Current Report Filing (8-k)

August 19 2019 - 4:47PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): August 19, 2019

Lumber

Liquidators Holdings, Inc.

(Exact Name of Registrant as Specified

in Charter)

|

Delaware

|

001-33767

|

27-1310817

|

|

(State or Other Jurisdiction

|

(Commission File Number)

|

(IRS Employer

|

|

of Incorporation)

|

|

Identification No.)

|

3000 John Deere Road, Toano, Virginia

23168

(Address of Principal Executive Offices)

(Zip Code)

(757) 259-4280

(Registrant’s telephone number,

including area code)

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class:

|

Trading Symbol:

|

Name of exchange on which registered:

|

|

Common Stock, par value $0.001 per share

|

LL

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.

¨

|

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements

of Certain Officers.

|

On August 19, 2019, Lumber Liquidators Holdings,

Inc. (the “Company”) announced that the Board of Directors appointed Nancy A. Walsh, age 58, as the Company’s

Chief Financial Officer. Ms. Walsh’s employment with the Company is expected to begin on or about September 9, 2019.

Prior to her appointment, Ms. Walsh most

recently served as Executive Vice President and Chief Financial Officer of Pier 1 Imports, Inc. from January 2018 until April 2019

and Executive Vice President and Chief Financial Officer of The Bon-Ton Stores, Inc. from November 2015 until January 2018. Prior

to that, Ms. Walsh served in various positions with Tapestry, Inc., formerly known as Coach, Inc., from 1999 to December 2013,

including as Senior Vice President, Finance from 2007 to 2013, Chief Risk Officer from 2003 to 2007, Vice President of Finance

and Treasurer from 2000 to 2003, and Chief Financial Officer of its Worldwide Wholesale Division from 1999 to 2000.

Ms. Walsh was appointed pursuant to the

terms of an offer letter, effective as of August 9, 2019 (the “Offer Letter Agreement”). In connection with Ms. Walsh’s

appointment as Chief Financial Officer, Ms. Walsh will receive an annual base salary of $500,000 and a $50,000 one-time sign-on

bonus. Ms. Walsh will be eligible to participate in the annual bonus plan for executive management (the “Plan”), with

a target payout of 60% of her annual base salary for 2019, with the opportunity to earn a maximum of 200% of target payout based

on the Company’s performance in accordance with the terms of the Plan. For 2019, any earned bonus will be pro-rated to the

date of hire in 2019. Subject to the approval of the Compensation Committee, it is expected that Ms. Walsh will receive a proposed

equity award pursuant to the Company’s Amended and Restated 2011 Equity Compensation Plan with a total cumulative value of

$750,000 to be granted three business days after the release of third quarter 2019 earnings. It is expected that the equity award

will consist of 50% restricted stock valued using the fair market value on the grant date and 50% options valued using the Black-Scholes-Merton

method as of the grant date. The restricted stock award and the options will each vest 25% ratably over a four-year period beginning

on the first-year anniversary of the grant date. Ms. Walsh also will be provided with up to $200,000 in reasonable relocation expenses

in accordance with the Company’s relocation policy. The foregoing description of the Offer Letter Agreement is qualified

in its entirety by reference to the full text of the Offer Letter Agreement, which is attached as Exhibit 10.1 to this Current

Report on Form 8-K and incorporated herein by reference.

In addition, the Company and Ms. Walsh entered

into a severance agreement. The terms of the severance agreement are substantially similar to the terms of the severance agreements

entered into by the Company and certain officers of the Company on July 26, 2018 and described in Item 5.02 of the Company’s

Current Report on Form 8-K, filed with the Securities and Exchange Commission on July 28, 2018, which description is incorporated

herein by reference. This description is not purported to be complete and is qualified in its entirety by reference to the full

text of the severance agreement, including the non-compete agreement that is attached as an appendix to the severance agreement,

which is attached as Exhibit 10.2 to this Current Report on Form 8-K and incorporated herein by reference.

The Company also announced on August 19,

2019, that Timothy J. Mulvaney will step down as Interim Chief Financial Officer when Ms. Walsh’s employment commences. Mr.

Mulvaney will continue to serve as the Company’s Senior Vice President, Chief Accounting Officer. In connection with Mr.

Mulvaney’s return as Senior Vice President, Chief Accounting Officer, Mr. Mulvaney’s base salary will be $300,000 and

his previously awarded retention bonus of $100,000 will be paid if he remains at the Company through March 31, 2020.

A copy of the press release containing these

announcements is attached hereto as Exhibit 99.1 and is incorporated by reference into Item 5.02 of this Current Report on Form

8-K.

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

Date: August 19, 2019

|

|

LUMBER LIQUIDATORS HOLDINGS, INC.

|

|

|

|

|

|

|

By:

|

/s/ M. Lee Reeves

|

|

|

|

M. Lee Reeves

|

|

|

|

Chief Legal Officer and Corporate Secretary

|

EXHIBIT INDEX

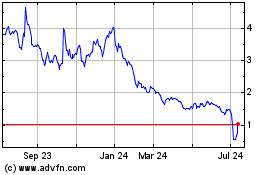

LL Flooring (NYSE:LL)

Historical Stock Chart

From Mar 2024 to Apr 2024

LL Flooring (NYSE:LL)

Historical Stock Chart

From Apr 2023 to Apr 2024