Current Report Filing (8-k)

September 04 2019 - 12:41PM

Edgar (US Regulatory)

SCHLUMBERGER LIMITED/NV P8 TX false 0000087347 0000087347 2019-09-04 2019-09-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 4, 2019

SCHLUMBERGER N.V. (SCHLUMBERGER LIMITED)

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Curaçao

|

|

1-4601

|

|

52-0684746

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

42, rue Saint-Dominique, Paris, France 75007

5599 San Felipe, Houston, Texas U.S.A. 77056

62 Buckingham Gate, London, United Kingdom SW1E 6AJ

Parkstraat 83, The Hague, The Netherlands 2514 JG

(Addresses of principal executive offices and zip or postal codes)

Registrant’s telephone number in the United States, including area code: (713) 513-2000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

common stock, par value $0.01 per share

|

|

SLB

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.06

|

Material Impairments.

|

As a result of the effects of current market valuations as well as various strategic decisions, Schlumberger Limited (“Schlumberger”) expects that it will, during the third quarter of 2019, record material non-cash impairment charges relating to goodwill, intangible assets and fixed assets. At the time of the filing of this Current Report on Form 8-K, Schlumberger is unable, in good faith, to make a determination of the amount or range of amounts of such impairment charges.

|

Item 7.01

|

Regulation FD Disclosure.

|

On September 4, 2019, Olivier Le Peuch, Chief Executive Officer of Schlumberger, presented at the Barclays CEO Energy-Power Conference in New York, New York, and provided, among other things, a financial and operational update. The presentation and slides are available on the Schlumberger Investor Relations website at http://www.slb.com/news/presentations.aspx and http://investorcenter.slb.com/phoenix.zhtml?c=97513&p=irol-presentations.

Cautionary Statement Regarding Forward-Looking Statements

This Form 8-K and the presentation referred to above contains “forward-looking statements” within the meaning of the federal securities laws — that is, statements about the future, not about past events. Such statements often contain words such as “expect,” “may,” “believe,” “plan,” “estimate,” “intend,” “anticipate,” “should,” “could,” “will,” “see,” “likely,” and other similar words. Forward-looking statements address matters that are, to varying degrees, uncertain, such as statements about our financial and performance targets and other forecasts or expectations regarding, or dependent on, our business outlook; our expectations regarding the estimated amount of any impairment charge; our expectations regarding the amount of cash expenditures estimated to be incurred as a result of any impairment charge; the growth for Schlumberger as a whole and for each of our product lines (and for specified products or geographic areas within each product line); oil and natural gas demand and production growth; oil and natural gas prices; pricing; access to raw materials; improvements in operating procedures and technology; capital expenditures by Schlumberger, as well as by the oil and gas industry; the business strategies of Schlumberger’s customers; Schlumberger’s acquisitions, joint ventures and alliances, as well as divestitures; future global economic conditions; and future results of operations. These statements are subject to risks and uncertainties, including, but not limited to, global economic conditions; changes in exploration and production spending by Schlumberger’s customers and changes in the level of oil and natural gas exploration and development; our inability to sufficiently monetize assets; general economic, political and business conditions in key regions of the world; foreign currency risk; pricing pressure; weather and seasonal factors; availability and cost of raw materials; our inability to meet our financial and performance targets and other forecasts or expectations; operational modifications, delays or cancellations; production declines; changes in government regulations and regulatory requirements,

including those related to offshore oil and gas exploration, radioactive sources, explosives, chemicals, hydraulic fracturing services and climate-related initiatives; the inability of technology to meet new challenges in exploration; and other risks and uncertainties detailed in our most recent Forms 10-K, 10-Q, and 8-K filed with or furnished to the SEC. If one or more of these or other risks or uncertainties materialize (or the consequences of such a development changes), or should underlying assumptions prove incorrect, actual outcomes may vary materially from those reflected in our forward-looking statements. The forward-looking statements speak only as of the date of the presentation referred to above, and Schlumberger disclaims any intention or obligation to update publicly or revise such statements, whether as a result of new information, future events or otherwise.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

SCHLUMBERGER LIMITED

|

|

|

|

/s/ Howard Guild

|

|

Howard Guild

|

|

Chief Accounting Officer

|

|

|

|

Date: September 4, 2019

|

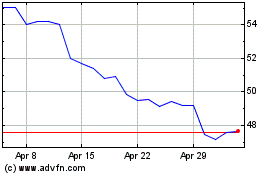

Schlumberger (NYSE:SLB)

Historical Stock Chart

From Mar 2024 to Apr 2024

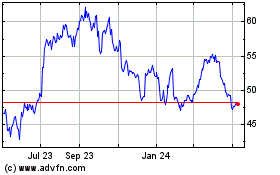

Schlumberger (NYSE:SLB)

Historical Stock Chart

From Apr 2023 to Apr 2024