Pixelworks, Inc. (NASDAQ: PXLW), a leading provider of power

efficient visual processing solutions, today announced financial

results for the second quarter ended June 30, 2019.

Second Quarter and Recent

Highlights

- Mobile revenue increased 14% and Video Delivery revenue grew

73% year-over-year

- ASUS launched ROG Phone II in conjunction with Tencent Games,

as the first smartphone to incorporate Soft Iris solution running

on the Qualcomm® Snapdragon™ 855 Plus Mobile Platform

- TrueCut® Motion Grading Wins Hollywood Professional Association

Engineering Excellence Award

- Black Shark launched Shark 2 Pro, its fourth gaming smartphone

to incorporate Iris visual processor

President and CEO of Pixelworks, Todd DeBonis,

commented, “Second quarter revenue was in-line with the midpoint of

our guidance as all areas of the business performed as expected,

with continued year-over-year revenue growth in both Mobile and

Video Delivery. Gross margin expanded sequentially and

year-over-year, and when combined with well-managed operating

expenses, resulted in EPS for the quarter at the high-end of our

guidance.

“We also made significant progress on advancing

our sales pipeline and further cultivating the ecosystem to enable

high-quality HDR video content on visual displays. As evidence of

our continued progress, Black Shark recently launched the Shark 2

Pro smartphone, their fourth gaming device to incorporate our Iris

visual processor. Additionally, ASUS launched the ROG Phone II in

conjunction with Tencent Games and became the first smartphone to

incorporate Pixelworks’ Soft Iris solution with advanced display

calibration running on the Snapdragon™ 855 Plus mobile

platform.”

DeBonis concluded, “As a result of our expanded

portfolio of hardware and software-based solutions, we are

extremely well positioned to increase adoption of our

industry-leading visual display solutions across a growing number

of new and existing mobile OEMs and streaming service providers. We

anticipate further momentum in the coming quarters as new mobile

devices are launched incorporating Pixelworks’ Iris visual

processors, Soft Iris and support for our award winning TrueCut

format – collectively contributing to a meaningful acceleration in

Mobile growth as we approach the end of 2019 and well into

2020.”

Second Quarter 2019 Financial

Results

Revenue in the second quarter of 2019 was $18.0

million, compared to $16.6 million in the first quarter of 2019 and

$19.3 million in the second quarter of 2018. Year-over-year, second

quarter revenue reflects continued growth in the Company’s Mobile

and Video Delivery businesses, offset by below normal seasonal

demand in the Projector market.

On a GAAP basis, gross profit margin in the

second quarter of 2019 was 52.0%, compared to 50.9% in the first

quarter of 2019 and 49.5% in the second quarter of 2018. On a

non-GAAP basis, second quarter 2019 gross profit margin was 54.1%,

compared to 53.3% in the first quarter of 2019 and 52.7% in the

second quarter of 2018.

GAAP operating expenses in the second quarter of

2019 were $11.7 million, compared to $11.9 million in the first

quarter of 2019 and $12.0 million in the year-ago quarter. Non-GAAP

operating expenses in the second quarter of 2019 were $9.6 million,

compared to $10.3 million in the first quarter of 2019 and $10.0

million in the year-ago quarter.

For the second quarter of 2019, the Company

recorded a GAAP net loss of $2.4 million, or ($0.06) per share,

compared to a GAAP net income of $133,000, or $0.00 per diluted

share, in the first quarter of 2019, which included a net gain of

$3.9 million related to the sale of non-strategic patents. The

Company recorded a GAAP net loss of $2.4 million, or ($0.07) per

share, in the second quarter of 2018.

For the second quarter of 2019, the Company

recorded a non-GAAP net loss of $97,000, or ($0.00) per share,

compared to a non-GAAP net loss of $1.5 million, or ($0.04) per

share, in the first quarter of 2019 and non-GAAP net income of

$31,000, or $0.00 per diluted share, in the second quarter of

2018.

Adjusted EBITDA in the second quarter of 2019

was $1.0 million, compared to ($464,000) in the first quarter of

2019 and $1.1 million in the second quarter of 2018.

Business Outlook

For the third quarter of 2019, Pixelworks

expects revenue to be in a range of between $17.5 million and $18.5

million, reflecting sequential and year-over-year growth in Mobile

combined with lower than normal seasonal demand in the Video

Delivery and Digital Projection markets. Additional guidance will

be provided as part of the Company’s earnings conference call.

Conference Call Information

Pixelworks will host a conference call today,

August 1, 2019, at 2:00 p.m. Pacific Time, which can be accessed by

calling 1-877-359-9508 and using passcode 6687844. A Web broadcast

of the call can be accessed by visiting the Company's investor page

at www.pixelworks.com. For those unable to listen to the live Web

broadcast, it will be archived for at least 30 days. A replay of

the conference call will also be available through Thursday, August

8, 2019, and can be accessed by calling 1-855-859-2056 and using

passcode 6687844.

About Pixelworks, Inc.

Pixelworks provides industry-leading display

processing and video delivery solutions and technology that enable

highly authentic viewing experiences with superior visual quality.

The Company has a 20-year history of delivering image processing

innovation to providers of leading-edge consumer electronics,

professional displays and video streaming services. Pixelworks is

headquartered in San Jose, CA. For more information, please visit

the company’s web site at www.pixelworks.com

Note: Pixelworks, the Pixelworks logo and

TrueCut are registered trademarks of Pixelworks, Inc. All other

trademarks are the property of their respective owners.

Non-GAAP Financial Measures

This earnings release makes reference to

non-GAAP gross profit margins, non-GAAP operating expenses,

non-GAAP net income (loss) and non-GAAP net income (loss) per

share, which exclude gain on sale of patents, inventory step-up and

backlog amortization, amortization of acquired intangible assets,

stock-based compensation expense, restructuring expenses, gain on

extinguishment of convertible debt, and discount accretion on

convertible debt fair value which are all required under GAAP as

well as the tax effect of the non-GAAP adjustments. The press

release also makes reference to and reconciles GAAP net income

(loss) and adjusted EBITDA, which Pixelworks defines as GAAP net

income (loss) before interest income (expense) and other, net,

income tax provision, depreciation and amortization, as well as the

specific items listed above.

Pixelworks management uses these non-GAAP

financial measures internally to understand, manage and evaluate

the business and establish its operational goals, review its

operations on a period to period basis, for compensation

evaluations, to measure performance, and for budgeting and resource

allocation. Pixelworks management believes it is useful for the

Company and investors to review, as applicable, both GAAP

information and non-GAAP financial measures to help assess the

performance of Pixelworks’ continuing business and to evaluate

Pixelworks’ future prospects. These non-GAAP measures, when

reviewed together with the GAAP financial information, provide

additional transparency and information for comparison and analysis

of operating performance and trends. These non-GAAP measures

exclude certain items to facilitate management’s review of the

comparability of our core operating results on a period to period

basis.

In calculating the above non-GAAP results,

management specifically adjusted for certain items related to the

acquisition of ViXS Systems, Inc., including amortization of

acquired intangible assets, and impact of inventory step up, both

related to fair valuing the items, restructuring expenses related

to a reduction in workforce and facility closure and

consolidations, gain on debt extinguishment, and accretion on

convertible debt. Management considers these items as either

limited in term or having no impact on Pixelworks’ cash flows, and

therefore has excluded such items to facilitate a review of current

operating performance and comparisons to our past operating

performance.

Because the Company’s non-GAAP financial

measures are not calculated in accordance with GAAP, they may not

necessarily be comparable to similarly titled measures employed by

other companies. These non-GAAP financial measures should not be

considered in isolation or as a substitute for the comparable GAAP

measures, and should be read only in conjunction with the Company’s

consolidated financial results as presented in accordance with

GAAP. A reconciliation between GAAP and non-GAAP financial measures

is included in this earnings release which is available in the

investor relations section of the Pixelworks' website.

Safe Harbor Statement

This release contains forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. These statements may be identified by use of terms such as

“begin,” “continue,” “will,” “expect”, “believe,” “anticipate” and

similar terms or the negative of such terms, and include, without

limitation, statements about the Company’s digital projection,

mobile and video delivery businesses, including market movement and

demand, customer engagements, mobile wins and the timing thereof,

growth in the mobile and video delivery markets, strategy,

seasonality, and additional guidance, particularly as to revenue

for the third quarter of 2019. All statements other than statements

of historical fact are forward-looking statements for purposes of

this release, including any projections of revenue or other

financial items or any statements regarding the plans and

objectives of management for future operations. Such statements are

based on management's current expectations, estimates and

projections about the Company's business. These statements are not

guarantees of future performance and involve numerous risks,

uncertainties and assumptions that are difficult to predict. Actual

results could vary materially from those contained in forward

looking statements due to many factors, including, without

limitation: our ability to execute on our strategy, competitive

factors, such as rival chip architectures, introduction or traction

by competing designs, or pricing pressures; the success of our

products in expanded markets; current global economic challenges;

changes in the digital display and projection markets; seasonality

in the consumer electronics market; our efforts to achieve

profitability from operations; our limited financial resources and

our ability to attract and retain key personnel. More information

regarding potential factors that could affect the Company's

financial results and could cause actual results to differ

materially from those discussed in the forward-looking statements

is included from time to time in the Company's Securities and

Exchange Commission filings, including its Annual Report on Form

10-K for the year ended December 31, 2018 as well as subsequent SEC

filings.

The forward-looking statements contained in this

release are as of the date of this release, and the Company does

not undertake any obligation to update any such statements, whether

as a result of new information, future events or otherwise.

[Financial Tables Follow]

|

PIXELWORKS, INC. CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (In thousands, except per

share data) (Unaudited) |

| |

|

|

|

| |

Three Months Ended |

|

Six Months Ended |

| |

June 30, |

|

March 31, |

|

June 30, |

|

June 30, |

|

June 30, |

| |

2019 |

|

2019 |

|

2018 |

|

2019 |

|

2018 |

|

Revenue, net |

|

$ |

18,027 |

|

|

$ |

16,648 |

|

|

$ |

19,251 |

|

|

$ |

34,675 |

|

|

$ |

34,543 |

|

| Cost of revenue (1) |

|

|

8,651 |

|

|

|

8,176 |

|

|

|

9,717 |

|

|

|

16,827 |

|

|

|

17,207 |

|

|

Gross profit |

|

|

9,376 |

|

|

|

8,472 |

|

|

|

9,534 |

|

|

|

17,848 |

|

|

|

17,336 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

Research and development (2) |

|

|

6,364 |

|

|

|

6,472 |

|

|

|

6,423 |

|

|

|

12,836 |

|

|

|

10,886 |

|

|

Selling, general and administrative (3) |

|

|

4,935 |

|

|

|

5,460 |

|

|

|

4,959 |

|

|

|

10,395 |

|

|

|

9,573 |

|

|

Restructuring |

|

|

398 |

|

|

|

— |

|

|

|

602 |

|

|

|

398 |

|

|

|

621 |

|

|

Total operating expenses |

|

|

11,697 |

|

|

|

11,932 |

|

|

|

11,984 |

|

|

|

23,629 |

|

|

|

21,080 |

|

|

Loss from operations |

|

|

(2,321 |

) |

|

|

(3,460 |

) |

|

|

(2,450 |

) |

|

|

(5,781 |

) |

|

|

(3,744 |

) |

| Interest income and other, net

(4) |

|

|

104 |

|

|

|

96 |

|

|

|

40 |

|

|

|

200 |

|

|

|

1,177 |

|

| Gain on sale of patents |

|

|

— |

|

|

|

3,905 |

|

|

|

— |

|

|

|

3,905 |

|

|

|

— |

|

|

Total other income, net |

|

|

104 |

|

|

|

4,001 |

|

|

|

40 |

|

|

|

4,105 |

|

|

|

1,177 |

|

|

Income (loss) before income taxes |

|

|

(2,217 |

) |

|

|

541 |

|

|

|

(2,410 |

) |

|

|

(1,676 |

) |

|

|

(2,567 |

) |

| Provision for income

taxes |

|

|

231 |

|

|

|

408 |

|

|

|

32 |

|

|

|

639 |

|

|

|

308 |

|

|

Net income (loss) |

|

$ |

(2,448 |

) |

|

$ |

133 |

|

|

$ |

(2,442 |

) |

|

$ |

(2,315 |

) |

|

$ |

(2,875 |

) |

| Net income (loss) per

share: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.06 |

) |

|

$ |

0.00 |

|

|

$ |

(0.07 |

) |

|

|

(0.06 |

) |

|

|

(0.08 |

) |

|

Diluted |

|

$ |

(0.06 |

) |

|

$ |

0.00 |

|

|

$ |

(0.07 |

) |

|

|

(0.06 |

) |

|

|

(0.08 |

) |

| Weighted average shares

outstanding: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

37,688 |

|

|

|

37,247 |

|

|

|

35,704 |

|

|

|

37,469 |

|

|

|

35,445 |

|

|

Diluted |

|

|

37,688 |

|

|

|

38,692 |

|

|

|

35,704 |

|

|

|

37,469 |

|

|

|

35,445 |

|

| —————— |

|

|

|

|

|

|

|

|

|

|

| (1) Includes: |

|

|

|

|

|

|

|

|

|

|

|

Amortization of acquired intangible assets |

|

|

298 |

|

|

|

298 |

|

|

|

298 |

|

|

|

596 |

|

|

|

596 |

|

|

Stock-based compensation |

|

|

83 |

|

|

|

95 |

|

|

|

78 |

|

|

|

178 |

|

|

|

144 |

|

|

Inventory step-up and backlog amortization |

|

|

— |

|

|

|

12 |

|

|

|

239 |

|

|

|

12 |

|

|

|

361 |

|

| (2) Includes stock-based

compensation |

|

|

703 |

|

|

|

661 |

|

|

|

627 |

|

|

|

1,364 |

|

|

|

1,222 |

|

| (3) Includes: |

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation |

|

|

879 |

|

|

|

933 |

|

|

|

682 |

|

|

|

1,812 |

|

|

|

1,221 |

|

|

Amortization of acquired intangible assets |

|

|

76 |

|

|

|

84 |

|

|

|

101 |

|

|

|

160 |

|

|

|

202 |

|

| (4) Includes: |

|

|

Gain on debt extinguishment |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,272 |

) |

|

Discount accretion on convertible debt fair value |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

69 |

|

| |

|

PIXELWORKS, INC. RECONCILIATION OF GAAP

AND NON-GAAP

FINANCIAL

INFORMATION * (In thousands, except per

share data) (Unaudited) |

| |

|

|

|

| |

Three Months Ended |

|

Six Months Ended |

| |

June 30, |

|

March 31, |

|

June 30, |

|

June 30, |

|

June 30, |

| |

2019 |

|

2019 |

|

2018 |

|

2019 |

|

2018 |

| Reconciliation of GAAP

and non-GAAP gross profit |

|

|

|

|

|

|

|

|

|

|

|

GAAP gross profit |

|

$ |

9,376 |

|

|

$ |

8,472 |

|

|

$ |

9,534 |

|

|

$ |

17,848 |

|

|

$ |

17,336 |

|

| Amortization of acquired

intangible assets |

|

|

298 |

|

|

|

298 |

|

|

|

298 |

|

|

|

596 |

|

|

|

596 |

|

| Stock-based compensation |

|

|

83 |

|

|

|

95 |

|

|

|

78 |

|

|

|

178 |

|

|

|

144 |

|

| Inventory step-up and backlog

amortization |

|

|

— |

|

|

|

12 |

|

|

|

239 |

|

|

|

12 |

|

|

|

361 |

|

|

Total reconciling items included in gross profit |

|

|

381 |

|

|

|

405 |

|

|

|

615 |

|

|

|

786 |

|

|

|

1,101 |

|

| Non-GAAP gross profit |

|

$ |

9,757 |

|

|

$ |

8,877 |

|

|

$ |

10,149 |

|

|

$ |

18,634 |

|

|

$ |

18,437 |

|

| Non-GAAP gross profit margin |

|

|

54.1 |

% |

|

|

53.3 |

% |

|

|

52.7 |

% |

|

|

53.7 |

% |

|

|

53.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation of GAAP

and non-GAAP operating expenses |

|

|

|

|

|

|

|

|

|

|

| GAAP operating expenses |

|

$ |

11,697 |

|

|

$ |

11,932 |

|

|

$ |

11,984 |

|

|

$ |

23,629 |

|

|

$ |

21,080 |

|

| Reconciling item included in

research and development: |

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation |

|

|

703 |

|

|

|

661 |

|

|

|

627 |

|

|

|

1,364 |

|

|

|

1,222 |

|

| Reconciling items included in

selling, general and administrative: |

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation |

|

|

879 |

|

|

|

933 |

|

|

|

682 |

|

|

|

1,812 |

|

|

|

1,221 |

|

|

Amortization of acquired intangible assets |

|

|

76 |

|

|

|

84 |

|

|

|

101 |

|

|

|

160 |

|

|

|

202 |

|

| Restructuring |

|

|

398 |

|

|

|

— |

|

|

|

602 |

|

|

|

398 |

|

|

|

621 |

|

|

Total reconciling items included in operating expenses |

|

|

2,056 |

|

|

|

1,678 |

|

|

|

2,012 |

|

|

|

3,734 |

|

|

|

3,266 |

|

| Non-GAAP operating

expenses |

|

$ |

9,641 |

|

|

$ |

10,254 |

|

|

$ |

9,972 |

|

|

$ |

19,895 |

|

|

$ |

17,814 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation of GAAP

and non-GAAP net income (loss) |

|

|

|

|

|

|

|

|

|

|

| GAAP net income (loss) |

|

$ |

(2,448 |

) |

|

$ |

133 |

|

|

$ |

(2,442 |

) |

|

$ |

(2,315 |

) |

|

$ |

(2,875 |

) |

| Reconciling items included in

gross profit |

|

|

381 |

|

|

|

405 |

|

|

|

615 |

|

|

|

786 |

|

|

|

1,101 |

|

| Reconciling items included in

operating expenses |

|

|

2,056 |

|

|

|

1,678 |

|

|

|

2,012 |

|

|

|

3,734 |

|

|

|

3,266 |

|

| Reconciling items included in

total other income, net |

|

|

— |

|

|

|

(3,905 |

) |

|

|

— |

|

|

|

(3,905 |

) |

|

|

(1,203 |

) |

| Tax effect of non-GAAP

adjustments |

|

|

(86 |

) |

|

|

219 |

|

|

|

(154 |

) |

|

|

133 |

|

|

|

(55 |

) |

| Non-GAAP net income (loss) |

|

$ |

(97 |

) |

|

$ |

(1,470 |

) |

|

$ |

31 |

|

|

$ |

(1,567 |

) |

|

$ |

234 |

|

| Non-GAAP net income (loss) per

share: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.00 |

) |

|

$ |

(0.04 |

) |

|

$ |

0.00 |

|

|

$ |

(0.04 |

) |

|

$ |

0.01 |

|

|

Diluted |

|

$ |

(0.00 |

) |

|

$ |

(0.04 |

) |

|

$ |

0.00 |

|

|

$ |

(0.04 |

) |

|

$ |

0.01 |

|

| Non-GAAP weighted average

shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

37,688 |

|

|

|

37,247 |

|

|

|

35,704 |

|

|

|

37,469 |

|

|

|

35,445 |

|

|

Diluted |

|

|

37,688 |

|

|

|

37,247 |

|

|

|

37,369 |

|

|

|

37,469 |

|

|

|

37,372 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| *Set forth above

are reconciliations of the non-GAAP financial measure to the most

directly comparable GAAP financial measure. The non-GAAP financial

measure disclosed by the company has limitations and should not be

considered a substitute for, or superior to, the financial measure

prepared in accordance with GAAP, and the reconciliations from GAAP

to Non-GAAP actuals should be carefully evaluated. Please refer to

"Non-GAAP Financial Measures” in this document for an explanation

of the adjustments made to the comparable GAAP measures, the ways

management uses the non-GAAP measures, and the reasons why

management believes the non-GAAP measures provide useful

information for investors. |

| |

|

PIXELWORKS, INC. RECONCILIATION OF GAAP

AND NON-GAAP EARNINGS PER

SHARE * (Figures may not sum due to

rounding) (Unaudited) |

| |

|

|

|

|

| |

|

Three Months Ended |

|

Six Months Ended |

| |

|

June 30, |

|

March 31, |

|

June 30, |

|

June 30, |

|

June 30, |

| |

|

2019 |

|

2019 |

|

2018 |

|

2019 |

|

2018 |

|

|

|

Dollars per share |

|

Dollars per share |

|

Dollars per share |

|

Dollars per share |

|

Dollars per share |

|

|

|

Basic |

|

Diluted |

|

Basic |

|

Diluted |

|

Basic |

|

Diluted |

|

Basic |

|

Diluted |

|

Basic |

|

Diluted |

| Reconciliation of GAAP

and non-GAAP net income (loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP net income (loss) |

|

$ |

(0.06 |

) |

|

$ |

(0.06 |

) |

|

$ |

0.00 |

|

|

$ |

0.00 |

|

|

$ |

(0.07 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.06 |

) |

|

$ |

(0.06 |

) |

|

$ |

(0.08 |

) |

|

$ |

(0.08 |

) |

| Reconciling items included in

gross profit |

|

|

0.01 |

|

|

|

0.01 |

|

|

|

0.01 |

|

|

|

0.01 |

|

|

|

0.02 |

|

|

|

0.02 |

|

|

|

0.02 |

|

|

|

0.02 |

|

|

|

0.03 |

|

|

|

0.03 |

|

| Reconciling items included in

operating expenses |

|

|

0.05 |

|

|

|

0.05 |

|

|

|

0.05 |

|

|

|

0.04 |

|

|

|

0.06 |

|

|

|

0.05 |

|

|

|

0.10 |

|

|

|

0.10 |

|

|

|

0.09 |

|

|

|

0.09 |

|

| Reconciling items included in

total other income, net |

|

|

— |

|

|

|

— |

|

|

|

(0.10 |

) |

|

|

(0.10 |

) |

|

|

— |

|

|

|

— |

|

|

|

(0.10 |

) |

|

|

(0.10 |

) |

|

|

(0.03 |

) |

|

|

(0.03 |

) |

| Tax effect of non-GAAP

adjustments |

|

|

— |

|

|

|

— |

|

|

|

0.01 |

|

|

|

0.01 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Non-GAAP net income

(loss) |

|

$ |

(0.00 |

) |

|

$ |

(0.00 |

) |

|

$ |

(0.04 |

) |

|

$ |

(0.04 |

) |

|

$ |

0.00 |

|

|

$ |

0.00 |

|

|

$ |

(0.04 |

) |

|

$ |

(0.04 |

) |

|

$ |

0.01 |

|

|

$ |

0.01 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| *Set forth above are

reconciliations of the non-GAAP financial measure to the most

directly comparable GAAP financial measure. The non-GAAP financial

measure disclosed by the company has limitations and should not be

considered a substitute for, or superior to, the financial measure

prepared in accordance with GAAP, and the reconciliations from GAAP

to Non-GAAP actuals should be carefully evaluated. Please refer to

"Non-GAAP Financial Measures” in this document for an explanation

of the adjustments made to the comparable GAAP measures, the ways

management uses the non-GAAP measures, and the reasons why

management believes the non-GAAP measures provide useful

information for investors. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PIXELWORKS, INC. RECONCILIATION OF GAAP

AND NON-GAAP GROSS PROFIT

MARGIN * (Figures may not sum due to

rounding) (Unaudited) |

| |

|

|

|

|

| |

|

Three Months Ended |

|

Six Months Ended |

| |

|

June 30, |

|

March 31, |

|

June 30, |

|

June 30, |

|

June 30, |

| |

|

2019 |

|

2019 |

|

2018 |

|

2019 |

|

2018 |

| Reconciliation of GAAP

and non-GAAP gross profit margin |

|

|

|

|

|

|

|

|

|

|

|

GAAP gross profit margin |

|

52.0 |

% |

|

50.9 |

% |

|

49.5 |

% |

|

51.5 |

% |

|

50.2 |

% |

| Amortization of acquired

intangible assets |

|

1.7 |

% |

|

1.8 |

% |

|

1.5 |

% |

|

1.7 |

% |

|

1.7 |

% |

| Stock-based compensation |

|

0.5 |

% |

|

0.6 |

% |

|

0.4 |

% |

|

0.5 |

% |

|

0.4 |

% |

| Inventory step-up and backlog

amortization |

|

— |

% |

|

0.1 |

% |

|

1.2 |

% |

|

0.0 |

% |

|

1.0 |

% |

|

Total reconciling items included in gross profit |

|

2.1 |

% |

|

2.4 |

% |

|

3.2 |

% |

|

2.3 |

% |

|

3.2 |

% |

| Non-GAAP gross profit

margin |

|

54.1 |

% |

|

53.3 |

% |

|

52.7 |

% |

|

53.7 |

% |

|

53.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| *Set forth above are

reconciliations of the non-GAAP financial measure to the most

directly comparable GAAP financial measure. The non-GAAP financial

measure disclosed by the company has limitations and should not be

considered a substitute for, or superior to, the financial measure

prepared in accordance with GAAP, and the reconciliations from GAAP

to Non-GAAP actuals should be carefully evaluated. Please refer to

"Non-GAAP Financial Measures” in this document for an explanation

of the adjustments made to the comparable GAAP measures, the ways

management uses the non-GAAP measures, and the reasons why

management believes the non-GAAP measures provide useful

information for investors. |

| |

|

|

|

|

|

|

|

|

|

|

|

PIXELWORKS, INC. RECONCILIATION OF GAAP

AND NON-GAAP

FINANCIAL

INFORMATION * (In thousands)

(Unaudited) |

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Six Months Ended |

|

|

|

June 30, |

|

March 31, |

|

June 30, |

|

June 30, |

|

June 30, |

|

|

|

2019 |

|

2019 |

|

2018 |

|

2019 |

|

2018 |

| Reconciliation of GAAP

net income (loss) and adjusted EBITDA |

|

|

|

|

|

|

|

|

|

|

|

GAAP net income (loss) |

|

$ |

(2,448 |

) |

|

$ |

133 |

|

|

$ |

(2,442 |

) |

|

$ |

(2,315 |

) |

|

$ |

(2,875 |

) |

| Stock-based compensation |

|

|

1,665 |

|

|

|

1,689 |

|

|

|

1,387 |

|

|

|

3,354 |

|

|

|

2,587 |

|

| Restructuring |

|

|

398 |

|

|

|

— |

|

|

|

602 |

|

|

|

398 |

|

|

|

621 |

|

| Amortization of acquired

intangible assets |

|

|

374 |

|

|

|

382 |

|

|

|

399 |

|

|

|

756 |

|

|

|

798 |

|

| Tax effect of non-GAAP

adjustments |

|

|

(86 |

) |

|

|

219 |

|

|

|

(154 |

) |

|

|

133 |

|

|

|

(55 |

) |

| Gain on sale of patents |

|

|

— |

|

|

|

(3,905 |

) |

|

|

— |

|

|

|

(3,905 |

) |

|

|

— |

|

| Inventory step-up and backlog

amortization |

|

|

— |

|

|

|

12 |

|

|

|

239 |

|

|

|

12 |

|

|

|

361 |

|

| Gain on debt

extinguishment |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,272 |

) |

| Discount accretion on

convertible debt fair value |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

69 |

|

| Non-GAAP net income

(loss) |

|

$ |

(97 |

) |

|

$ |

(1,470 |

) |

|

$ |

31 |

|

|

$ |

(1,567 |

) |

|

$ |

234 |

|

| EBITDA adjustments: |

|

|

|

|

|

|

|

|

|

|

| Depreciation and

amortization |

|

$ |

887 |

|

|

$ |

913 |

|

|

$ |

923 |

|

|

$ |

1,800 |

|

|

$ |

1,749 |

|

| Non-GAAP interest expense

(income) and other, net |

|

|

(104 |

) |

|

|

(96 |

) |

|

|

(40 |

) |

|

|

(200 |

) |

|

|

26 |

|

| Non-GAAP provision for income

taxes |

|

|

317 |

|

|

|

189 |

|

|

|

186 |

|

|

|

506 |

|

|

|

363 |

|

| Adjusted EBITDA |

|

$ |

1,003 |

|

|

$ |

(464 |

) |

|

$ |

1,100 |

|

|

$ |

539 |

|

|

$ |

2,372 |

|

| |

|

|

|

|

|

|

|

|

|

|

| *Set forth above are

reconciliations of the non-GAAP financial measure to the most

directly comparable GAAP financial measure. The non-GAAP financial

measure disclosed by the company has limitations and should not be

considered a substitute for, or superior to, the financial measure

prepared in accordance with GAAP, and the reconciliations from GAAP

to Non-GAAP actuals should be carefully evaluated. Please refer to

"Non-GAAP Financial Measures” in this document for an explanation

of the adjustments made to the comparable GAAP measures, the ways

management uses the non-GAAP measures, and the reasons why

management believes the non-GAAP measures provide useful

information for investors. |

| |

|

PIXELWORKS, INC. CONDENSED CONSOLIDATED

BALANCE SHEETS (In thousands)

(Unaudited) |

|

|

|

|

|

|

|

|

|

June 30, 2019 |

|

December 31, 2018 |

|

|

ASSETS |

|

|

|

|

| Current assets: |

|

|

|

|

|

Cash and cash equivalents |

$ |

16,746 |

|

$ |

17,944 |

|

|

Short-term marketable securities |

|

6,575 |

|

|

6,069 |

|

|

Accounts receivable, net |

|

7,353 |

|

|

6,982 |

|

|

Inventories |

|

2,842 |

|

|

2,954 |

|

|

Prepaid expenses and other current assets |

|

2,303 |

|

|

1,494 |

|

|

Total current assets |

|

35,819 |

|

|

35,443 |

|

| Property and equipment, net |

|

4,817 |

|

|

6,151 |

|

| Operating lease right of use

assets |

|

5,173 |

|

|

— |

|

| Other assets, net |

|

1,606 |

|

|

1,132 |

|

| Acquired intangible assets,

net |

|

3,452 |

|

|

4,208 |

|

| Goodwill |

|

18,407 |

|

|

18,407 |

|

|

Total assets |

$ |

69,274 |

|

$ |

65,341 |

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

| Current liabilities: |

|

|

|

|

|

Accounts payable |

$ |

2,183 |

|

$ |

2,116 |

|

|

Accrued liabilities and current portion of long-term

liabilities |

|

9,158 |

|

|

10,256 |

|

|

Current portion of income taxes payable |

|

578 |

|

|

263 |

|

|

Total current liabilities |

|

11,919 |

|

|

12,635 |

|

| Long-term liabilities, net of

current portion |

|

674 |

|

|

1,017 |

|

| Operating lease liabilities, net

of current portion |

|

3,595 |

|

|

— |

|

| Income taxes payable, net of

current portion |

|

2,335 |

|

|

2,299 |

|

|

Total liabilities |

|

18,523 |

|

|

15,951 |

|

| Shareholders’ equity |

|

50,751 |

|

|

49,390 |

|

|

Total liabilities and shareholders’ equity |

$ |

69,274 |

|

$ |

65,341 |

|

| |

Contacts:

Investor ContactShelton Group Brett PerryP:

+1-214-272-0070 E: bperry@sheltongroup.com

Company ContactPixelworks, Inc.Steven MooreP:

+1-408-200-9221E: smoore@pixelworks.com

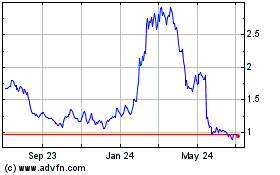

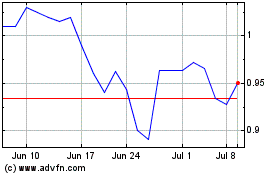

Pixelworks (NASDAQ:PXLW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pixelworks (NASDAQ:PXLW)

Historical Stock Chart

From Apr 2023 to Apr 2024