Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

September 10 2019 - 3:38PM

Edgar (US Regulatory)

Issuer Free Writing Prospectus, dated September 10, 2019

Filed Pursuant to Rule 433 under the Securities Act of 1933

Registration No. 333-229812

LYB International Finance II B.V.

€500,000,000 0.875% Guaranteed Notes due 2026

€500,000,000 1.625% Guaranteed Notes due 2031

Pricing Term Sheet dated September 10, 2019

|

Issuer:

|

|

LYB International Finance II B.V.

|

|

|

|

|

|

Parent Guarantor:

|

|

LyondellBasell Industries N.V.

|

|

|

|

|

|

Security Description:

|

|

€500,000,000 0.875% Guaranteed Notes due 2026 (the “2026 Notes”)

€500,000,000 1.625% Guaranteed Notes due 2031 (the “2031 Notes”)

|

|

|

|

|

|

Distribution:

|

|

SEC-registered

|

|

|

|

|

|

Principal Amount:

|

|

2026 Notes: €500,000,000

2031 Notes: €500,000,000

|

|

|

|

|

|

Coupon:

|

|

2026 Notes: 0.875%

2031 Notes: 1.625%

|

|

|

|

|

|

Maturity Date:

|

|

2026 Notes: September 17, 2026

2031 Notes: September 17, 2031

|

|

|

|

|

|

Offering Price:

|

|

2026 Notes: 99.642% of face amount

2031 Notes: 98.924% of face amount

|

|

|

|

|

|

Benchmark Security:

|

|

2026 Notes: DBR 0.000% due August 15, 2026

2031 Notes: DBR 0.000% due August 15, 2029

|

|

|

|

|

|

Benchmark Security Spot:

|

|

2026 Notes: 105.51%

2031 Notes: 105.72%

|

|

|

|

|

|

Spread to Benchmark Security:

|

|

2026 Notes: +170 basis points

2031 Notes: +228.4 basis points

|

|

|

|

|

|

Mid-Swap Yield:

|

|

2026 Notes: -0.342%

2031 Notes: -0.025%

|

|

|

|

|

|

Spread to Mid-Swap:

|

|

2026 Notes: + 127 basis points

2031 Notes: + 175 basis points

|

|

|

|

|

|

Yield to Maturity:

|

|

2026 Notes: 0.928%

2031 Notes: 1.725%

|

|

|

|

|

|

Interest Payment Dates:

|

|

Annually on September 17

|

|

|

|

|

|

First Interest Payment Date:

|

|

September 17, 2020

|

|

|

|

|

|

Net Proceeds to Issuer (before expenses):

|

|

€987,580,000

|

|

|

|

|

|

Day Count Convention:

|

|

ACTUAL/ACTUAL (ICMA)

|

|

|

|

|

|

Optional Redemptions:

|

|

|

|

|

|

|

|

Make-Whole Call:

|

|

2026 Notes: Before June 17, 2026 at a discount rate equal to the Comparable Government Bond Rate (as defined in the preliminary prospectus supplement dated September 10, 2019) plus 30 basis points, plus accrued and unpaid interest, if any

|

|

|

|

2031 Notes: Before June 17, 2031 at a discount rate equal to the Comparable Government Bond Rate plus 35 basis points, plus accrued and unpaid interest, if any

|

|

|

|

|

|

Par Call:

|

|

2026 Notes: Commencing June 17, 2026, plus accrued and unpaid interest, if any for the 2026 Notes

2031 Notes: Commencing June 17, 2031, plus accrued and unpaid interest, if any for the 2031 Notes

|

|

|

|

|

|

|

|

See “Description of the Notes—Optional Redemption” in the preliminary prospectus supplement for more information.

|

|

|

|

|

|

Change of Control Triggering Event:

|

|

Puttable at 101% of principal plus accrued and unpaid interest and additional interest, if any

|

|

|

|

|

|

Trade Date:

|

|

September 10, 2019

|

|

|

|

|

|

Settlement Date*:

|

|

September 17, 2019 (T+5)

|

|

|

|

|

|

CUSIP / ISIN / Common Code:

|

|

2026 Notes: 50247W AC1 / XS2052310054 / 205231005

2031 Notes: 50247W AD9 / XS2052313827 / 205231382

|

|

|

|

|

|

Governing Law:

|

|

State of New York

|

|

|

|

|

|

Expected Listing:

|

|

Global Exchange Market of Euronext Dublin

|

|

|

|

|

|

Expected Ratings**:

|

|

Baa1/BBB+ (stable/negative) (Moody’s/S&P)

|

|

|

|

|

|

Denominations/Multiple:

|

|

€100,000 / €1,000

|

|

|

|

|

|

Clearing and Settlement:

|

|

Euroclear/Clearstream

|

|

|

|

|

|

Stabilization:

|

|

Stabilization/FCA

|

|

|

|

|

|

Joint Book-Running Managers:

|

|

Citigroup Global Markets Limited

|

|

|

|

Deutsche Bank AG, London Branch

|

|

|

|

J.P. Morgan Securities plc

|

|

|

|

Merrill Lynch International

|

|

|

|

Mizuho International plc

|

|

|

|

Morgan Stanley & Co. International plc

|

|

|

|

Wells Fargo Securities International Limited

|

|

|

|

|

|

Co-Managers:

|

|

Barclays Bank PLC

|

|

|

|

Credit Suisse Securities (Europe) Limited

|

|

|

|

HSBC Securities (USA) Inc.

|

|

|

|

ING Bank N.V., Belgian Branch

|

|

|

|

Scotiabank Europe plc

|

|

|

|

|

|

Junior Co-Manager:

|

|

UniCredit Bank AG

|

* It is expected that delivery of the notes will be made to investors on or about September 17, 2019, which will be the fifth business day following the date hereof (such settlement being referred to as “T+5”). Under Rule 15c6-1 under the Securities Exchange Act of 1934, trades in the secondary market are required to settle in two business days, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade the notes on the date of pricing or the next two business days will be required, by virtue of the fact that the notes initially settle in T+5, to specify an alternate settlement arrangement at the time of any such trade to prevent a failed settlement. Purchasers of the notes who wish to trade the notes on the date of pricing or the next two succeeding business days should consult their own advisors.

**A securities rating is not a recommendation to buy, sell or hold securities and may be revised or withdrawn at any time.

The issuer has filed a registration statement (including a prospectus) and a preliminary prospectus supplement with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement, the preliminary prospectus supplement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus and the related prospectus supplement if you request it by calling Citigroup Global Markets Limited toll-free at 1 (800) 831-9146 or Deutsche Bank AG, London Branch toll-free at 1 (800) 503-4611.

MANUFACTURER TARGET MARKET (MIFID II PRODUCT GOVERNANCE) IS ELIGIBLE COUNTERPARTIES AND PROFESSIONAL CLIENTS ONLY (ALL DISTRIBUTION CHANNELS). NO PRIIPS KEY INFORMATION DOCUMENT (KID) HAS BEEN PREPARED AS NOT AVAILABLE TO RETAIL IN EEA.

ANY DISCLAIMER OR OTHER NOTICE THAT MAY APPEAR BELOW IS NOT APPLICABLE TO THIS COMMUNICATION AND SHOULD BE DISREGARDED. SUCH DISCLAIMER OR NOTICE WAS AUTOMATICALLY GENERATED AS A RESULT OF THIS COMMUNICATION BEING SENT BY BLOOMBERG OR ANOTHER EMAIL SYSTEM.

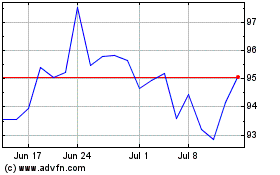

LyondellBasell Industrie... (NYSE:LYB)

Historical Stock Chart

From Mar 2024 to Apr 2024

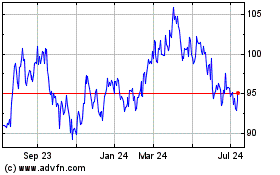

LyondellBasell Industrie... (NYSE:LYB)

Historical Stock Chart

From Apr 2023 to Apr 2024