FlexShopper, Inc. (Nasdaq: FPAY) (“FlexShopper” or the “Company”),

a leading national online lease-to-own (“LTO”) retailer and LTO

payment solution provider, today announced its financial results

for both the second quarter and first six months of 2019,

highlighted by continued growth in originations, revenues and

Adjusted EBITDA.

Results for the Quarter Ended June 30,

2019 vs. Quarter Ended June 30, 20181:

- Net lease revenues and

fees1 increased 51.9% to $19.9 million from $13.1

million.

- FlexShopper originated 29,252 gross

leases, up 24.6% from 23,474.

- Gross lease originations increased

$4.0 million, an increase of 43.4%, to $13.2 million from $9.2

million.

- The average origination value

increased to $452 from $393.

- Net loss decreased to $(0.3)

million compared with net loss of $(2.0) million.

- Net loss attributable to common

stockholders declined to $(0.9) million, or $(0.05) per diluted

share, compared to $(2.6) million, or $(0.48) per diluted

share.

- Gross Profit increased 37.9% to

$5.9 million from $4.3 million.

- Adjusted EBITDA increased to $1.7

million compared to ($0.4) million.

Results for the Six Months

Ended June 30, 2019 vs. Six Months Ended June

30, 20181:

- Net lease revenues and fees rose

52.8% to $41.7 million from $27.3 million.

- Lease originations increased from

45,517 to 59,245, for an increase of of 30.2%.

- Gross lease originations increased

$9.3 million, an increase of 50.5%, to $27.7 million from $18.4

million.

- The average origination value

advanced to $467 versus $404.

- Net income posted positive at $0.2

million compared to a net loss of $(4.3) million.

- Net loss attributable to common

shareholders decreased to $(1.0)

million or $(0.06) per diluted share, compared

to $(5.5) million, or $(1.03) per diluted

share.

- Gross Profit increased 53.9% to

$12.8 million from $8.3 million.

- Adjusted EBITDA2 grew to $4.1

million compared to $(1.3) million.

1 Beginning with Q1 2019 financial results, the

Company adopted a new accounting standard which requires revenues

to be reported net of bad debt expense. The Company has

retroactively adopted the provisions of the new accounting standard

to prior periods in order to provide an accurate comparison.2

Adjusted EBITDA is a non-GAAP financial measure. Refer to the

definitions and reconciliations of this measure under “Non-GAAP

Measures.”

Q2 2019 Highlights and Recent

Developments

- Continued growth in

originations. FlexShopper originated 29,252 gross leases

in Q2 2019, representing an increase of 24.6% compared with the

prior year period. Growth continued to be driven by the

combination of repeat customer activity, along with strong growth

in the Company’s B2B channel.

- Lease originations through

third-party retail stores, the Company’s B2B channel, increased

776% compared to the same period last year. In addition,

retail store lease originations increased from 6.7% of total

originations in the second quarter of 2018 to 24.5% of originations

in the second quarter of 2019. Leases

acquired through the Company’s B2B retail channel have

significantly lower acquisition costs than the Company’s direct to

consumer, or B2C, channel.

- The Company’s average cost

to acquire a new customer continued to decrease in the second

quarter of 2019, reaching a new quarterly low of $58, compared to

$167 for the same period in 2018. The Company continues to

optimize its marketing expense, which declined from $1.3 million in

Q2 2018 to $0.3 million in Q2 2019. For the six months ended

June 30, 2019, marketing expense was $1.2 million compared with

$2.4 million in the same period last year.

- Completed roll-outs with

two B2B partners. During Q2, the Company completed the

rollout of its integrationless, mobile app-based LTO checkout

option at more than 560 additional retail locations between two new

retail partners.

- Business model continuing

to gain leverage. Gross Profit increased 37.9%

during Q2 2019 resulting in $712,038 of operating income compared

to an operating loss of $929,568 for the same period last year.

Gross Profit increased 53.9% for the six months ended June 30, 2019

resulting in operating income of $2.4 million compared to an

operating loss of $2.3 million for the same period last

year.

Brad Bernstein, CEO, commented on the Company’s

success, saying “Following strong first quarter results, we are

very pleased to record another quarter of solidly-positive Adjusted

EBITDA. All of our channels are contributing to our lease

origination growth and we are particularly excited about our recent

accelerated growth in our B2B in-store channel. Omnichannel growth,

combined with our strong repeat business, continues to translate

into increases in Gross Profit, which is growing at a faster rate

than our expenses; this has led to our improved bottom line

performance and illustrates the operating leverage of our model. We

are very focused on efficiently increasing lease originations

across all of our channels which ultimately enhances the leverage

in our business.”

2019 Outlook

The Company is updating its guidance for

2019.

|

|

Current Guidance |

Previous Guidance |

|

2019 Gross Lease Originations |

> $72 million |

> $70 million |

|

2019 Gross Revenue |

> $112 million |

> $110 million |

|

2019 Gross Profit |

> $26.5 million |

> $25.5 million |

|

2019 Adjusted EBITDA |

> $5.0 million |

> $4.0 million |

| |

|

|

The Company's guidance for Gross Lease

Originations, Gross Revenue, Gross Profit and Adjusted EBITDA are

forward-looking statements. They are subject to various risks and

uncertainties that could cause the Company's actual results to

differ materially from the anticipated targets. There can be no

assurance the Company will meet these financial projections. See

the cautionary information about forward-looking statements in the

"Forward-Looking Statements" section of this press release.

Additionally, Adjusted EBITDA is a non-GAAP financial measure.

Refer to the definition of this measure under “Non-GAAP Measures,”

but note that information reconciling forward-looking non-GAAP

measures to GAAP measures is not available without unreasonable

effort.

Conference Call Details

|

Date: |

|

Tuesday, August 13, 2019 |

|

Time: |

|

10:00 a.m., Eastern time |

|

|

|

|

|

Participant Dial-In Numbers: |

|

Domestic callers: |

|

(877) 407-3944 |

|

International callers: |

|

(412) 902-0038 |

| |

|

|

Access by Webcast

The call will also be simultaneously webcast over the Internet

via the “Investor” section of the Company’s website at

www.flexshopper.com or by clicking on the conference call link:

https://78449.themediaframe.com/dataconf/productusers/fpay/mediaframe/31688/indexl.html.

An audio replay of the call will be archived on the Company’s

website.

FLEXSHOPPER,

INC.CONSOLIDATED STATEMENTS OF

OPERATIONS(unaudited)

| |

|

For the three months ended June 30, |

|

|

For the six months ended June 30, |

|

| |

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

2018 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Lease revenues and fees, net |

|

$ |

19,901,156 |

|

|

$ |

13,104,990 |

|

|

$ |

41,685,935 |

|

|

$ |

27,266,568 |

|

| Lease merchandise sold |

|

|

763,184 |

|

|

|

487,830 |

|

|

|

1,709,802 |

|

|

|

1,102,348 |

|

|

Total revenues |

|

|

20,664,340 |

|

|

|

13,592,820 |

|

|

|

43,395,737 |

|

|

|

28,368,916 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Costs and

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of lease revenues,

consisting of depreciation and impairment of lease merchandise |

|

|

14,260,308 |

|

|

|

8,987,412 |

|

|

|

29,538,247 |

|

|

|

19,395,158 |

|

| Cost of lease merchandise

sold |

|

|

498,838 |

|

|

|

324,705 |

|

|

|

1,063,845 |

|

|

|

658,468 |

|

| Marketing |

|

|

314,229 |

|

|

|

1,260,237 |

|

|

|

1,162,775 |

|

|

|

2,429,187 |

|

| Salaries and benefits |

|

|

2,037,081 |

|

|

|

2,031,788 |

|

|

|

3,795,168 |

|

|

|

4,211,164 |

|

| Operating expenses |

|

|

2,841,846 |

|

|

|

1,918,246 |

|

|

|

5,438,128 |

|

|

|

3,957,184 |

|

|

Total costs and expenses |

|

|

19,952,302 |

|

|

|

14,522,388 |

|

|

|

40,998,163 |

|

|

|

30,651,161 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

income/(loss) |

|

|

712,038 |

|

|

|

(929,568 |

) |

|

|

2,397,574 |

|

|

|

(2,282,245 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense including

amortization of debt issuance costs |

|

|

1,021,984 |

|

|

|

1,045,338 |

|

|

|

2,203,977 |

|

|

|

1,979,005 |

|

| Net

income/(loss) |

|

|

(309,946 |

) |

|

|

(1,974,906 |

) |

|

|

193,597 |

|

|

|

(4,261,250 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dividends on Series 2

Convertible Preferred Shares |

|

|

609,282 |

|

|

|

604,824 |

|

|

|

1,218,450 |

|

|

|

1,208,504 |

|

| Net loss attributable

to common shareholders |

|

$ |

(919,228 |

) |

|

$ |

(2,579,730 |

) |

|

$ |

(1,024,853 |

) |

|

$ |

(5,469,754 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted

(loss) per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(0.05 |

) |

|

$ |

(0.48 |

) |

|

$ |

(0.06 |

) |

|

$ |

(1.03 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| WEIGHTED AVERAGE COMMON

SHARES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

|

17,666,193 |

|

|

|

5,368,390 |

|

|

|

17,658,562 |

|

|

|

5,331,445 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FLEXSHOPPER,

INC.CONSOLIDATED BALANCE SHEETS

| |

|

June 30, |

|

|

December 31, |

|

| |

|

2019 |

|

|

2018 |

|

| |

|

(unaudited) |

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

| CURRENT ASSETS: |

|

|

|

|

|

|

|

Cash |

|

$ |

2,791,829 |

|

|

$ |

6,141,210 |

|

|

Accounts receivable, net |

|

|

6,897,421 |

|

|

|

6,375,963 |

|

|

Prepaid expenses |

|

|

517,139 |

|

|

|

317,160 |

|

|

Lease merchandise, net |

|

|

24,425,167 |

|

|

|

32,364,697 |

|

|

Total current assets |

|

|

34,631,556 |

|

|

|

45,199,030 |

|

| |

|

|

|

|

|

|

|

|

| PROPERTY AND EQUIPMENT,

net |

|

|

5,266,219 |

|

|

|

3,336,664 |

|

| |

|

|

|

|

|

|

|

|

| OTHER ASSETS, net |

|

|

129,884 |

|

|

|

90,621 |

|

| |

|

$ |

40,027,659 |

|

|

$ |

48,626,315 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| CURRENT LIABILITIES: |

|

|

|

|

|

|

|

|

|

Current portion of loan payable under credit agreement to

beneficial shareholder net of $0 at 2019 and $167,483 at 2018 of

unamortized issuance costs |

|

$ |

- |

|

|

$ |

14,252,717 |

|

|

Accounts payable |

|

|

2,571,890 |

|

|

|

8,317,216 |

|

|

Accrued payroll and related taxes |

|

|

364,659 |

|

|

|

393,095 |

|

|

Promissory notes to related parties net of $13,333 at 2019 and $0

at 2018 of unamortized issuance costs |

|

|

1,053,114 |

|

|

|

1,814,771 |

|

|

Accrued expenses |

|

|

799,468 |

|

|

|

1,335,505 |

|

|

Lease liability - current portion |

|

|

224,998 |

|

|

|

- |

|

|

Total current liabilities |

|

|

5,014,129 |

|

|

|

26,113,304 |

|

| |

|

|

|

|

|

|

|

|

|

Loan payable under credit agreement to beneficial shareholder net

of $226,963 at 2019 and $164,752 at 2018 of unamortized issuance

costs and current portion |

|

|

20,480,678 |

|

|

|

14,020,335 |

|

|

Promissory notes to related parties net of $33,103 at 2019 and $0

at 2018 of unamortized issuance costs and current portion |

|

|

3,716,896 |

|

|

|

- |

|

|

Lease liabilities less current portion |

|

|

1,734,564 |

|

|

|

- |

|

|

Total liabilities |

|

|

30,946,267 |

|

|

|

40,133,639 |

|

| |

|

|

|

|

|

|

|

|

| STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

Series 1 Convertible Preferred Stock, $0.001 par value - authorized

250,000 shares, issued and outstanding 171,191 shares at 2019 and

239,405 shares at 2018 at $5.00 stated value |

|

|

855,955 |

|

|

|

1,197,025 |

|

|

Series 2 Convertible Preferred Stock, $0.001 par value - authorized

25,000 shares, issued and outstanding 21,952 shares at $1,000

stated value |

|

|

21,952,000 |

|

|

|

21,952,000 |

|

|

Common stock, $0.0001 par value- authorized 40,000,000 shares,

issued and outstanding 17,666,193 shares at 2019 and 17,579,870

shares at 2018 |

|

|

1,767 |

|

|

|

1,758 |

|

|

Additional paid in capital |

|

|

34,810,668 |

|

|

|

34,074,488 |

|

|

Accumulated deficit |

|

|

(48,538,998 |

) |

|

|

(48,732,595 |

) |

|

Total stockholders’ equity |

|

|

9,081,392 |

|

|

|

8,492,676 |

|

| |

|

$ |

40,027,659 |

|

|

$ |

48,626,315 |

|

| |

|

|

|

|

|

|

|

|

FLEXSHOPPER,

INC.CONSOLIDATED STATEMENTS OF CASH

FLOWSFor the six months ended June 30, 2019 and

2018(unaudited)

| |

|

2019 |

|

|

2018 |

|

| CASH FLOWS FROM OPERATING

ACTIVITIES: |

|

|

|

|

|

|

|

Net income/(loss) |

|

$ |

193,597 |

|

|

$ |

(4,261,250 |

) |

|

Adjustments to reconcile net income/(loss) to net cash used in

operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation and impairment of lease merchandise |

|

|

29,538,247 |

|

|

|

19,395,158 |

|

|

Other depreciation and amortization |

|

|

1,237,143 |

|

|

|

1,191,510 |

|

|

Compensation expense related to issuance of stock options and

warrants |

|

|

371,972 |

|

|

|

72,481 |

|

|

Provision for doubtful accounts |

|

|

15,774,830 |

|

|

|

10,658,805 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(16,296,288 |

) |

|

|

(10,504,020 |

) |

|

Prepaid expenses and other |

|

|

(198,666 |

) |

|

|

(60,167 |

) |

|

Lease merchandise |

|

|

(21,598,717 |

) |

|

|

(15,786,419 |

) |

|

Security deposits |

|

|

(40,801 |

) |

|

|

- |

|

|

Accounts payable |

|

|

(5,745,326 |

) |

|

|

(3,188,174 |

) |

|

Accrued payroll and related taxes |

|

|

(28,436 |

) |

|

|

(38,832 |

) |

|

Accrued expenses |

|

|

(511,712 |

) |

|

|

108,198 |

|

|

Net cash used in operating activities |

|

|

(2,695,843 |

) |

|

|

(2,412,710 |

) |

| |

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES |

|

|

|

|

|

|

|

|

|

Purchases of property and equipment, including capitalized software

costs |

|

|

(1,105,122 |

) |

|

|

(1,021,551 |

) |

|

Net cash used in investing activities |

|

|

(1,105,122 |

) |

|

|

(1,021,551 |

) |

| |

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES |

|

|

|

|

|

|

|

|

|

Refund of equity issuance related costs |

|

|

23,147 |

|

|

|

- |

|

|

Proceeds from exercise of warrants |

|

|

- |

|

|

|

1,750 |

|

|

Proceeds from promissory notes, net of fees |

|

|

3,440,000 |

|

|

|

3,465,000 |

|

|

Repayment of promissory note |

|

|

(500,000 |

) |

|

|

- |

|

|

Proceeds from loan payable under credit agreement |

|

|

1,358,343 |

|

|

|

3,550,000 |

|

|

Repayment of loan payable under credit agreement |

|

|

(9,255,988 |

) |

|

|

(6,420,852 |

) |

|

Repayment of installment loan |

|

|

(5,604 |

) |

|

|

(5,604 |

) |

|

Debt issuance related costs |

|

|

- |

|

|

|

(69,000 |

) |

|

Net cash (used in) provided by financing activities |

|

|

(4,940,102 |

) |

|

|

521,294 |

|

| |

|

|

|

|

|

|

|

|

|

DECREASE IN CASH |

|

|

(3,349,381 |

) |

|

|

(2,912,967 |

) |

| |

|

|

|

|

|

|

|

|

| CASH, beginning of period |

|

|

6,141,210 |

|

|

|

4,968,915 |

|

| |

|

|

|

|

|

|

|

|

| CASH, end of period |

|

$ |

2,791,829 |

|

|

$ |

2,055,948 |

|

| |

|

|

|

|

|

|

|

|

| Supplemental cash flow

information: |

|

|

|

|

|

|

|

|

|

Interest paid |

|

$ |

1,936,218 |

|

|

$ |

1,422,484 |

|

| Non-cash financing

activities: |

|

|

|

|

|

|

|

|

|

Conversion of preferred stock to common stock |

|

$ |

341,070 |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Measures

We regularly review a number of metrics,

including the following key metrics, to evaluate our business,

measure our performance, identify trends affecting our business,

formulate financial projections and make strategic decisions.

Adjusted EBITDA represents net income before

interest, stock-based compensation, taxes, depreciation (other than

depreciation of leased inventory), amortization, and one-time or

non-recurring items. We believe that Adjusted EBITDA provides

us with an understanding of one aspect of earnings before the

impact of investing and financing charges and income

taxes.

Key performance metrics for the three months ended June 30, 2019

and 2018 were as follows:

| |

|

Three months ended June 30, |

|

|

|

|

|

|

|

| |

|

2019 |

|

|

2018 |

|

|

$ Change |

|

|

% Change |

|

| Adjusted

EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income/(loss) |

|

$ |

(309,946 |

) |

|

$ |

(1,974,906 |

) |

|

$ |

1,664,960 |

|

|

|

84.3 |

|

| Amortization of debt

costs |

|

|

58,569 |

|

|

|

160,903 |

|

|

|

(102,334 |

) |

|

|

(63.6 |

) |

| Other amortization and

depreciation |

|

|

593,605 |

|

|

|

462,530 |

|

|

|

131,075 |

|

|

|

28.3 |

|

| Interest expense |

|

|

963,415 |

|

|

|

884,435 |

|

|

|

78,980 |

|

|

|

8.9 |

|

| Stock compensation |

|

|

303,243 |

|

|

|

22,779 |

|

|

|

280,464 |

|

|

|

1,231.2 |

|

| Non-recurring

product/infrastructure expenses |

|

|

134,814 |

|

|

|

- |

|

|

|

134,814 |

|

|

|

- |

|

| Adjusted EBITDA |

|

$ |

1,743,699 |

|

|

$ |

(444,259 |

) |

|

$ |

2,187,958 |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Key performance metrics for the six months ended June 30, 2019

and 2018 were as follows:

| |

|

Six months ended June 30, |

|

|

|

|

|

|

|

| |

|

2019 |

|

|

2018 |

|

|

$ Change |

|

|

% Change |

|

| Adjusted

EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income/(loss) |

|

$ |

193,597 |

|

|

$ |

(4,261,250 |

) |

|

$ |

4,454,847 |

|

|

|

- |

|

| Amortization of debt

costs |

|

|

118,834 |

|

|

|

293,307 |

|

|

|

(174,473 |

) |

|

|

(59.5 |

) |

| Other amortization and

depreciation |

|

|

1,118,308 |

|

|

|

898,204 |

|

|

|

220,104 |

|

|

|

24.5 |

|

| Interest expense |

|

|

2,085,143 |

|

|

|

1,685,698 |

|

|

|

399,445 |

|

|

|

23.7 |

|

| Stock compensation |

|

|

328,772 |

|

|

|

72,481 |

|

|

|

256,291 |

|

|

|

353.6 |

|

| Non recurring

product/infrastructure expenses |

|

|

227,111 |

|

|

|

- |

|

|

|

227,111 |

|

|

|

- |

|

| Adjusted EBITDA |

|

$ |

4,071,765 |

|

|

$ |

(1,311,560 |

) |

|

$ |

5,156,214 |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Company refers to Adjusted EBITDA in the

above tables as the Company uses this measure to evaluate operating

performance and to make strategic decisions about the

Company. Management believes that Adjusted EBITDA provides

relevant and useful information which is widely used by analysts,

investors and competitors in its industry in assessing

performance.

About FlexShopper

FlexShopper, Inc. is a financial and technology

company that provides brand name electronics, home furnishings and

other durable goods to consumers on a lease-to-own (LTO) basis

through its e-commerce marketplace (www.FlexShopper.com) as well as

its patented and patent pending systems. FlexShopper also provides

LTO technology platforms to retailers and e-retailers to facilitate

transactions with consumers that want to acquire their products,

but do not have sufficient cash or credit. FlexShopper approves

consumers utilizing its proprietary consumer screening model,

collects from consumers under an LTO contract and funds the LTO

transactions by paying merchants for the goods.

Forward-Looking Statements

All statements in this release that are not

based on historical fact are “forward-looking statements” within

the meaning of Section 21E of the Securities Exchange Act of 1934.

These statements include the Company’s financial guidance for

fiscal year 2019 appearing under “2019 Outlook” above.

Forward-looking statements, which are based on certain assumptions

and describe our future plans, strategies and expectations, can

generally be identified by the use of forward-looking terms such as

“believe,” “expect,” “may,” “will,” “should,” “could,” “seek,”

“intend,” “plan,” “goal,” “estimate,” “anticipate,” or other

comparable terms. Examples of forward-looking statements include,

among others, statements we make regarding expectations of lease

originations during the holiday season; the expansion of our

lease-to-own program; expectations concerning our partnerships with

retail partners; investments in, and the success of, our

underwriting technology and risk analytics platform; our ability to

collect payments due from customers; expected future operating

results; and expectations concerning our business strategy.

Forward-looking statements involve inherent risks and uncertainties

which could cause actual results to differ materially from those in

the forward-looking statements, as a result of various factors

including, among others, the following: our limited operating

history, limited cash and history of losses; our ability to obtain

adequate financing to fund our business operations in the future;

the failure to successfully manage and grow our FlexShopper.com

e-commerce platform; our ability to maintain compliance with

financial covenants under our credit agreement; our dependence on

the success of our third-party retail partners and our continued

relationships with them; our compliance with various federal, state

and local laws and regulations, including those related to consumer

protection; the failure to protect the integrity and security of

customer and employee information; and the other risks and

uncertainties described in the Risk Factors and in Management’s

Discussion and Analysis of Financial Condition and Results of

Operations sections of our Annual Report on Form 10-K and

subsequently filed Quarterly Reports on Form 10-Q. The

forward-looking statements made in this release speak only as of

the date of this release, and FlexShopper assumes no obligation to

update any such forward-looking statements to reflect actual

results or changes in expectations, except as otherwise required by

U.S. federal securities laws.

Contact:Jeremy HellmanVice

PresidentThe Equity Group212-836-9626jhellman@equityny.com

FlexShopper, Inc.Investor

Relationsir@flexshopper.com

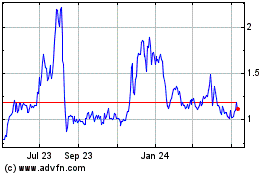

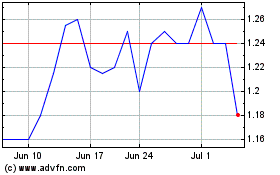

FlexShopper, Inc.

FlexShopper (NASDAQ:FPAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

FlexShopper (NASDAQ:FPAY)

Historical Stock Chart

From Apr 2023 to Apr 2024