UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month

of August, 2019

Commission

File Number: 001-38714

STONECO LTD.

(Exact

name of registrant as specified in its charter)

R. Fidêncio

Ramos, 308, 10th floor—Vila Olímpia

São

Paulo—SP, 04551-010, Brazil

+55 (11)

3004-9680

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

☐

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

☐

STONECO

LTD.

INCORPORATION

BY REFERENCE

This report on Form 6-K shall

be deemed to be incorporated by reference into the registration statement on Form S-8 (Registration Number: 333-230629) of StoneCo

Ltd. and to be a part thereof from the date on which this report is filed, to the extent not superseded by documents or reports

subsequently filed or furnished.

Unaudited

Interim Condensed

Consolidated

Financial Statements

StoneCo

Ltd.

June

30, 2019

StoneCo Ltd.

Unaudited interim condensed consolidated

statement of financial position

As of June 30, 2019 and December 31,

2018

(In thousands of Brazilian Reais)

|

|

|

Notes

|

|

June 30,

2019

|

|

December 31, 2018

|

|

Assets

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

5

|

|

|

160,635

|

|

|

|

297,929

|

|

|

Short-term investments

|

|

6

|

|

|

2,704,844

|

|

|

|

2,770,589

|

|

|

Accounts receivable from card issuers

|

|

7

|

|

|

12,518,915

|

|

|

|

9,244,608

|

|

|

Trade accounts receivable

|

|

|

|

|

52,773

|

|

|

|

44,616

|

|

|

Recoverable taxes

|

|

|

|

|

90,798

|

|

|

|

56,918

|

|

|

Prepaid expenses

|

|

|

|

|

22,623

|

|

|

|

15,066

|

|

|

Derivative financial instruments

|

|

|

|

|

9,053

|

|

|

|

1,195

|

|

|

Other accounts receivable

|

|

|

|

|

16,813

|

|

|

|

6,860

|

|

|

|

|

|

|

|

15,576,454

|

|

|

|

12,437,781

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-current assets

|

|

|

|

|

|

|

|

|

|

|

|

Receivables from related parties

|

|

13

|

|

|

7,916

|

|

|

|

8,095

|

|

|

Deferred tax assets

|

|

8

|

|

|

261,994

|

|

|

|

262,668

|

|

|

Other accounts receivable

|

|

|

|

|

10,998

|

|

|

|

8,507

|

|

|

Investment in associate

|

|

|

|

|

19,161

|

|

|

|

2,237

|

|

|

Property and equipment

|

|

9

|

|

|

375,782

|

|

|

|

266,273

|

|

|

Intangible assets

|

|

10

|

|

|

323,404

|

|

|

|

307,657

|

|

|

|

|

|

|

|

999,255

|

|

|

|

855,437

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

|

|

|

16,575,709

|

|

|

|

13,293,218

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and equity

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable to clients

|

|

11

|

|

|

5,796,019

|

|

|

|

4,996,102

|

|

|

Trade accounts payable

|

|

|

|

|

95,648

|

|

|

|

117,836

|

|

|

Loans and financing

|

|

12

|

|

|

984,298

|

|

|

|

761,056

|

|

|

Obligations to FIDC senior quota holders

|

|

12

|

|

|

1,139,831

|

|

|

|

16,646

|

|

|

Labor and social security liabilities

|

|

|

|

|

105,069

|

|

|

|

96,732

|

|

|

Taxes payable

|

|

|

|

|

60,826

|

|

|

|

51,569

|

|

|

Derivative financial instruments

|

|

|

|

|

829

|

|

|

|

586

|

|

|

Other accounts payable

|

|

|

|

|

23,543

|

|

|

|

14,248

|

|

|

|

|

|

|

|

8,206,063

|

|

|

|

6,054,775

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-current liabilities

|

|

|

|

|

|

|

|

|

|

|

|

Loans and financing

|

|

12

|

|

|

268,728

|

|

|

|

1,395

|

|

|

Obligations to FIDC senior quota holders

|

|

12

|

|

|

2,562,609

|

|

|

|

2,057,925

|

|

|

Deferred tax liabilities

|

|

8

|

|

|

97,134

|

|

|

|

80,223

|

|

|

Provision for contingencies

|

|

|

|

|

2,995

|

|

|

|

1,242

|

|

|

Other accounts payable

|

|

|

|

|

4,722

|

|

|

|

4,667

|

|

|

|

|

|

|

|

2,936,188

|

|

|

|

2,145,452

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

|

|

|

11,142,251

|

|

|

|

8,200,227

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity

|

|

14

|

|

|

|

|

|

|

|

|

|

Issued capital

|

|

|

|

|

62

|

|

|

|

62

|

|

|

Capital reserve

|

|

|

|

|

5,368,886

|

|

|

|

5,351,873

|

|

|

Other comprehensive income

|

|

|

|

|

(81,769

|

)

|

|

|

(56,334

|

)

|

|

Retained earnings (Accumulated losses)

|

|

|

|

|

146,819

|

|

|

|

(202,276

|

)

|

|

Equity attributable to owners of the parent

|

|

|

|

|

5,433,998

|

|

|

|

5,093,325

|

|

|

Non-controlling interests

|

|

|

|

|

(540

|

)

|

|

|

(334

|

)

|

|

Total equity

|

|

|

|

|

5,433,458

|

|

|

|

5,092,991

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and equity

|

|

|

|

|

16,575,709

|

|

|

|

13,293,218

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these unaudited

interim condensed consolidated financial statements.

StoneCo Ltd.

Unaudited interim consolidated statement

of profit and other comprehensive income

For the six months ended June 30,

2019 and 2018

(In thousands of Brazilian Reais, unless

otherwise stated)

|

|

|

|

|

Six months ended June 30

|

|

Three months ended June 30

|

|

|

|

Notes

|

|

2019

|

|

2018

|

|

2019

|

|

2018

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net revenue from transaction activities and other services

|

|

|

|

|

346,014

|

|

|

|

204,093

|

|

|

|

177,251

|

|

|

|

113,850

|

|

|

Net revenue from subscription services and equipment rental

|

|

|

|

|

145,786

|

|

|

|

84,999

|

|

|

|

74,608

|

|

|

|

46,546

|

|

|

Financial income

|

|

|

|

|

548,633

|

|

|

|

333,062

|

|

|

|

297,239

|

|

|

|

183,515

|

|

|

Other financial income

|

|

|

|

|

81,532

|

|

|

|

13,574

|

|

|

|

37,094

|

|

|

|

3,789

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenue and income

|

|

16

|

|

|

1,121,965

|

|

|

|

635,728

|

|

|

|

586,192

|

|

|

|

347,700

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of services

|

|

|

|

|

(186,164

|

)

|

|

|

(141,061

|

)

|

|

|

(100,784

|

)

|

|

|

(70,230

|

)

|

|

Administrative expenses

|

|

|

|

|

(142,141

|

)

|

|

|

(117,366

|

)

|

|

|

(77,381

|

)

|

|

|

(58,447

|

)

|

|

Selling expenses

|

|

|

|

|

(149,959

|

)

|

|

|

(81,406

|

)

|

|

|

(87,260

|

)

|

|

|

(43,747

|

)

|

|

Financial expenses, net

|

|

|

|

|

(145,411

|

)

|

|

|

(142,581

|

)

|

|

|

(78,771

|

)

|

|

|

(74,021

|

)

|

|

Other operating expenses, net

|

|

|

|

|

(43,785

|

)

|

|

|

(20,796

|

)

|

|

|

(32,325

|

)

|

|

|

(15,672

|

)

|

|

|

|

17

|

|

|

(667,460

|

)

|

|

|

(503,210

|

)

|

|

|

(376,521

|

)

|

|

|

(262,117

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss on investment in associates

|

|

|

|

|

(529

|

)

|

|

|

(378

|

)

|

|

|

(529

|

)

|

|

|

(255

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit (loss) before income taxes

|

|

|

|

|

453,976

|

|

|

|

132,140

|

|

|

|

209,142

|

|

|

|

85,328

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current income tax and social contribution

|

|

8

|

|

|

(74,646

|

)

|

|

|

(49,570

|

)

|

|

|

(1,593

|

)

|

|

|

(23,059

|

)

|

|

Deferred income tax and social contribution

|

|

8

|

|

|

(30,441

|

)

|

|

|

5,144

|

|

|

|

(35,696

|

)

|

|

|

754

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income for the period

|

|

|

|

|

348,889

|

|

|

|

87,714

|

|

|

|

171,853

|

|

|

|

63,023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income that may be reclassified to profit or loss in subsequent periods (net of tax):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts receivable from card issuers at fair value through other comprehensive income

|

|

|

|

|

(25,108

|

)

|

|

|

7,525

|

|

|

|

(16,882

|

)

|

|

|

(582

|

)

|

|

Other comprehensive income that will not be reclassified to profit or loss in subsequent periods (net of tax):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss on equity instruments designated at fair value through other comprehensive income

|

|

|

|

|

(327

|

)

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income for the period, net of tax

|

|

|

|

|

(25,435

|

)

|

|

|

7,525

|

|

|

|

(16,882

|

)

|

|

|

(582

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total comprehensive income for the period, net of tax

|

|

|

|

|

323,454

|

|

|

|

95,239

|

|

|

|

154,971

|

|

|

|

62,441

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Owners of the parent

|

|

|

|

|

349,095

|

|

|

|

85,029

|

|

|

|

171,946

|

|

|

|

61,398

|

|

|

Non-controlling interests

|

|

|

|

|

(206

|

)

|

|

|

2,685

|

|

|

|

(93

|

)

|

|

|

1,624

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total comprehensive income attributable to:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Owners of the parent

|

|

|

|

|

323,660

|

|

|

|

92,312

|

|

|

|

155,064

|

|

|

|

60,841

|

|

|

Non-controlling interests

|

|

|

|

|

(206

|

)

|

|

|

2,927

|

|

|

|

(93

|

)

|

|

|

1,599

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per share for the period attributable to owners of the parent

|

|

15

|

|

|

R$ 1.26

|

|

|

|

R$ 0.38

|

|

|

|

R$ 0.62

|

|

|

|

R$ 0.27

|

|

|

Diluted earnings per share for the period attributable to owners of the parent

|

|

15

|

|

|

R$ 1.24

|

|

|

|

R$ 0.38

|

|

|

|

R$ 0.61

|

|

|

|

R$ 0.27

|

|

The accompanying notes are an integral

part of these unaudited interim condensed consolidated financial statements.

StoneCo Ltd.

Unaudited interim consolidated statement

of changes in equity

For the six months ended June 30,

2019 and 2018

(In thousands of Brazilian Reais)

|

|

|

|

|

Attributable

to owners of the parent

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital

reserve

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issued

capital

|

|

Additional

paid-in capital

|

|

Transactions

among shareholders

|

|

Other

reserves

|

|

Total

|

|

Other

comprehensive income

|

|

Retained

earnings (Accumulated losses)

|

|

Total

|

|

Non-controlling

interest

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of January 1, 2018

|

|

|

|

|

46

|

|

|

|

1,190,902

|

|

|

|

(237,517

|

)

|

|

|

14,364

|

|

|

|

967,749

|

|

|

|

(43,063

|

)

|

|

|

(503,508

|

)

|

|

|

421,224

|

|

|

|

14,059

|

|

|

|

435,283

|

|

|

Capital increase

|

|

|

|

|

-

|

|

|

|

3,240

|

|

|

|

-

|

|

|

|

-

|

|

|

|

3,240

|

|

|

|

-

|

|

|

|

-

|

|

|

|

3,240

|

|

|

|

-

|

|

|

|

3,240

|

|

|

Reclassification of share-based payments liability

to equity

|

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

199,665

|

|

|

|

199,665

|

|

|

|

-

|

|

|

|

-

|

|

|

|

199,665

|

|

|

|

-

|

|

|

|

199,665

|

|

|

Net income for the period

|

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

85,029

|

|

|

|

85,029

|

|

|

|

2,685

|

|

|

|

87,714

|

|

|

Other comprehensive income for the period

|

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

7,283

|

|

|

|

-

|

|

|

|

7,283

|

|

|

|

242

|

|

|

|

7,525

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of June 30,

2018 (unaudited)

|

|

|

|

|

46

|

|

|

|

1,194,142

|

|

|

|

(237,517

|

)

|

|

|

214,029

|

|

|

|

1,170,654

|

|

|

|

(35,780

|

)

|

|

|

(418,479

|

)

|

|

|

716,441

|

|

|

|

16,986

|

|

|

|

733,427

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of December 31, 2018

|

|

|

|

|

62

|

|

|

|

5,440,047

|

|

|

|

(223,676

|

)

|

|

|

135,502

|

|

|

|

5,351,873

|

|

|

|

(56,334

|

)

|

|

|

(202,276

|

)

|

|

|

5,093,325

|

|

|

|

(334

|

)

|

|

|

5,092,991

|

|

|

Share-based payments

|

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

17,013

|

|

|

|

17,013

|

|

|

|

-

|

|

|

|

-

|

|

|

|

17,013

|

|

|

|

-

|

|

|

|

17,013

|

|

|

Net income for the period

|

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

349,095

|

|

|

|

349,095

|

|

|

|

(206

|

)

|

|

|

348,889

|

|

|

Other comprehensive income for the period

|

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(25,435

|

)

|

|

|

-

|

|

|

|

(25,435

|

)

|

|

|

-

|

|

|

|

(25,435

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of June 30,

2019 (unaudited)

|

|

|

|

|

62

|

|

|

|

5,440,047

|

|

|

|

(223,676

|

)

|

|

|

152,515

|

|

|

|

5,368,886

|

|

|

|

(81,769

|

)

|

|

|

146,819

|

|

|

|

5,433,998

|

|

|

|

(540

|

)

|

|

|

5,433,458

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral

part of these unaudited interim condensed consolidated financial statements.

StoneCo Ltd.

Unaudited interim consolidated statement

of cash flows

For the six months ended June 30,

2019 and 2018

(In thousands of Brazilian Reais)

|

|

|

|

|

Six months ended June 30

|

|

|

|

Notes

|

|

2019

|

|

2018

|

|

Operating activities

|

|

|

|

|

|

|

|

Net income for the period

|

|

|

|

|

348,889

|

|

|

|

87,714

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments to reconcile net income (loss) for the period to net cash flows:

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

17

|

|

|

63,849

|

|

|

|

40,025

|

|

|

Deferred income tax expenses

|

|

8

|

|

|

30,441

|

|

|

|

(5,144

|

)

|

|

Loss on investment in associates

|

|

|

|

|

529

|

|

|

|

378

|

|

|

Other financial costs and foreign exchange, net

|

|

|

|

|

27,281

|

|

|

|

72,012

|

|

|

Provision for contingencies

|

|

|

|

|

1,666

|

|

|

|

299

|

|

|

Share-based payments expense

|

|

|

|

|

17,013

|

|

|

|

-

|

|

|

Allowance for doubtful accounts

|

|

|

|

|

20,217

|

|

|

|

8,982

|

|

|

Loss on disposal of property, equipment and intangible assets

|

|

9/10

|

|

|

2,880

|

|

|

|

18,838

|

|

|

Onerous contract

|

|

|

|

|

-

|

|

|

|

(415

|

)

|

|

Fair value adjustment in derivatives

|

|

|

|

|

(7,615

|

)

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Working capital adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

Accounts receivable from card issuers

|

|

|

|

|

(3,302,774

|

)

|

|

|

(683,375

|

)

|

|

Receivables from related parties

|

|

|

|

|

2,963

|

|

|

|

(1,027

|

)

|

|

Recoverable taxes

|

|

|

|

|

(59,377

|

)

|

|

|

(59,111

|

)

|

|

Prepaid expenses

|

|

|

|

|

(7,557

|

)

|

|

|

(5,941

|

)

|

|

Trade and other accounts receivable

|

|

|

|

|

(40,093

|

)

|

|

|

(23,053

|

)

|

|

Accounts payable to clients

|

|

|

|

|

241,412

|

|

|

|

(32,071

|

)

|

|

Taxes payable

|

|

|

|

|

127,655

|

|

|

|

51,211

|

|

|

Labor and social security liabilities

|

|

|

|

|

8,337

|

|

|

|

27,292

|

|

|

Provision for contingencies

|

|

|

|

|

87

|

|

|

|

(10

|

)

|

|

Other Liabilities

|

|

|

|

|

(22,610

|

)

|

|

|

6,548

|

|

|

Interest paid

|

|

12

|

|

|

(86,626

|

)

|

|

|

(75,611

|

)

|

|

Interest income received, net of costs

|

|

|

|

|

547,853

|

|

|

|

217,290

|

|

|

Income tax paid

|

|

|

|

|

(92,901

|

)

|

|

|

(17,835

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash used in operating activities

|

|

|

|

|

(2,178,481

|

)

|

|

|

(373,004

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investing activities

|

|

|

|

|

|

|

|

|

|

|

|

Purchases of property and equipment

|

|

9

|

|

|

(117,004

|

)

|

|

|

(92,476

|

)

|

|

Purchases and development of intangible assets

|

|

10

|

|

|

(29,684

|

)

|

|

|

(24,280

|

)

|

|

Proceeds from (acquisition of) short-term investments, net

|

|

|

|

|

138,445

|

|

|

|

(7,351

|

)

|

|

Proceeds from the disposal of non-current assets

|

|

|

|

|

871

|

|

|

|

1,108

|

|

|

Acquisition of interest in associates

|

|

|

|

|

(7,033

|

)

|

|

|

(386

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash (used in) provided by investing activities

|

|

|

|

|

(14,405

|

)

|

|

|

(123,385

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financing activities

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from borrowings

|

|

12

|

|

|

450.000

|

|

|

|

-

|

|

|

Payment of borrowings

|

|

12

|

|

|

(1,386

|

)

|

|

|

(526

|

)

|

|

Proceeds from FIDC senior quota holders

|

|

12

|

|

|

1,620,000

|

|

|

|

-

|

|

|

Payment of leases

|

|

12

|

|

|

(11,365

|

)

|

|

|

(5,333

|

)

|

|

Capital increase, net of transaction costs

|

|

14

|

|

|

-

|

|

|

|

3,240

|

|

|

Acquisition of non-controlling interests

|

|

|

|

|

(455

|

)

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash used in financing activities

|

|

|

|

|

2,056,794

|

|

|

|

(2,619

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Effect of foreign exchange on cash and cash equivalents

|

|

|

|

|

(1,202

|

)

|

|

|

(50

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Change in cash and cash equivalents

|

|

|

|

|

(137,294

|

)

|

|

|

(499,058

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at beginning of period

|

|

5

|

|

|

297,929

|

|

|

|

641,952

|

|

|

Cash and cash equivalents at end of period

|

|

5

|

|

|

160,635

|

|

|

|

142,894

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Change in cash and cash equivalents

|

|

|

|

|

(137,294

|

)

|

|

|

(499,058

|

)

|

The accompanying notes are an integral part of these unaudited

interim condensed consolidated financial statements.

StoneCo Ltd.

Notes to unaudited interim condensed consolidated

financial statements

June 30, 2019

(In thousands of Brazilian Reais, unless

otherwise stated)

StoneCo Ltd. (the “Company”),

formerly known as DLP Payments Holdings Ltd., is a Cayman Islands exempted company with limited liability, incorporated on March 11,

2014. The registered office of the Company is Harbour Place, 103 South Church Street in George Town, Grand Cayman. The Company’s

principal executive office is located in the city of São Paulo, Brazil.

The Company is controlled by

HR Holdings, LLC, which owns 61.44% of Class B common shares, whose ultimate parent is an investment fund, VCK Investment Fund

Limited SAC, owned by the co-founding individuals.

The Company and its subsidiaries

(collectively, the “Group”) are principally engaged in providing financial technology solutions to clients and integrated

partners to conduct electronic commerce seamlessly across in-store, online, and mobile channels, which include integration to cloud-based

technology platforms, offering services for acceptance of various forms of electronic payment, automation of business processes

at the point-of-sale and working capital solutions.

The Group controls three

investment funds known as Fundo de Investimento em Direitos Creditórios (“FIDC”): (i) TAPSO FIDC

(“FIDC TAPSO”) which provides working capital solution to clients, (ii) FIDC Bancos Emissores de Cartão de

Crédito — Stone (“FIDC AR 1”) and (iii) FIDC Bancos Emissores de Cartão de

Crédito — Stone II (“FIDC AR 2”) used as funding sources to raise capital. A FIDC is legally an

investment fund authorized by the Brazilian Monetary Council, and specifically designed as investment vehicle for investing

in Brazilian credit receivables, such as credit card receivable.

The interim condensed consolidated

financial statements of the Group for the six months ended June 30, 2019 and 2018 were approved at the Board of Directors’

meeting on August 13, 2019.

|

|

1.1.

|

Initial Public Offering and Follow On

|

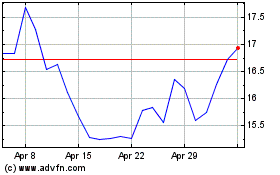

The Company completed its Initial

Public Offering (“IPO”) in October 2018, and in additional to simultaneous transaction, received net proceeds of R$

4,299,695, with R$ 75,774 of offering expenses.

On April 1, 2019 the Company

filed a follow-on prospectus

declared effective

by the Securities and Exchange Commission

(”SEC”) On April 2, 2019 in which selling shareholders offered 19,500,000 Class A common shares of the Company. The

Company did not offer any Class A common shares and did not receive any proceeds from the sale of this shares.

|

|

1.2.

|

Seasonality of operations

|

The Group’s revenues

are subject to seasonal fluctuations as a result of consumer spending patterns. Historically, revenues have been strongest during

the last quarter of the year as a result of higher sales during the Brazilian holiday season. This is due to the increase in the

number and amount of electronic payment transactions related to seasonal retail events. Adverse events that occur during these

months could have a disproportionate effect on the results of operations for the entire fiscal year. As a result of seasonal fluctuations

caused by these and other factors, results for an interim period may not be indicative of those expected for the full fiscal year.

The

interim condensed consolidated financial statements of the Group include the following subsidiaries and structured entities:

|

|

|

|

|

|

|

% Group’s equity interest

|

|

Entity name

|

|

Country of

incorporation

|

|

Principal activities

|

|

June 30,

2019

|

|

December 31,

2018

|

|

|

|

|

|

|

|

|

|

|

|

DLP Capital LLC (“DLP Capital”)

|

|

USA

|

|

Holding company

|

|

100.00

|

|

100.00

|

|

DLPPar Participações S.A. (“DLP Par”)

|

|

Brazil

|

|

Employee trust

|

|

100.00

|

|

100.00

|

|

MPB Capital LLC (“MPB Capital”)

|

|

USA

|

|

Investment company

|

|

100.00

|

|

100.00

|

|

StoneCo Brasil Participações S.A. (“StoneCo Brasil”)

|

|

Brazil

|

|

Holding company

|

|

100.00

|

|

100.00

|

|

Stone Pagamentos S.A. (“Stone”)

|

|

Brazil

|

|

Merchant acquiring

|

|

100.00

|

|

100.00

|

|

MNLT Soluções de Pagamento S.A. (“MNLT”)

|

|

Brazil

|

|

Merchant acquiring

|

|

100.00

|

|

100.00

|

|

Pagar.me Pagamentos S.A. (“Pagar.me”)

|

|

Brazil

|

|

Merchant acquiring

|

|

100.00

|

|

100.00

|

|

Buy4 Processamento de Pagamentos S.A. (“Buy4”)

|

|

Brazil

|

|

Processing card transactions

|

|

100.00

|

|

99.99

|

|

Buy4 Sub LLC (“Buy4 LLC”)

|

|

USA

|

|

Cloud store card transactions

|

|

100.00

|

|

99.99

|

|

Cappta S.A. (“Cappta”)

|

|

Brazil

|

|

Electronic fund transfer

|

|

61.79

|

|

61.79

|

|

Mundipagg Tecnologia em Pagamentos S.A. (“Mundipagg”)

|

|

Brazil

|

|

Technology services

|

|

99.70

|

|

99.70

|

|

Equals S.A. (“Equals”)

|

|

Brazil

|

|

Reconciliation services

|

|

100.00

|

|

100.00

|

|

Stone Franchising Ltda. (“Stone Franchising”)

|

|

Brazil

|

|

Franchising management

|

|

99.99

|

|

99.99

|

|

TAG Tecnologia para o Sistema Financeiro S.A. (“TAG”)

|

|

Brazil

|

|

Financial assets register

|

|

99.98

|

|

99.98

|

|

FIDC TAPSO

|

|

Brazil

|

|

Receivables investment fund

|

|

100.00

|

|

100.00

|

|

FIDC AR 1

|

|

Brazil

|

|

Receivables investment fund

|

|

100.00

|

|

100.00

|

|

FIDC AR 2

|

|

Brazil

|

|

Receivables investment fund

|

|

100.00

|

|

100.00

|

On June 21, 2018, the Group

acquired a 27.06% interest in Linked Gourmet Soluções para Restaurantes S.A. (“Linked”) for R$ 2,366

payable by December 2018. On April, 2019, the Group acquired additional 9,38% interest to 36,44% through capital increase of R$

2,000 in the company payable until December 2019. Linked is an unlisted company based in São Paulo, Brazil, that develops

software and services for the food service market. The Group also holds an option to acquire an additional interest, exercisable

in the period from 2 to 3 years from the date of the initial acquisition, which would allow the Group to obtain control of Linked.

Through this acquisition, the Group expects to obtain synergies in servicing its clients.

On February 6, 2019, the Group

acquired a 25.0% interest in Collact Serviços Digitais Ltda. (“Collact”), a private company based in São

Paulo, Brazil, that develops customer relationship management (“CRM”) software for customer engagement, focused mainly

in the food service segment, with which the Company expects to obtain synergies in its services to clients. The Group will pay

R$ 1,667 until April 2020 for the acquisition of such interest. The Group also holds an option to acquire an additional interest

in the period from 2 to 3 years from the date of the initial acquisition, which will allow the Group to acquire an additional 25%

interest in Collact.

On June 4, 2019, the Group

acquired a 33,33% interest in VHSYS Sistema de Gestão, S.A. (“VHSYS”) for R$ 13,785 payable until January 2020.

The Group also holds an option to acquire an additional interest in the period from 1 to 2 years from the date of the initial acquisition.

VHSYS is an omni-channel, cloud-based, API driven, POS and ERP platform built to serve an array of service and retail businesses.

The self-service platform consists of over 40 applications, accessible a la carte, such as order and sales management, invoicing,

dynamic inventory management, cash and payments management, CRM, mobile messaging, along with marketplace, logistics, and e-commerce

integrations, among others.

|

|

3.

|

Basis of preparation and changes to the Group’s accounting policies

|

|

|

3.1.

|

Basis of preparation

|

The interim condensed consolidated

financial statements for the six months ended June 30, 2019 have been prepared in accordance with IAS 34 –

Interim

Financial Reporting

as issued by the International Accounting Standards Board (“IASB”).

The interim condensed consolidated

financial statements do not include all the information and disclosures required in the annual financial statements and should

be read in conjunction with the Group’s annual consolidated financial statements as of December 31, 2018.

The accounting policies adopted

are consistent with those of the previous financial year and corresponding interim reporting period, except for the adoption of

new and amended standards as set out below.

The interim condensed consolidated

financial statements are presented in Brazilian reais (“R$”), and all values are rounded to the nearest thousand (R$

000), except when otherwise indicated.

|

|

3.2.

|

New and amended standards and interpretations

|

|

|

(i)

|

New and amended standards and interpretations adopted

|

The accounting policies adopted

in the preparation of the interim condensed consolidated financial statements are consistent with those followed in the preparation

of the Group’s annual consolidated financial statements for the year ended December 31, 2018, except for the adoption

of new standards effective as of January 1, 2019.

The Group has adopted IFRS

16 – Leases from January 1, 2019, applying the simplified transition approach, and has not restated comparatives for the

2018 reporting period, as permitted under the specific transitional provisions in the standard. The reclassifications and the adjustments

arising from the new leasing rules are therefore recognized in the opening balance sheet on January 1, 2019.

The Group elected to use the

transition practical expedient allowing the standard to be applied only to contracts that were previously identified as leases

applying IAS 17 – Leases and IFRIC 4 - Determining Whether an Arrangement Contains a Lease at the date of initial application.

The Group also elected to use the recognition exemptions for lease contracts that, at the commencement date, have a lease term

of 12 months or less and do not contain a purchase option (‘short-term leases’), and lease contracts for which the

underlying asset is of low value (‘low-value assets’).

On adoption of IFRS 16, the

group recognized lease liabilities in relation to leases which had previously been classified as ‘operating leases’

under the principles of IAS 17. These liabilities were measured at the present value of the remaining lease payments, discounted

using the lessee’s incremental borrowing rate as of January 1, 2019. The weighted average lessee’s incremental borrowing

rate applied to the lease liabilities on January 1, 2019 was 6.8% per year.

Impact of adoption on the

statement of financial position (increase/(decrease)) as of January 1, 2019 is as follows:

|

|

|

2019

|

|

Assets

|

|

|

|

Property and equipment (Offices)

|

|

|

35,213

|

|

|

Property and equipment (Vehicles)

|

|

|

5,722

|

|

|

Total assets

|

|

|

40,935

|

|

|

|

|

|

|

|

|

Liabilities

|

|

|

|

|

|

Loans and financing

|

|

|

40,935

|

|

|

Deferred tax liabilities

|

|

|

-

|

|

|

Total liabilities

|

|

|

40,935

|

|

Impact of adoption on the

statement of profit or loss (increase/(decrease)) for the six and three months ended June 30, 2019 is as follows:

|

|

|

Six months

|

|

Three months

|

|

Depreciation expense (included in Cost of services)

|

|

|

(233

|

)

|

|

|

(117

|

)

|

|

Depreciation expense (included in Administrative expenses)

|

|

|

(5,485

|

)

|

|

|

(2,831

|

)

|

|

Depreciation expense (included in Selling expenses)

|

|

|

(3,896

|

)

|

|

|

(2,136

|

)

|

|

Financial expenses, net

|

|

|

(1,331

|

)

|

|

|

(664

|

)

|

|

Deferred income tax and social contribution

|

|

|

210

|

|

|

|

103

|

|

|

Rent expense (included in Cost of services and Administrative expenses)

|

|

|

10,328

|

|

|

|

5,446

|

|

|

Profit for the period

|

|

|

(407

|

)

|

|

|

(199

|

)

|

|

Attributable to:

|

|

|

|

|

|

|

|

|

|

Equity holders of the parent

|

|

|

(407

|

)

|

|

|

(199

|

)

|

|

Non-controlling interests

|

|

|

-

|

|

|

|

-

|

|

From January 1, 2019, the payments

of leases (principal and interest) were classified as financing activities, except short-term lease and lease of low-value assets

(classified in operating activity), in accordance with IFRS 16 and IAS 6 – Statement of Cash Flows, reducing the cash flows

of this activity. The impact of adoption on the statement of cash flows (increase/(decrease)) for the six months ended June 30,

2019 is as follows:

|

|

|

June 30,

2019

|

|

Net cash flows from operating activities

|

|

|

10,735

|

|

|

Net cash flows from financing activities

|

|

|

(10,328

|

)

|

There is no impact on other

comprehensive income and the basic and diluted EPS.

a) Nature of the effect of

adoption of IFRS 16

The Group has lease contracts

for various items of Offices, Pin Pads & POS, software, vehicles and other equipment.

Before the adoption of IFRS

16, the Group classified each of its leases (as lessee) at the inception date as either a finance lease or an operating lease.

A lease was classified as a finance lease if it transferred substantially all the risks and rewards incidental to ownership of

the leased asset to the Group; otherwise it was classified as an operating lease. Finance leases were capitalized at the commencement

of the lease at the inception date fair value of the leased property or, if lower, at the present value of the minimum lease payments.

Lease payments were apportioned between interest (recognized as finance costs) and reduction of the lease liability. In an operating

lease, the leased property was not capitalized and the lease payments were recognized as rent expense in the statement of profit

or loss on a straight-line basis over the lease term.

Upon adoption of IFRS 16, the

Group applied a single recognition and measurement approach for all leases that it is the lessee, except for short-term leases

and leases of low-value assets. The Group recognized lease liabilities to make lease payments and right-of-use assets representing

the right to use the underlying assets.

b) Summary of new accounting

policies

Set out below are the new accounting

policies of the Group upon adoption of IFRS 16:

• Right-of-use assets

The Group recognizes right-of-use

assets at the commencement date of the lease. Right-of-use assets are measured at cost, less any accumulated depreciation and impairment

losses, and adjusted for any remeasurement of lease liabilities. The cost of right-of-use assets includes the amount of lease liabilities

recognized, initial direct costs incurred, and lease payments made at or before the commencement date less any lease incentives

received. Unless the Group is reasonably certain to obtain ownership of the leased asset at the end of the lease term, the recognized

right-of-use assets are depreciated on a straight-line basis over the shorter of its estimated useful life and the lease term.

Right-of-use assets are subject to impairment. The Group has also reclassified for better presentation the assets under finance

leases according with IAS 17 previously classified in each of the classes mentioned on item a).

• Lease liabilities

At the commencement date of

the lease, the Group recognizes lease liabilities measured at the present value of lease payments to be made over the lease term.

The lease payments include fixed payments (including in-substance fixed payments) less any lease incentives receivable and amounts

expected to be paid under residual value guarantees. The lease payments also include the exercise price of a purchase option reasonably

certain to be exercised by the Group and payments of penalties for terminating a lease, if the lease term reflects the Group exercising

the option to terminate. The variable lease payments are recognized as expense in the period on which the event or condition that

triggers the payment occurs.

In calculating the present

value of lease payments, the Group uses the incremental borrowing rate at the lease commencement date if the interest rate implicit

in the lease is not readily determinable. After the commencement date, the amount of lease liabilities is increased to reflect

the accretion of interest and reduced for the lease payments made. In addition, the carrying amount of lease liabilities is remeasured

if there is a modification, a change in the lease term, a change in the in-substance fixed lease payments or a change in the assessment

to purchase the underlying asset.

• Short-term leases and

leases of low-value assets

The Group applies the short-term

lease recognition exemption to its short-term leases of Offices, Pin Pads & POS, software, vehicles and equipment (i.e., those

leases that have a lease term of 12 months or less from the commencement date and do not contain a purchase option). It also applies

the lease of low-value assets recognition exemption to leases of office equipment that are considered of low value (i.e., below

US$ 5,000). Lease payments on short-term leases and leases of low-value assets are recognized as expense on a straight-line basis

over the lease term.

c) Amounts recognized in the

statement of financial position and profit or loss

Set out below, are the carrying

amounts of the Group’s right-of-use assets and lease liabilities and the movements during the period:

|

|

|

Right-of-use assets

|

|

|

|

|

|

Offices

|

|

Vehicles

|

|

Total

|

|

Lease liabilities

|

|

As of December 31, 2018

|

|

-

|

|

-

|

|

-

|

|

-

|

|

Initial adoption of IFRS 16

|

|

|

35,213

|

|

|

|

5,722

|

|

|

|

40,935

|

|

|

|

40,935

|

|

|

As of January 1, 2019

|

|

|

35,213

|

|

|

|

5,722

|

|

|

|

40,935

|

|

|

|

40,935

|

|

|

Additions

|

|

|

3,313

|

|

|

|

2,010

|

|

|

|

5,323

|

|

|

|

5,323

|

|

|

Depreciation expense

|

|

|

(7,228

|

)

|

|

|

(2,386

|

)

|

|

|

(9,614

|

)

|

|

|

-

|

|

|

Interest expense

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

1,331

|

|

|

Payments

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(10,328

|

)

|

|

As of June 30, 2019

|

|

|

31,298

|

|

|

|

5,346

|

|

|

|

36,644

|

|

|

|

37,261

|

|

The Group has not early adopted

any other standard, interpretation or amendment that has been issued but is not yet effective.

Several other amendments and

interpretations were applied for the first time in 2019, but do not have an impact on the interim condensed consolidated financial

statements of the Group.

The preparation of interim

condensed financial statements of the Company and its subsidiaries requires management to make judgments and estimates and to adopt

assumptions that affect the amounts presented referring to revenues, expenses, assets and liabilities at the financial statement

date. Actual results may differ from these estimates.

In preparing these interim

condensed consolidated financial statements, the significant judgements and estimates made by management in applying the Group’s

accounting policies and the key sources of estimation uncertainty were the same as those that are set the consolidated financial

statements for the year ended December 31, 2018 and no retrospective adjustments were made.

In

reviewing the operational performance of the Group and allocating resources, the chief operating decision maker of the Group (“CODM”),

who is the Group’s Chief Executive Officer (“CEO”) and the Board of Directors (“BoD”), reviews selected

items of the statement of profit or loss and other comprehensive income.

The

CODM considers the whole Group as a single operating and reportable segment, monitoring operations, making decisions on fund allocation

and evaluating performance based on a single operating segment. The CODM reviews relevant financial data on a combined basis for

all subsidiaries and associates.

The

Group’s revenue, results and assets for this one reportable segment can be determined by reference to the interim condensed

consolidated statement of profit or loss and other comprehensive income and interim condensed consolidated statement of financial

position.

|

|

5.

|

Cash and cash equivalents

|

|

|

|

June 30,

2019

|

|

December 31,

2018

|

|

|

|

|

|

|

|

Short-term bank deposits—denominated in R$

|

|

|

139,047

|

|

|

|

235,488

|

|

|

Short-term bank deposits—denominated in US$

|

|

|

21,588

|

|

|

|

62,441

|

|

|

|

|

|

160,635

|

|

|

|

297,929

|

|

Cash

and cash equivalents in the statement of financial position comprise cash at banks and on hand and short-term deposits with a

maturity of three months or less, which are subject to an insignificant risk of changes in value, readily convertible into cash.

|

|

6.

|

Short-term investments

|

|

|

|

June 30,

2019

|

|

December 31,

2018

|

|

Listed securities (a)

|

|

|

|

|

|

Bonds

|

|

|

2,687,380

|

|

|

|

2,752,743

|

|

|

Unlisted securities (b)

|

|

|

|

|

|

|

|

|

|

Investment funds

|

|

|

9,222

|

|

|

|

9,328

|

|

|

Equity securities

|

|

|

8,242

|

|

|

|

8,518

|

|

|

|

|

|

2,704,844

|

|

|

|

2,770,589

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

Listed securities are comprised of public and private

bonds with maturities greater than three months, indexed to fixed and floating rates. As of June 30, 2019, listed securities are

mainly indexed to 100% CDI rate (2018 – 95% CDI rate).

|

|

|

(b)

|

Unlisted securities are comprised of foreign investment

fund shares, and ordinary shares in entities that are not traded in an active market and whose fair value is determined using

valuation techniques. The Group uses its judgment to select a method and makes assumptions that are mainly based on market conditions

existing at the end of each reporting period. The Group elected to recognize the changes in fair value of the existing equity

instruments through OCI.

|

Short-term investments are

classified as financial assets measured at fair value through profit or loss, unless otherwise elected and indicated, and as Level 1

and 2 under the fair value level hierarchy, as described in Note 19. Short-term investments are denominated in Brazilian Reais,

U.S. dollars and EURO.

|

|

7.

|

Accounts receivable from card issuers

|

|

|

|

June 30,

2019

|

|

December 31,

2018

|

|

|

|

|

|

|

|

Accounts receivable from card issuers (a)

|

|

|

12,442,270

|

|

|

|

9,195,466

|

|

|

Accounts receivable from other acquirers (b)

|

|

|

83,195

|

|

|

|

54,968

|

|

|

Allowance for expected credit losses

|

|

|

(6,550

|

)

|

|

|

(5,826

|

)

|

|

|

|

|

12,518,915

|

|

|

|

9,244,608

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

Accounts receivable from card issuers, net of interchange

fees, as a result of processing transactions with clients.

|

|

|

(b)

|

Accounts receivable from other acquirers related to

PSP (Payment Service Provider) transactions.

|

As of June 30, 2019,

R$ 4,076,643 of the total Accounts receivable from card issuers are held by FIDC AR 1 and FIDC AR 2 (December 31, 2018

— R$ 2,166,132). Accounts receivable held by FIDCs guarantee the obligations to FIDC senior quota holders.

Income taxes are comprised

of taxation over operations in Brazil, related to Corporate Income Tax (“IRPJ”) and Social Contribution on Net Profit

(“CSLL”). According to Brazilian tax law, income taxes and social contribution are assessed and paid by legal entity

and not on a consolidated basis.

(a)

Reconciliation of

income tax expense

The following is a reconciliation

of income tax expense to profit for the period, calculated by applying the combined Brazilian statutory rates at 34% for the six

months ended June 30, 2019 and 2018:

|

|

|

Six months ended June 30

|

|

Three months ended June 30

|

|

|

|

2019

|

|

2018

|

|

2019

|

|

2018

|

|

|

|

|

|

|

|

|

|

|

|

Profit before income taxes

|

|

|

453,976

|

|

|

|

132,140

|

|

|

|

209,142

|

|

|

|

85,327

|

|

|

Brazilian statutory rate

|

|

|

34

|

%

|

|

|

34

|

%

|

|

|

34

|

%

|

|

|

34

|

%

|

|

Tax (expense) at the statutory rate

|

|

|

(154,352

|

)

|

|

|

(44,927

|

)

|

|

|

(71,108

|

)

|

|

|

(29,011

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additions (exclusions):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain (loss) from entities not subject to the payment of income taxes

|

|

|

20,838

|

|

|

|

(3,674

|

)

|

|

|

8,211

|

|

|

|

1,925

|

|

|

Other permanent differences

|

|

|

7,075

|

|

|

|

(501

|

)

|

|

|

5,702

|

|

|

|

305

|

|

|

Equity pickup on associates

|

|

|

(180

|

)

|

|

|

(129

|

)

|

|

|

(180

|

)

|

|

|

(171

|

)

|

|

Unrecorded deferred taxes

|

|

|

(477

|

)

|

|

|

475

|

|

|

|

(191

|

)

|

|

|

800

|

|

|

Use of tax losses previously unrecorded

|

|

|

5,585

|

|

|

|

-

|

|

|

|

5,585

|

|

|

|

(146

|

)

|

|

Previously unrecognized deferred income tax

|

|

|

653

|

|

|

|

234

|

|

|

|

653

|

|

|

|

234

|

|

|

Tax incentives

|

|

|

4,124

|

|

|

|

829

|

|

|

|

2,392

|

|

|

|

492

|

|

|

Interest on capital

|

|

|

6,994

|

|

|

|

-

|

|

|

|

6,994

|

|

|

|

-

|

|

|

Research and development tax benefit

|

|

|

4,653

|

|

|

|

3,267

|

|

|

|

4,653

|

|

|

|

3,267

|

|

|

Total income tax and social contribution (expense)

|

|

|

(105,087

|

)

|

|

|

(44,426

|

)

|

|

|

(37,289

|

)

|

|

|

(22,305

|

)

|

|

Effective tax rate

|

|

|

23

|

%

|

|

|

34

|

%

|

|

|

18

|

%

|

|

|

26

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current income tax and social contribution

|

|

|

(74,646

|

)

|

|

|

(49,570

|

)

|

|

|

(1,593

|

)

|

|

|

(23,059

|

)

|

|

Deferred income tax and social contribution

|

|

|

(30,441

|

)

|

|

|

5,144

|

|

|

|

(35,696

|

)

|

|

|

754

|

|

|

Total income tax and social contribution (expense)

|

|

|

(105,087

|

)

|

|

|

(44,426

|

)

|

|

|

(37,289

|

)

|

|

|

(22,305

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(b)

Deferred income taxes

Net

changes in deferred income taxes relate to the following:

|

|

|

2019

|

|

Begining balance

|

|

|

182,445

|

|

|

Losses available for offsetting against future taxable income

|

|

|

(23,842

|

)

|

|

Tax credit carryforward

|

|

|

(923

|

)

|

|

Temporary differences under FIDC

|

|

|

(17,300

|

)

|

|

Amortization of intangible assets acquired in business combinations

|

|

|