Current Report Filing (8-k)

August 20 2019 - 5:01PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 15, 2019

Medicine Man Technologies, Inc.

(Exact name of registrant as specified in

its charter)

|

Nevada

|

|

001-36868

|

|

46-5289499

|

(State or other jurisdiction of

incorporation)

|

|

(Commission

File Number)

|

|

IRS Employer

Identification No.)

|

|

4880 Havana Street, Suite 201

Denver, Colorado

|

|

80239

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(303) 371-0387

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(

see

General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

|

Not applicable

|

|

Not applicable

|

|

Not applicable

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

☒

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 1.01 Entry into a Material

Definitive Agreement.

On August 15, 2019 (the “Execution

Date”), Medicine Man Technologies (the “Company”), a Nevada corporation, entered into a binding term sheet (the

“Term Sheet”) with an edible and extract company (the “Seller”) setting forth the terms of the acquisition

by the Company of 100% of the capital stock and assets of the Seller (the “Acquisition”).

As consideration, the Company shall pay

a total purchase price of $17,250,000 (the “Purchase Price”) consisting of $3,450,000 cash and 4,677,967 shares of

its common stock, par value $0.001 per share. The 4,677,967 shares was determined by averaging the closing price of Company’s

common stock for the five (5) days prior to August 8, 2019, which equated to $2.95 per share.

The Purchase Price is predicated on projected

2019 gross revenues of the Seller. The Purchase Price will be adjusted to reflect the actual 2019 gross revenues on a date and

method mutually agreed upon by the Company and Seller and shall be memorialized in the Long-Form Agreement (as defined below).

However, no adjustment in the Purchase Price will be made if the variation between Seller’s actual and projected 2019 sales

is greater than or equal to ten percent (10%), assuming that the EBITDA margin is also kept at or above fifteen percent (15%).

The Purchase Price will be payable at the closing, with certain trading restrictions on the stock, to be defined in the Long-Form

Agreement. In addition, claw-back language for fifteen percent (15%) of the shares will also be included in the Long-Form Agreement.

The obligations of the Company and Seller

under the Term Sheet are conditioned upon the satisfaction or mutual waiver of certain closing conditions (the “Conditions”),

including the following:

|

|

i.

|

regulatory approval relating to all applicable filings and expiration or early termination of any

applicable waiting periods;

|

|

|

ii.

|

regulatory approval of the Marijuana Enforcement Division and applicable local licensing authority

approval;

|

|

|

iii.

|

receipt of all material necessary, third party, consents and approvals;

|

|

|

iv.

|

each party's compliance in all material respects with the respective obligations under the Term

Sheet;

|

|

|

v.

|

a tax structure that is satisfactory to both the Company and Seller;

|

|

|

vi.

|

the execution of property leases (including, but not limited to, first right of refusals for the

acquisition of the underlying real estate when applicable, in market terms); and

|

|

|

vii.

|

the execution of employment agreements mutually acceptable to each party.

|

The Term Sheet contemplates the parties

entering into a long-form agreement and other ancillary documents to memorialize the Acquisition (the “Long-Form Agreement”)

upon the conclusion of all standard legal and business due diligence. In the event the Long-Form Agreement is not agreed to within

one year of the Execution Date and all of the Conditions are either satisfied or waived, the Acquisition shall be consummated and

governed by the terms of the Term Sheet.

On August 19, 2019, the Company issued

a press release with respect to the foregoing, a copy of which is attached hereto as Exhibit 99.1.

Item 9.01. Financial Statements and

Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

thereunto duly authorized.

|

|

Medicine Man Technologies, Inc.

|

|

|

|

|

Date: August 20, 2019

|

By:

/s/ Andrew Williams

|

|

|

Andrew Williams

|

|

|

Chief Executive Officer

|

|

|

|

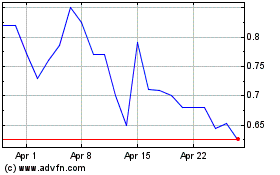

Medicine Man Technologies (QX) (USOTC:SHWZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Medicine Man Technologies (QX) (USOTC:SHWZ)

Historical Stock Chart

From Apr 2023 to Apr 2024