Estée Lauder Reports Strong Sales Fueled by Asian Shoppers

August 19 2019 - 3:08PM

Dow Jones News

By Kimberly Chin

Estée Lauder Cos. projected strong growth in 2020 after the

company reported sales increases in Asia and higher demand for its

premium skin care brands, sending shares of the company to an

all-time high.

The New York-based cosmetics company said it expects sales to

rise between 7% and 8% in fiscal 2020, hitting the top end of its

projected long-term sales growth of 6% to 8%.

The projections came after the company reported robust demand

across all of its emerging markets, led by China. In fiscal 2019,

sales from the Asia-Pacific region rose 23% and sales from Europe

and the Middle East increased 20% from a year earlier.

Shares rose 12% to $201.02 on Monday. The stock has climbed more

than 50% year to date.

Executives said they are confident that a growing middle class,

especially in emerging markets, as well as hyperlocal marketing

initiatives will drive sales higher next year. "We are benefiting

more from the momentum of those markets, and we are less exposed to

some of the slower growth channels in particular than we have been

historically, " said Chief Financial Officer Tracey Travis in a

call with analysts.

About half of Estée Lauder's sales come from North America,

which had negative sales growth in 2019, compared with other

regions which experienced percentage growth in the double digits.

The company said that broader retail trends in the U.S., such as

increased competition, slowing beauty sales overall and less foot

traffic at stores, have damped growth.

Ms. Travis also said the closure of stores in 2019 from

department-store operator Bon-Ton Stores Inc. has added to

challenges in its U.S. business, knocking off at least one

percentage point of growth in North America.

Chief Executive Fabrizio Freda told analysts he expects the U.S.

business to stabilize next year and eventually return to growth in

the long term, particularly through Estée Lauder's marketing

efforts and new product launches.

Overall net sales climbed 8.6% for the year, compared with

fiscal 2018.

Fourth-quarter sales were up 8.9% to $3.59 billion. Excluding

currency fluctuations and restructuring-related charges, sales rose

12%. Analysts polled by FactSet estimated quarterly sales of $3.53

billion.

Profit in the three-month period ended June 30 fell to $157

million, or 43 cents a share, largely due to higher expenses and

restructuring costs. Excluding certain items, Estée Lauder made 64

cents a share, topping analysts' estimates of 53 cents a share.

The company said it spent more on marketing in the quarter,

which helped drive some of its sales growth but also pushed

expenses up 5.9%.

Estée Lauder said its multiyear restructuring initiative, which

began in May 2016 to help the company cut costs, streamline

operations and exit underperforming businesses, will likely be

completed in fiscal 2021.

The company now expects the effort to cost between $950 million

and $990 million before taxes, but yield cost savings between $425

million and $475 million before taxes. This compares with its

previous guidance of $900 million and $950 million in costs and

between $350 million and $450 million in savings.

Next year, the company projects per-share earnings to come

between $5.62 and $5.74. Excluding restructuring charges and other

items, the company expects earnings between $5.90 and $5.98 a share

for the year.

In the current quarter, the company expects sales growth of 9%

to 10%, and earnings of $1.48 and $1.52 a share. Excluding special

items, Estée Lauder forecasts earnings of $1.56 to $1.59 a

share.

Write to Kimberly Chin at kimberly.chin@wsj.com

(END) Dow Jones Newswires

August 19, 2019 14:53 ET (18:53 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

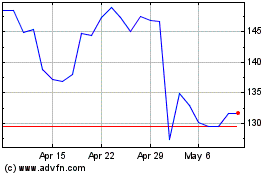

Estee Lauder Companies (NYSE:EL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Estee Lauder Companies (NYSE:EL)

Historical Stock Chart

From Apr 2023 to Apr 2024