UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a16 OR 15d16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For August 20, 2019

Harmony Gold Mining Company Limited

Randfontein Office Park

Corner Main Reef Road and Ward Avenue Randfontein, 1759

South Africa

(Address of principal executive offices)

*-

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20 F or Form 40F.)

Form 20F ☒ Form 40F ☐

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing

the information to the Commission pursuant to Rule 12g32(b) under the Securities Exchange Act of 1934.)

Yes ☐ No ☒

Page | 3

Harmony Gold Mining Company Limited

Registration number 1950/038232/06

Incorporated in the Republic of South Africa

ISIN: ZAE000015228

JSE share code: HAR

(“Harmony” and/or “the Company”)

RESULTS FOR THE YEAR ENDED 30 JUNE 2019 - SHORT FORM ANNOUNCEMENT

Harmony well positioned to benefit from higher gold prices

Johannesburg. Tuesday, 20 August 2019.

Harmony Gold Mining Company Limited (“Harmony” or “the Company”) is pleased to announce its financial and operating results for the year ended 30 June 2019 (“FY19”).

In line with our strategy to produce safe, profitable ounces and increasing margins through operational excellence and value accretive acquisitions, both annual gold production and cash flows were boosted by the inclusion of a full year of production from Moab Khotsong and Hidden Valley in FY19.

FY19 key features

|

|

|

|

•

|

17% increase in gold production to 1.438Moz, resulting in a 23% increase in production profit

|

|

|

|

|

•

|

2% increase in underground recovered grade to 5.59g/t

|

|

|

|

|

•

|

32% increase in revenue to R26 912 million (19% increase to US$1 898 million)

|

|

|

|

|

•

|

Moab Khotsong and Hidden Valley boost cash flow - generated R1 375

|

million (US$97 million) in operating free cash flow

|

|

|

|

•

|

Successful hedging strategy topped up - secured cash flow margins,

|

contributing R477 million (US$34 million) to cash flow

|

|

|

|

•

|

50% decrease in loss per share to 498 SA cents (51% decrease to 35 US cents)

|

|

|

|

|

•

|

19% increase in headline earnings per share to 204 SA cents (8% increase to 14 US cents)

|

|

|

|

|

•

|

No ordinary cash dividend declared for the year ended 30 June 2019 (nil for the year ended 30 June 2018)

|

Key operating results

Year ended

Year ended

%

June 2019

June 2018

Change

Gold produced

kg

44 734

38 193

17

oz

1 438 231

1 227 934

17

Underground grade

g/t

5.59

5.48

2

Gold price received

R/kg

586 653

570 709

3

US$/oz

1 287

1 380

(7)

Cash operating costs

R/kg

439 722

421 260

(4)

US$/oz

965

1 018

5

Total costs and capital¹

R/kg

544 487

499 028

(9)

US$/oz

1 194

1 207

1

All-in sustaining costs²

R/kg

550 005

508 970

(8)

US$/oz

1 207

1 231

2

Production profit

R million

6 588

5 356

23

US$ million

465

416

12

Exchange rate

R/US$

14.18

12.85

10

¹ FY18 excludes investment capital for Hidden Valley

² Excludes share-based payment charge

Key financial results

Year ended

Year ended

%

June 2019

June 2018

Change

Basic loss per share

SA cents

(498)

(1 003)

50

US cents

(35)

(72)

51

Headline earnings

R million

1 067

763

40

US$ million

75

58 29

Headline earnings per share

SA cents 204 171

19

US cents

14

13

8

“I wish to extend my personal, heartfelt condolences to the families, colleagues and friends of the employees who lost their lives in mining accidents in FY19. Together with each and every employee, my aim is to ensure safe production, by preventing fatalities and embedding a proactive safety culture. It is important that every employee returns home each day - both safe and healthy”, said Peter Steenkamp, chief executive officer.

“Throughout FY20, we will continue to focus on producing safe, profitable production, pursue safe, value accretive acquisitions and strengthen our cash flows. Value - rather than volume - will translate to shareholder returns in the long term”, Steenkamp concluded.

FY20 group production and cost guidance

In the next financial year, we plan to produce approximately 1.46Moz at an all-in sustaining unit cost of R579 000/kg.

This short-form announcement is the responsibility of the board of directors of the Company (“Board”).

Shareholders are advised that this short-form announcement represents a summary of the information contained in the full announcement (results booklet) and does not contain full or complete details published on the Stock Exchange News Service (“SENS”), via the JSE link and on Harmony’s website (

www.harmony.co.za

) on 20 August 2019.

The financial results as contained in the condensed consolidated financial statements for the year ended 30 June 2019 have been reviewed by

PricewaterhouseCoopers Inc., who expressed an unmodified review conclusion thereon.

Any investment decisions by investors and/or shareholders should be based on a consideration of the full announcement as a whole and shareholders are encouraged to review the full announcement (results booklet), which is available for viewing on the Company’s website referred to above and via the JSE link.

The full announcement (results booklet) is also available for inspection at the registered office of the Company, Randfontein Office Park, Randfontein, 1760, Corner Main Reef Road/Ward Avenue, Randfontein and at the offices of the sponsors, JP Morgan. Inspection of the full announcement is available to investors and/or shareholders at no charge, during normal business hours from today, 20 August 2019, until 27 August 2019.

Copies of the full announcement (results booklet) may be requested from

corporate@harmony.co.za

.

The JSE link is as follows:

https://senspdf.jse.co.za/documents/2019/jse/isse/HARE/FY19result.pdf

In addition, the company wishes to notify shareholders of its Broad Based Black Economic Empowerment report included in on pages 96 to 97 in its integrated annual report which is available on the company’s website at

https://www.har.co.za/18/

.

ends.

For more details contact:

Lauren Fourie

Investor Relations Manager

+27(0)71 607 1498 (mobile)

Marian van der Walt

Executive: Investor Relations

+27(0)82 888 1242 (mobile)

Johannesburg, South Africa

20 August 2019

Sponsor:

J.P. Morgan Equities South Africa Proprietary Limited

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on

its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Harmony Gold Mining Company Limited

|

|

|

|

|

Date: August 20, 2019

|

By: /s/ Frank Abbott

|

|

|

Name: Frank Abbott

|

|

|

Title: Financial Director

|

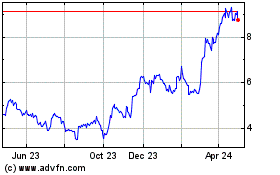

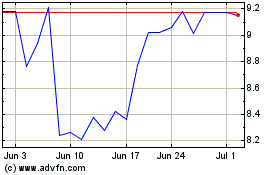

Harmony Gold Mining (NYSE:HMY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Harmony Gold Mining (NYSE:HMY)

Historical Stock Chart

From Apr 2023 to Apr 2024