Alimera Sciences Board of Directors Approves Reverse Stock Split and 10b5-1 Stock Purchase Plan for U.S. Executive Managemen...

September 05 2019 - 8:00AM

Alimera Sciences, Inc. (Nasdaq: ALIM) (“Alimera”), a leader in the

commercialization and development of prescription ophthalmology

treatments for the management of retinal diseases, today announced

that its board of directors has approved a proposal to effect a

reverse stock split of its common stock. The reverse stock split is

expected to result in a higher per share price and a corresponding

lower number of total shares issued and outstanding, which should

enable Alimera to attain the minimum $1.00 per share bid price

requirement for its common stock as required for continued listing

on the Nasdaq Global Market.

Alimera believes that a reverse stock split can help increase

the marketability of its stock to a broader range of potential

investors. The proposal is subject to stockholder approval of an

amendment to Alimera’s restated certificate of incorporation that

would effect the reverse stock split. Alimera expects to hold a

special meeting of stockholders to obtain stockholder approval.

Additionally, Alimera’s board of directors and its compensation

committee have approved 10b5-1 stock purchase plans for Alimera’s

U.S. executive management team. SEC Rule 10b5-1 provides a

mechanism for companies and corporate insiders to purchase or sell

a pre-determined number of shares over a specified period of time.

Under the recently approved 10b5-1 plans, Rick Eiswirth, President

and Chief Executive Officer, Dave Holland, Chief Marketing Officer,

Phil Jones, Chief Financial Officer, and Samer Kaba, Chief Medical

Officer, have agreed to purchase shares of common stock from

Alimera in amounts ranging from 5% to 7% of each bimonthly base

salary paycheck, beginning on September 15, 2019 and ending on the

last payroll date in 2019. Alimera will issue the shares under its

2019 Omnibus Incentive Plan.

Alimera plans to file a preliminary proxy statement with the SEC

later this month regarding the special meeting. The preliminary

proxy statement will include the time, date, location and other

important information regarding the special meeting and the reverse

stock split proposal. As Alimera has previously disclosed, Nasdaq

has informed Alimera that it has until December 2, 2019 to regain

compliance with the minimum per share market price requirements.

Before that deadline, Alimera intends to hold the special

stockholders meeting, obtain the necessary stockholder approvals,

and effect the reverse stock split.

Although Alimera intends to effect the reverse stock split as

soon as practicable, there can be no assurances that the reverse

stock split will be completed, will result in an increased per

share price or will achieve its other intended effects. Alimera

reserves the right, in its discretion, to abandon the reverse stock

split at any time before it files the applicable amendment to its

certificate of incorporation with the Delaware Secretary of

State.

About Alimera Sciences, Inc.

Alimera, founded in June 2003, is a pharmaceutical company that

specializes in the commercialization and development of

prescription ophthalmic pharmaceuticals. Alimera is presently

focused on diseases affecting the back of the eye, or retina,

because these diseases are not well treated with current therapies

and affect millions of people in our aging populations. For

more information, please visit www.alimerasciences.com.

IMPORTANT ADDITIONAL INFORMATION AND WHERE TO FIND

IT

This communication may be deemed to be solicitation

material in connection with the proposal to be submitted to

Alimera’s stockholders at a special meeting seeking stockholder

adoption of an amendment to Alimera’s certificate of incorporation

to effect a reverse stock split of its common stock (the “Reverse

Split Proposal”). In connection with the Reverse Split Proposal,

Alimera intends to file a preliminary proxy statement on Schedule

14A with the SEC. Any definitive proxy statement will also be made

available to Alimera stockholders before the special meeting.

Before making any voting decision, Alimera stockholders are urged

to carefully read the entire proxy statement when it becomes

available, and any other relevant documents filed with the SEC, as

well as any amendments or supplements to these documents, because

they will contain important information about the Reverse Split

Proposal. The documents that Alimera files with the SEC may be

obtained free of charge at the SEC’s website at www.sec.gov. In

addition, the documents that Alimera files with the SEC may be

obtained free of charge from Alimera at www.alimerasciences.com.

Alternatively, these documents, when available, can be obtained

free of charge from Alimera upon written request to Alimera

Sciences, Inc., 6120 Windward Parkway, Suite 290, Alpharetta,

Georgia 30005, Attention: Secretary, or by calling (678)

990-5740.

Alimera and certain of its directors and executive

officers may be deemed to be participants in the solicitation of

proxies from Alimera stockholders in favor of the approval of

Reverse Split Proposal. Information regarding Alimera’s directors

and executive officers is contained in Alimera’s Annual Report on

Form 10-K for the year ended December 31, 2018, its Current Reports

on Form 8-K dated April 30, 2019, May 8, 2019 and July 19, 2019,

and its Proxy Statement on Schedule 14A, dated April 29, 2019,

all of which are filed with the SEC. Additional information

regarding the interests of those participants and other persons who

may be deemed participants in the transaction may be obtained by

reading the proxy statement and other relevant documents filed with

the SEC when they become available. Free copies of these documents

may be obtained as described in the preceding

paragraph.

Forward Looking Statements

This press release contains “forward-looking statements,” within

the meaning of the Private Securities Litigation Reform Act of

1995, regarding, among other things, Alimera’s intentions to

implement a reverse stock split, the timing of the reverse split

and its effects if implemented. Such forward-looking statements are

based on current expectations and involve inherent risks and

uncertainties, including factors that could delay, divert or change

either of them, and could cause actual results to differ materially

from those projected in the forward-looking statements. Meaningful

factors that could cause actual results to differ include, but are

not limited to, (a) a failure to receive stockholder approval of

the reverse stock split proposal at the special meeting of

stockholders, and (b) other factors discussed in the “Risk Factors”

and “Management’s Discussion and Analysis of Financial Condition

and Results of Operations” sections of Alimera’s Annual Report on

Form 10-K for the year ended December 31, 2018 and Alimera’s

Quarterly Reports on Form 10-Q for the first and second quarters of

2019, which are on file with the SEC and available on the SEC’s

website at http://www.sec.gov.

The forward-looking statements in this press release speak only

as of the date of this press release (unless another date is

indicated). Alimera undertakes no obligation, and specifically

declines any obligation, to publicly update or revise any such

forward-looking statements, whether as a result of new information,

future events or otherwise.

|

For investor inquiries: |

For media inquiries: |

|

Scott Gordon

for Alimera

Sciences

scottg@coreir.com |

Jules Abrahamfor Alimera Sciencesjulesa@coreir.com |

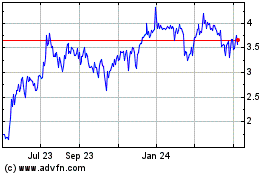

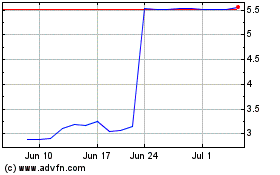

Alimera Sciences (NASDAQ:ALIM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alimera Sciences (NASDAQ:ALIM)

Historical Stock Chart

From Apr 2023 to Apr 2024