DuPont Sees Sales Falling -- Update

August 01 2019 - 10:59AM

Dow Jones News

By Austen Hufford

DuPont de Nemours Inc. said it expects organic sales to fall

this year, the latest company to report weakness in industrial

markets including car and electronics production.

The speciality-chemicals maker said Thursday that it expects the

soft demand in many of its businesses to continue through the

second half of the year.

"We are not counting on any improvement happening," Executive

Chairman Edward Breen told investors.

Shares rose 1.3% in morning trading as the company beat earnings

expectations for the quarter through price increases and cost

savings. DuPont had $100 million of cost savings for the quarter

and expects $450 million for the year.

DuPont, based in Wilmington, Del., emerged from the split-up of

DowDuPont Inc. this year. DowDuPont spun off its materials-science

business into a company now called Dow Inc. and its agriculture

business into a company now called Corteva Inc. DuPont is the

specialty-sciences portion of the company. Dow and DuPont agreed to

merge in 2015.

Organic sales, which excludes currency movements and

acquisitions, fell 3% in the company's second quarter with volume

declines offsetting higher prices. The sales declines were spread

across the U.S. and Canada, Europe and Asia. Sales in China were

down 3% versus the prior year, compared to a 10% drop in the first

quarter.

The company said it still expects research-and-development

spending equal to about 4% of sales this year.

"We are not touching R&D just because we are seeing a little

short-term softness," Mr. Breen said.

Sales volumes fell 12% in the company's transportation and

industrial business due to lower car production and weak demand for

electronics. The company also said its construction-products

business was hurt by slower home construction in North America.

DuPont also said it has benefited from the rise of meat

replacements because the company makes pea and soy proteins. Large

restaurant chains, including Burger King and White Castle, have

introduced new plant-based meat alternatives to their menus.

"We are pretty well positioned in that market," Chief Executive

Marc Doyle said.

DuPont said it expects adjusted earnings for the year to be

between $3.75 and $3.85 a share.

For the second quarter, DuPont had a net loss of $571 million,

compared with a profit of $1.77 billion in the comparable period a

year earlier. Its net loss was 76 cents a share compared with a

profit of $2.27 a share a year ago. The loss was largely due to an

impairment charge.

On an adjusted basis, the company said earnings were 97 cents a

share, up from 89 cents a share. Analysts polled by FactSet were

expecting adjusted earnings of 89 cents a share.

Net sales were $5.47 billion, down 6.6%. Analysts expected $6.02

billion.

--Allison Prang contributed to this article.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

August 01, 2019 10:44 ET (14:44 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

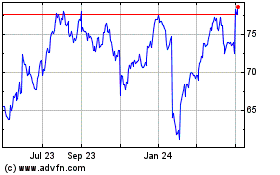

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

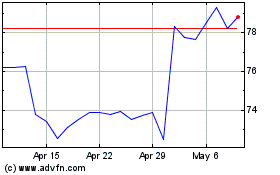

From Mar 2024 to Apr 2024

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Apr 2023 to Apr 2024