|

OFFERING

CIRCULAR NO. 1 DATED AUGUST 30, 2019

(to

the offering circular dated August 29, 2019)

|

|

Filed

Pursuant to Rule 253(g)(2)

|

|

|

The

Marquie Group, Inc.

(f/k/a Music of Your Life, Inc.)

|

|

(Exact

name of issuer as specified in its charter)

|

|

|

|

Florida

|

|

(State

or other jurisdiction of incorporation or organization)

|

|

|

|

https://www.themarquiegroup.com/

3225

McLeod Drive, Suite 100,

Las

Vegas, Nevada

800-351-3021

|

|

(Address,

including zip code, and telephone number, including area code of issuer’s principal executive office)

|

|

4461

Health and Personal Care

|

|

26-2091212

|

(Primary

Standard Industrial

Classification Code Number)

|

|

(I.R.S.

Employer

Identification Number)

|

EXPLANATORY

NOTE

This

document (the "Supplement") supplements the amended offering circular of The Marquie Group, Inc. (the "Company,"

"we," "us," or "our") dated August 16, 2019 and originally qualified August 29, 2019 ("Offering

Circular"). Unless otherwise defined in this Supplement, capitalized terms used herein shall have the same meanings as set

forth in the Offering Circular, including the disclosures incorporated by reference therein.

The

purpose of this Supplement is to disclose that we have determined to set the offering price at $0.0075 per share. We have amended

to the offering circular to describe this offering price throughout.

Maximum

offering up to 1,333,333,333 shares

This

is a public offering of shares of common stock of The Marquie Group, Inc.

The

total offering shall be for $10,000,000 with an offering price of $0.0075 per share, equaling maximum of 1,333,333,333 total shares.

The Company’s shareholders have approved a reverse stock split of the common stock at a ratio of 1:400. The end date of

the offering will be August 28, 2020. Investors may subscribe to the offering immediately, however, shares will not be delivered

to a subscriber until the reverse stock split has been deemed effective by FINRA.

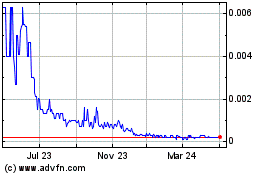

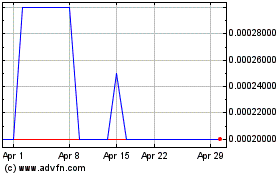

Our

common stock currently trades on the OTC Pink market under the symbol “TMGI” and the closing price of our common stock

on August 29, 2019 was $0.0001. Post reverse stock split, we anticipate that our stock will trade around $0.04 per

share. Our common stock currently trades on a sporadic and limited basis.

We

are offering our shares without the use of an exclusive placement agent. However, the Company reserves the right to retain one.

upon the approval of any subscription to this Offering Circular, the Company shall immediately deposit said proceeds into the

bank account of the Company and may dispose of the proceeds in accordance with the Use of Proceeds.

We

expect to commence the sale of the shares as of the date on which the Offering Statement of which this Offering Circular is qualified

by the Commission.

See

“Risk Factors” to read about factors you should consider before buying shares of common stock.

Generally,

no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual

income or net worth. Different rules apply to accredited investors and non-natural persons. Before making

any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C)

of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

The

United States Securities and Exchange Commission does not pass upon the merits of or give its approval to any securities offered

or the terms of the offering, nor does it pass upon the accuracy or completeness of any offering circular or other solicitation

materials. These securities are offered pursuant to an exemption from registration with the Commission; however, the Commission

has not made an independent determination that the securities offered are exempt from registration.

This

Offering Circular is following the offering circular format described in Part II (a)(1)(ii) of Form 1-A.

Offering

Circular Dated August 30, 2019

TABLE OF CONTENTS

No dealer, salesperson or other person

is authorized to give any information or to represent anything not contained in this Offering Circular. You must not rely on any

unauthorized information or representations. This Offering Circular is an offer to sell only the shares offered hereby, but only

under circumstances and in jurisdictions where it is lawful to do so. The information contained in this Offering Circular is current

only as of its date.

SUMMARY

This summary highlights

information contained elsewhere in this Offering Circular. This summary does not contain all of the information that you should

consider before deciding to invest in our common stock. You should read this entire Offering Circular carefully, including the

“Risk Factors” section, our historical consolidated financial statements and the notes thereto, and unaudited pro forma

financial information, each included elsewhere in this Offering Circular. Unless the context requires otherwise,

references in this Offering Circular to “the Company,” “we,” “us” and “our” refer

to The Marquie Group, Inc.

OUR COMPANY

The Marquie Group, Inc. (“TMGI”

or “The Company”) (TMGI: OTC) was incorporated on January 30, 2008, in the State of Florida, as Maximum

Consulting, Inc., changing its name to ZhongSen International Tea Company in April 2008, with the principal business objective

of providing sales and marketing consulting services to small to medium sized Chinese tea producing companies who wish to export

and distribute high quality Chinese tea products worldwide. The Company commenced business activities in August 2008, when it

entered into a related party Sales and Marketing Agreement with Yunnan Zhongsen Group, Ltd. However, due to lack of capital, the

Company was unable to implement its business plan fully. On May 31, 2013, the Company entered into an acquisition agreement (the

“Acquisition”) of Music of Your Life, Inc., a Nevada corporation (“MYL Nevada”). As a result of the Acquisition,

MYL Nevada is a wholly-owned subsidiary of the Company, and the Company is now operating a multi-media entertainment company,

producing television shows and radio programming. The Company changed its name to Music of Your Life, Inc. effective July 26,

2013.

On August 16, 2018 (see

Note 7), the Company merged with The Marquie Group, Inc. (“TMG”) in exchange for the issuance of a total of 40,000,002

shares of our common stock to TMG’s stockholders. Following the merger, the Company had 40,912,865 shares of common stock

issued and outstanding. On December 5, 2018, the Company amended and restated its Articles of Incorporation providing for a change

in the Company’s name from “Music of Your Life, Inc.” to “The Marquie Group, Inc.” On February 22,

2018 our FINRA symbol changed from “MYLI” to “TMGI.”

On July 21, 2019, the

Board of Directors recommended to the shareholders of the Company a reverse stock split at a ratio of 400:1, which was approved

by the shareholders on the same date. The Company expects the Split to be deemed effective by FINRA on or around August 21, 2019.

OVERVIEW

The Company is currently

operating two businesses; a nationally syndicated radio network called “Music of Your Life”, broadcasting on AM, FM,

and HD terrestrial radio stations across the United Sates, and heard around the world over the Internet; and a direct-to-consumer,

health and beauty product line called “Whim”, that use innovative formulations of plant-based, amino-acids and other

natural alternatives to chemical ingredients, with and without non-THC CBD oil. The Company plans to market the new Whim products

on the Music of Your Life network upon launch.

OUR STRATEGY

Our branded, solution-driven slate

of multiple SKU’s includes facial masks, facial serums, eye serums, CBD tinctures, and beauty drinks, each with unique,

skin and complexion enhancing properties. Marketing plan includes a multi-channel, national sales program developed by the Company’s

team of health and beauty product marketing specialists that will target consumers through proven and tested inspirational branding

and sensorial experience. The new Whim™ products will be introduced initially on the Company’s nationally syndicated

radio network, Music of Your Life, the Company’s streaming video channels, and Jacquie Carter’s social media reach

which covers more than 90-countries, on the Company recently released website, www.simplywhim.com.

THE OFFERING

|

Common

Stock we are offering(1)

|

|

Up

to 1,333,333,333 shares of Common Stock at a price of $0.0075 per share.

|

|

|

|

|

|

Common Stock

outstanding before this Offering (2)

|

|

873,349 Common

Stock, par value $0.01

|

|

|

|

|

|

Use of proceeds

|

|

The funds raised

per this offering will be utilized in administrative and legal fees, product inventory, marketing, and staffing in the United

States. See “Use of Proceeds” for more details.

|

|

|

|

|

|

Risk Factors

|

|

See “Risk

Factors” and other information appearing elsewhere in this Offering Circular for a discussion of factors you should

carefully consider before deciding whether to invest in our common stock.

|

|

(1)

|

The maximum offering is based upon the lower offering price in our range post a 1:400 reverse stock split.

|

|

|

|

|

(2)

|

As of July 16, 2019 we have 349,339,793 shares of common stock issued and outstanding. We estimate that upon qualification and post a reverse stock split of 1:400 we will have approximately 873,000. As we will round up to the nearest whole share, our calculation is not completely accurate until the reverse stock split is effective. Upon qualification of this Offering, we will immediately file a supplemental filing providing an accurate calculation of the total issued and outstanding shares of common stock at that time.

|

|

|

|

|

(3)

|

Calculated post reverse stock split at 400:1

|

This offering is being

made on a self-underwritten basis without the use of an exclusive placement agent, although the Company may choose to engage a

placement agent at its sole discretion. As there is no minimum offering, upon the approval of any subscription to this Offering

Circular, the Company shall immediately deposit said proceeds into the bank account of the Company and may dispose of the proceeds

in accordance with the Use of Proceeds.

Management will make its

best effort to fill the subscription. In the event that the Offering Circular is fully subscribed, any additional subscriptions

shall be rejected and returned to the subscribing party along with any funds received.

In order to subscribe to

purchase the shares, a prospective investor must complete a subscription agreement and send payment by check, wire transfer

or ACH. Investors must answer certain questions to determine compliance with the investment limitation set forth in

Regulation A Rule 251(d)(2)(i)(C) under the Securities Act of 1933, which states that in offerings such as this one, where the

securities will not be listed on a registered national securities exchange upon qualification, the aggregate purchase price to

be paid by the investor for the securities cannot exceed 10% of the greater of the investor’s annual income or net worth. In

the case of an investor who is not a natural person, revenues or net assets for the investors’ most recently completed fiscal

year are used instead.

The Company has not currently

engaged any party for the public relations or promotion of this offering.

As of the date of this

filing, there are no additional offers for shares, nor any options, warrants, or other rights for the issuance of additional shares

except those described herein.

RISK FACTORS

Investing in our common stock involves

a high degree of risk. You should carefully consider each of the following risks, together with all other information set

forth in this Offering Circular, including the consolidated financial statements and the related notes, before making a decision

to buy our common stock. If any of the following risks actually occurs, our business could be harmed. In that case, the trading

price of our common stock could decline, and you may lose all or part of your investment.

This offering contains forward-looking

statements. Forward-looking statements relate to future events or our future financial performance. We generally identify forward-looking

statements by terminology such as “may,” “will,” “should,” “expects,” “plans,”

“anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,”

“believes,” “estimates,” “predicts,” “potential” or “continue” or the

negative of these terms or other similar words. These statements are only predictions. The outcome of the events described in these

forward-looking statements is subject to known and unknown risks, uncertainties and other factors that may cause our customers’

or our industry’s actual results, levels of activity, performance or achievements expressed or implied by these forward-looking

statements, to differ. “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and

Results of Operations” and “Business,” as well as other sections in this prospectus, discuss the important factors

that could contribute to these differences.

The forward-looking statements made in

this prospectus relate only to events as of the date on which the statements are made. We undertake no obligation to update any

forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence

of unanticipated events.

This prospectus also contains market data

related to our business and industry. This market data includes projections that are based on a number of assumptions. If these

assumptions turn out to be incorrect, actual results may differ from the projections based on these assumptions. As a result, our

markets may not grow at the rates projected by these data, or at all. The failure of these markets to grow at these projected rates

may have a material adverse effect on our business, results of operations, financial condition and the market price of our common

stock.

Risk Related to our Company and our Business

We may require additional

funds in the future to achieve our current business strategy and our inability to obtain funding may cause our business plan to

fail.

We may need to raise additional

funds through public or private debt or equity sales in order to fund our future operations and fulfill contractual obligations

in the future. These financings may not be available when needed. Even if these financings are available, it may be on terms that

we deem unacceptable or are materially adverse to your interests with respect to dilution of book value, dividend preferences,

liquidation preferences, or other terms. Our inability to obtain financing would have an adverse effect on our ability to implement

our current business plan and develop our products, and as a result, could require us to diminish or suspend our operations and

possibly cease our existence.

Even if we are successful in

raising capital in the future, we will likely need to raise additional capital to continue and/or expand our operations. If we

do not raise the additional capital, the value of any investment in our Company may become worthless. In the event we do not raise

additional capital from conventional sources, it is likely that we may need to scale back or curtail implementing our business

plan.

Our management has a limited

experience operating a public company in the CBD and healthy lifestyle industry and is subject to the risks commonly encountered

by early-stage companies.

Although the management of The Marquie

Group, Inc. has experience in operating public companies, current management has not had to manage expansion while being a public

company in in the beauty products and healthy lifestyle industry. Because we have a limited operating history for our current business

model, our operating prospects should be considered in light of the risks and uncertainties frequently encountered by early-stage

companies in rapidly evolving markets. These risks include:

|

|

●

|

risks that we may not have sufficient capital to achieve our growth strategy;

|

|

|

●

|

risks that we may not develop our product and service offerings in a manner that enables us to be profitable and meet our customers’ requirements;

|

|

|

●

|

risks that our growth strategy may not be successful; and

|

|

|

●

|

risks that fluctuations in our operating results will be significant relative to our revenues.

|

These risks are described in more detail

below. Our future growth will depend substantially on our ability to address these and the other risks described in this section.

If we do not successfully address these risks, our business would be significantly harmed.

We may not be successful in the implementation

of our business strategy or our business strategy may not be successful, either of which will impede our development and growth

.

Our business consists of a direct-to-consumer

platform for health and beauty products containing plant-based ingredients, amino-acids, and other natural ingredients, with and

without non-THC CBD oil. Our ability to implement this business strategy is dependent on our ability to:

|

|

●

|

Distinguish ourselves in a very competitive market;

|

|

|

●

|

Establish brand recognition and customer loyalty; and

|

|

|

●

|

Manage growth in administrative overhead costs during the initiation of our business efforts.

|

We do not know whether we will be able

to continue successfully implementing our business strategy or whether our business strategy will ultimately be successful. In

assessing our ability to meet these challenges, a potential investor should take into account our need for significant amounts

of capital to fund marketing and product development within our subsidiaries and brand recognition, our management’s relative

inexperience, the competitive conditions existing in our industry and general economic conditions. Our growth is largely dependent

on our ability to successfully implement our business strategy. Our revenues may be adversely affected if we fail to implement

our business strategy or if we divert resources to a business that ultimately proves unsuccessful.

We must effectively manage the growth

of our operations, or our company will suffer .

Our business consists of a direct-to-consumer

platform for health and beauty products containing plant-based ingredients, amino-acids, and other natural ingredients, with and

without non-THC CBD oil. Expansion of our operations, to include the development of all our portfolio, may also cause a significant

demand on our management, finances and other resources. Our ability to manage the anticipated future growth, should it occur, will

depend upon a significant expansion of our accounting and other internal management systems and the implementation and subsequent

improvement of a variety of systems, procedures and controls. There can be no assurance that significant problems in these areas

will not occur. Any failure to expand these areas and implement and improve, procedures and controls in an efficient manner at

a pace consistent with our business could have a material adverse effect on our business, financial condition and results of operations.

There can be no assurance that our attempts to expand our marketing, sales, manufacturing and customer support efforts will be

successful or will result in additional sales or profitability in any future period.

We have limited existing brand identity

and customer loyalty; if we fail to market our brand to promote our service offerings, our business could suffer.

Because of our limited commercialization

of our subsidiary products, we currently do not have strong brand identity or brand loyalty. We believe that establishing and maintaining

brand identity and brand loyalty is critical to attracting customers once we have a commercially viable product offered by our

subsidiaries. In order to attract customers to our subsidiary products, we may be forced to spend substantial funds to create and

maintain brand recognition among consumers. We believe that the cost of our sales campaigns could increase substantially in the

future. If our branding efforts are not successful, our ability to earn revenues and sustain our operations will be harmed.

Promotion and enhancement of our products

and services will depend on our success in consistently providing high-quality products and services to our customers.

The Angell Family Trust, beneficially

owns approximately or has the right to vote on 0.02% of our outstanding Common Stock and 100% of our Series A Preferred Stock,

which counts for 80.00% of the total voting rights of the Common Stock before the offering and would retain 80.00% of the total

rights of following the sale of the maximum offering of 1,333,333,333 Common shares. As a result, it has and may retain a substantial

voting power in all matters submitted to our stockholders for approval including:

|

|

●

|

Election of our board of directors;

|

|

|

●

|

Removal of any of our directors;

|

|

|

●

|

Amendment of our Certificate of Incorporation or bylaws;

|

|

|

●

|

Adoption of measures that could delay or prevent a change in control or impede a merger, takeover or other business combination involving us.

|

As a result of its ownership and position,

the Angell Family Trust is able to substantially influence all matters requiring stockholder approval, including the election of

directors and approval of significant corporate transactions. In addition, the future prospect of sales of significant amounts

of shares held by it could affect the market price of our common stock if the marketplace does not orderly adjust to the increase

in shares in the market and the value of your investment in our company may decrease. The Angell Family Trust’s stock ownership

may discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of us, which in turn could

reduce our stock price or prevent our stockholders from realizing a premium over our stock price.

We have a history of operating losses

and we will need additional financing to meet our future long-term capital requirements.

We have a history of losses and may continue

to incur operating and net losses for the foreseeable future. As of February 28, 2019, we had negative working capital of $2,497,534

and an accumulated deficit of $5,088,599. We generated a net loss for the nine months ended February 28, 2019 of $3,734,415. We

have not achieved sustainable profitability on an annual basis. We may not be able to reach a level of revenue to achieve profitability.

If our revenues grow slower than anticipated, or if operating expenses exceed expectations, then we may not be able to achieve

profitability in the near future or at all, which may depress our stock price.

We may need significant additional

capital, which we may be unable to obtain .

We may need to obtain additional financing

over time to fund operations. Our management cannot predict the extent to which we will require additional financing and can provide

no assurance that additional financing will be available on favorable terms or at all. The rights of the holders of any debt or

equity that may be issued in the future could be senior to the rights of common shareholders, and any future issuance of equity

could result in the dilution of our common shareholders’ proportionate equity interests in our company. Failure to obtain

financing or an inability to obtain financing on unattractive terms could have a material adverse effect on our business, prospects,

results of operation and financial condition.

Our resources may not be sufficient

to manage our potential growth; failure to properly manage our potential growth would be detrimental to our business.

We may fail to adequately manage our potential

future growth. Any growth in our operations will place a significant strain on our administrative, financial and operational resources,

and increase demands on our management and on our operational and administrative systems, controls and other resources. We cannot

assure you that our existing personnel, systems, procedures or controls will be adequate to support our operations in the future

or that we will be able to successfully implement appropriate measures consistent with our growth strategy. As part of this growth,

we may have to implement new operational and financial systems, procedures and controls to expand, train and manage our employee

base, and maintain close coordination among our technical, accounting, finance, marketing and sales staff. We cannot guarantee

that we will be able to do so, or that if we are able to do so, we will be able to effectively integrate them into our existing

staff and systems. To the extent we acquire businesses, we will also need to integrate and assimilate new operations, technologies

and personnel. If we are unable to manage growth effectively, such as if our sales and marketing efforts exceed our capacity to

install, maintain and service our products or if new employees are unable to achieve performance levels, our business, operating

results and financial condition could be materially and adversely affected.

Our financial situation creates doubt

whether we will continue as a going concern .

Since inception, the Company has generated

minimal revenues and has incurred losses and reported losses for the period from inception through March 31, 2019. Further, we

expect to incur a net loss for the fiscal year ending May 31, 2019, primarily as a result of increased operating expenses. There

can be no assurances that we will be able to achieve a level of revenues adequate to generate sufficient cash flow from operations

or obtain additional financing through private placements, public offerings and/or bank financing necessary to support our working

capital requirements. To the extent that funds generated from any private placements, public offerings and/or bank financing are

insufficient, we will have to raise additional working capital. No assurance can be given that additional financing will be available,

or if available, will be on acceptable terms. These conditions raise substantial doubt about our ability to continue as a going

concern. If adequate working capital is not available, we may be forced to discontinue operations, which would cause investors

to lose their entire investment. Our auditors have indicated that these conditions raise substantial doubt about the Company’s

ability to continue as a going concern

We will need to increase the size

of our organization, and we may be unable to manage rapid growth effectively.

Our failure to manage growth effectively

could have a material and adverse effect on our business, results of operations and financial condition. We anticipate that a period

of significant expansion will be required to address possible acquisitions of business, products, or rights, and potential internal

growth to handle licensing and research activities. This expansion will place a significant strain on management, operational and

financial resources. To manage the expected growth of our operations and personnel, we must both improve our existing operational

and financial systems, procedures and controls and implement new systems, procedures and controls. We must also expand our finance,

administrative, and operations staff. Our current personnel, systems, procedures and controls may not adequately support future

operations. Management may be unable to hire, train, retain, motivate and manage necessary personnel or to identify, manage and

exploit existing and potential strategic relationships and market opportunities.

We are dependent on the continued

services and performance of our senior management, the loss of any of whom could adversely affect our business, operating results

and financial condition.

Our future performance depends on the continued

services and continuing contributions of our senior management to execute our business plan, and to identify and pursue new opportunities

and product innovations. The loss of services of senior management, could significantly delay or prevent the achievement of our

strategic objectives. The loss of the services of senior management for any reason could adversely affect our business, prospects,

financial condition and results of operations.

We may become subject to claims of

infringement or misappropriation of the intellectual property rights of others, which could prohibit us from developing our products,

require us to obtain licenses from third parties or to develop non-infringing alternatives and subject us to substantial monetary

damages.

Third parties could, in the future, assert

infringement or misappropriation claims against us with respect to products we develop. Whether a product infringes a patent or

misappropriates other intellectual property involves complex legal and factual issues, the determination of which is often uncertain.

Therefore, we cannot be certain that we have not infringed the intellectual property rights of others. Our potential competitors

may assert that some aspect of our product infringes their patents. Because patent applications may take years to issue, there

also may be applications now pending of which we are unaware that may later result in issued patents upon which our products could

infringe. There also may be existing patents or pending patent applications of which we are unaware upon which our products may

inadvertently infringe.

Any infringement or misappropriation claim

could cause us to incur significant costs, place significant strain on our financial resources, divert management’s attention

from our business and harm our reputation. If the relevant patents in such claim were upheld as valid and enforceable and we were

found to infringe them, we could be prohibited from selling any product that is found to infringe unless we could obtain licenses

to use the technology covered by the patent or are able to design around the patent. We may be unable to obtain such a license

on terms acceptable to us, if at all, and we may not be able to redesign our products to avoid infringement. A court could also

order us to pay compensatory damages for such infringement, plus prejudgment interest and could, in addition, treble the compensatory

damages and award attorney fees. These damages could be substantial and could harm our reputation, business, financial condition

and operating results. A court also could enter orders that temporarily, preliminarily or permanently enjoin us and our customers

from making, using, or selling products, and could enter an order mandating that we undertake certain remedial activities. Depending

on the nature of the relief ordered by the court, we could become liable for additional damages to third parties.

A competitor with a stronger or more

suitable financial position may enter our marketplace .

The success of our business primarily depends

on the success our products and their market performance, compared to rival technologies offered by a competitor. If a direct competitor

arrives in our market, achieving market acceptance for our services may require additional marketing efforts and the expenditure

of significant funds, the availability of which we cannot be assured, to create awareness and demand among customers. We have limited

financial, personnel and other resources to undertake additional marketing activities. Accordingly, no assurance can be given that

we will be able to win business from a stronger competitor.

Litigation may harm our business.

Substantial, complex or extended litigation

could cause us to incur significant costs and distract our management. For example, lawsuits by employees, stockholders, collaborators,

distributors, customers, competitors or others could be very costly and substantially disrupt our business. Disputes from time

to time with such companies, organizations or individuals are not uncommon, and we cannot assure you that we will always be able

to resolve such disputes or on terms favorable to us. Unexpected results could cause us to have financial exposure in these matters

in excess of recorded reserves and insurance coverage, requiring us to provide additional reserves to address these liabilities,

therefore impacting profits.

Risks Related to Our Business and

Industry

U.S. Federal and foreign regulation

and enforcement may adversely impact the CBD supply chain which may negatively impact our revenues, or we may be found to be violating

the Controlled Substances Act or other U.S. federal, state, or foreign laws, which could substantially impact our ability to access

financial and banking services.

The Company will utilize only non-THC

derived cannabidiol (CBD) ingredients in its internal, and topical formulas. CBD can be extracted from THC containing and non-THC

containing strains of Cannabis. While our intention is to only procure CBD from reputable, non-cannabis-based sources,

this is an emerging industry and regulation and enforcement actions are ongoing. If we are found to be sourcing our CBD from THC-based

sources or vendors, it may substantially impact our standing under the law, which could in turn lead to an inability to access

to retain financial and/or banking services.

In December 2018, the Farm Bill was signed

into law. Under section 10113 of the Farm Bill, state departments of agriculture must consult with the state’s governor and

chief law enforcement officer to devise a plan that must be submitted to the Secretary of USDA. A state’s plan to license

and regulate hemp can only commence once the Secretary of USDA approves that state’s plan. In states opting not to devise

a hemp regulatory program, USDA will construct a regulatory program under which hemp cultivators in those states must apply for

licenses and comply with a federally run program. This system of shared regulatory programming is similar to options states had

in other policy areas such as health insurance marketplaces under ACA, or workplace safety plans under OSHA—both of which

had federally-run systems for states opting not to set up their own systems. Non-cannabis hemp be a highly regulated crop in the

United States for both personal and industrial production.

The law outlines actions that are considered

violations of federal hemp law (including such activities as cultivating without a license or producing cannabis with more than

0.3 percent THC). The law details possible punishments for such violations, pathways for violators to become compliant, and even

which activities qualify as felonies under the law, such as repeated offenses.

The Marquie Group will utilize only non-THC

ingredients in those formulas which contain CBD.

Section 12619 of the Farm Bill removes

hemp-derived products from its Schedule I status under the Controlled Substances Act, but the legislation does not legalize CBD

generally. CBD, with some minor exceptions, remains a Schedule I substance under federal law. The Farm Bill ensures that any cannabinoid—a

set of chemical compounds found in the cannabis plant—that is derived from hemp will be legal, if and only if that hemp is

produced in a manner consistent with the Farm Bill, associated federal regulations, association state regulations, and by a licensed

grower. Though many states have adopted their own policies legalizing the sale and manufacture of products containing CBD oil,

all other cannabinoids, produced in any other setting, remain a Schedule I substance under federal law and are thus illegal.

In October 2018, the United States Drug

Enforcement Agency (“DEA”) rescheduled drugs approved by the United States Food and Drug Administration (“FDA”)

which contain CBD derived from cannabis and no more than 0.1 percent tetrahydrocannabinols from Schedule I, the highest level of

restriction with a high potential for abuse, to Schedule V, the lowest restriction with the lowest potential for abuse under the

Controlled Substances Act (“CSA”). This ruling does not apply to Cannabidiol (“CBD”) products such as oils,

tinctures, extracts, and other foods because they are not FDA approved.

In October 2018, the FDA was advised by

the DEA that removing CBD from the CSA would violate international drug treaties to which the United States is a signatory. Specifically,

the DEA explained that the United States would “not be able to keep obligations under the 1961 Single Convention on Narcotic

Drugs if CBD were decontrolled under the CSA”.

Consequently, the FDA revised its recommendation

and advised the DEA to place CBD in Schedule V—which applies to drugs with demonstrated medical value and deemed unlikely

to cause harm, abuse, or addiction—instead. Nonetheless, the FDA declared that “[i]f treaty obligations do not require

control of CBD, or the international controls on CBD…are removed at some future time, the above recommendation for Schedule

V under the CSA would need to be revisited promptly.”

On May 22, 2018, the DEA released the Internal

Directive Regarding the Presence of Cannabinoids in Products and Materials Made from the Cannabis Plant , which states “The

mere presence of cannabinoids is not itself dispositive as to whether a substance is within the scope of the CSA; the dispositive

question is whether the substance falls within the CSA definition of marijuana.”

Most CBD products are derived from Cannabis

sativa or Cannabis Indica plants. Cannabis sativa is primarily used to produce hemp. Hemp contains little or no THC. Cannabis Indica

is primarily used to produce Marijuana (“Marijuana-CBD”). Marijuana-CBD remains a Schedule I substance. Marijuana-CBD

products may be legal under state law in states like Washington, Oregon, and California but their sale is only permitted through

a state-regulated marijuana market in the respective state of legal cultivation. Marijuana-CBD products are only legal in states

where they were cultivated and these products are heavily regulated at all stages of production, from seed-to-sale. These products

come from licensed producers, are developed by licensed processors or manufacturers, and are sold to the public through licensed

retailers or dispensaries. Marijuana-CBD products may also contain significant levels of THC.

On the other hand, CBD derived from Cannabis

sativa, which produces industrial hemp (“Hemp-CBD”) can be argued as falling completely outside the CSA because the

cultivation of industrial hemp was legalized by Section 7606 of the Agricultural Act of 2014 (the “2014 Farm Bill”).

Industrial hemp is defined as the cannabis plant with less than 3% THC. The 2014 Farm Bill also requires that industrial hemp to

be cultivated under a state agricultural pilot program. Some states also require a license to cultivate or process industrial hemp

into other products like Hemp-CBD.

The distribution of Hemp-CBD products is

arguably legal under federal law because the 2014 Farm Bill does not explicitly limit distribution. In oral arguments during HIA

v. DEA, the DEA admitted that the 2018 Farm Bill preempted the CSA with regards to industrial hemp. The DEA has rarely taken any

enforcement action against distributors of Hemp-CBD, in part because Congress has limited the DEA’s ability to use federal

funds to do so and because the DEA would have to legally establish that the CSA does in fact cover Hemp-CBD. However, the

DEA, FDA, and other federal agencies issued guidance in 2016 stating that the 2014 Farm Bill did not permit the interstate

transfer or commercial sale of industrial hemp. Several states like Idaho prohibit the distribution of Hemp-CBD. Other states like

Ohio, Michigan, and California significantly restrict the distribution of Hemp-CBD.

Even though Hemp-CBD does not fall within

the CSA, Hemp-CBD products have not been approved by the FDA. This is also true of Marijuana-CBD. This means that even cannabis

derived Marijuana-CBD and Hemp-CBD products containing less than 1% THC are not approved CBD drugs for lack of FDA approval.

There is always some risk of enforcement

action against Hemp-CBD distributors, as the budgetary restriction that prevented the DEA from using funds to prosecute industrial

hemp distributors expired on September 30, 2018. It is also possible that the FDA could take a more aggressive approach to limit

the distribution of CBD products.

We may be subject to compliance actions

by the Food and Drug Administration (FDA) for making unsubstantiated claims as to our products efficacy or intended use.

Though we strive to comply with all state

and federal regulations, in the process of promoting and discussing the potential benefits of our health and beauty products, particularly

those who list CBD as an active ingredient, we may inadvertently make statements which are deemed to be unsubstantiated claims

by the FDA as to the efficacy or intended use of our products.

On April 2, 2019, outgoing FDA Commissioner

Scott Gotlieb issued a statement on the agency’s website, www.fda.gov, pledging the agency will continue to use its authority

to take action against companies and product developers which make unproven claims to treat serious or life-threatening diseases,

and “where patients may be misled to forgo otherwise effective, available therapy and opt instead for a product that has

no proven value or may cause them serious harm.”

The FDA has issued warning letters, in

collaboration with the Federal Trade Commission, to three companies – Advanced Spine and Pain LLC (d/b/a Relievus), Nutra

Pure LLC and PotNetwork Holdings Inc. – in response to their making unsubstantiated claims related to more than a dozen different

products and spanning multiple product webpages, online stores and social media websites. The FDA deemed that companies “used

these online platforms to make unfounded, egregious claims about their products’ ability to limit, treat or cure cancer,

neurodegenerative conditions, autoimmune diseases, opioid use disorder, and other serious diseases, without sufficient evidence

and the legally required FDA approval.”

Examples of claims made by the companies

which have been deemed deceptive marketing by the FDA include CBD’s ability to

|

|

●

|

Effectively treat substance use disorders

|

|

|

●

|

Reduce the rewarding effects of morphine

|

|

|

●

|

Reduce drug-seeking for heroin

|

|

|

●

|

Avoid or Reduce opiate withdrawal symptoms

|

|

|

●

|

Stop cancer cells in several cervical cancer varieties

|

|

|

●

|

Degrease human glioma cell growth and invasion

|

|

|

●

|

Slow the progression of Alzheimer’s

|

|

|

●

|

Block spinal, peripheral and gastrointestinal mechanisms responsible for pain associated with migraines, fibromyalgia, and Irritable Bowel Syndrome

|

The agency has said it may pursue a company

making medical claims about products asserting to contain CBD that haven’t been approved by the FDA. The FDA has stated that

selling unapproved products with unsubstantiated therapeutic claims can put patients and consumers at risk. The FDA does not believe

these products have not been shown to be safe or effective, and deceptive marketing of unproven treatments may keep some patients

from accessing appropriate, recognized therapies to treat serious and even fatal diseases. Additionally, because they are not evaluated

by the FDA, there may be other ingredients that are not disclosed, which may be harmful.

The FDA has pledged to continue to monitor

the marketplace and take enforcement action as needed to protect the public health against companies illegally selling CBD products

that claim to prevent, diagnose, treat, or cure serious diseases, such as cancer, Alzheimer’s disease, psychiatric disorders

and diabetes; illegally selling cannabis and cannabis-derived products that can put consumers at risk; and marketing and distributing

such products in violation of the FDA’s authorities.

Though we have no intention to make any

of the claims stated above, whether through advertising, sales, or promotional materials, there may be additional claims made in

the future about the efficacy or intended use of our health and beauty products, including those which may list CBD as an active

ingredient, which may be deemed to be unsubstantiated claims by the FDA.

Different state and federal government

agencies, as well as different advertising networks, may have their own regulations and restrictions regarding advertising CBD

products which could make effective advertising difficult.

Though only a portion of our product line

in development may contain CBD, marketing or selling those products would make us subject to the rules of various state and federal

agencies, as well as advertising networks, regarding the promotion of our products.

Relevant state and local laws may make

it difficult to advertise CBD in various markets. The two largest ad buying platforms -- Facebook and Google -- still do not allow

CBD advertising (it is designated as a “dangerous product”) on their platforms, which limits the digital marketing

efforts of CBD companies to organic marketing. For new businesses, the inability to promote their brand without paid social and

search ads makes it extremely challenging to get the qualified traffic needed to grow their online retail business. If we are found

by these platforms to be advertising CBD, it could significantly impede our ability to market our products online.

Additional regulatory considerations that

must be taken into account include the Federal Trade Commission’s regulation of unfair and deceptive product labeling and

marketing, as well as state law regulation of food safety. States have the authority to regulate matters related to the health

and safety of its own citizens, such that the 2018 Farm Bill and regulation by the USDA will not necessarily preempt state or local

laws regulating the manufacture and distribution of cannabis-related products that are not directly in conflict with federal law.

States may still choose to enact their own laws that can promote or restrict the sale of cannabis-based products. States such as

Indiana and Alabama do not permit the sale of CBD oil on a personal level without a prescription. Failure to successfully navigate

this shifting and varied legal environment could prohibit our ability to effectively market in certain states.

Any and all claims of medicinal value must

be substantiated with reputable scientific support and may be subject to evaluation by the FDA. If we are unable to scientifically

validate many of the popular claims being made regarding the efficacy of CBD, we will not be able to share those claims and could

be less competitive than competitors who are less compliant.

Failure to remain in compliance could result

in enforcement actions from the FTC, FDA, and other federal and state agencies.

There are limitations to how CBD

may be marketed and what potential benefits may be advertised which may restrict the scope of our marketing efforts.

Any and all claims of medicinal value must

be substantiated with reputable scientific support and may be subject to evaluation by the FDA and we may be unable to effectively

market our products without proper scientific documentation. If we cannot produce the requisite documentation, we may be unable

to effectively market any products which contain CBD as an active ingredient.

In April 2019, outgoing FDA Commissioner

Scott Gottlieb acknowledged that the FDA is considering whether to use its authority to issue regulations that would permit the

marketing of CBD in foods or as dietary supplements. However, until the law changes, it is the FDA’s position that selling

unapproved products with unsubstantiated therapeutic claims both violates the law and potentially puts patients at risk. Commissioner

Gottlieb also asserted that it continues to be unlawful to market foods containing added CBD or THC or dietary supplements containing

CBD or THC, regardless of whether the substances are hemp-derived and regardless of the claims being made. FDA takes this position

based on the operation of statutory “exclusionary clauses” in the Food, Drug and Cosmetic Act related to food additives

and dietary supplements. Specifically, FDA has determined that both CBD and THC, which are now active ingredients in FDA-approved

drugs, were the subject of substantial clinical investigations before they were marketed as foods or dietary supplements, and due

to the operation of the exclusionary clauses, FDA concludes that it is currently illegal to introduce CBD or THC into the food

supply or to market these ingredients as dietary supplements.

Additional regulatory considerations that

must be taken into account include the Federal Trade Commission’s regulation of unfair and deceptive product labeling and

marketing, as well as state law regulation of food safety.

We are subject to risks relating

to legal proceedings.

We are subject to various claims and legal

actions arising in the ordinary course of its business. Any such litigation could be very costly and could distract our management

from focusing on operating our business. The existence of any such litigation could harm our business, results of operations and

financial condition. Results of actual and potential litigation are inherently uncertain. An unfavorable result in a legal proceeding

could adversely affect our reputation, financial condition and operating results.

We will be subject to the U.S. Foreign

Corrupt Practices Act and other anti-corruption laws, as well as export control laws, customs laws, sanctions laws and other laws

governing our anticipated operations. If we fail to comply with these laws, we could be subject to civil or criminal penalties,

other remedial measures, and legal expenses, which could adversely affect our business, results of operations and financial condition.

Our operations, if initiated, will be subject

to certain anti-corruption laws, including the U.S. Foreign Corrupt Practices Act (“FCPA”), and other anti-corruption

laws that apply in countries where we do business. The FCPA and other anti-corruption laws generally prohibit us and our employees

and intermediaries from bribing, being bribed or making other prohibited payments to government officials or other persons to obtain

or retain business or gain some other business advantage. We and our commercial partners operate in a number of jurisdictions that

pose a high risk of potential FCPA violations and we participate in collaborations and relationships with third parties whose actions

could potentially subject us to liability under the FCPA or local anti-corruption laws. In addition, we cannot predict the nature,

scope or effect of future regulatory requirements to which our international operations might be subject or the manner in which

existing laws might be administered or interpreted.

We also anticipate becoming subject to

other laws and regulations governing our international operations, including regulations administered in the U.S. and in the EU,

including applicable export control regulations, economic sanctions on countries and persons, customs requirements and currency

exchange regulations (collectively, “Trade Control Laws”).

There can be no assurance that we will

be completely effective in ensuring our compliance with all applicable anticorruption laws, including the FCPA or other legal requirements,

such as Trade Control Laws. Any investigation of potential violations of the FCPA, other anti-corruption laws or Trade Control

Laws by U.S., EU or other authorities could have an adverse impact on our reputation, our business, results of operations and financial

condition. Furthermore, should we be found not to be in compliance with the FCPA, other anti-corruption laws or Trade Control Laws,

we may be subject to criminal and civil penalties, disgorgement and other sanctions and remedial measures, as well as the accompanying

legal expenses, any of which could have a material adverse effect on our reputation and liquidity, as well as on our business,

results of operations and financial condition.

The U.S. laws pertaining to the importation

and exportation of hemp-based products may adversely affect our ability to fully implement our business plan.

In the United States today the U.S. Customs

Service has a “zero tolerance standard” for the importation of industrial hemp. What this means is that a product cannot

have any potentially dangerous substances contained in it or it will be considered adulterated and unfit for human consumption,

and thus illegal to possess or use per U.S. Federal Law. In 2001 the DEA elaborated on this and clarified that any product with

any quantity of THC in it at all cannot be imported into the United States. Since no hemp-based products containing THC are legally

permitted in the United States such products with THC are not allowed to be exported out of the United States either. Because of

the strict laws that exist with the U.S. importation and exportation of industrial hemp products our business could be adversely

affected. Should our supply chain be accidentally contaminated by THC, we have no system in place for evaluating THC levels in

our products prior to delivery.

We operate in a highly competitive

environment, and if we are unable to compete with our competitors, our business, financial condition, results of operations, cash

flows and prospects could be materially adversely affected.

We operate in a highly competitive environment.

Our competition includes all other companies that are in the business of distributing or reselling hemp-based products for personal

use or consumption. A highly competitive environment could materially adversely affect our business, financial condition, results

of operations, cash flows and prospects.

We and our customers may have difficulty

accessing the service of banks, which may make it difficult to sell our products and services.

Since the use of cannabis is illegal under

federal law, federally chartered banks will not accept for deposit funds from businesses involved with cannabis, even if the end

product is non-psychoactive CBD. Consequently, businesses involved in the cannabis industry often have trouble finding a bank willing

to accept their business. The inability to open bank accounts may make it difficult for our customers to operate. There does appears

to be recent movement to allow state-chartered banks and credit unions to provide banking to the industry, but as of the date of

this report there are only nominal entities that have been formed that offer these services. Further, in a February 6, 2018, Forbes

article, United States Secretary of the Treasury, Steven Mnuchin, is reported to have testified that his department is “reviewing

the existing guidance.” But he clarified that he doesn’t want to rescind it without having an alternate policy in place

to address public safety concerns.

Financial transactions involving proceeds

generated by cannabis-related conduct can form the basis for prosecution under the federal money laundering statutes, unlicensed

money transmitter statute and the U.S. Bank Secrecy Act. Despite guidance from the U.S. Department of the Treasury suggesting it

may be possible for financial institutions to provide services to cannabis-related businesses consistent with their obligations

under the Bank Secrecy Act, banks remain hesitant to offer banking services to cannabis-related businesses. Consequently, those

businesses involved in the cannabis industry continue to encounter difficulty establishing banking relationships. Our inability

to maintain our current bank accounts would make it difficult for us to operate our business, increase our operating costs, and

pose additional operational, logistical and security challenges and could result in our inability to implement our business plan.

Similarly, many of our customers are directly involved in cannabis sales and further restriction to their ability to access banking

services may make it difficult for them to purchase our products, which could have a material adverse effect on our business, financial

condition and results of operations.

We are subject to certain federal

regulations relating to cash reporting.

The Bank Secrecy Act, enforced by FinCEN,

requires us to report currency transactions in excess of $10,000, including identification of the customer by name and social security

number, to the IRS. This regulation also requires us to report certain suspicious activity, including any transaction that exceeds

$5,000 that we know, suspect or have reason to believe involves funds from illegal activity or is designed to evade federal regulations

or reporting requirements and to verify sources of funds. Substantial penalties can be imposed against us if we fail to comply

with this regulation. If we fail to comply with these laws and regulations, the imposition of a substantial penalty could have

a material adverse effect on our business, financial condition and results of operations.

We may be subject to certain tax

risks and treatments that could negatively impact our results of operations.

Section 280E of the Internal Revenue Code,

as amended, prohibits businesses from deducting certain expenses associated with trafficking controlled substances (within the

meaning of Schedule I and II of the Controlled Substances Act). The IRS has invoked Section 280E in tax audits against various

cannabis businesses in the U.S. that are permitted under applicable state laws. Although the IRS issued a clarification allowing

the deduction of certain expenses, the scope of such items is interpreted very narrowly and the bulk of operating costs and general

administrative costs are not permitted to be deducted. While there are currently several pending cases before various administrative

and federal courts challenging these restrictions, there is no guarantee that these courts will issue an interpretation of Section

280E favorable to cannabis businesses.

Risks Related to the Securities Markets

and Ownership of our Equity Securities

The Common Stock is thinly traded,

so you may be unable to sell at or near ask prices or at all if you need to sell your shares to raise money or otherwise desire

to liquidate your shares.

The Common Stock has historically been

sporadically traded on the OTC Pink Sheets, meaning that the number of persons interested in purchasing our shares at or near ask

prices at any given time may be relatively small or non-existent. This situation is attributable to a number of factors, including

the fact that we are a small company which is relatively unknown to stock analysts, stock brokers, institutional investors and

others in the investment community that generate or influence sales volume, and that even if we came to the attention of such persons,

they tend to be risk-averse and would be reluctant to follow an unproven company such as ours or purchase or recommend the purchase

of our shares until such time as we became more seasoned and viable. As a consequence, there may be periods of several days or

more when trading activity in our shares is minimal or non-existent, as compared to a seasoned issuer which has a large and steady

volume of trading activity that will generally support continuous sales without an adverse effect on share price. We cannot give

you any assurance that a broader or more active public trading market for our common shares will develop or be sustained, or that

current trading levels will be sustained.

The market price for the common stock

is particularly volatile given our status as a relatively unknown company with a small and thinly traded public float, limited

operating history and lack of revenue, which could lead to wide fluctuations in our share price. The price at which you purchase

our shares may not be indicative of the price that will prevail in the trading market. You may be unable to sell your common shares

at or above your purchase price, which may result in substantial losses to you.

The market for our shares of common stock

is characterized by significant price volatility when compared to seasoned issuers, and we expect that our share price will continue

to be more volatile than a seasoned issuer for the indefinite future. The volatility in our share price is attributable to a number

of factors. First, as noted above, our shares are sporadically traded. Because of this lack of liquidity, the trading of relatively

small quantities of shares may disproportionately influence the price of those shares in either direction. The price for our shares

could, for example, decline precipitously in the event that a large number of our shares is sold on the market without commensurate

demand, as compared to a seasoned issuer which could better absorb those sales without adverse impact on its share price. Secondly,

we are a speculative investment due to, among other matters, our limited operating history and lack of revenue or profit to date,

and the uncertainty of future market acceptance for our potential products. As a consequence of this enhanced risk, more risk-averse

investors may, under the fear of losing all or most of their investment in the event of negative news or lack of progress, be more

inclined to sell their shares on the market more quickly and at greater discounts than would be the case with the securities of

a seasoned issuer. The following factors may add to the volatility in the price of our shares: actual or anticipated variations

in our quarterly or annual operating results; acceptance of our inventory of games; government regulations, announcements of significant

acquisitions, strategic partnerships or joint ventures; our capital commitments and additions or departures of our key personnel.

Many of these factors are beyond our control and may decrease the market price of our shares regardless of our operating performance.

We cannot make any predictions or projections as to what the prevailing market price for our shares will be at any time, including

as to whether our shares will sustain their current market prices, or as to what effect the sale of shares or the availability

of shares for sale at any time will have on the prevailing market price.

Shareholders should be aware that, according

to SEC Release No. 34-29093, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns

include (1) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer;

(2) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; (3) boiler

room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons; (4) excessive

and undisclosed bid-ask differential and markups by selling broker-dealers; and (5) the wholesale dumping of the same securities

by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse

of those prices and with consequent investor losses. Our management is aware of the abuses that have occurred historically in the

penny stock market. Although we do not expect to be in a position to dictate the behavior of the market or of broker-dealers who

participate in the market, management will strive within the confines of practical limitations to prevent the described patterns

from being established with respect to our securities. The occurrence of these patterns or practices could increase the volatility

of our share price.

The market price of our common stock

may be volatile and adversely affected by several factors.

The market price of our common stock could

fluctuate significantly in response to various factors and events, including, but not limited to:

|

|

●

|

our ability to integrate operations, technology, products and services;

|

|

|

●

|

our ability to execute our business plan;

|

|

|

●

|

operating results below expectations;

|

|

|

●

|

our issuance of additional securities, including debt or equity or a combination thereof;

|

|

|

●

|

announcements of technological innovations or new products by us or our competitors

|

|

|

●

|

loss of any strategic relationship;

|

|

|

●

|

industry developments, including, without limitation, changes in healthcare policies or practices;

|

|

|

●

|

economic and other external factors;

|

|

|

●

|

period-to-period fluctuations in our financial results; and

|

|

|

●

|

whether an active trading market in our common stock develops and is maintained.

|

In addition, the securities markets have

from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular

companies. These market fluctuations may also materially and adversely affect the market price of our common stock. Issuers using

the Alternative Reporting standard for filing financial reports with OTC Markets are often subject to large volatility unrelated

to the fundamentals of the company.

Our issuance of additional shares

of Common Stock, or options or warrants to purchase those shares, would dilute your proportionate ownership and voting rights.

We are entitled under our articles

of incorporation to issue up to 10,000,000,000 shares of common stock. We have issued and outstanding, as of the date of this

prospectus, 349,339,793 shares of common stock. Our board may generally issue shares of common stock, preferred stock or options

or warrants to purchase those shares, without further approval by our shareholders based upon such factors as our board of directors

may deem relevant at that time. It is likely that we will be required to issue a large amount of additional securities to raise

capital to further our development. It is also likely that we will issue a large amount of additional securities to directors,

officers, employees and consultants as compensatory grants in connection with their services, both in the form of stand-alone

grants or under our stock plans. We cannot give you any assurance that we will not issue additional shares of common stock, or

options or warrants to purchase those shares, under circumstances we may deem appropriate at the time.

The elimination of monetary liability

against our directors, officers and employees under our Articles of Incorporation and the existence of indemnification rights to

our directors, officers and employees may result in substantial expenditures by our company and may discourage lawsuits against

our directors, officers and employees.

Our Articles of Incorporation contains

provisions that eliminate the liability of our directors for monetary damages to our company and shareholders. Our bylaws also

require us to indemnify our officers and directors. We may also have contractual indemnification obligations under our agreements

with our directors, officers and employees. The foregoing indemnification obligations could result in our company incurring substantial

expenditures to cover the cost of settlement or damage awards against directors, officers and employees that we may be unable to

recoup. These provisions and resultant costs may also discourage our company from bringing a lawsuit against directors, officers

and employees for breaches of their fiduciary duties, and may similarly discourage the filing of derivative litigation by our shareholders

against our directors, officers and employees even though such actions, if successful, might otherwise benefit our company and

shareholders.

Anti-takeover provisions may impede

the acquisition of our company.

Certain provisions of the Florida Law

have anti-takeover effects and may inhibit a non-negotiated merger or other business combination. These provisions are intended

to encourage any person interested in acquiring us to negotiate with, and to obtain the approval of, our board of directors in

connection with such a transaction. However, certain of these provisions may discourage a future acquisition of us, including

an acquisition in which the shareholders might otherwise receive a premium for their shares. As a result, shareholders who might

desire to participate in such a transaction may not have the opportunity to do so.

Our past filings may be deemed

insufficient.

Form 8-K shall be used for current

reports under Section 13or 15(d) of the Securities Exchange Act of 1934, filed pursuant to Rule 13a-11 or Rule 15d-11 and for

reports of nonpublic information required to be disclosed by Regulation FD (17 CFR 243.100 and 243.101). Form 8-K is required

to be filed no less than four business days from the date of the reported event. On September 6, 2018, we disclosed the reverse

merger with The Marquie Group, Inc. which was reported on Form

8-K filed with the Commission. The reverse merger occurred on August 16, 2018. As a result, we were not in compliance with

the requirements of Form 8-K. Although a failure to file a timely Form 8-K shall not be deemed a violation of Section 10 of the

Securities Exchange Act of 1934 or Rules 10b-5: 1.01, 1.02, 2.03-2.06, 4.02(a), (5.02(e), or 6.03 of the Securities Exchange Act

of 1934, the Commissions guidance suggests that failure to properly file a Form 8-K may be considered prima facie evidence

of a lack of sufficient disclosure controls under the Sarbanes-Oxley Act of 2002. In addition, the Commission may deem that the

Company has lost the ability to file a registration statement on Form S-3. Although such an offering is not currently anticipated,

the loss of our ability to utilized Form S-3 may affect our ability to grow in the future.

We may become involved in securities

class action litigation that could divert management’s attention and harm our business.

The stock market in general, and the shares

of early stage companies in particular, have experienced extreme price and volume fluctuations. These fluctuations have often been

unrelated or disproportionate to the operating performance of the companies involved. If these fluctuations occur in the future,

the market price of our shares could fall regardless of our operating performance. In the past, following periods of volatility

in the market price of a particular company’s securities, securities class action litigation has often been brought against

that company. If the market price or volume of our shares suffers extreme fluctuations, then we may become involved in this type

of litigation, which would be expensive and divert management’s attention and resources from managing our business.

As a public company, we may also from time

to time make forward-looking statements about future operating results and provide some financial guidance to the public markets.

Our management has limited experience as a management team in a public company and as a result, projections may not be made timely

or set at expected performance levels and could materially affect the price of our shares. Any failure to meet published forward-looking

statements that adversely affect the stock price could result in losses to investors, stockholder lawsuits or other litigation,

sanctions or restrictions issued by the SEC.

The subscription agreement for

the purchase of common stock from the Company contains an exclusive forum provision, which will limit investors ability to litigate

any issue that arises in connection with the offering anywhere other than the state and Federal courts in Nevada.

The subscription agreement states

that it shall be governed by the local law of the State of Nevada and the United States, and the parties consent to the

exclusive jurisdiction of the state and Federal courts in Nevada. They will not have the benefit of bringing a lawsuit in a

more favorable jurisdiction or under more favorable law than the local law of the State of Nevada. Insomuch claims are

brought under the Securities Act of 1933, our provision requires that a claim be brought in federal court. We also believe

this provision would require an action brought under the Securities Exchange Act of 1934 also be brought in federal court, as

Section 27 of the Securities Exchange Act of 1934 provides exclusive jurisdiction to the federal courts for claims brought

pursuant to the Securities Exchange Act of 1934. However, Section 22 of the Securities Act creates concurrent jurisdiction

for federal and state courts over all suits brought to enforce any duty or liability created by the Securities Act or the

rules and regulations thereunder. As noted above, our subscription agreement will provide that the courts of Nevada and the

federal district court for the District of Nevada shall have concurrent jurisdiction over any action arising under the

Securities Act. Accordingly, there is uncertainty as to whether a court would enforce such provision, and our stockholders

will not be deemed to have waived our compliance with the federal securities laws and the rules and regulations thereunder.

Additionally, as contract law is generally based in state law, a claim may be bought under state law. The inconsistencies of

venue and applicably law could make any action brought by an investor extremely difficult. Moreover, we cannot provide any

certainty as to whether a court would enforce our forum and choice of law provisions. The combination of both potentially

unfavorable forum and the lack of certainty regarding enforceability poses a risk regarding litigation related to the

subscription to this Offering and should be considered by each investor before signing the subscription

agreement.

Our common stock is currently deemed

a “penny stock,” which makes it more difficult for our investors to sell their shares.

The SEC has adopted Rule 15g-9 which establishes

the definition of a “penny stock,” for the purposes relevant to us, as any equity security that has a market price

of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules