hedging activities, the effect of economic conditions,

intellectual property rights, the outcome of competitive products,

risks in product development, the results of financing efforts, the

ability to complete transactions, and other factors discussed from

time to time in the Company’s Securities and Exchange Commission

filings. The Company undertakes no obligation to update or revise

any forward-looking statement for events or circumstances after the

date on which such statement is made.

Company Contact

Coffee Holding Co., Inc.Andrew

GordonPresident& CEO718-832-0800

COFFEE HOLDING CO.,

INC.CONDENSED CONSOLIDATED BALANCE

SHEETSJULY 31, 2019 AND OCTOBER 31,

2018

| |

|

July 31, 2019 |

|

|

October 31, 2018 |

|

| |

|

(Unaudited) |

|

|

|

|

|

- ASSETS - |

|

|

|

|

|

|

|

|

| CURRENT

ASSETS: |

|

|

|

|

|

|

|

|

|

Cash |

|

$ |

2,568,780 |

|

|

$ |

4,611,384 |

|

|

Accounts receivable, net of allowances of $144,000 for 2019 and

2018 |

|

|

8,492,642 |

|

|

|

9,914,297 |

|

|

Inventories |

|

|

17,702,156 |

|

|

|

15,271,106 |

|

|

Prepaid expenses and other current assets |

|

|

686,359 |

|

|

|

578,861 |

|

|

Prepaid and refundable income taxes |

|

|

288,639 |

|

|

|

383,206 |

|

| TOTAL CURRENT

ASSETS |

|

|

29,738,576 |

|

|

|

30,758,854 |

|

| |

|

|

|

|

|

|

|

|

| Machinery and equipment, at

cost, net of accumulated depreciation of $6,753,814 and $6,251,828

for 2019 and 2018, respectively |

|

|

2,416,457 |

|

|

|

2,350,208 |

|

| Customer list and

relationships, net of accumulated amortization of $139,522 and

$108,875 for 2019 and 2018, respectively |

|

|

545,478 |

|

|

|

576,125 |

|

| Trademarks and tradenames |

|

|

1,488,000 |

|

|

|

1,488,000 |

|

| Other intangible assets |

|

|

331,124 |

|

|

|

331,124 |

|

| Non-compete, net of

accumulated amortization of $24,750 and $9,900 for 2019 and 2018,

respectively |

|

|

74,250 |

|

|

|

89,100 |

|

| Goodwill |

|

|

2,157,661 |

|

|

|

2,157,661 |

|

| Equity method investments |

|

|

87,085 |

|

|

|

89,776 |

|

| Deferred income tax asset |

|

|

446,823 |

|

|

|

440,325 |

|

| Deposits and other assets |

|

|

462,050 |

|

|

|

552,904 |

|

|

TOTAL ASSETS |

|

$ |

37,747,504 |

|

|

$ |

38,834,077 |

|

| |

|

|

|

|

|

|

|

|

|

- LIABILITIES AND STOCKHOLDERS’ EQUITY - |

|

|

|

|

|

|

|

|

| CURRENT

LIABILITIES: |

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

3,627,521 |

|

|

$ |

4,833,548 |

|

|

Line of credit |

|

|

5,767,640 |

|

|

|

6,260,014 |

|

|

Due to broker |

|

|

96,704 |

|

|

|

22,046 |

|

|

Note payable |

|

|

|

|

|

|

70,255 |

|

|

Income taxes payable |

|

|

200 |

|

|

|

1,505 |

|

| TOTAL CURRENT

LIABILITIES |

|

|

9,492,065 |

|

|

|

11,187,368 |

|

| |

|

|

|

|

|

|

|

|

| Deferred income tax

liabilities |

|

|

844,532 |

|

|

|

882,022 |

|

| Deferred rent payable |

|

|

205,992 |

|

|

|

242,143 |

|

| Deferred compensation

payable |

|

|

435,987 |

|

|

|

532,726 |

|

| TOTAL

LIABILITIES |

|

|

10,978,576 |

|

|

|

12,844,259 |

|

| |

|

|

|

|

|

|

|

|

| STOCKHOLDERS’

EQUITY: |

|

|

|

|

|

|

|

|

|

Coffee Holding Co., Inc. stockholders’ equity: |

|

|

|

|

|

|

|

|

|

Preferred stock, par value $.001 per share; 10,000,000 shares

authorized; no shares issued and outstanding |

|

|

- |

|

|

|

- |

|

|

Common stock, par value $.001 per share; 30,000,000 shares

authorized, 6,494,680 shares issued; 5,569,349 shares outstanding

as of July 31 2019 and October 31, 2018 |

|

|

6,494 |

|

|

|

6,494 |

|

|

Additional paid-in capital |

|

|

16,332,943 |

|

|

|

16,104,075 |

|

|

Retained earnings |

|

|

13,592,508 |

|

|

|

13,404,767 |

|

|

Less: Treasury stock, 925,331 common shares, at cost as of July 31,

2019 and October 31, 2018 |

|

|

(4,633,560 |

) |

|

|

(4,633,560 |

) |

|

Total Coffee Holding Co., Inc. Stockholders’ Equity |

|

|

25,298,385 |

|

|

|

24,881,776 |

|

|

Noncontrolling interest |

|

|

1,470,543 |

|

|

|

1,108,042 |

|

|

TOTAL EQUITY |

|

|

26,768,928 |

|

|

|

25,989,818 |

|

| TOTAL LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

$ |

37,747,504 |

|

|

$ |

38,834,077 |

|

COFFEE HOLDING CO.,

INC.CONDENSED CONSOLIDATED STATEMENTS OF

INCOMEFOR THE NINE AND THREE MONTHS ENDED JULY 31,

2019 AND 2018(Unaudited)

|

|

|

Nine Months Ended July 31, |

|

|

Three Months Ended July 31, |

|

|

|

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

2018 |

|

| NET

SALES |

|

$ |

65,944,583 |

|

|

$ |

67,717,019 |

|

|

$ |

21,594,285 |

|

|

$ |

23,439,903 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| COST OF SALES

(including $5.9 and $7.0 million related party cots for the nine

months ended July 31, 2019 and 2018, respectively and $1.8 and $2.6

million for the three months ended July 31, 2019 and 2018,

respectively.) |

|

|

53,705,272 |

|

|

|

56,263,183 |

|

|

|

17,465,685 |

|

|

|

19,648,710 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GROSS

PROFIT |

|

|

12,239,311 |

|

|

|

11,453,836 |

|

|

|

4,128,600 |

|

|

|

3,791,193 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING

EXPENSES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling and administrative |

|

|

10,853,495 |

|

|

|

8,905,830 |

|

|

|

3,701,112 |

|

|

|

3,352,268 |

|

|

Officers’ salaries |

|

|

530,750 |

|

|

|

510,750 |

|

|

|

170,250 |

|

|

|

170,250 |

|

|

TOTAL |

|

|

11,384,245 |

|

|

|

9,416,580 |

|

|

|

3,871,362 |

|

|

|

3,522,518 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INCOME FROM

OPERATIONS |

|

|

855,066 |

|

|

|

2,037,256 |

|

|

|

257,238 |

|

|

|

268,675 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER INCOME

(EXPENSE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

8,903 |

|

|

|

11,170 |

|

|

|

3,548 |

|

|

|

3,433 |

|

|

(Loss) gain from equity method investment |

|

|

(2,691 |

) |

|

|

(4,359 |

) |

|

|

(2,613 |

) |

|

|

199 |

|

|

Interest expense |

|

|

(195,493 |

) |

|

|

(286,555 |

) |

|

|

(64,625 |

) |

|

|

(99,906 |

) |

|

TOTAL |

|

|

(189,281 |

) |

|

|

(279,744 |

) |

|

|

(63,690 |

) |

|

|

(96,274 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INCOME BEFORE

PROVISION FOR INCOME TAXES AND NON-CONTROLLING INTEREST IN

SUBSIDIARY |

|

|

665,785 |

|

|

|

1,757,412 |

|

|

|

193,548 |

|

|

|

172,401 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes |

|

|

115,543 |

|

|

|

447,105 |

|

|

|

34,413 |

|

|

|

35,721 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET INCOME BEFORE

NON-CONTROLLING INTEREST IN SUBSIDIARY |

|

|

550,242 |

|

|

|

1,310,407 |

|

|

|

159,135 |

|

|

|

136,680 |

|

|

Less: Net (income) attributable to the non-controlling

interest |

|

|

(362,501 |

) |

|

|

(352,481 |

) |

|

|

(47,641 |

) |

|

|

(120,990 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET INCOME

ATTRIBUTABLE TO COFFEE HOLDING CO., INC. |

|

$ |

187,741 |

|

|

$ |

957,926 |

|

|

$ |

111,494 |

|

|

$ |

15,690 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted earnings per

share |

|

$ |

.03 |

|

|

$ |

.17 |

|

|

$ |

.02 |

|

|

$ |

.00 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares

outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

|

5,569,349 |

|

|

|

5,720,360 |

|

|

|

5,569,349 |

|

|

|

5,673,914 |

|

COFFEE HOLDING CO.,

INC.CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWSNINE MONTHS ENDED JULY 31, 2019 AND

2018(Unaudited)

| |

|

2019 |

|

|

2018 |

|

| OPERATING

ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

550,242 |

|

|

$ |

1,310,407 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

547,483 |

|

|

|

544,564 |

|

|

Stock-based compensation |

|

|

228,868 |

|

|

|

- |

|

|

Unrealized loss (gain) on commodities |

|

|

74,658 |

|

|

|

317,176 |

|

|

Loss (gain) on equity method investments |

|

|

2,691 |

|

|

|

4,359 |

|

|

Deferred rent |

|

|

(36,151 |

) |

|

|

1,323 |

|

|

Deferred income taxes |

|

|

(43,988 |

) |

|

|

3,750 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

1,421,655 |

|

|

|

4,917,860 |

|

|

Inventories |

|

|

(2,431,050 |

) |

|

|

2,240,892 |

|

|

Prepaid expenses and other current assets |

|

|

(107,498 |

) |

|

|

(50,625 |

) |

|

Prepaid green coffee |

|

|

- |

|

|

|

171,350 |

|

|

Prepaid and refundable income taxes |

|

|

94,567 |

|

|

|

178,848 |

|

|

Accounts payable and accrued expenses |

|

|

(1,206,027 |

) |

|

|

(1,698,518 |

) |

|

Deposits and other assets |

|

|

90,854 |

|

|

|

|

|

|

Deferred compensation payable |

|

|

(96,739 |

) |

|

|

|

|

|

Income taxes payable |

|

|

(1,305 |

) |

|

|

5,889 |

|

| Net cash (used in)

provided by operating activities |

|

|

(911,740 |

) |

|

|

7,947,275 |

|

| |

|

|

|

|

|

|

|

|

| INVESTING

ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Cash paid for business acquisition |

|

|

- |

|

|

|

(2,740,217 |

) |

|

Purchases of machinery and equipment |

|

|

(568,235 |

) |

|

|

(299,554 |

) |

| Net cash used in

investing activities |

|

|

(568,235 |

) |

|

|

(3,039,771 |

) |

| |

|

|

|

|

|

|

|

|

| FINANCING

ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Advances under bank line of credit |

|

|

7,626 |

|

|

|

3,800,200 |

|

|

Purchase of treasury stock |

|

|

- |

|

|

|

(894,368 |

) |

|

Principal payment on note payable |

|

|

(70,255 |

) |

|

|

|

|

|

Principal payments under bank line of credit |

|

|

(500,000 |

) |

|

|

(5,059,065 |

) |

| Net cash used in

financing activities |

|

|

(562,629 |

) |

|

|

(2,153,133 |

) |

| |

|

|

|

|

|

|

|

|

| NET (DECREASE)

INCREASE IN CASH |

|

|

(2,042,604 |

) |

|

|

2,754,371 |

|

| |

|

|

|

|

|

|

|

|

| CASH, BEGINNING OF

PERIOD |

|

|

4,611,384 |

|

|

|

2,325,650 |

|

| |

|

|

|

|

|

|

|

|

| CASH, END OF

PERIOD |

|

$ |

2,568,780 |

|

|

$ |

5,080,021 |

|

| |

|

|

|

|

|

|

|

|

| SUPPLEMENTAL

DISCLOSURE OF CASH FLOW DATA: |

|

|

|

|

|

|

|

|

|

Interest paid |

|

$ |

197,216 |

|

|

$ |

285,603 |

|

|

Income taxes paid |

|

$ |

66,269 |

|

|

$ |

245,838 |

|

COFFEE HOLDING CO.,

INC.CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWSNINE MONTHS ENDED APRIL 30, 2019 AND

2018(Unaudited)

| SUPPLEMENTAL

DISCLOSURE OF NON-CASH INVESTING AND FINANCING

ACTIVITIES: |

|

|

|

|

|

On April 24, 2018 Generations Coffee Company acquired the assets of

Steep & Brew, Inc.: |

|

|

|

|

| |

|

|

|

|

|

Accounts receivable |

|

$ |

86,442 |

|

|

Inventory |

|

|

1,140,893 |

|

|

Equipment |

|

|

450,000 |

|

|

Prepaid expenses |

|

|

62,882 |

|

|

Non-compete |

|

|

150,000 |

|

|

Goodwill |

|

|

1,000,000 |

|

|

Less: Note payable |

|

|

150,000 |

|

|

Net cash paid |

|

$ |

2,740,217 |

|

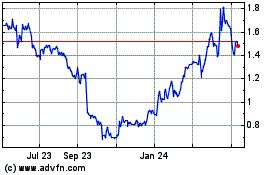

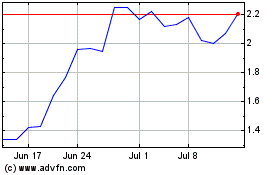

Coffee (NASDAQ:JVA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Coffee (NASDAQ:JVA)

Historical Stock Chart

From Apr 2023 to Apr 2024