Exhibit 99.1

NXT ENERGY SOLUTIONS INC.

Unaudited Condensed Consolidated Interim Financial

Statements

For the three and six months ended

June 30, 2019

NXT ENERGY SOLUTIONS INC.

Condensed Consolidated Interim Balance Sheets

(Unaudited-expressed

in Canadian dollars)

|

|

|

|

|

|

|

|

|

Assets

|

|

|

|

Current

assets

|

|

|

|

Cash

and cash equivalents

|

$

1,156,351

|

$

339,532

|

|

Short-term

investments (Note 3)

|

1,800,000

|

3,900,000

|

|

Accounts

receivable (Note 4)

|

9,129,288

|

61,279

|

|

Prepaid

expenses

|

226,055

|

65,159

|

|

|

12,311,694

|

4,365,970

|

|

Long

term assets

|

|

|

|

Deposits

(Note 5)

|

539,306

|

560,341

|

|

Property

and equipment (Note 6)

|

505,935

|

683,157

|

|

Right

of use Assets (Note 7)

|

3,307,277

|

-

|

|

Intellectual

property (Note 8)

|

18,812,433

|

19,654,800

|

|

|

$

35,476,645

|

$

25,264,268

|

|

Liabilities and Shareholders' Equity

|

|

|

|

Current

liabilities

|

|

|

|

Accounts

payable and accrued liabilities (Note 9)

|

$

1,025,418

|

$

499,535

|

|

Deferred

revenue

|

-

|

-

|

|

Contract

Obligations (Note 10)

|

132,079

|

-

|

|

Current

portion of capital lease obligation (Note 11)

|

703,423

|

42,603

|

|

|

1,860,920

|

542,138

|

|

Long-term

liabilities

|

|

|

|

Long-term

lease obligation (Note 11)

|

3,046,322

|

42,515

|

|

Other

liabilities

|

-

|

362,368

|

|

Asset

retirement obligation

|

27,816

|

26,778

|

|

Deferred

charges

|

-

|

79,000

|

|

|

3,074,138

|

510,661

|

|

|

4,935,058

|

1,052,799

|

|

Commitments

and contingencies (Note 12)

|

|

|

|

Going

concern (Note 1)

|

|

|

|

Shareholders'

equity

|

|

|

|

Common

shares (Note 13): - authorized unlimited

|

|

|

|

Issued:

68,573,558 (2018 - 68,573,558) common shares

|

96,656,248

|

96,656,248

|

|

Contributed

capital

|

9,270,234

|

9,262,684

|

|

Deficit

|

(76,095,829

)

|

(82,418,397

)

|

|

Accumulated

other comprehensive income

|

710,934

|

710,934

|

|

|

30,541,587

|

24,211,469

|

|

|

$

35,476,645

|

$

25,264,268

|

|

Signed

"George Liszicasz"

|

|

Signed

"Bruce G. Wilcox"

|

|

Director

|

|

Director

|

The

accompanying notes are an integral part of these condensed

consolidated interim financial statements.

NXT ENERGY SOLUTIONS INC.

Condensed

Consolidated Interim

Statements of Income (Loss) and

Comprehensive Income (Loss)

(Unaudited-expressed

in Canadian dollars)

|

|

For the

three months ended June 30,

|

For the

six months ended June 30,

|

|

|

|

|

|

|

|

Revenue

|

|

|

|

|

|

Survey

revenue (Note 18)

|

$

10,954,617

|

$

-

|

$

10,954,617

|

$

-

|

|

Expenses

|

|

|

|

|

|

Survey

costs, net

|

1,412,380

|

267,672

|

1,790,113

|

517,434

|

|

General

and administrative expenses

|

767,401

|

1,110,634

|

1,689,150

|

2,092,038

|

|

Stock

based compensation expense

|

3,775

|

153,791

|

7,550

|

449,075

|

|

Amortization

expense (Note 6 and 8)

|

443,154

|

447,192

|

886,851

|

894,383

|

|

|

2,626,710

|

1,979,289

|

4,373,664

|

3,952,930

|

|

|

|

|

|

|

Interest

expense (income), net

|

3,916

|

(14,276

)

|

7,116

|

(14,207

)

|

|

Foreign

exchange (gain) loss

|

234,244

|

(3,264

)

|

240,350

|

(10,136

)

|

|

Intellectual

property and other expenses

|

3,859

|

(635

)

|

10,919

|

(12,823

)

|

|

|

242,019

|

(18,175

)

|

258,385

|

(37,166

)

|

|

|

|

|

|

|

|

Income (loss) before income tax

|

8,085,888

|

(1,961,114

)

|

6,322,568

|

(3,915,764

)

|

|

|

|

|

|

|

Current

|

-

|

-

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) and comprehensive income

(loss)

|

8,085,888

|

(1,961,114

)

|

6,322,568

|

(3,915,764

)

|

Net income (loss) per share (Note 14)

|

|

|

|

|

Basic

|

$

0.12

|

$

(0.03

)

|

$

0.09

|

$

(0.06

)

|

|

Diluted

|

$

0.11

|

$

(0.03

)

|

$

0.09

|

$

(0.06

)

|

The

accompanying notes are an integral part of these condensed

consolidated interim financial statements.

NXT

ENERGY SOLUTIONS INC.

Condensed

Consolidated Interim

Statements of Cash Flows

(Unaudited-expressed

in Canadian dollars)

|

|

For the three months ended June 30,

|

For the six months ended June 30,

|

|

|

|

|

|

|

|

Cash provided by (used in):

|

|

|

|

|

|

Operating activities

|

|

|

|

|

|

Comprehensive

income (loss) for the period

|

$

8,085,888

|

$

(1,961,114

)

|

6,322,568

|

$

(3,915,764

)

|

|

Items

not affecting cash:

|

|

|

|

|

|

Stock

based compensation expense (Note 15)

|

3,775

|

153,791

|

7,550

|

449,075

|

|

Amortization

expense (Notes 6 and 8)

|

443,154

|

447,192

|

886,851

|

894,383

|

|

Non-cash

changes to asset retirement obligation

|

521

|

518

|

1,037

|

1,035

|

|

Amortization

of financial liability

|

(42,824

)

|

-

|

(85,649

)

|

-

|

|

Foreign

Exchange

|

218,113

|

(17,321

)

|

224,219

|

(23,611

)

|

|

Amortization

of deferred gain on sale of aircraft

|

-

|

(38,825

)

|

-

|

(77,650

)

|

|

Deferred

rent

|

-

|

(730

)

|

-

|

(1,460

)

|

|

Change

in non-cash working capital balances (Note 17)

|

(9,092,898

)

|

(526,475

)

|

(8,618,826

)

|

(607,880

)

|

|

|

(8,470,159

)

|

18,150

|

(7,584,818

)

|

633,892

|

|

Net

cash used in operating activities

|

(384,271

)

|

(1,942,964

)

|

(1,262,250

)

|

(3,281,872

)

|

|

|

|

|

|

|

|

Financing activities

|

|

|

|

|

|

Proceeds

from exercise of stock options

|

-

|

-

|

-

|

5,067

|

|

Net

Proceeds from Private Placement

|

-

|

4,103,011

|

-

|

8,392,332

|

|

Repayment

of capital lease obligation

|

(10,554

)

|

(9,806

)

|

(20,931

)

|

(19,458

)

|

|

Net

cash from (used in) financing activities

|

(10,554

)

|

4,093,205

|

(20,931

)

|

8,377,941

|

|

|

|

|

|

|

|

Investing activities

|

|

|

|

|

|

Proceeds

for sale/purchase of property and equipment, net

|

-

|

(10,006

)

|

-

|

(10,006

)

|

|

Increase

in short-term investments

|

900,000

|

(4,950,001

)

|

2,100,000

|

(4,300,000

)

|

|

Net

cash from (used in) investing activities

|

900,000

|

(4,960,007

)

|

2,100,000

|

(4,310,006

)

|

|

|

|

|

|

|

|

Net

increase (decrease) in cash and cash equivalents

|

505,175

|

(2,809,766

)

|

816,819

|

786,063

|

|

Cash

and cash equivalents, beginning of the period

|

651,176

|

3,762,447

|

339,532

|

166,618

|

|

Cash

and cash equivalents, end of the period

|

$

1,156,351

|

$

952,681

|

$

1,156,351

|

$

952,681

|

|

|

|

|

|

|

|

Supplemental information

|

|

|

|

|

|

|

(15,799

)

|

(10,339

)

|

(32,390

)

|

(10,931

)

|

|

Cash taxes paid

|

-

|

-

|

-

|

-

|

The

accompanying notes are an integral part of these condensed

consolidated interim financial statements.

NXT ENERGY SOLUTIONS INC.

Condensed

Consolidated Interim

Statements of Shareholders'

Equity

(Unaudited-expressed

in Canadian dollars)

|

|

For the six

months ending June 30,

|

|

|

|

|

|

Common Shares

|

|

|

|

Balance

at beginning of the period (Note 13)

|

$

96,656,248

|

$

88,121,286

|

|

Issuance

of Common Stock on Private Placement

|

-

|

7,438,085

|

|

Issued

upon exercise of stock options

|

-

|

5,067

|

|

Transfer

from contributed capital upon exercise of stock

options

|

-

|

6,441

|

|

Balance

at end of the period

|

96,656,248

|

95,570,879

|

|

Contributed Capital

|

|

|

|

Balance

at beginning of the period

|

9,262,684

|

8,195,075

|

|

Issuance

of warrants on Private Placement

|

-

|

698,932

|

|

Recognition

of stock based compensation expense

|

7,550

|

449,075

|

|

Contributed

capital transferred to common shares

|

-

|

-

|

|

upon

exercise of stock options

|

-

|

(6,441

)

|

|

|

|

|

|

Balance

at end of the period

|

9,270,234

|

9,336,641

|

|

Deficit

|

|

|

|

Balance

at beginning of the period

|

(82,418,397

)

|

(75,449,887

)

|

|

Net

income (loss) and comprehensive income (loss)

|

6,322,568

|

(3,915,764

)

|

|

|

|

|

|

Balance

at end of the period

|

(76,095,829

)

|

(79,365,651

)

|

|

Accumulated Other Comprehensive Income

|

|

|

|

Balance

at beginning and end of the period

|

710,934

|

710,935

|

|

Total Shareholders' Equity at end of the period

|

$

30,541,587

|

$

26,252,804

|

The

accompanying notes are an integral part of these condensed

consolidated interim financial statements.

NXT ENERGY SOLUTIONS INC.

Notes

to the Unaudited Condensed Consolidated Interim Financial

Statements

As at

and for three years and six months periods ended June 30,

2019

(Expressed in Canadian dollars unless otherwise

stated)

1. The Company and Going Concern

NXT

Energy Solutions Inc. (the "Company" or "NXT") is a publicly traded

company based in Calgary, Alberta Canada.

NXT's

proprietary Stress Field Detection ("SFD

®

") technology is

an airborne survey system that is used in the oil and natural gas

exploration industry to identify subsurface trapped fluid

accumulations. These condensed consolidated interim financial

statements have been prepared on a going concern basis. The

going concern basis of presentation assumes that NXT will continue

in operation for the foreseeable future and will be able to realize

its assets and discharge its liabilities and commitments in the

normal course of business.

The

events described in the following paragraphs highlight that there

is substantial doubt about NXT’s ability to continue as a

going concern within one year after the date that these financial

statements have been issued.

The

Company’s current cash position, in addition to payments of

approximately $4,400,000 United States Dollars received in the

third quarter on the Nigerian SFD

®

survey are not

expected to be sufficient to meet the Company’s obligations

for the 12 month period beyond the date that these financial

statements have been issued. With completion of the Nigerian

SFD

®

survey, the Company’s cash position will improve if contract

milestones payments continue to be made as per contract

terms.

The

Company is also taken future steps to reduce costs which include

evaluating alternatives to reduce aircraft and office costs. In

addition, the Advisory Board has been suspended indefinitely and

staffing costs are being reduced with new Human Resource policies.

If required, further financing options that may or may not be

available to the Company include issuance of new equity, debentures

or bank credit facilities. The need for any of these options

will be dependent on the timing of securing new contracts and

obtaining financing terms that are acceptable to both the Company

and the financier.

NXT

continues to develop its pipeline of opportunities to secure new

revenue contracts. However, the Company’s longer-term success

remains dependent upon its ability convert these opportunities into

successful contracts and to continue to attract new client projects

and expand the revenue base to a level sufficient to exceed fixed

operating costs and generate positive cash flow from

operations. The occurrence and timing of these events cannot

be predicted with certainty.

The

condensed consolidated financial interim statements do not reflect

adjustments that would be necessary if the going concern basis was

not appropriate. If the going concern basis was not

appropriate for these consolidated financial statements, then

significant adjustments would be necessary in the classification

and carrying value of assets and liabilities and the reported

revenues and expenses.

NXT ENERGY SOLUTIONS INC.

Notes

to the Unaudited Condensed Consolidated Interim Financial

Statements

As at

and for the three and six month periods ended June 30,

2019

(Expressed in Canadian dollars unless otherwise

stated)

2. Significant Accounting Policies

Basis of Presentation

These

condensed consolidated interim financial statements for the period

ended June 30, 2019 have been prepared by management in accordance

with generally accepted accounting principles of the United States

of America ("US GAAP") and by applying the same accounting policies

and methods as used in preparing the consolidated financial

statements for the fiscal year ended December 31, 2018, except as

noted below.

Update to Significant Accounting Policies

Revenue

The performance obligation for NXT is the acquisition, processing,

interpretation and integration of Stress Field Detection

(SFD

®

) data. Revenue

from the sale of SFD

®

survey

contracts (net of any related foreign sales taxes) is recognized

over time by measuring the progress toward satisfaction of its

performance obligations to the customer.

All funds received or invoiced in

advance of recognition of revenue are reflected as contract

obligations and classified as a current liability on our balance

sheet.

The Company uses direct survey costs as the input measure to

recognize revenue given in any fiscal period. The percentage of

direct survey costs incurred to date over the total expected survey

costs to be incurred, provides an appropriate measure of the stage

performance obligation being satisfied over time.

Leases

On January 1, 2019, NXT adopted ASC Topic 842, Leases (“Topic

842”) and related amendments, using the modified

retrospective approach recognizing a cumulative effect adjustment

at the beginning of the reporting period in which Topic 842 was

applied. Results for reporting the periods beginning after January

1, 2019, are presented in accordance with Topic 842, while prior

periods have not been restated and are reported in accordance with

ASC Topic 840, Leases (“Topic 840”). On transition, NXT

elected certain practical expedients permitted under Topic 842

which include:

a)

No reassessment of the classification of leases previously assessed

under Topic 840.

b)

The use of hindsight in determining the lease term where the

contract contains terms to extend or terminate the

lease

The policy and disclosures required under Topic 842 are included in

Note 11, Leases.

NXT ENERGY SOLUTIONS INC.

Notes

to the Unaudited Condensed Consolidated Interim Financial

Statements

As at

and for the three and six month periods ended June 30,

2019

(Expressed in Canadian dollars unless otherwise

stated)

In accordance with Topic 842, NXT recognized a Right of Use ("ROU")

asset and corresponding lease liability for all operating leases on

the Condensed Consolidated Interim Balance Sheet. Prior to the

adoption of Topic 842, operating leases were not recognized on the

Condensed Consolidated Interim Balance Sheet. There was no impact

to finance leases on transition to Topic 842. The impact from

recognizing operating leases on NXT’s Condensed Consolidated

Balance Sheet is as follows:

|

Account

|

|

As reported

December 31,

2018

|

|

Balance on

Adoption as at

January 1,

2019

|

|

Property

and equipment

|

i

|

$

683,157

|

$

(139,725

)

|

$

543,432

|

|

Right

of Use

|

|

-

|

3,536,161

|

3,536,161

|

|

Total

Assets

|

|

$

25,264,268

|

$

3,396,436

|

$

28,660,704

|

|

|

|

|

|

|

|

Accounts

payable and accrued liabilities

|

|

$

499,535

|

$

(155,301

)

|

$

344,234

|

|

Current

portion of capital lease obligations

|

i

|

42,603

|

(42,603

)

|

-

|

|

Current

portion of lease obligations

|

|

-

|

672,087

|

672,087

|

|

Capital

lease obligations

|

i

|

42,515

|

(42,515

)

|

-

|

|

Long-term

lease obligations

|

|

-

|

3,406,136

|

3,406,136

|

|

Other

liabilities

|

|

362,368

|

(362,368

)

|

-

|

|

Deferred

charges

|

|

79,000

|

(79,000

)

|

-

|

|

Total

Liabilities and Shareholders’ Equity

|

|

$

25,264,268

|

$

3,396,436

|

$

28,660,704

|

Notes:

i.

Reclassify

previously recognized finance leases:

Leases

accounted for as finance leases were reclassified to ROU Assets and

lease liabilities from property, plant and equipment and capital

lease obligations, respectively.

The

Company recognized lease liabilities in relation to leases which

had previously been classified as operating. Under the principles

of the new standard these leases have been measured at the present

value of the remaining lease payments, discounted using the

Company’s estimated incremental borrowing rates or implied

interest rate in the lease contract. Rates varied between 7.4% and

15.7%. Total lease liabilities of $4,078,223 were recorded as at

January 1, 2019, of which $672,087 is the current

portion.

iii.

Account

payable and other accrued liabilities, Other

liabilities:

The

deferred gain on sale of the aircraft was reclassified from

Accounts payable and other accrued liabilities and Other

liabilities to Current portion of lease obligations and Long-term

Lease Obligations.

The

Deferred charges for the office lease have been reclassified to ROU

assets and are being amortized on a straight line basis over the

remaining period of the lease.

NXT ENERGY SOLUTIONS INC.

Notes

to the Unaudited Condensed Consolidated Interim Financial

Statements

As at

and for the

three and six month

periods ended June 30, 2019

(Expressed in Canadian dollars unless otherwise

stated)

Although

Topic 842 does not have a material impact on the Condensed

Consolidated Statements of Earnings or Cash Flows, the change in

the accounting of the aircraft lease now has interest expense of

$18,228 and $38,019 for the three and six months ended June 30,

2019 being recorded, whereas under Topic 840 that amount was

recorded under survey costs. In the Condensed Consolidated Interim

Statements of Cash Flows under Operating Activities, amortization

of deferred gain on sale of aircraft and deferred rent are now

presented as Non-cash lease and interest expense, under Topic

842.

3. Short-term investments

Short-term

investments consist of Guaranteed Investment Certificates

(“GIC’s”) with maturity dates of one year from

the date of purchase for Canadian Dollar GIC’s and overnight

for United States GIC’s. For June 30, 2019, interest rates

are 2.15%. For December 31, 2018, interest rates ranged from 2.10%

to 2.15%.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One year cashable

GIC’s

|

$

1,800,000

|

$

3,900,000

|

|

|

1,800,000

|

3,900,000

|

4. Accounts Receivable

Accounts

receivable are all current as of June 30, 2019.

|

|

|

|

|

|

|

|

|

|

|

|

Trade

receivables

|

$

9,011,158

|

$

-

|

|

Other

receivables

|

118,130

|

61,279

|

|

|

9,129,288

|

61,279

|

|

Allowance

for doubtful accounts

|

-

|

-

|

|

Net

accounts receivable

|

9,129,288

|

61,279

|

NXT ENERGY SOLUTIONS INC.

Notes

to the Unaudited Condensed Consolidated Interim Financial

Statements

As at

and for the

three and six month

periods ended June 30, 2019

(Expressed in Canadian dollars unless otherwise

stated)

5. Deposits

Security

deposits have been made to the lessors of the office building and

the aircraft. The aircraft deposit is held in United States

Dollars.

|

|

|

|

|

|

|

|

|

|

|

|

Building

|

$

43,309

|

$

43,310

|

|

Aircraft

|

495,997

|

517,031

|

|

|

539,306

|

560,341

|

6. Property and equipment

|

|

|

|

|

|

For the period ended June 30, 2019

|

|

|

|

|

Survey

equipment

|

$

684,890

|

$

634,033

|

$

50,858

|

|

Computers

and software

|

1,256,101

|

1,209,768

|

46,333

|

|

Furniture

and other equipment

|

528,420

|

506,737

|

21,683

|

|

Leasehold

improvements

|

965,108

|

578,047

|

387,062

|

|

|

3,434,519

|

2,926,584

|

505,935

|

|

|

|

|

|

|

|

|

|

|

|

For the period ended December 31, 2018

|

|

|

|

|

Survey

equipment

|

$

684,890

|

$

628,037

|

$

56,853

|

|

Computers

and software

|

1,256,101

|

1,201,047

|

55,054

|

|

Furniture

and other equipment

|

528,420

|

504,328

|

24,092

|

|

Leasehold

improvements

|

1,165,108

|

617,950

|

547,158

|

|

|

3,634,519

|

2,951,362

|

683,157

|

NXT ENERGY SOLUTIONS INC.

Notes

to the Unaudited Condensed Consolidated Interim Financial

Statements

As at

and for the

three and six month

periods ended June 30, 2019

(Expressed in Canadian dollars unless otherwise

stated)

7

. Right of

use assets

|

|

|

|

|

|

For the period ended June 30, 2019

|

|

|

|

|

Aircraft

|

$

1,578,774

|

$

123,385

|

$

1,455,389

|

|

Office

Building

|

1,799,868

|

96,571

|

1,703,297

|

|

Printer

|

17,794

|

1,942

|

15,852

|

|

Office

equipment

|

139,725

|

6,986

|

132,739

|

|

|

3,536,161

|

228,884

|

3,307,277

|

8. Intellectual property

During

2015, NXT acquired the permanent rights to the SFD

®

technology for

use in the exploration of hydrocarbons from Mr. George Liszicasz

and recorded the acquisition as an intellectual property asset on

the balance sheet. The asset was recorded at the fair value of the

consideration transferred, including the related tax effect, of

approximately $25.3 million.

The

asset is being amortized on a straight line basis over its

estimated useful life of 15 years. The annual amortization expense

expected to be recognized in each of the next five years is

approximately $1.7 million per year for a 5 year aggregate total of

$8.5 million.

|

|

|

|

|

|

|

|

|

|

|

|

Intellectual

property acquired

|

$

25,271,000

|

$

25,271,000

|

|

Accumulated

amortization

|

(6,458,567

)

|

(5,616,200

)

|

|

|

18,812,433

|

19,654,800

|

9. Accounts payable and accrued liabilities

|

|

|

|

|

|

|

|

|

|

|

|

Accrued

liabilities related to:

|

|

|

|

Consultants

and professional fees

|

$

288,055

|

$

151,427

|

|

Board

of Directors' fees

|

102,500

|

22,500

|

|

Deferred

gain on sale of aircraft (current)

|

-

|

155,301

|

|

Payroll

(wages payable and vacation pay)

|

113,240

|

47,271

|

|

|

503,795

|

376,499

|

|

Trade

payables and other

|

521,623

|

123,036

|

|

|

1,025,418

|

499,535

|

NXT ENERGY SOLUTIONS INC.

Notes

to the Unaudited Condensed Consolidated Interim Financial

Statements

As at

and for the

three and six month

periods ended June 30, 2019

(Expressed in Canadian dollars unless otherwise

stated)

10. Contract Obligations

The

Company has received a deposit of $100,000USD from Alberta Green

Ventures Limited Partnership (“AGV”) on behalf the

Co-operative Agreement. See Note 13 for further

details.

|

|

|

|

|

|

|

|

|

|

|

|

Contract

obligations

|

$

132,079

|

$

-

|

11. Lease obligation

|

|

|

|

|

|

|

|

|

Aircraft)

|

$

1,893,276

|

$

-

|

|

Office

Building

|

1,776,677

|

-

|

|

Printer

|

15,604

|

-

|

|

Office

equipment

|

64,188

|

85,118

|

|

|

3,749,745

|

85,118

|

|

Current

Portion of lease obligations

|

(703,423

)

|

(42,603

)

|

|

Long-term

lease obligations

|

3,046,322

|

42,515

|

Leases

entered into for the use of an asset are classified as either

operating or finance, which is determined at contract inception.

Upon commencement of the lease, a ROU asset and corresponding lease

liability are recognized on the Condensed Consolidated Interim

Balance Sheet for all operating and finance leases. NXT has elected

the short-term lease exemption, which does not require a ROU asset

or lease liability to be recognized on the Condensed Consolidated

Interim Balance Sheet when the lease term is 12 months or less and

does not include an option to purchase the underlying asset that

the lessee is reasonably certain to exercise.

Upon

commencement of the lease, ROU assets are measured at the initial

measurement of the lease liability adjusted for any lease payments

made before commencement date of the lease, less any lease

incentives received and including any initial direct costs

incurred. Lease liabilities are initially measured at the present

value of future minimum lease payments over the lease term. The

discount rate used to determine the present value is the rate

implicit in the lease unless that rate cannot be determined, in

which case NXT’s incremental borrowing rate is

used.

NXT ENERGY SOLUTIONS INC.

Notes

to the Unaudited Condensed Consolidated Interim Financial

Statements

As at

and for the

three and six month

periods ended June 30, 2019

(Expressed in Canadian dollars unless otherwise

stated)

Operating

lease ROU assets and liabilities are subsequently measured at the

present value of the lease payments not yet paid and discounted at

the initial discount rate at commencement of the lease, less any

impairments to the ROU asset. Operating lease expense and revenue

from any subleases are recognized in the Condensed Consolidated

Interim Statement of Earnings on a straight line basis over the

lease term. Finance lease ROU assets are over the estimated useful

life of the asset if the lessee is reasonably certain to exercise a

purchase option or ownership of the leased asset transfers at the

end of the lease term, otherwise the leased assets are amortized

over the lease term. Operating leases include office building,

aircraft and printer. Finance leases include office equipment.

Currently there are no subleases.

NXT’s

lease contracts include rights to extend leases after the initial

term. Rights to extend or terminate a lease are included in the

lease term when there is reasonable certainty the right will be

exercised. Factors used to assess reasonable certainty of rights to

extend or terminate a lease include current and forecasted survey

plans, anticipated changes in strategies, historical practice in

extending similar contracts and current market

conditions.

12. Commitments and contingencies

Associated

with the adoption of Topic 842, all operating leases were

recognized on the Condensed Consolidated Balance Sheet.

Accordingly, operating leases are not included in the commitments

table below. The table below is the non-lease operating cost

components associated with the building lease. See Notes 2 and 11

for additional disclosures on leases.

|

For

the fiscal period ending June 30,

|

|

|

2019

|

$

110,962

|

|

2020

|

222,069

|

|

2021

|

222,501

|

|

2022

|

222,501

|

|

2023

|

222,501

|

|

|

1,000,534

|

|

Thereafter,

2024 through 2025

|

389,377

|

|

|

1,389,911

|

NXT ENERGY SOLUTIONS INC.

Notes

to the Unaudited Condensed Consolidated Interim Financial

Statements

As at

and for the

three and six month

periods ended June 30, 2019

(Expressed in Canadian dollars unless otherwise

stated)

13. Common shares

The

Company is authorized to issue an unlimited number of common

shares, of which the following are issued and

outstanding:

|

|

For the three months ended

|

|

|

|

|

|

|

|

|

|

|

|

As

at the beginning of the year

|

68,573,558

|

$

96,656,248

|

58,161,133

|

$

88,121,286

|

|

Shares

issued during the year:

|

|

|

|

|

|

Issuance

of Common Stock

|

|

|

|

|

|

on

the Private Placement

|

-

|

-

|

9,210,497

|

7,438,085

|

|

Exercise

of stock options

|

-

|

-

|

6,667

|

11,508

|

|

As

at the end of the period

|

68,573,558

|

96,656,248

|

67,378,297

|

95,570,879

|

In

February 2019, NXT entered into a Co-operative Agreement with AGV

to propose up to three SFD

®

surveys

within two years. As part of the consideration for the agreement,

NXT received approval from the Toronto Stock Exchange and

shareholders for a 12-month extension of the expiry date of

AGV’s 3,421,648 warrants (“Warrants”). Each

Warrant entitles the holder to acquire one Common Share at an

exercise price of $1.20 to February 16, 2020

.

14. Earnings (Loss) per share

|

|

For the three

months

ended June

30,

|

For the six

months

ended June

30,

|

|

|

|

|

|

|

|

Comprehensive

earnings (loss) for the period

|

$

8,085,888

|

$

(1,961,114

)

|

$

6,322,568

|

$

(3,915,764

)

|

|

Weighted average

number of shares outstanding for the period:

|

|

|

|

|

|

Basic

|

68,573,558

|

64,319,452

|

68,573,558

|

62,366,678

|

|

Diluted

|

73,267,206

|

64,319,452

|

73,274,112

|

62,366,678

|

|

Net Income (loss)

per share – Basic

|

$

0.12

|

$

(0.03

)

|

$

0.09

|

$

(0.06

)

|

|

Net Income (loss)

per share – Diluted

|

$

0.11

|

$

(0.03

)

|

$

0.09

|

$

(0.06

)

|

In

periods in which a loss results, all outstanding stock options are

excluded from the fully diluted loss per share calculations as

their effect is anti-dilutive.

NXT ENERGY SOLUTIONS INC.

Notes

to the Unaudited Condensed Consolidated Interim Financial

Statements

As at

and for the

three and six month

periods ended June 30, 2019

(Expressed in Canadian dollars unless otherwise

stated)

15. Stock options

The

following is a summary of stock options which are outstanding as at

June 30, 2019.

|

|

|

|

Average remaining contractual life (in years)

|

|

$

0.59

|

150,000

|

50,000

|

4.3

|

|

$

1.35

|

236,900

|

236,900

|

0.5

|

|

$

1.39

|

22,500

|

22,500

|

0.0

|

|

$

1.45

|

37,500

|

37,500

|

2.5

|

|

$

1.48

|

37,500

|

37,500

|

2.0

|

|

$

1.50

|

50,000

|

50,000

|

2.1

|

|

$

1.57

|

30,000

|

30,000

|

0.6

|

|

$

1.67

|

150,000

|

150,000

|

0.4

|

|

$

1.73

|

92,600

|

92,600

|

1.4

|

|

$

1.82

|

165,000

|

165,000

|

1.3

|

|

$

2.10

|

300,000

|

300,000

|

1.2

|

|

|

1,272,000

|

1,172,000

|

1.4

|

A

continuity of the number of stock options which are outstanding at

the end of the current period and as at the prior fiscal year ended

June 30, 2019 is as follows:

|

|

For the three months ended

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Options

outstanding, start of the period

|

1,297,000

|

$

1.58

|

1,648,667

|

$

1.60

|

|

Granted

|

-

|

-

|

1,150,000

|

$

1.06

|

|

Exercised

|

-

|

-

|

(6,667

)

|

$

0.76

|

|

Expired

|

(25,000

)

|

$

1.61

|

(65,000

)

|

$

1.17

|

|

Forfeited

|

-

|

-

|

(1,430,000

)

|

$

1.21

|

|

Options

outstanding, end of the period

|

1,272,000

|

$

1.58

|

1,297,000

|

$

1.58

|

|

Options

exercisable, end of the period

|

1,172,000

|

$

1.67

|

1,197,000

|

$

1.67

|

NXT ENERGY SOLUTIONS INC.

Notes

to the Unaudited Condensed Consolidated Interim Financial

Statements

As at

and for the

three and six month

periods ended June 30, 2019

(Expressed in Canadian dollars unless otherwise

stated)

Stock

options granted generally expire, if unexercised, five years from

the date granted and entitlement to exercise them generally vests

at a rate of one-third at the end of each of the first three years

following the date of grant.

Stock

based compensation expense (“SBCE”) is calculated based

on the fair value attributed to grants of stock options using the

Black-Scholes valuation model and utilizing the following weighted

average assumptions:

|

For the period ended

|

|

|

|

Expected dividends

paid per common share

|

-

|

Nil

|

|

Expected life in

years

|

-

|

5.0

|

|

Expected volatility

in the price of common shares

|

-

|

65

%

|

|

Risk free interest

rate

|

-

|

1.75

%

|

|

Weighted average

fair market value per share at grant date

|

-

|

$

1.06

|

|

Intrinsic (or

"in-the-money") value per share of options exercised

|

-

|

$

0.59

|

The

unamortized portion of SBCE related to the non-vested portion of

stock options, which will be recognized in 2019 to 2020 is

approximately $20,000.

16. Financial instruments

1) Non-derivative financial instruments:

The

Company's non-derivative financial instruments consist of cash and

cash equivalents, short-term investments, accounts receivable,

accounts payables and accrued liabilities and finance leases. The

carrying value of these financial instruments approximates their

fair values due to their short terms to maturity. NXT is not

exposed to significant interest or credit risks arising from these

financial instruments. NXT is exposed to foreign exchange risk as a

result of periodically holding foreign denominated financial

instruments. Any unrealized foreign exchange gains and losses

arising on such holdings are reflected in earnings at the end of

each period.

2) Derivative financial instruments

As at

June 30, 2019 and 2018, the Company held no derivative financial

instruments.

NXT ENERGY SOLUTIONS INC.

Notes

to the Unaudited Condensed Consolidated Interim Financial

Statements

As at

and for the

three and six month

periods ended June 30, 2019

(Expressed in Canadian dollars unless otherwise

stated)

17. Change in non-cash working capital

The

changes in non-cash working capital balances are comprised

of:

|

|

For the three months ended June 30

|

For the six months ended June 30

|

|

|

|

|

|

|

|

Accounts

receivable

|

$

(9,239,098

)

|

$

(90,936

)

|

$

(9,273,628

)

|

$

(79,180

)

|

|

Prepaid

expenses and deposits

|

(13,946

)

|

(57,614

)

|

(160,896

)

|

(34,874

)

|

|

Accounts

payable and accrued liabilities

|

421,424

|

(377,925

)

|

680,796

|

(493,625

)

|

|

Income

taxes payable

|

-

|

-

|

-

|

(201

)

|

|

Contractual

obligations

|

(261,278

)

|

-

|

134,902

|

-

|

|

|

(9,092,898

)

|

(526,475

)

|

(8,618,826

)

|

(607,880

)

|

|

|

|

|

|

|

|

Portion

attributable to:

|

|

|

|

|

|

Operating

activities

|

(9,092,898

)

|

(526,475

)

|

(8,618,826

)

|

(607,880

)

|

|

Financing

activities

|

-

|

-

|

-

|

-

|

|

Investing

activities

|

-

|

-

|

-

|

-

|

|

|

(9,092,898

)

|

(526,475

)

|

(8,618,826

)

|

(607,880

)

|

18. Geographic information

NXT

conducts all of its survey operations from its head office in

Canada, and occasionally maintains administrative offices in

foreign locations if and when needed. NXT has no long term assets

outside of Canada.

Revenues

by geographic area were generated solely in Nigeria in the second

quarter in 2019, entirely from a single client. There were no

revenues in 2018.

|

|

For three months ended June 30,

|

For the six-month period ended June 30

|

|

|

|

|

|

|

|

Nigeria

|

$

10,954,617

|

$

-

|

$

10,954,617

|

$

-

|

NXT ENERGY SOLUTIONS INC.

Notes

to the Unaudited Condensed Consolidated Interim Financial

Statements

As at

and for the three and six month periods ended June 30,

2019

(Expressed in Canadian dollars unless otherwise

stated)

19. Other related party transactions

One of

the members of NXT’s Board of Directors is a partner in a law

firm which provides legal advice to NXT. Legal fees (including

costs related to share issuance) incurred with this firm were as

follows:

|

|

For three months

ended June 30,

|

For the

six-month period ended June 30

|

|

|

|

|

|

|

|

Legal

Fees

|

$

57,160

|

$

188,263

|

$

97,149

|

$

209,156

|

Accounts

payable and accrued liabilities includes a total of

$81,720

($5,999 as at December 31, 2018)

payable to this law firm.

In

addition, accounts payable and accrued liabilities includes $NIL

($7,461 as at December 31, 2018) related to re-imbursement of

expenses owing to an Officer of NXT.

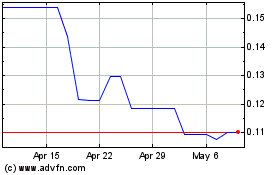

NXT Energy Solutions (QB) (USOTC:NSFDF)

Historical Stock Chart

From Mar 2024 to Apr 2024

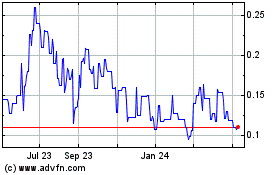

NXT Energy Solutions (QB) (USOTC:NSFDF)

Historical Stock Chart

From Apr 2023 to Apr 2024