NetApp Shares Slide on Guidance Cut, Downgrades

August 02 2019 - 10:47AM

Dow Jones News

By Colin Kellaher

NetApp Inc. (NTAP) shares fell nearly 20% Friday morning after

the data-management company warned that its fiscal first-quarter

results would fall short of its previous estimates and cut its

full-year revenue guidance.

The Sunnyvale, Calif., company said it now expects adjusted

earnings of 55 cents to 60 cents a share on revenue of $1.22

billion to $1.23 billion, down from a previous forecast of adjusted

earnings of 78 cents to 86 cents a share on revenue of $1.315

billion to $1.465 billion.

NetApp also said it now expects full-year revenue will fall by

5% to 10%, instead of the mid-single-digit increase it previously

forecast.

The downbeat guidance prompted several Wall Street firms to cut

their ratings and price targets.

Analysts at Piper Jaffray downgraded the stock to "neutral" from

"overweight" and slashed their NetApp price target to $48 from

$75.

Piper said a weak macro environment could persist for the next

six to 12 months, making it difficult for NetApp to fix its

execution issues against that backdrop. The analysts added that

NetApp may also see increased pressure from Dell's planned launch

of a new mid-range platform at the end of the year.

Shares of NetApp were recently down 19.6% to $46.39.

Write to Colin Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

August 02, 2019 10:32 ET (14:32 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

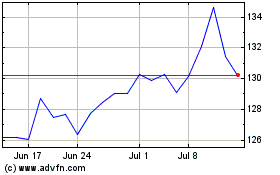

NetApp (NASDAQ:NTAP)

Historical Stock Chart

From Mar 2024 to Apr 2024

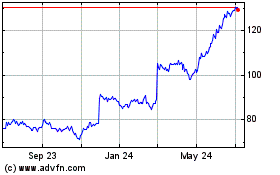

NetApp (NASDAQ:NTAP)

Historical Stock Chart

From Apr 2023 to Apr 2024