XPEL, Inc. (Nasdaq: XPEL), a global provider of protective films

and coatings, announced results for the second quarter and six

months ended June 30, 2019.

Second Quarter Highlights:

- Revenues increased 4.5% to $30.1 million compared to second

quarter 2018, the highest revenue quarter in the history of XPEL;

Sequential revenue growth of 21.7% compared to first quarter of

2019

- Gross margin improved to 35.3% compared to 29.7% in second

quarter 2018

- Earnings per share of $0.11 compared to $0.09 per share in

second quarter 2018

Ryan Pape, President and Chief Executive Officer of XPEL,

commented, “We continued to see strong revenue growth in the second

quarter in most of our regions led by the US which posted 55.5%

growth. As expected, this growth was partially offset by continued

declines in China due to the timing of China sales acceleration in

the first half of 2018, but we expect that impact to moderate in

the third quarter. While overall revenue growth was moderate in the

second quarter, we drove substantially improved gross margin

through increased sales to our higher margin customers and due to

our continued focus on gross margins. We are energized by the

opportunities we’re seeing across the majority of our geographic

markets, and believe we are well positioned for continued growth as

we move through the balance of 2019.”

For the Quarter Ended June 30, 2019:

Revenues. Revenues increased approximately $1.3 million or 4.5%

to $30.1 million as compared to $28.8 million in the prior

year.

Gross Margin. Gross margin was 35.3% versus 29.7% in the second

quarter of 2018. The increase was related to an improved mix of

increased sales to higher margin customers and continued

improvements in per unit costs.

Expenses. Selling, general and administrative expenses increased

to $6.7 million or 22.1% of sales as compared to $5.1 million or

17.7% of sales in the prior year period. This increase was due

mainly to increases in personnel, occupancy, information technology

and research and development costs to support the ongoing growth of

the business and increased professional fees due to ancillary costs

related to the Company’s U.S. regulatory filings. Additionally, in

the second quarter of 2019 the Company incurred costs associated

with its annual dealer conference which was held in the first

quarter of 2018 and in the second quarter of 2019.

EBITDA. EBITDA (Earnings Before Interest, Taxes, Depreciation,

and Amortization) increased to $4.4 million, or 16.4%, as compared

to $3.8 million in the prior year1.

Net income. Net income increased to $3.0 million, or $0.11 per

basic and diluted share versus net income of $2.6 million, or $0.09

per basic and diluted share in the second quarter of 2018.

For the Six Months Ended June 30, 2019:

Revenues. Revenues increased approximately $0.9 million or 1.7%

to $54.8 million as compared to $53.9 million in the first half of

the prior year.

Gross Margin. Gross margin was 34.3% versus 30.0% in the first

six months of 2018. The increase was related to an improved mix of

increased sales to higher margin customers and continued

improvements in per unit costs.

Expenses. Selling, general and administrative expenses increased

to $12.3 million or 22.5% of sales as compared to $9.9 million or

18.4% of sales in the prior year period. This increase was due

mainly to increases in personnel, occupancy, information technology

and research and development costs to support the ongoing growth of

the business and increased professional fees due to ancillary costs

related to the Company’s U.S. regulatory filings.

EBITDA. EBITDA (Earnings Before Interest, Taxes, Depreciation,

and Amortization) increased to $7.2 million, or 5.2%, as compared

to $6.9 million in the prior year2.

Net income. Net income increased to $4.9 million, or $0.18 per

basic and diluted share versus net income of $4.7 million, or $0.17

per basic and diluted share for the first half of 2018.

Conference Call Information

The Company will host a conference call and webcast today,

Wednesday, August 21, 2019 at 11:00 a.m. Eastern Time to discuss

the Company’s results for the second quarter of 2019.

To access the live webcast, please visit the XPEL, Inc. website

at www.xpel.com/investor.

To participate in the call by phone, dial (877) 407-8033

approximately five minutes prior to the scheduled start time.

International callers please dial (201) 689-8033.

A replay of the teleconference will be available until September

21, 2019 and may be accessed by dialing (877) 481-4010.

International callers may dial (919) 882-2331. Callers should use

conference ID: 52951.

About XPEL, Inc.

XPEL is a leading provider of protective films and coatings,

including automotive paint protection film, surface protection

film, automotive and architectural window films and ceramic

coatings. With a global footprint, a network of trained installers

and proprietary DAP software, XPEL is dedicated to exceeding

customer expectations by providing high-quality products, leading

customer service, expert technical support and world-class

training. XPEL, Inc. . (Nasdaq: XPEL; TSXV: XPEL.U) is publicly

traded on Nasdaq and the TSX Venture Exchange.

Safe harbor statement

This release includes forward-looking statements regarding XPEL,

Inc. and its business, which may include, but is not limited to,

anticipated use of proceeds from capital transactions, expansion

into new markets, and execution of the company's growth strategy.

Often, but not always, forward-looking statements can be identified

by the use of words such as "plans," "is expected," "expects,"

"scheduled," "intends," "contemplates," "anticipates," "believes,"

"proposes" or variations (including negative variations) of such

words and phrases, or state that certain actions, events or results

"may," "could," "would," "might" or "will" be taken, occur or be

achieved. Such statements are based on the current expectations of

the management of XPEL. The forward-looking events and

circumstances discussed in this release may not occur by certain

specified dates or at all and could differ materially as a result

of known and unknown risk factors and uncertainties affecting the

company, performance and acceptance of the company's products,

economic factors, competition, the equity markets generally and

many other factors beyond the control of XPEL. Although XPEL has

attempted to identify important factors that could cause actual

actions, events or results to differ materially from those

described in forward-looking statements, there may be other factors

that cause actions, events or results to differ from those

anticipated, estimated or intended. No forward-looking statement

can be guaranteed. Except as required by applicable securities

laws, forward-looking statements speak only as of the date on which

they are made and XPEL undertakes no obligation to publicly update

or revise any forward-looking statement, whether as a result of new

information, future events, or otherwise.

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release

1see reconciliation of non-GAAP financial measures below.

2see reconciliation of non-GAAP financial measures below.

XPEL, Inc.

Condensed Consolidated

Statements of Income

(Unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2019

2018

2019

2018

Revenue

Product revenue

$

25,425,489

$

24,988,880

$

46,480,212

$

47,083,121

Service revenue

4,668,665

3,802,011

8,339,388

6,829,289

Total revenue

30,094,154

28,790,891

54,819,600

53,912,410

Cost of Sales

Cost of product sales

18,551,030

19,560,320

34,239,063

36,410,156

Cost of service

917,111

665,731

1,804,444

1,332,270

Total cost of sales

19,468,141

20,226,051

36,043,507

37,742,426

Gross Margin

10,626,013

8,564,840

18,776,093

16,169,984

Operating Expenses

Sales and marketing

2,064,836

1,479,510

3,663,942

3,036,608

General and administrative

4,589,906

3,620,542

8,667,857

6,895,140

Total operating expenses

6,654,742

5,100,052

12,331,799

9,931,748

Operating Income

3,971,271

3,464,788

6,444,294

6,238,236

Interest expense

29,074

47,130

57,780

104,084

Foreign currency exchange loss (gain)

(3,518)

56,505

14,908

23,124

Income before income taxes

3,945,715

3,361,153

6,371,606

6,111,028

Income tax expense

938,405

808,011

1,504,293

1,469,073

Net income

3,007,310

2,553,142

4,867,313

4,641,955

Income (loss) attributed to

non-controlling interest

1,293

(1,968)

2,709

(10,513)

Net income attributable to stockholders

of the Company

$

3,006,017

$

2,555,110

$

4,864,604

$

4,652,468

Earnings per share attributable to

stockholders of the Company

Basic and diluted

$

0.11

$

0.09

$

0.18

$

0.17

Weighted Average Number of Common

Shares

Basic and diluted

27,612,597

27,612,597

27,612,597

27,612,597

XPEL Inc.

Condensed Consolidated Balance

Sheets

(Unaudited)

(Audited)

June 30,

December 31,

2019

2018

Assets

Current

Cash and cash equivalents

$

5,473,964

$

3,971,226

Accounts receivable, net

7,549,789

5,554,313

Inventory, net

15,304,778

10,799,611

Prepaid expenses and other current

assets

1,312,016

706,718

Total current assets

29,640,547

21,031,868

Property and equipment, net

3,711,031

3,384,206

Right-of-Use lease assets

4,016,516

-

Intangible assets, net

3,595,785

3,804,026

Other non-current assets

35,999

-

Goodwill

2,349,501

2,322,788

Total assets

$

43,349,379

$

30,542,888

Liabilities

Current

Current portion of notes payable

$

670,516

$

853,150

Current portion lease liabilities

976,339

-

Accounts payable and accrued

liabilities

11,255,718

6,292,093

Income tax payable

565,350

1,337,599

Total current liabilities

13,467,923

8,482,842

Deferred tax liability, net

549,257

478,864

Non-current portion of lease

liabilities

3,137,297

-

Non-current portion notes payable

502,080

968,237

Total liabilities

17,656,557

9,929,943

Stockholders‘ Equity

Preferred stock, $0.001 par value;

authorized 10,000,000; none issued and outstanding

-

-

Common stock, $0.001 par value;

100,000,000 shares authorized; 27,612,597 and 27, 612,597 issued

and outstanding, respectively

27,613

27,613

Additional paid-in-capital

11,348,163

11,348,163

Accumulated other comprehensive loss

(976,292

)

(1,190,055

)

Retained Earnings

15,481,857

10,617,253

25,881,341

20,802,974

Non-controlling interest

(188,519

)

(190,029

)

Total stockholders‘ equity

25,692,822

20,612,945

Total liabilities and stockholders‘

equity

$

43,349,379

$

30,542,888

Reconciliation of Non-GAAP Financial Measure

EBITDA is a non-GAAP financial measure. EBITDA is defined as net

income (loss) plus interest expense, net, plus income tax expense

plus depreciation expense and amortization expense. EBITDA should

be considered in addition to, not as a substitute for, or superior

to, financial measures calculated in accordance with GAAP. It is

not a measurement of our financial performance under GAAP and

should not be considered as alternatives to revenue or net income

(loss), as applicable, or any other performance measures derived in

accordance with GAAP and may not be comparable to other similarly

titled measures of other businesses. EBITDA has limitations as an

analytical tool and you should not consider it in isolation or as a

substitute for analysis of our operating results as reported under

GAAP.

EBITDA does not reflect the impact of certain cash charges

resulting from matters we consider not to be indicative of ongoing

operations and other companies in our industry may calculate EBITDA

differently than we do, limiting its usefulness as a comparative

measure.

EBITDA Reconciliation

Three Months Ended June 30,

2019

Three Months Ended June 30,

2018

Six Months Ended June 30,

2019

Six Months Ended June 30,

2018

Net income

$3,007,310

$2,553,142

$4,867,313

$4,641,955

Interest

29,074

47,130

57,780

104,084

Taxes

938,405

808,011

1,504,293

1,469,073

Depreciation

220,270

179,549

421,088

338,867

Amortization

186,824

175,532

371,372

312,169

EBITDA

$4,381,883

$3,763,364

$7,221,846

$6,866,148

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190821005144/en/

Investor Relations: John Nesbett/Jennifer Belodeau IMS Investor

Relations Phone: (203) 972-9200 Email: jnesbett@institutionalms.com

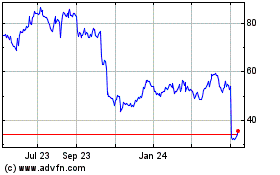

XPEL (NASDAQ:XPEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

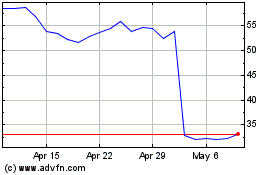

XPEL (NASDAQ:XPEL)

Historical Stock Chart

From Apr 2023 to Apr 2024