UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14C INFORMATION

Information

Statement Pursuant to Section 14(c) of the Securities Exchange Act of 1934

Check

the appropriate box:

[X]

Preliminary Information Statement

[ ]

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)2))

[ ]

Definitive Information Statement

THE

GREATER CANNABIS COMPANY, INC.

(Name

of Registrant as Specified in Charter)

Payment

of Filing Fee (Check the appropriate box):

[X]

No fee required

[ ]

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11

1.

Title of each class of securities to which transaction applies:

2.

Aggregate number of securities to which transaction applies:

3.

Per unit price or other underlying value of transaction, computed pursuant to Exchange Act Rule O-11 (Set forth the amount on

which the filing fee is calculated and state how it was determined):

4.

Proposed maximum aggregate value of transaction:

5.

Total fee paid:

[ ]

Fee paid previously with preliminary materials.

[ ]

Check box if any part of the fee is offset as provided by Exchange Act Rule O-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of

its filing.

1.

Amount Previously Paid:

2.

Form Schedule or Registration Statement No.:

3.

Filing Party:

4.

Date Filed:

SCHEDULE

14C INFORMATION STATEMENT

Pursuant

to Regulation 14C of the Securities Exchange Act

of

1934, as amended

The

Greater Cannabis Company, Inc.

15

Walker Avenue, Suite 101

Baltimore, MD 21208

GENERAL

INFORMATION

This

Information Statement (the “Information Statement”) has been filed with the Securities and Exchange Commission and

is being furnished, pursuant to Section 14C of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

to the holders (the “Stockholders”) of the common stock, par value $.001 per share (the “Common Stock”),

of The Greater Cannabis Company, Inc., a Florida Corporation (the “Company”), to notify such Stockholders that on

or about August 1, 2019, the Company received written consents in lieu of a meeting of Stockholders from holders of 500,000,000

shares of voting securities representing approximately 62% of the shares of the total issued and outstanding shares of voting

stock of the Company (the “Majority Stockholders”) to authorize the Company’s Board of Directors to approve

the following:

(1)

to authorize the Company to issue three new classes of preferred stock with such rights, terms and features as the Board of Directors

determine in its sole discretion with each new class to consist of 10,000,000 shares of preferred stock (the “Preferred

Stock Transaction”).

On

August 1, 2019, the Board of Directors of the Company approved the Preferred Stock Transaction, subject to Stockholder approval.

The Majority Stockholders approved the Increase by written consent in lieu of a meeting on August 1, 2019. Accordingly, your consent

is not required and is not being solicited in connection with the approval of the Increase. The Increase will become effective

when we file the Certificate of Amendment (the “Amendment”) with the Secretary of State of the State of Florida twenty

(20) days after the Definitive Information Statement is filed and mailed to Stockholders of Record. The Increase is not in any

way related to any plans or intentions to enter into a merger, consolidation, acquisition or similar business transaction.

WE

ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND A PROXY.

Dated:

August 5, 2019

For

the Board of Directors of

|

The Greater Cannabis Company, Inc.

|

|

|

|

|

|

|

By:

|

/s/ Aitan Zacharin

|

|

|

|

Aitan

Zacharin

|

|

|

|

Chief Executive Officer and Director

|

|

RECOMMENDATION

OF THE BOARD OF DIRECTORS

ACTIONS

TO BE TAKEN

ACTION

I – AUTHORIZATION OF THE CREATION OF THREE NEW CLASSES OF PREFERRED SHARES – THE SERIES B, SERIES C AND SERIES D CONVERTIBLE

PREFERRED SHARES

The

Board of Directors has determined that it will be necessary to authorize the creation of the Series B, Series C and Series D classes

of preferred stock with each class to have such rights, terms and features as the Board may determine in its sole discretion.

These classes of convertible preferred stock will provide the Company flexibility to restructure existing indebtedness and other

outstanding securities and to consummate such financing transactions as are required until it can become cash-flow positive. The

creation of the Series B, Series C and Series D classes of convertible preferred stock is hereinafter referred to as the “Preferred

Stock Transaction”)

Purpose

of the Increase

On

August 1, 2019, the Company’s Board of Directors and the Majority Stockholders owning a majority of the Company’s

voting securities approved a resolution authorizing the Company to amend the Articles of Incorporation to effect the Preferred

Stock Transaction. The Board believes that the Preferred Stock Transaction will provide the Company the flexibility to to restructure

existing indebtedness and other outstanding securities and to consummate such financing transactions as are required until it

can become cash-flow positive. The Preferred Stock Transaction is not in any way related to any plans or intentions to enter into

a merger, consolidation, acquisition or similar business transaction.

Amended

Certificate of Incorporation

Upon

the effectiveness and on the date that is twenty (20) days following the mailing of this Information Statement, the Board of Directors

shall have the Company’s Certificate of Amendment to the Articles of Incorporation filed with the State of Florida in order

to effect the Increase.

ADDITIONAL

INFORMATION

The

Company is subject to the informational requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

and in accordance therewith files reports, proxy statements and other information including annual and quarterly reports on Form

10-K and 10-Q (the “1934 Act Filings”) with the Securities and Exchange Commission (the “Commission”).

Reports and other information filed by the Company can be inspected and copied at the public reference facilities maintained at

the Commission at Room 1024, 450 Fifth Street, N.W., Washington, DC 20549. Copies of such material can be obtained upon written

request addressed to the Commission, Public Reference Section, 450 Fifth Street, N.W., Washington, D.C. 20549, at prescribed rates.

The Commission maintains a web site on the Internet (http://www.sec.gov) that contains reports, proxy and information statements

and other information regarding issuers that file electronically with the Commission through the Electronic Data Gathering, Analysis

and Retrieval System (“EDGAR”).

The

following documents as filed with the Commission by the Company are incorporated herein by reference:

1.

Annual Report on Form 10-K for the year ended December 31, 2018; and

2.

Quarterly Report on Form 10-Q for the quarter ended March 30, 2019.

The

Company shall provide, without charge, to each person to whom an Information Statement is delivered, upon written or oral request

of such person and by first class mail or other equally prompt means within one (1) business day of receipt of such request, a

copy of any and all of the information that has been incorporated by reference in the Information Statement (not including exhibits

to the information that is incorporated by reference unless such exhibits are specifically incorporated by reference into the

information that the Information Statement incorporates), and the address and telephone numbers to which such a request is to

be directed.

INTEREST

OF CERTAIN PERSONS IN OR OPPOSITION TO MATTERS TO BE ACTED UPON

Except

as disclosed elsewhere in this Information Statement, none of the following persons have any substantial interest, direct or indirect,

by security holdings or otherwise in any matter to be acted upon:

1.

any director or officer of our Company since January 1, 2018 being the commencement of our last completed financial year;

2.

any proposed nominee for election as a director of our Company; and

3.

any associate or affiliate of any of the foregoing persons.

The

shareholdings of our directors and officers are set forth below in the section entitled “Security Ownership of Certain Beneficial

Owners and Management.” To our knowledge, no director has advised that he intends to oppose the Increase as more particularly

described herein.

OUTSTANDING

VOTING SECURITIES

Our

authorized capital stock consists of 500,000,000 shares of Common Stock, par value $0.001 per share, of which 35,272,483 shares

were outstanding as at August 2, 2019 and 10,000,000 shares of Series A Convertible Preferred Stock, par value $0.001 (the “Record

Date”).

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following information table sets forth certain information regarding the Company’s common stock owned on the Record Date

by (i) each who is known by the Company to own beneficially more than 5% of its outstanding Common Stock, (ii) each director and

officer, and (iii) all officers and directors as a group:

The

following table lists, as at the date hereof, the number of shares of common stock of our Company that are beneficially owned

by (i) each person or entity known to our Company to be the beneficial owner of more than 5% of the outstanding common stock;

(ii) each officer and director of our Company; and (iii) all officers and directors as a group. Information relating to beneficial

ownership of common stock by our principal shareholders and management is based upon information furnished by each person using

“beneficial ownership” concepts under the rules of the Securities and Exchange Commission. Under these rules, a person

is deemed to be a beneficial owner of a security if that person has or shares voting power, which includes the power to vote or

direct the voting of the security, or investment power, which includes the power to vote or direct the voting of the security.

The person is also deemed to be a beneficial owner of any security of which that person has a right to acquire beneficial ownership

within 60 days. Under the Securities and Exchange Commission rules, more than one person may be deemed to be a beneficial owner

of the same securities, and a person may be deemed to be a beneficial owner of securities as to which he or she may not have any

pecuniary beneficial interest. Except as noted below, each person has sole voting and investment power.

|

Name of Beneficial Owner

|

|

Common Stock

Beneficially

Owned(1)

|

|

|

Percentage of

Common

Stock (1)

|

|

|

Wayne Anderson

|

|

|

6,019,016

|

|

|

|

17.06

|

%

|

|

TD Ameritrade

|

|

|

4,468,537

|

|

|

|

12.66

|

%

|

|

Emet Capital Partners

|

|

|

10,384,600

|

|

|

|

29.44

|

%

|

|

Aitan Zacharin (2)

|

|

|

84,766,650

|

|

|

|

70.06

|

%

|

|

Mark Radom (2)

|

|

|

74,166,650

|

|

|

|

67.58

|

%

|

|

Elisha Kalfa (2)

|

|

|

74,166,650

|

|

|

|

67.58

|

%

|

|

Joe Kalfa (2)

|

|

|

74,166,650

|

|

|

|

67.58

|

%

|

|

Fernando Bisker (2)

|

|

|

74,166,650

|

|

|

|

67.58

|

%

|

|

Sigalush LLC (2)

|

|

|

74,166,650

|

|

|

|

67.58

|

%

|

|

David Tavor (2)

|

|

|

15,000,000

|

|

|

|

29.83

|

%

|

|

Officers and directors as a Group (2)

|

|

|

173,933,300

|

|

|

|

83.13

|

%

|

(1)

Beneficial Ownership is determined in accordance with the rules of the Securities and Exchange Commission and generally includes

voting or investment power with respect to securities. Shares of common stock subject to options, warrants, convertible debt or

convertible preferred shares currently exercisable or convertible, or exercisable or convertible within 60 days of August 5, 2019

are deemed outstanding for computing percentage of the person holding such option or warrant but are not deemed outstanding for

computing the percentage of any other person. Percentages are based on a total of shares of common stock outstanding on August

5, 2019, which was 35,272,483, and the shares issuable upon exercise of options, warrants exercisable, preferred stock and debt

convertible on or within 60 days of August 5, 2019.

(2)

The shares included under “Officers and Directors as a Group” include those held by Aitan Zacharin, the Company’s

chief executive officer, Mark Radom, the Company’s general counsel and David Tavor, director. Aitan Zacharin holds 1,695,333

shares of Series A Convertible Preferred Stock, Mark Radom holds 1,483,333 shares of Series A Convertible Preferred Stock and

David Tavor holds 300,000 shares of Series A Convertible Preferred Stock. Each share of Series A Convertible Preferred Stock is

convertible into 50 shares of common stock.

DISSENTER’S

RIGHTS OF APPRAISAL

The

Stockholders have no right under Florida Corporate Law, the Company’s Articles of Incorporation consistent with above, or

Bylaws to dissent from any of the provisions adopted in the Amendment.

ANTI-TAKEOVER

EFFECTS OF THE PROPOSED INCREASE

Release

No. 34-15230 of the staff of the Securities and Exchange Commission requires disclosure and discussion of the effects of any stockholder

proposal that may be used as an anti-takeover device. Although the Company has no intent or plan to employ the additional unissued

authorized shares as an anti-takeover device, it is possible that management could use the additional shares to resist or frustrate

a third-party transaction providing an above-market premium that is favored by a majority of the independent stockholders. For

example, shares of authorized and unissued common stock could (within the limits imposed by applicable law) be issued in one or

more transactions that would discourage persons from attempting to gain control of the Company, by diluting the voting power of

shares then outstanding. Similarly, the issuance of additional shares to certain persons allied with the Company’s management

could have the effect of making it more difficult to remove the Company’s current management by diluting the stock ownership

or voting rights of persons seeking to cause such removal. Each of these, together with other anti-takeover provisions in our

charter documents and provided by Florida law, could potentially limit the opportunity for the Company’s stockholders to

dispose of their stock at a premium.

The

Company’s articles of incorporation and by-laws do not presently contain any provisions having anti-takeover effects and

this proposal is not a plan by management to adopt a series of amendments to the Company’s articles of incorporation or

by-laws to institute an anti-takeover provision. The Company does not have any plans or proposals to adopt other provisions or

enter into other arrangements that may have material anti-takeover consequences.

The

Board of Directors is not aware of any attempt, or contemplated attempt, to acquire control of the Company, and this proposal

is not being presented with the intent that it be utilized as a type of anti-takeover device or to secure management’s positions

within the Company.

EFFECTIVE

DATE OF INCREASE

Pursuant

to Rule 14c-2 under the Exchange Act, the Preferred Stock Transaction shall not be filed with the Secretary of State of Florida

until a date at least twenty (20) days after the date on which this Information Statement has been mailed to the Stockholders.

The Company anticipates that the action contemplated hereby will be effected on or about the close of business on August 26, 2019.

CONCLUSION

As

a matter of regulatory compliance, we are sending you this Information Statement, which describes the purpose and effect of the

above action. Your consent to the above action is not required and is not being solicited in connection with this action. This

Information Statement is intended to provide our Stockholders information required by the rules and regulations of the Securities

Exchange Act of 1934.

Signature

Pursuant

to the requirements of the Securities Exchange Act of 1934, The Greater Cannabis Company, Inc. has duly caused this report to

be signed by the undersigned hereunto authorized.

|

THE

GREATER CANNABIS COMPANY, INC.

|

|

|

|

|

|

By:

|

/s/

Aitan

Zacharin

|

|

|

|

Aitan

Zacharin

|

|

|

|

President,

CEO and Director

|

|

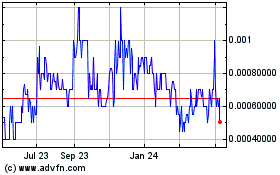

Greater Cannabis (PK) (USOTC:GCAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

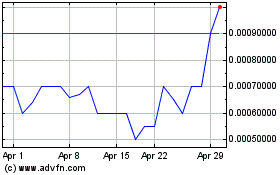

Greater Cannabis (PK) (USOTC:GCAN)

Historical Stock Chart

From Apr 2023 to Apr 2024