UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant

x

Filed by a Party other than the Registrant

¨

Check the appropriate box:

x

Preliminary Proxy Statement

¨

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

¨

Definitive Proxy Statement

¨

Definitive Additional Materials

¨

Soliciting Material under §240.14a -12

|

INNOVATION PHARMACEUTICALS INC.

|

|

(Name of Registrant as Specified In Its Charter)

|

______________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

x

|

No fee required.

|

|

¨

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

______________________________________________

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

_______________________________________________

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

_____________________________________________________________________________________

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

____________________________________________

|

|

|

(5)

|

Total fee paid:

|

|

|

|

______________________________________________

|

|

¨

|

Fee paid previously with preliminary materials.

|

|

|

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid: ________________________________________

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.: ________________________

|

|

|

|

|

|

|

(3)

|

Filing Party: __________________________________________________

|

|

|

|

|

|

|

(4)

|

Date Filed: ___________________________________________________

|

INNOVATION PHARMACEUTICALS INC.

100 Cummings Center, Suite 151-B

Beverly, Massachusetts 01915

(978) 921-4125

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON

SEPTEMBER [__], 2019

Dear Stockholder:

Notice is hereby given that a Special Meeting of Stockholders (the “Special Meeting”) of Innovation Pharmaceuticals Inc., a Nevada corporation (the “Company”), will be held on [______], September [__], 2019 at [_____] a.m., local time, at [__________], for the following purposes:

|

|

1.

|

To consider and, if appropriate, approve an amendment to Article III of our Amended and Restated Articles of Incorporation to increase the number of authorized shares of the Company’s Class A common stock from 300,000,000 shares to 600,000,000 shares (the “Increased Capitalization Charter Amendment”);

|

|

|

|

|

|

|

2.

|

To approve the adjournment of the Special Meeting, if necessary or appropriate, to solicit additional proxies if there are not sufficient votes to approve and adopt the Increased Capitalization Charter Amendment (the “Adjournment Proposal”); and

|

|

|

|

|

|

|

3.

|

To transact such other business as may properly come before the Special Meeting or any adjournment thereof.

|

If you owned our common stock at the close of business on August [__], 2019, you may attend and vote at the Special Meeting. A proxy statement describing the matters to be considered at the Special Meeting is attached to this notice.

Your vote is important. Whether or not you plan to attend the meeting, I hope that you will vote as soon as possible. You may vote your shares by either completing, signing and returning the accompanying proxy card or casting your vote via a toll-free telephone number or over the Internet.

|

|

Sincerely,

|

|

|

|

|

|

|

|

/s/ Leo Ehrlich

|

|

|

|

Leo Ehrlich

|

|

|

|

Chief Executive Officer

|

|

August [__], 2019

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON SEPTEMBER [___], 2019

This Notice and our proxy statement are available online at

http://www.ipharminc.com

|

TABLE OF CONTENTS

PRELIMINARY PROXY MATERIALS - SUBJECT TO COMPLETION

INNOVATION PHARMACEUTICALS INC.

100 Cummings Center, Suite 151-B

Beverly, Massachusetts 01915

(978) 921-4125

__________________

PROXY STATEMENT

__________________

The Board of Directors (“Board”) of Innovation Pharmaceuticals Inc., a Nevada corporation (the “Company,” “Innovation Pharmaceuticals,” “we” or “us”), is furnishing this proxy statement and the accompanying proxy card to you to solicit your proxy for a Special Meeting of Stockholders (the “Special Meeting”). The Special Meeting will be held on [_________], September [__], 2019 at [____] a.m., local time, at [_____________].

QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING

What is this proxy statement?

Our Board is soliciting your proxy to vote your shares at the Special Meeting. This proxy statement includes information that we are required to provide to you under the rules of the Securities and Exchange Commission (the “SEC”) and that is designed to assist you in voting your shares. The Company is making this proxy statement and the accompanying proxy first available on or about August [__], 2019.

Why am I receiving these materials?

You are receiving this document because you were one of our stockholders on August [__], 2019, the record date for the Special Meeting. We are soliciting your proxy to vote your shares of our common stock upon certain matters at the Special Meeting. Because our shares are widely held, it would be impractical, if not impossible, for our stockholders to meet physically in sufficient numbers to hold a meeting. Accordingly, proxies are solicited from our stockholders.

You should read this proxy statement carefully, as it contains important information regarding the Special Meeting and matters to be voted on thereat. The enclosed materials allow you to submit a proxy to vote your shares without attending the Special Meeting in person and to ensure that your shares are represented and voted at the Special Meeting.

Your vote is important, and every vote matters. Even if you plan to attend the Special Meeting in person, we encourage you to submit a proxy as soon as possible.

Who may vote at the Special Meeting?

We have fixed the close of business on August [__], 2019, as the record date for determining who is entitled to vote at the Special Meeting. As of that date, there were [________] shares of our Class A common stock and [________] shares of our Class B common stock outstanding and entitled to be voted at the Special Meeting and any postponement(s) or adjournment(s) thereof. In accordance with our Amended and Restated Articles of Incorporation, holders of our Class A common stock may cast one vote for each share of Class A common stock held on August [__], 2019 on all matters presented at the Special Meeting, and holders of our Class B common stock may cast ten votes for each share of Class B common stock held on August [__], 2019 on all matters presented at the Special Meeting.

Where and when is the Special Meeting, and who may attend?

The Special Meeting will be held on [__________], September [__] 4, 2019 at [____] a.m., local time, at [_____________]. Stockholders of record at the close of business on August [__], 2019, the record date, or their duly appointed proxies, may attend the Special Meeting. All stockholders will need proof of identification along with proof of ownership or their proxy card to enter the Special Meeting. Beneficial owners of shares held in “street name” who wish to attend the meeting must present proof of ownership of Innovation Pharmaceuticals common stock as of the record date, such as via a bank or brokerage account statement, and will only be able to vote at the Special Meeting if they have a proxy, executed in their favor, from the stockholder of record (the bank, brokerage firm, or other nominee) giving them the right to vote the shares at the Special Meeting.

Whether or not you plan to attend the Special Meeting in person, please submit a proxy to vote your shares as promptly as possible so that your shares may be represented and voted at the Special Meeting.

What proposals will be voted on at the Special Meeting?

There are two proposals to be considered and voted on at the Special Meeting:

|

|

(1)

|

To consider and, if appropriate, approve an amendment to Article III of our Amended and Restated Articles of Incorporation to increase the number of authorized shares of our Class A common stock from 300,000,000 shares to 600,000,000 shares (the “Increased Capitalization Charter Amendment”); and

|

|

|

|

|

|

|

(2)

|

To approve the adjournment of the Special Meeting, if necessary or appropriate, to solicit additional proxies if there are not sufficient votes to approve and adopt the Increased Capitalization Charter Amendment (the “Adjournment Proposal”).

|

An additional purpose of the Special Meeting is to transact any other business that may properly come before the Special Meeting and any and all adjournments or postponements of the Special Meeting.

Will there be any other business on the agenda?

The Board knows of no other matters that are likely to be brought before the Special Meeting. If any other matters properly come before the Special Meeting, however, the persons named in the enclosed proxy, or their duly appointed substitute acting at the Special Meeting, will be authorized to vote or otherwise act on those matters in accordance with their judgment.

What are my choices when voting on the proposed amendment to the Company’s Amended and Restated Articles of Incorporation, and what vote is needed to approve the proposed amendment?

In regards to the vote on the proposed amendment to the Company’s Amended and Restated Articles of Incorporation, stockholders may:

|

|

·

|

vote in favor of the proposed amendment;

|

|

|

|

|

|

|

·

|

vote against the proposed amendment; or

|

|

|

|

|

|

|

·

|

abstain from voting on the proposed amendment.

|

The affirmative vote of the holders of at least a majority of the voting power of our issued and outstanding common stock is required to approve the proposed amendment to the Company’s Amended and Restated Articles of Incorporation.

What are my choices when voting on the Adjournment Proposal, and what vote is needed to approve the Adjournment Proposal?

In regards to the vote on the Adjournment Proposal, stockholders may:

|

|

·

|

vote in favor of the Adjournment Proposal;

|

|

|

|

|

|

|

·

|

vote against the Adjournment Proposal; or

|

|

|

|

|

|

|

·

|

abstain from voting on the Adjournment Proposal.

|

The affirmative vote of the holders of a majority of the votes cast at the Special Meeting in person or represented by proxy is required to approve the Adjournment Proposal.

Why is the Company seeking to increase the Company’s authorized capitalization?

The Board believes that the Company will need to raise additional capital in order to implement its business plan and is contemplating various alternatives to raise capital, including a potential private placement of shares of common stock or securities convertible into shares of common stock. In addition, we may issue shares to acquire other companies or assets or engage in business combination transactions. Currently, we have no specific plans, arrangements or understandings, whether written or oral, with respect to the increase in shares available for issuance as a result of the Increased Capitalization Charter Amendment.

How does the Company’s Board of Directors recommend that I vote?

Our Board of Directors unanimously recommends that you vote:

|

|

·

|

“FOR” the Increased Capitalization Charter Amendment proposal; and

|

|

|

|

|

|

|

·

|

“FOR” the Adjournment Proposal.

|

What information is available on the Internet?

A copy of this proxy statement and our 2018 Annual Report on Form 10-K is available for download free of charge at

www.ipharminc.com

. We make available on the Investors subpage of our website (under the link “Financials & Filings”) free of charge our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, ownership reports on Forms 3, 4 and 5 and any amendments to those reports as soon as practicable after we electronically file such reports with the SEC. Further, copies of the charters for our Audit Committee, Compensation Committee and Nominating and Governance Committee, our Code of Ethics, and our Corporate Governance Guidelines are also available on the Investors subpage of our website (under the link “Corporate Governance”).

Information from our website is not incorporated by reference into this proxy statement.

What constitutes a quorum?

A quorum is the presence, in person or by proxy, of the holders of one-third of the shares of the common stock entitled to vote. A quorum is required for the transaction of business at the special meeting. Under Nevada law, an abstaining vote and a “broker non-vote” are counted as present and are, therefore, included for purposes of determining whether a quorum of shares is present at the Special Meeting.

What are “broker votes” and “broker non-votes?”

On certain “routine” matters, brokerage firms have discretionary authority under applicable stock exchange rules to vote their customers’ shares if their customers do not provide voting instructions. When a brokerage firm votes its customers’ shares on a routine matter without receiving voting instructions (referred to as a “broker vote”), these shares are counted both for establishing a quorum to conduct business at the Special Meeting and in determining the number of shares voted “FOR” or “AGAINST” the routine matter. When a matter is not a routine matter and the brokerage firm has not received voting instructions from the beneficial owner of the shares with respect to that matter, the brokerage firm cannot vote the shares on that matter. This is called a “broker non-vote.” For purposes of the Special Meeting, neither the Increased Capitalization Charter Amendment proposal nor the Adjournment Proposal is considered a “routine” matter.

Because the proposal to amend our Amended and Restated Articles of Incorporation to increase the authorized Class A common stock is not considered a “routine” matter for stockholder consideration, the brokers will not have discretionary authority to vote your shares with respect to such matter and if you do not instruct your bank or broker how to vote your shares, no votes will be cast on your behalf with respect to such matter, which will have the same effect as a vote against the proposal. The failure to submit a proxy, or instruct a broker or other nominee to vote, as the case may be, will have no effect on the Adjournment Proposal.

We encourage you to provide instructions to your brokerage firm, bank or other nominee by voting your proxy. This action ensures your shares will be voted at the Special Meeting on all matters up for consideration.

What if I abstain from voting?

You have the option to “ABSTAIN” from voting with respect to the proposed amendment to our Amended and Restated Articles of Incorporation. Abstentions with respect to this proposal are counted for purposes of establishing a quorum, but will not be voted on the Increased Capitalization Charter Amendment proposal. As a result, if a quorum is present, abstentions will have the same effect as a vote “AGAINST” the Increased Capitalization Charter Amendment proposal. An abstention will have no effect on the Adjournment Proposal.

How will my shares be voted if I return my proxy card or vote via telephone or Internet? What if I return my proxy card but do not provide voting instructions or complete the telephone or Internet voting procedures but do not specify how I want to vote my shares?

Our Board of Directors has named Leo Ehrlich, our Chairman and Chief Executive Officer, and Dr. Arthur Bertolino, our President and Chief Medical Officer, as official proxy holders. They will vote all proxies, or record an abstention or withholding, in accordance with the directions on the proxy.

All shares represented by properly executed proxies, unless previously revoked, will be voted at the Special Meeting as you direct.

IF YOU SIGN AND RETURN YOUR PROXY CARD BUT GIVE NO DIRECTION OR COMPLETE THE TELEPHONE OR INTERNET VOTING PROCEDURES BUT DO NOT SPECIFY HOW YOU WANT TO VOTE YOUR SHARES, THE SHARES WILL BE VOTED “FOR” THE APPROVAL OF THE PROPOSED AMENDMENT TO OUR AMENDED AND RESTATED ARTICLES OF INCORPORATION AND “FOR” THE ADJOURNMENT PROPOSAL.

How do I vote if my shares are registered directly in my name?

If your shares are registered directly in your name with our transfer agent you are considered a “stockholder of record” or “record holder” with respect to those shares. Please carefully consider the information contained in this Proxy Statement and, whether or not you plan to attend the Special Meeting, you may vote your shares in the following four ways:

|

|

·

|

By Telephone

— Stockholders located in the United States can vote by telephone by calling the number listed on the proxy card and following the instructions;

|

|

|

|

|

|

|

·

|

By Interne

t — You can vote over the Internet going to the link provided on the proxy card and following the instructions;

|

|

|

|

|

|

|

·

|

By Mail

— You can vote by mail by signing, dating and mailing the enclosed proxy card; or

|

|

|

|

|

|

|

·

|

At the Special Meeting

— You may vote your shares at the Special Meeting if you bring proof of identification along with your proxy card or proof of ownership.

|

Telephone and Internet voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m. (Eastern Time) on September [__], 2019.

If you hold your shares in street name through a broker, bank or other nominee rather than directly in your own name, you are considered the beneficial owner of those shares, and proxy materials are being forwarded to you by your broker, bank or other nominee, together with a voting instruction card. To vote at the Special Meeting, beneficial owners will need to contact the broker, bank or other nominee that holds their shares to obtain a “legal proxy” to bring to the Special Meeting.

If you hold shares in the name of a broker, bank or other nominee you may be able to vote those shares by Internet or telephone depending on the voting procedures used by your broker, bank or other nominee, as explained below under the question “How do I vote if my shares are held in “street name” by a broker, bank or other nominee?”

No cumulative voting rights are authorized, and dissenters’ rights and rights of appraisal are not applicable to the matters being voted upon.

How do I vote if my shares are held in “street name” by a broker, bank or other nominee?

If your shares are held by a broker, bank or other nominee (this is called “street name”), your broker, bank or other nominee will send you instructions for voting those shares, and you should vote by following the instructions on your voting instruction form. Many (but not all) brokerage firms, banks and other nominees offer Internet and telephone voting options.

May I change or revoke my proxy after it has been submitted?

Yes. Any stockholder of record executing a proxy has the power to revoke such proxy at any time prior to its exercise. You may revoke your proxy prior to exercise by:

|

|

·

|

submitting a written notice of revocation of your proxy by mail to:

|

|

|

|

|

|

|

|

Innovation Pharmaceuticals Inc.

100 Cummings Center, Suite 151-B

Beverly, Massachusetts 01915

Attention: Corporate Secretary

|

|

|

·

|

submitting a properly signed proxy card bearing a later date to the address immediately above;

|

|

|

|

|

|

|

·

|

voting over the Internet or by telephone per the instruction included herein; or

|

|

|

|

|

|

|

·

|

voting in person at the special meeting.

|

If your shares are held in “street name” by a broker, bank or other nominee, you must contact your broker, bank or other nominee to change your vote or obtain a legal proxy to vote your shares if you wish to cast your vote in person at the Special Meeting.

What does it mean if I receive more than one proxy card or voting instruction card?

If your shares are registered differently or held in more than one account, you will receive more than one proxy card or voting instruction card. Please complete and return all of the proxy cards or voting instruction cards you receive (or submit each of your proxies over the Internet or by telephone) to ensure that all of your shares are voted.

Who is soliciting my vote?

In this proxy statement, our Board of Directors is soliciting your vote for matters being submitted for stockholder approval at the Special Meeting.

Who will bear the cost for soliciting votes for the Special Meeting?

We will bear the cost of soliciting proxies. In addition to the use of mail, our directors, officers and non-officer employees may solicit proxies in person or by telephone or other means. These persons will not be compensated for the solicitation but may be reimbursed for out-of-pocket expenses. We have also made arrangements with brokerage firms and other custodians, nominees and fiduciaries to forward this material to the beneficial owners of our common stock, and we will reimburse them for their reasonable out-of-pocket expenses. We have retained [_____________] to assist in soliciting proxies by mail, telephone, and personal interviews for a fee of approximately $[__________], plus certain additional per-service fees and reimbursement for its reasonable fees and customary expenses.

Where can I find voting results of the Special Meeting?

We will announce preliminary voting results at the Special Meeting and publish final results on a Current Report on Form 8-K that we expect to file with the SEC within four business days after the Special Meeting (a copy of which will be available on the “Investors” subpage of our website,

www.ipharminc.com

, under the link “Financials & Filings”). If our final voting results are not available within four business days after the meeting, we will file a Current Report on Form 8-K reporting the preliminary voting results and subsequently file the final voting results in an amendment to the Current Report on Form 8-K within four business days after the final voting results are known to us.

Whom should I contact with questions about the Special Meeting?

If you have questions about the Special Meeting, the proposals, require assistance in submitting your proxy or voting your shares, or need additional copies of this proxy statement or the enclosed proxy card, please contact our proxy solicitor, [____________]:

[_______________]

Email: [______________]

If your bank, brokerage firm or other nominee holds your shares, you should also call your bank, brokerage firm or other nominee for additional information.

What if I have more than one account?

Please vote proxies for all accounts to ensure that all your shares are voted. You may consolidate multiple accounts through our transfer agent, West Coast Stock Transfer, Inc., online at

http://westcoaststocktransfer.com

or by calling (619) 664-4780.

What is “householding?”

“Householding” means that we deliver a single set of proxy materials when requested to households with multiple stockholders, provided certain conditions are met. Householding reduces our printing and mailing costs.

If you or another stockholder of record sharing your address would like to receive an additional copy of the proxy materials, we will promptly deliver it to you upon your request in one of the following manners:

|

|

·

|

by sending a written request by mail to:

|

|

|

|

|

|

|

|

Innovation Pharmaceuticals Inc.

100 Cummings Center, Suite 151-B

Beverly, Massachusetts 01915

Attention: Corporate Secretary

|

|

|

|

|

|

|

·

|

by calling our Corporate Secretary, at (978) 921-4125.

|

If you would like to opt out of householding in future mailings, or if you are currently receiving multiple mailings at one address and would like to request householded mailings, you may do so by contacting our Corporate Secretary as indicated above.

Will a list of stockholders entitled to vote at the Special Meeting be available?

In accordance with Nevada law, a list of stockholders entitled to vote at the Special Meeting will be available at our executive office on [___________], 2019, and will be accessible for ten days prior to the Special Meeting and any postponement(s) or adjournment(s) thereof between the hours of 9:00 a.m. and 5:00 p.m. at our corporate headquarters.

Can I receive future stockholder communications electronically through the Internet?

Yes. You may elect to receive future notices of meetings, proxy materials and annual reports electronically through the Internet. To consent to electronic delivery, vote your shares using the Internet. At the end of the Internet voting procedure, the on-screen Internet voting instructions will tell you how to request future stockholder communications be sent to you electronically.

Once you consent to electronic delivery, you must vote your shares using the Internet and your consent will remain in effect until withdrawn. You may withdraw this consent at any time during the voting process and resume receiving stockholder communications in print form.

PROPOSAL 1 — PROPOSAL TO AMEND THE ARTICLES OF INCORPORATION TO INCREASE THE AUTHORIZED CAPITALIZATION

Introduction

On July 17, 2019, the Board acted unanimously to adopt the proposal to amend our Amended and Restated Articles of Incorporation (the “Articles of Incorporation”), to increase the number of authorized shares of Class A common stock, par value $0.0001 per share, from 300,000,000 shares to 600,000,000 shares (the “Increased Capitalization Charter Amendment”). The Board is now asking you to approve the Increased Capitalization Charter Amendment.

On August [__], 2019, there were [__________] shares of our Class A common stock outstanding and [__________] shares of our Class B common stock outstanding. In addition, as of June 30, 2019, an aggregate of [___________] shares of Class A common stock were reserved for issuance upon conversion or exercise of various debt and equity instruments that we have issued.

Form of the Amendment

If stockholders approve this proposal, the Articles of Incorporation will be amended to increase the number of shares of Class A common stock the Company is authorized to issue from 300,000,000 shares to 600,000,000 shares. The par value of the Class A common stock will remain at $0.0001 per share. The number of authorized shares of Class B common stock and preferred stock will remain at 100,000,000 shares and 10,000,000 shares, respectively, and will not be increased by the amendment. In addition to increasing the number of authorized shares of Class A common stock, the Increased Capitalization Charter Amendment would also update the introductory clause to Article III of the Articles of Incorporation and update certain defined terms, with the initial paragraph of subsection (a) of Article III to read in its entirety as follows:

“(a)

Authorized Capital Stock

.

The total number of shares of stock that the Corporation shall have authority to issue is 710,000,000, consisting of

|

|

(i)

|

600,000,000 shares of Class A Common Stock, par value $0.0001 per share (“Class A Common Stock”);

|

|

|

|

|

|

|

(ii)

|

100,000,000 shares of Class B Common Stock, par value $0.0001 per share (“Class B Common Stock” and together with the Class A Common Stock, “Common Stock”)

|

|

|

|

|

|

|

(iii)

|

10,000,000 shares of Preferred Stock, par value $0.001 per share (“Preferred Stock”).

|

[REMAINDER OF ARTICLE III IS NOT AFFECTED]

Purpose of the Amendment

The Board believes that it is advisable to have a greater number of authorized shares of Class A common stock available for issuance in connection with various general corporate programs and purposes. The Board believes that having the authority to issue additional shares of Class A common stock will enhance the business and financial flexibility of the Company and avoid the possible delays and significant expense of calling and holding an additional special meeting of stockholders to increase the authorized shares of Class A common stock at a later date.

The newly authorized shares of Class A common stock would be issuable for any proper corporate purpose, including future acquisitions, investment opportunities, capital raising transactions of equity or convertible debt securities, stock splits, stock dividends, issuance under future equity compensation plans, employee stock or incentive and savings plans or for other corporate purposes. The shares may be issued by the Board in its discretion, subject to any further stockholder action required in the case of any particular issuance by applicable law, regulatory agency, or under the rules of any securities exchange.

The Board believes that the Company will need to raise additional capital in order to implement its business plan and is contemplating various alternatives to raise capital, including a potential private placement of shares of common stock or securities convertible into shares of common stock. Currently, we have no specific plans, arrangements or understandings, whether written or oral, with respect to the increase in shares available for issuance as a result of the Increased Capitalization Charter Amendment. In addition, there is no present agreement to issue any material amount of shares of Class A common stock, with the exception of the shares of Class A common stock issuable upon conversion of the warrants and Series B preferred stock issued or issuable pursuant to the securities purchase agreement dated as of October 5, 2018 and as amended on May 9, 2019, details of which may be found in the Company’s Current Reports on Form 8-K filed on October 9, 2018 and May 10, 2019.

Rights of Additional Authorized Shares

The additional authorized shares of Class A common stock, if and when issued, would be part of the existing class of Class A common stock and would have the same rights and privileges as the shares of Class A common stock currently outstanding. The amendment would not alter the respective rights of the Class A common stock and Class B common stock. The Company’s stockholders do not have preemptive rights with respect to its Class A or Class B common stock. Accordingly, should the Board elect to issue additional shares of common stock, existing stockholders would not have any preferential rights to purchase the shares.

Potential Adverse Effects of the Amendment

Future issuances of Class A common stock or securities convertible into Class A common stock could have a dilutive effect on the earnings per share, book value per share, voting power and percentage interest of holdings of current stockholders. In addition, the availability of additional shares of Class A common stock for issuance could, under certain circumstances, discourage or make more difficult efforts to obtain control of the Company. The Board is not aware of any attempt, or contemplated attempt, to acquire control of the Company. This proposal is not being presented with the intent that it be used to prevent or discourage any acquisition attempt, but nothing would prevent the Board from taking any appropriate actions not inconsistent with its fiduciary duties.

Effectiveness of the Amendment and Vote Required

If the proposed amendment is adopted, it will become effective upon the filing of a certificate of amendment to the Articles of Incorporation with the Secretary of State of the State of Nevada. See

Annex A

to this proxy statement for the form of the certificate. The affirmative vote of the holders of at least a majority of the voting power of our issued and outstanding common stock is required to approve the proposed amendment to the Articles of Incorporation.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE INCREASED CAPITALIZATION CHARTER AMENDMENT PROPOSAL.

PROPOSAL 2 — POSSIBLE ADJOURNMENT TO SOLICIT ADDITIONAL PROXIES, IF NECESSARY OR APPROPRIATE

As discussed elsewhere in this proxy statement, the Company’s stockholders are being asked to vote to approve the adjournment of the Special Meeting, if necessary or appropriate, to obtain additional proxies if there are not sufficient votes to approve the Increased Capitalization Charter Amendment at the time of the Special Meeting.

If this proposal is approved, the Special Meeting could be adjourned to any date. If the Special Meeting is adjourned, stockholders who have already submitted their proxies will be able to revoke them at any time prior to their use. If you sign and return a proxy and do not indicate how you wish to vote on any proposal, or if you indicate that you wish to vote in favor of the Increased Capitalization Charter Amendment but do not indicate a choice on the Adjournment Proposal, your shares of common stock will be voted “FOR” the Adjournment Proposal.

The affirmative vote of the holders of a majority of the votes cast at the Special Meeting in person or represented by proxy is required to approve the Adjournment Proposal.

The Company does not intend to call a vote on the Adjournment Proposal if the Increased Capitalization Charter Amendment considered at the Special Meeting has been approved at the Special Meeting.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ADJOURNMENT PROPOSAL.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information known to us with respect to the beneficial ownership of our common stock as of August [__], 2019, for: (i) each person known by us to beneficially own more than 5% of our voting securities, (ii) each named executive officer, (iii) each of our directors, and (iv) all of our current executive officers and directors as a group. The address of each of the persons set forth below is in care of Innovation Pharmaceuticals Inc., 100 Cummings Center, Suite 151-B, Beverly, Massachusetts 01915.

|

|

|

Shares Beneficially Owned(1)

|

|

|

% of Total

|

|

|

|

|

Class A

|

|

|

Class B

|

|

|

Voting

|

|

|

Name of Beneficial Owner

|

|

Shares

|

|

|

%

|

|

|

Shares

|

|

|

%

|

|

|

Power(2)

|

|

|

Officers and Directors

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Leo Ehrlich(3)

|

|

|

34,159,412

|

|

|

|

15.8

|

|

|

|

18,000,000

|

|

|

|

100

|

|

|

|

51.9

|

|

|

Arthur P. Bertolino(4)

|

|

|

4,025,524

|

|

|

|

2.1

|

|

|

|

—

|

|

|

|

—

|

|

|

*

|

|

|

Barry Schechter(5)

|

|

|

269,665

|

|

|

*

|

|

|

|

—

|

|

|

|

—

|

|

|

*

|

|

|

Zorik Spektor(5)

|

|

|

44,665

|

|

|

*

|

|

|

|

—

|

|

|

|

—

|

|

|

*

|

|

|

Jane Harness(6)

|

|

|

505,828

|

|

|

*

|

|

|

|

—

|

|

|

|

—

|

|

|

*

|

|

|

All current executive officers and directors as a group (5 persons)(7)

|

|

|

39,005,094

|

|

|

|

17.9

|

|

|

|

—

|

|

|

|

—

|

|

|

|

52.9

|

|

|

5% Stockholders

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Krishna Menon(8)

|

|

|

15,043,286

|

|

|

|

7.8

|

|

|

|

—

|

|

|

|

—

|

|

|

|

4.0

|

|

_______

* Denotes less than 1%.

|

(1)

|

“Beneficial owner” means having or sharing, directly or indirectly (i) voting power, which includes the power to vote or to direct the voting, or (ii) investment power, which includes the power to dispose or to direct the disposition, of shares of the common stock of an issuer. The definition of beneficial ownership includes shares underlying options or warrants to purchase common stock, or other securities or convertible debt convertible into common stock, that are exercisable or convertible or that will become exercisable or convertible within 60 days. Unless otherwise indicated, the beneficial owner has sole voting and investment power. For each stockholder, the calculation of percentage of beneficial ownership is based upon [192,132,420] shares of Class A common stock and [909,090] shares of Class B common stock outstanding as of August [__], 2019, and shares of common stock subject to options, warrants and/or conversion rights held by the stockholder that are currently exercisable or are exercisable within 60 days of August [__], 2019, which are deemed to be outstanding and to be beneficially owned by the stockholder holding such options, warrants or conversion rights. The percentage ownership of any stockholder is determined by assuming that the stockholder has exercised all options, warrants and conversion rights to obtain additional securities and that no other stockholder has exercised such rights.

|

|

|

|

|

(2)

|

Percentage total voting power represents voting power with respect to all shares of our Class A common stock and Class B common stock, voting together as a single class. Each holder of Class B common stock is entitled to ten votes per share of Class B common stock, and each holder of Class A common stock is entitled to one vote per share of Class A common stock on all matters submitted to our stockholders for a vote. The Class A common stock and Class B common stock vote together as a single class on all matters submitted to a vote of our stockholders, except as may otherwise be required by law. The Class B common stock is convertible at any time by the holder into shares of Class A common stock on a share-for-share basis.

|

|

|

|

|

(3)

|

Includes (i) 7,335,002 shares of Class A common stock held directly by Mr. Ehrlich, (ii) 2,752,310 shares of Class A common stock held by Mr. Ehrlich’s spouse, (iii) 4,072,100 shares of Class A common stock into which a convertible loan and accrued interest in the amount of $2.0 million may be converted at $0.50 per share, (iv) vested options to purchase 2,000,000 shares of Class A common stock granted to Mr. Ehrlich under the 2010 Equity Incentive Plan, (v) 909,090 shares of Class B common stock held directly by Mr. Ehrlich, and (vi) vested options to purchase 17,090,910 shares of Class B common stock granted to Mr. Ehrlich under the 2010 Equity Incentive Plan. Each share of Class A common stock carries one vote and each share of Class B common stock carries ten votes on all matters before the Company’s stockholders. Class B common stock is convertible into shares of Class A common stock at the holder’s election.

|

|

(4)

|

Includes 1,544,597 shares of Class A common stock issuable upon the exercise of stock options that are currently exercisable or are exercisable within 60 days of August [__], 2019.

|

|

|

|

|

(5)

|

For each of Messrs. Schechter and Spektor, includes 19,665 shares of Class A common stock issuable upon the exercise of stock options that are currently exercisable or are exercisable within 60 days of August [__], 2019.

|

|

|

|

|

(6)

|

Includes 345,974 shares of Class A common stock issuable upon the exercise of stock options that are currently exercisable or are exercisable within 60 days of August [__], 2019.

|

|

|

|

|

(7)

|

Includes 26,002,001 shares of Class A common stock and 17,090,910 shares of Class B common stock issuable upon the exercise of stock options, warrants or other conversion rights, or in the case of Class A common stock, upon the conversion of Class B common stock, in each case that are currently exercisable or are exercisable within 60 days of August [__], 2019.

|

|

|

|

|

(8)

|

Consists of 15,043,286 shares of Class A common stock held by the Menon Family Trust, for which Dr. Menon serves as trustee.

|

FUTURE STOCKHOLDER PROPOSALS

The Board of Directors has not yet determined the date on which the next annual meeting of the Company’s stockholders (an “Annual Meeting”) will be held. Stockholders may submit proposals on matters appropriate for stockholder action at an Annual Meetings in accordance with the rules and regulations adopted by the SEC. Any proposal which an eligible stockholder desires to have included in our proxy statement and presented at the next Annual Meeting will be included in our proxy statement and related proxy card if it is received by us a reasonable time before we begin to print and send our proxy materials and if it complies with SEC rules regarding inclusion of proposals in proxy statements. In order to avoid controversy as to the date on which we receive a proposal, it is suggested that any stockholder who wishes to submit a proposal submit such proposal by certified mail, return receipt requested.

Other deadlines apply to the submission of stockholder proposals for the next Annual Meeting that are not required to be included in our proxy statement under SEC rules. With respect to these stockholder proposals for the next Annual Meeting, a stockholder’s notice must be received by us not more than ten calendar days following the day on which public announcement of the date of such Annual Meeting is first made by the Company. The form of proxy distributed by the Board of Directors for such meeting will confer discretionary authority to vote on any such proposal not received by such date. If any such proposal is received by such date, the proxy statement for the Annual Meeting will provide advice on the nature of the matter and how we intend to exercise our discretion to vote on each such matter if it is presented at that meeting.

STOCKHOLDER COMMUNICATION WITH THE BOARD OF DIRECTORS

Stockholders may communicate with the Board, including non-management directors, by sending a letter to our Board, c/o Corporate Secretary, Innovation Pharmaceuticals Inc., 100 Cummings Center, Suite 151-B, Beverly, Massachusetts 01915 for submission to the Board or committee or to any specific director to whom the correspondence is directed. Stockholders communicating through this means should include with the correspondence evidence, such as documentation from a brokerage firm, that the sender is a current record or beneficial stockholder of the Company. All communications received as set forth above will be opened by the Corporate Secretary or his designee for the sole purpose of determining whether the contents contain a message to one or more of our directors. Any contents that are not advertising materials, promotions of a product or service, patently offensive materials or matters deemed, using reasonable judgment, inappropriate for the Board will be forwarded promptly to the Chairman of the Board, the appropriate committee or the specific director, as applicable.

ANNUAL REPORT ON FORM 10-K

We will provide without charge to each person solicited by this proxy statement, on the written request of such person, a copy of our Annual Report on Form 10-K, including the financial statements and financial statement schedules, as filed with the SEC for our most recent fiscal year. Such written requests should be directed to Innovation Pharmaceuticals Inc., c/o Corporate Secretary, 100 Cummings Center, Suite 151-B, Beverly, Massachusetts 01915. A copy of our Annual Report on Form 10-K is also made available on our website after it is filed with the SEC.

OTHER MATTERS

As of the date of this proxy statement, the Board has no knowledge of any business which will be presented for consideration at the Special Meeting other than the Increased Capitalization Charter Amendment and the Adjournment Proposal. Should any other matters be properly presented, it is intended that the enclosed proxy card will be voted in accordance with the best judgment of the persons voting the proxies.

There are no arrangements known to us, including any pledge by any person of our securities, the operation of which may at a subsequent date result in a change in control of the Company.

None of our directors or executive officers has any interest, direct or indirect, in the proposals other than interests arising from the ownership of securities where those directors and executive officers receive no extra or special benefit not shared on a pro rata basis by all other holders of our common stock.

|

|

By Order of the Board of Directors,

|

|

|

|

|

|

|

|

/s/ Leo Ehrlich

|

|

|

|

Leo Ehrlich

|

|

|

|

Chief Executive Officer

|

|

Beverly, Massachusetts

August [__], 2019

ANNEX A

CERTIFICATE OF AMENDMENT

(PURSUANT TO NRS 78.385 AND 78.390)

Certificate of Amendment to Articles of Incorporation

For Nevada Profit Corporations

(Pursuant to NRS 78.385 and 78.390 - After Issuance of Stock)

1. Name of corporation:

Innovation Pharmaceuticals Inc.

2. The articles have been amended as follows: (provide article numbers, if available)

Section (a) of Article III of the Amended and Restated Articles of Incorporation is amended and restated in its entirety to read as follows:

“(a)

Authorized Capital Stock

.

The total number of shares of stock that the Corporation shall have authority to issue is 710,000,000, consisting of

(i) 600,000,000 shares of Class A Common Stock, par value $0.0001 per share (“Class A Common Stock”);

(ii) 100,000,000 shares of Class B Common Stock, par value $0.0001 per share (“Class B Common Stock” and together with the Class A Common Stock, “Common Stock”)

(iii) 10,000,000 shares of Preferred Stock, par value $0.001 per share (“Preferred Stock”).

The holders of shares of the Class A Common Stock shall not have the right to convert their shares of Class A Common Stock into any other securities.

The holders of shares of the Class B Common Stock at their election shall have the right, at any time or from time to time, to convert any or all of their shares of Class B Common Stock into shares of Class A Common Stock, on a one to one basis, by delivery to the Corporation of the certificates representing such shares of Class B Common Stock duly endorsed for such conversion. Any shares of the Class B Common Stock that are transferred will automatically convert into shares of the Class A Common Stock, on a one to one basis, effective as of the date on which certificates representing such shares are presented for transfer on the books of the Corporation.

VOTING RIGHTS

Subject to the limitations provided by law and subject to any voting rights applicable to shares of the Preferred Stock, the Class A Common Stock and the Class B Common Stock shall have the sole right and power to vote on all matters on which a vote of shareholders is to be taken. In all matters, with respect to actions both by vote and by consent, each holder of shares of the Class A Common Stock shall be entitled to cast one vote in person or by proxy for each share of Class A Common Stock standing in such holder’s name on the transfer books of the Corporation; and each holder of shares of the Class B Common Stock shall be entitled to cast ten votes in person or by proxy for each share of Class B Common Stock standing in such holder’s name on the transfer books of the Corporation. Except as otherwise provided above and subject to the limitations provided by law and subject to any voting rights applicable to shares of the Preferred Stock, the holders of shares of the Class A Common Stock and Class B Common Stock shall vote together as a single class, together with the holders of any shares of the Preferred Stock which are entitled to vote, and not as a separate class.”

3. The vote by which the stockholders holding shares in the corporation entitling them to exercise at least a majority of the voting power, or such greater proportion of the voting power as may be required in the case of a vote by classes or series, or as may be required by the provisions of the articles of incorporation* have voted in favor of the amendment is:_________________

4. Effective date and time of filing: (optional) Date:____________ Time:____________

(must not be later than 90 days after the certificate is filed)

5. Signature: (required)

X___________________________

Signature of Officer

*If any proposed amendment would alter or change any preference or any relative or other right given to any class or series of outstanding shares, then the amendment must be approved by the vote, in addition to the affirmative vote otherwise required, of the holders of shares representing a majority of the voting power of each class or series affected by the amendment regardless to limitations or restrictions on the voting power thereof.

IMPORTANT:

Failure to include any of the above information and submit with the proper fees may cause this filing to be rejected.

PRELIMINARY PROXY MATERIALS - SUBJECT TO COMPLETION

FORM OF PROXY CARD

|

Innovation Pharmaceuticals Inc.

100 Cummings Center

Suite 151B

Beverly, MA 01915-6117

|

VOTE BY INTERNET - www.proxyvote.com

Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 P.M. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form.

ELECTRONIC DELIVERY OF FUTURE PROXY MATERIALS

If you would like to reduce the costs incurred by our company in mailing proxy materials, you can consent to receiving all future proxy statements, proxy cards and annual reports electronically via e-mail or the Internet. To sign up for electronic delivery, please follow the instructions above to vote using the Internet and, when prompted, indicate that you agree to receive or access proxy materials electronically in future years.

VOTE BY PHONE - 1-800-[__________]

Use any touch-tone telephone to transmit your voting instructions up until 11:59 P.M. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you call and then follow the instructions.

VOTE BY MAIL

Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717.

|

TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: X

KEEP THIS PORTION FOR YOUR RECORDS

DETACH AND RETURN THIS PORTION ONLY

THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED.

The Board of Directors recommends you vote FOR the following:

|

|

|

|

For

|

Against

|

Abstain

|

|

1.

|

To consider and, if appropriate, approve an amendment to Article III of the Company’s Amended and Restated Articles of Incorporation to increase the number of authorized shares of the Company’s Class A common stock from 300,000,000 shares to 600,000,000 shares

|

|

o

|

o

|

o

|

|

|

|

|

|

|

|

|

2.

|

To approve the adjournment of the Special Meeting, if necessary or appropriate, to solicit additional proxies if there are not sufficient votes to approve and adopt the Increased Capitalization Charter Amendment

|

|

o

|

o

|

o

|

Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name, by authorized officer.

|

|

|

|

|

|

Signature [PLEASE SIGN WITHIN BOX]

|

Date

|

Signature [PLEASE SIGN WITHIN BOX]

|

Date

|

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting:

The Notice & Proxy Statement is/are available at www.proxyvote.com.

|

Innovation Pharmaceuticals Inc.

Special Meeting of Stockholders

September [__], 2019 [___] AM

This proxy is solicited by the Board of Directors

The stockholders hereby appoint(s) Mr. Leo Ehrlich and Dr. Arthur Bertolino, or either of them, as proxies, each with the power to appoint his substitute, and hereby authorizes them to represent and to vote, as designated on the reverse side of this ballot, all of the shares of common stock of INNOVATION PHARMACEUTICALS INC. that the stockholder(s) is/are entitled to vote at the Special Meeting of Stockholders to be held at [___] AM, Eastern Time on September [__], 2019, at [______________], and any adjournment or postponement thereof.

This proxy, when properly executed, will be voted in the manner directed herein. If no such direction is made, this proxy will be voted in accordance with the Board of Directors’ recommendations.

Continued and to be signed on reverse side

|

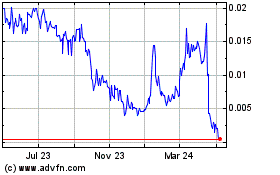

Innovation Pharmaceuticals (PK) (USOTC:IPIX)

Historical Stock Chart

From Mar 2024 to Apr 2024

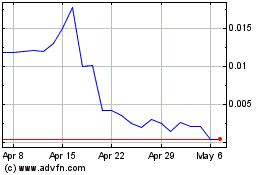

Innovation Pharmaceuticals (PK) (USOTC:IPIX)

Historical Stock Chart

From Apr 2023 to Apr 2024